Investing quickly in cryptocurrency can be an enticing prospect for many, especially given the market’s notorious volatility and potential for high returns. However, this approach carries significant risks and requires a strategic mindset. Understanding the dynamics of the cryptocurrency market, the various investment methods available, and the inherent risks involved is crucial for anyone considering a rapid investment strategy.

Cryptocurrency operates in a decentralized environment, which means it is not controlled by any central authority. This decentralization contributes to its appeal as an investment vehicle but also adds layers of complexity and risk. The market is influenced by numerous factors, including technological developments, regulatory changes, and market sentiment. Therefore, making quick investments without thorough research can lead to substantial losses.

Investors should be aware that while the potential for high returns exists, so does the risk of significant losses. Quick investments can lead to emotional decision-making, often resulting in poor investment choices. Hence, it is essential to approach cryptocurrency investing with a clear strategy and an understanding of both the opportunities and risks involved.

| Key Considerations | Description |

|---|---|

| Market Volatility | Cryptocurrency prices can fluctuate dramatically in short periods. |

| Investment Strategy | Having a defined strategy can mitigate risks associated with rapid investments. |

| Research Importance | Thorough research is crucial before making any investment decisions. |

Understanding Cryptocurrency Market Dynamics

The cryptocurrency market is characterized by rapid changes and high volatility. Prices can soar or plummet within hours, driven by factors such as news events, regulatory announcements, or shifts in investor sentiment. This environment creates both opportunities and challenges for investors.

Market Sentiment plays a critical role in cryptocurrency pricing. Social media trends and news coverage can significantly impact investor behavior. For instance, positive news about a particular cryptocurrency can lead to a surge in buying activity, while negative news can trigger panic selling.

Technological Developments also influence market dynamics. Innovations such as new blockchain technologies or upgrades to existing platforms can enhance the utility of cryptocurrencies, attracting more investors. Conversely, security breaches or technological failures can lead to loss of confidence and rapid sell-offs.

Regulatory Changes are another vital factor affecting the cryptocurrency market. Governments around the world are still developing their regulatory frameworks for cryptocurrencies. Announcements regarding regulations can lead to immediate price reactions as investors adjust their expectations based on perceived risks or opportunities.

Investors must stay informed about these dynamics to make educated decisions when investing quickly in cryptocurrencies.

Strategies for Quick Cryptocurrency Investment

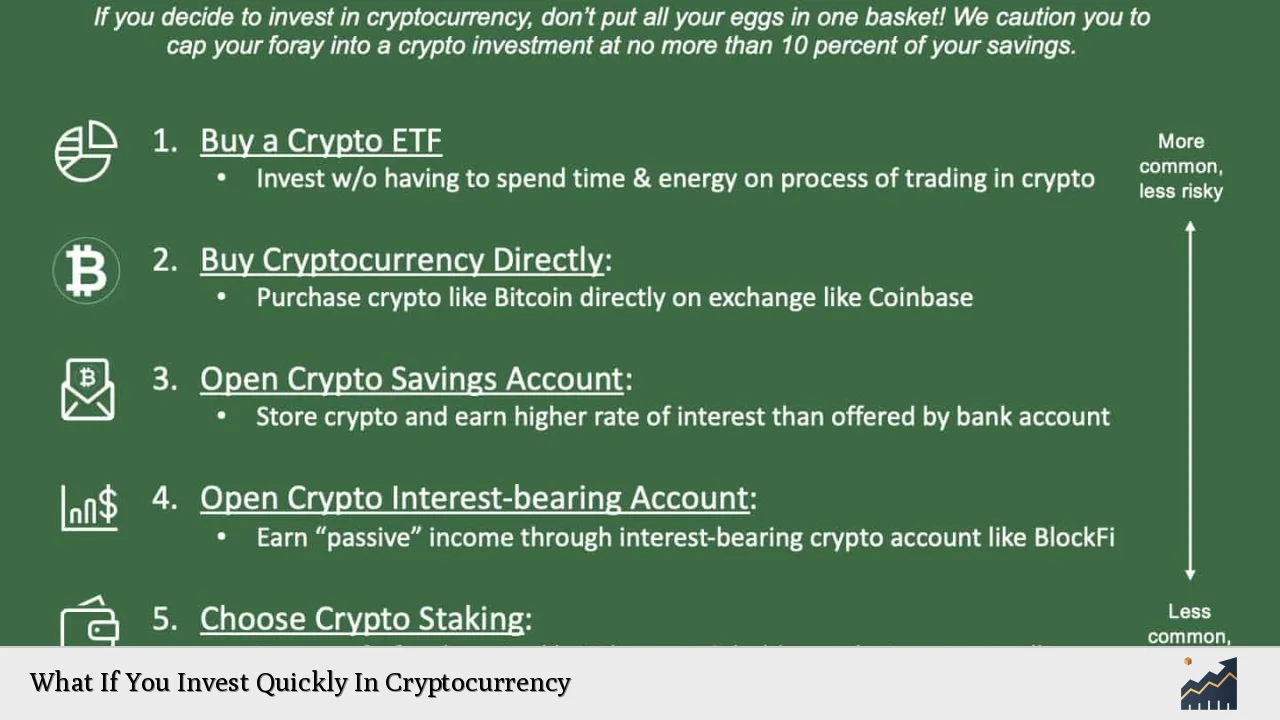

When considering quick investments in cryptocurrency, having a well-defined strategy is essential. Here are some effective strategies that investors can employ:

- Dollar-Cost Averaging: Instead of investing a lump sum at once, consider spreading your investment over time. This method reduces the impact of volatility by averaging out purchase prices.

- Limit Orders: Utilize limit orders to set specific buy prices for cryptocurrencies. This allows you to enter the market at favorable prices without having to monitor it continuously.

- Stay Updated: Regularly follow crypto news and market analysis to identify potential investment opportunities quickly. Being informed about upcoming events or trends can help you act swiftly when needed.

- Use Technical Analysis: Familiarize yourself with technical analysis tools that help predict price movements based on historical data. This knowledge can guide your quick investment decisions.

- Diversify Investments: Avoid putting all your funds into one cryptocurrency. Diversifying across different assets can mitigate risks associated with sudden price drops in any single asset.

Implementing these strategies effectively requires discipline and a clear understanding of your financial goals and risk tolerance.

Risks Associated With Quick Investments

Investing quickly in cryptocurrency comes with several inherent risks that every investor should be aware of:

- Market Volatility: The most significant risk is the extreme volatility of cryptocurrency prices. Rapid price swings can lead to substantial gains but also devastating losses if investments are not managed carefully.

- Emotional Decision-Making: Quick investments often stem from emotional reactions rather than rational analysis. This impulse-driven approach can result in poor investment choices that lead to losses.

- Lack of Research: Rushing into investments without adequate research increases the likelihood of falling victim to scams or investing in poorly performing assets.

- Regulatory Risks: Changes in regulations can have immediate effects on cryptocurrency values. Investors must stay informed about legal developments that could impact their holdings.

- Security Risks: The digital nature of cryptocurrencies makes them susceptible to hacking and theft. Using secure wallets and exchanges is crucial for protecting your investments.

Understanding these risks allows investors to develop strategies that minimize potential downsides while maximizing opportunities for profit.

Practical Steps For Quick Cryptocurrency Investment

If you decide to invest quickly in cryptocurrency, follow these practical steps to enhance your chances of success:

1. Choose a Reliable Exchange: Select a reputable cryptocurrency exchange that offers robust security features and user-friendly interfaces for quick transactions.

2. Create an Account: Sign up for an account on your chosen exchange and complete any necessary verification processes promptly.

3. Link Your Payment Method: Connect your bank account or credit card to facilitate fast funding of your trading account.

4. Conduct Research: Before making any purchases, conduct thorough research on cryptocurrencies you are interested in investing in. Analyze their fundamentals, market trends, and potential future developments.

5. Make Your Purchase: Once you feel confident about your choice, proceed with your purchase using either market orders or limit orders based on your strategy.

6. Monitor Your Investments: After purchasing cryptocurrencies, keep an eye on their performance regularly and be prepared to make adjustments as needed based on market conditions.

7. Secure Your Holdings: Transfer your cryptocurrencies from exchanges into secure wallets (hardware wallets are recommended) to protect against theft and hacking attempts.

By following these steps diligently, you can navigate the fast-paced world of cryptocurrency investing more effectively.

FAQs About What If You Invest Quickly In Cryptocurrency

- What are the benefits of quick investing in cryptocurrency?

Quick investing allows you to capitalize on sudden price movements for potentially higher returns. - How do I choose which cryptocurrencies to invest in quickly?

Research popular coins with strong fundamentals or those trending due to recent news. - What should I do if my quick investment loses value?

Assess the situation; consider holding long-term if fundamentals remain strong or cut losses if necessary. - Is it safe to invest quickly in lesser-known altcoins?

Lesser-known altcoins may offer high rewards but come with increased risk; thorough research is essential. - How important is timing when investing quickly?

Timing is crucial; being aware of market trends helps seize opportunities before they disappear.

In conclusion, investing quickly in cryptocurrency presents both exciting opportunities and significant risks. By understanding the market dynamics, employing effective strategies, and being mindful of inherent risks, investors can navigate this volatile landscape more successfully. Always prioritize thorough research and maintain a disciplined approach to maximize potential returns while minimizing losses.