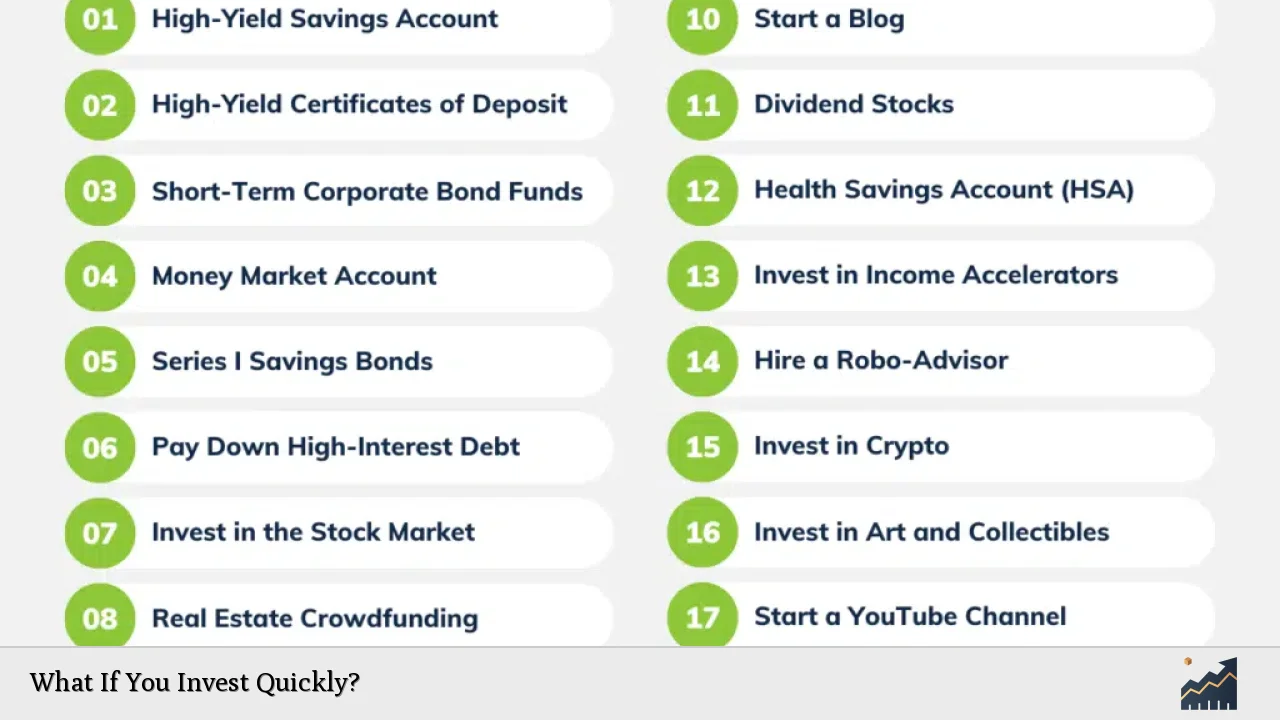

Investing quickly can be an enticing prospect for many individuals looking to capitalize on market opportunities. However, it involves a unique set of risks and considerations. Quick investments often aim for immediate gains, but they can also lead to significant losses if not approached carefully. Understanding the implications of rapid investing is crucial for anyone considering this strategy.

When you invest quickly, you might be tempted by the allure of fast returns. This could involve trading stocks, cryptocurrencies, or other assets that are experiencing volatility. While the potential for quick profits exists, so does the risk of substantial losses. Therefore, it is essential to have a clear strategy and an understanding of market dynamics before diving in.

Investing quickly requires a different mindset compared to long-term investing. It often involves active monitoring of market trends and making timely decisions based on real-time data. This approach can be stressful and may not suit everyone, especially those who prefer a more stable investment strategy.

| Aspect | Details |

|---|---|

| Potential Returns | High returns possible in short timeframes |

| Risks | Increased risk of loss due to market volatility |

Understanding Quick Investments

Quick investments typically refer to strategies that prioritize short-term gains over long-term growth. This can include day trading, swing trading, or investing in volatile assets like cryptocurrencies or penny stocks. The primary goal is to take advantage of price fluctuations within a short period.

Investors who engage in quick investing often rely on technical analysis and market trends rather than fundamental analysis. This means they focus on price movements and volume rather than the underlying value of the asset. While this can lead to profitable trades, it also increases exposure to risks associated with sudden market changes.

Important info to consider is that quick investments require a solid understanding of market indicators and trends. Investors need to be able to react swiftly to changes in the market environment. This often means dedicating significant time to research and monitoring.

Moreover, the emotional aspect of quick investing cannot be overlooked. The pressure to make rapid decisions can lead to impulsive actions that may not align with an investor’s overall strategy or risk tolerance. Therefore, having a well-defined plan is crucial.

Risks Involved in Quick Investing

Investing quickly comes with heightened risks compared to traditional investing methods. One major risk is market volatility, which refers to the rapid price movements that can occur within short timeframes. This volatility can lead to significant gains but also substantial losses.

Another critical risk is emotional decision-making. The fast-paced nature of quick investing can lead investors to make hasty decisions driven by fear or greed rather than rational analysis. This emotional trading often results in poor investment choices and financial losses.

Additionally, transaction costs can accumulate quickly when engaging in frequent trading. Each transaction may incur fees that erode profits, especially if trades are not successful. Investors must account for these costs when calculating potential returns.

Lastly, there is the risk of overtrading, where investors buy and sell too frequently in an attempt to capitalize on every opportunity. Overtrading can lead to burnout and poor decision-making as investors become overwhelmed by constant market fluctuations.

Strategies for Quick Investing

To navigate the complexities of quick investing effectively, it is essential to employ specific strategies that can help mitigate risks while maximizing potential returns.

- Set Clear Goals: Define what you aim to achieve with your quick investments, whether it’s a specific return percentage or a target amount.

- Develop a Trading Plan: Outline your entry and exit strategies, including stop-loss orders to minimize potential losses.

- Use Technical Analysis: Familiarize yourself with chart patterns and indicators that can help identify potential trading opportunities.

- Stay Informed: Keep up with market news and trends that could impact your investments. Information is crucial in making timely decisions.

- Practice Risk Management: Determine how much capital you are willing to risk on each trade and stick to that limit regardless of market conditions.

Implementing these strategies can enhance your chances of success when investing quickly while helping you manage associated risks effectively.

The Importance of Research

Conducting thorough research is vital for successful quick investing. Understanding the assets you are dealing with allows you to make informed decisions based on data rather than speculation.

Research should include:

- Market Trends: Analyze current trends affecting the asset class you are interested in, such as economic indicators or industry news.

- Historical Performance: Review past performance data for insights into how similar assets have reacted under comparable conditions.

- Competitor Analysis: Examine what other investors are doing within your target market segment and learn from their successes or failures.

By dedicating time to research before making quick investments, you position yourself better for success while minimizing exposure to unnecessary risks.

Emotional Discipline in Quick Investing

Emotional discipline plays a crucial role in successful quick investing. The ability to remain calm under pressure allows investors to make rational decisions rather than reacting impulsively based on fear or excitement.

Key aspects of maintaining emotional discipline include:

- Sticking to Your Plan: Adhere strictly to your trading plan without deviating due to emotions or external influences.

- Setting Realistic Expectations: Understand that not every trade will be profitable; accept losses as part of the investing process.

- Taking Breaks When Necessary: If emotions run high, step back from trading temporarily until you regain composure and clarity.

Cultivating emotional discipline enables investors to navigate the fast-paced world of quick investing more effectively while reducing the likelihood of costly mistakes driven by emotional responses.

FAQs About What If You Invest Quickly

- What are the benefits of quick investing?

Quick investing can yield high returns in short periods if done correctly. - What types of assets are best for quick investments?

Volatile assets like stocks, cryptocurrencies, and options are often favored for quick investments. - How do I manage risks associated with quick investing?

Implement risk management strategies like stop-loss orders and setting clear investment limits. - Can emotional factors affect my investment decisions?

Yes, emotions like fear and greed can lead to impulsive decisions that may harm your investment outcomes. - Is research important for quick investing?

Absolutely; thorough research helps inform your decisions and reduces reliance on speculation.

Investing quickly can offer exciting opportunities but requires careful consideration and strategic planning. By understanding the risks involved and employing effective strategies, investors can navigate this fast-paced environment successfully while minimizing potential pitfalls.