Investing on weekends has gained traction among various investor demographics, particularly those looking for flexibility in their trading schedules. As traditional markets are generally closed during weekends, many investors turn to alternative options such as cryptocurrencies, forex, and other trading platforms that operate continuously. This article explores the implications of investing on weekends, the strategies involved, and the potential benefits and risks associated with this approach.

| Aspect | Description |

|---|---|

| Flexibility | Allows investors to trade at their convenience without weekday constraints. |

| Market Options | Includes cryptocurrencies, forex, and some indices that remain open. |

The Rise of Weekend Investing

Weekend investing has become popular due to the increasing number of digital platforms that facilitate trading outside traditional hours. Investors often find themselves busy during weekdays with work commitments, making weekends an ideal time to engage in financial activities. This trend is particularly evident among millennials and younger investors who prefer a more flexible approach to managing their investments.

Investing on weekends allows individuals to capitalize on market movements that occur when traditional stock markets are closed. For instance, cryptocurrencies operate 24/7, providing ample opportunities for weekend trading. This flexibility can lead to increased engagement in investment activities as individuals can focus without the distractions of a typical workweek.

Moreover, weekend investing can be seen as a strategic move to take advantage of specific market conditions that may arise over the weekend. For example, news events or economic data releases often occur during this time, potentially influencing market sentiment when trading resumes on Monday.

Strategies for Weekend Investing

When considering weekend investing, it is essential to adopt effective strategies that align with market conditions and personal investment goals. Here are some popular strategies:

- Cryptocurrency Trading: Cryptocurrencies are a popular choice for weekend investors due to their continuous trading nature. Investors can monitor price fluctuations and make trades at any time.

- Forex Trading: The forex market operates almost around the clock, allowing traders to engage in currency pairs during weekends. This provides opportunities for profit based on global economic events.

- Binary Options: Some brokers offer binary options trading over the weekend. This involves predicting whether an asset’s price will rise or fall within a specific timeframe.

- Technical Analysis: Utilizing technical indicators such as Bollinger Bands can help traders identify potential entry and exit points during the weekend.

- Market Research: Weekends provide an excellent opportunity for investors to conduct research and analysis on upcoming trends or events that may impact their investments.

Each strategy has its unique characteristics and requires careful consideration of market dynamics and personal risk tolerance.

Benefits of Weekend Investing

Investing over the weekend comes with several advantages that can enhance an investor’s portfolio:

- Increased Opportunities: Weekend investing opens up additional trading opportunities that may not be available during regular market hours.

- Less Competition: With fewer traders active during weekends, there may be less competition in certain markets, potentially allowing for better pricing on trades.

- Focus and Concentration: The quieter environment of weekends can lead to improved focus when making investment decisions without weekday distractions.

- Flexibility: Investors can choose their own trading hours based on personal schedules, making it easier to manage investments alongside other commitments.

These benefits contribute to the growing appeal of weekend investing among various investor demographics.

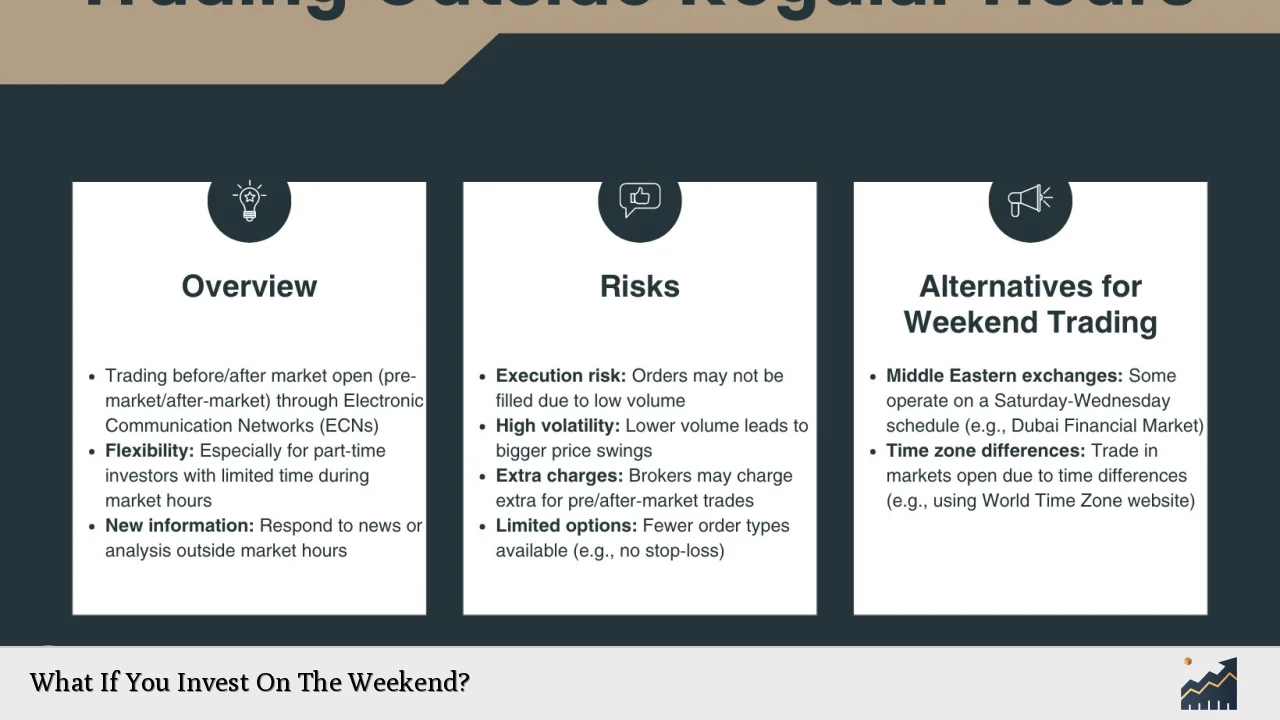

Risks Associated with Weekend Investing

While there are numerous advantages to investing on weekends, it is also crucial to be aware of potential risks:

- Lower Liquidity: Many markets experience lower trading volumes during weekends, which can lead to increased volatility and wider spreads between bid and ask prices.

- Market Gaps: Prices may change significantly between the close of one trading session and the opening of another. This can result in unexpected losses if a position is not managed properly.

- Limited Information: With fewer analysts and news outlets operating over the weekend, investors may have limited access to timely information that could influence their trades.

- Emotional Trading: The flexibility of weekend trading can lead some investors to make impulsive decisions based on emotions rather than sound analysis.

Understanding these risks is essential for anyone considering weekend investing as part of their overall strategy.

How to Get Started with Weekend Investing

If you are interested in exploring weekend investing, here are some steps you can take:

1. Choose Your Market: Decide which market you want to invest in—cryptocurrencies, forex, or binary options are popular choices for weekend trading.

2. Select a Broker: Find a reliable broker that offers access to your chosen market during weekends. Ensure they provide necessary tools for analysis and execution.

3. Develop a Strategy: Create a clear investment strategy tailored to your goals and risk tolerance. Consider using technical analysis or following market news closely.

4. Start Small: Begin with smaller investments while you familiarize yourself with how weekend trading works. Gradually increase your exposure as you gain confidence.

5. Monitor Your Investments: Keep track of your trades and analyze performance regularly. Adjust your strategy based on what you learn from your experiences.

By following these steps, you can effectively navigate the world of weekend investing while minimizing risks associated with this approach.

FAQs About What If You Invest On The Weekend

- Can I trade stocks over the weekend?

No, traditional stock markets are closed over the weekend; however, you can trade cryptocurrencies and forex. - What are the best assets to invest in on weekends?

Cryptocurrencies and forex are popular choices due to their continuous trading availability. - Is weekend investing risky?

Yes, it carries risks such as lower liquidity and potential price gaps between sessions. - How do I start weekend investing?

Select a market, choose a broker, develop a strategy, start small, and monitor your investments. - Are there any specific strategies for weekend trading?

Strategies include technical analysis, cryptocurrency trading, forex trading, and binary options.

In conclusion, investing on weekends offers unique opportunities but also comes with its set of challenges. By understanding both sides of this approach and implementing effective strategies while being mindful of risks, investors can potentially enhance their portfolios while enjoying greater flexibility in their investment activities.