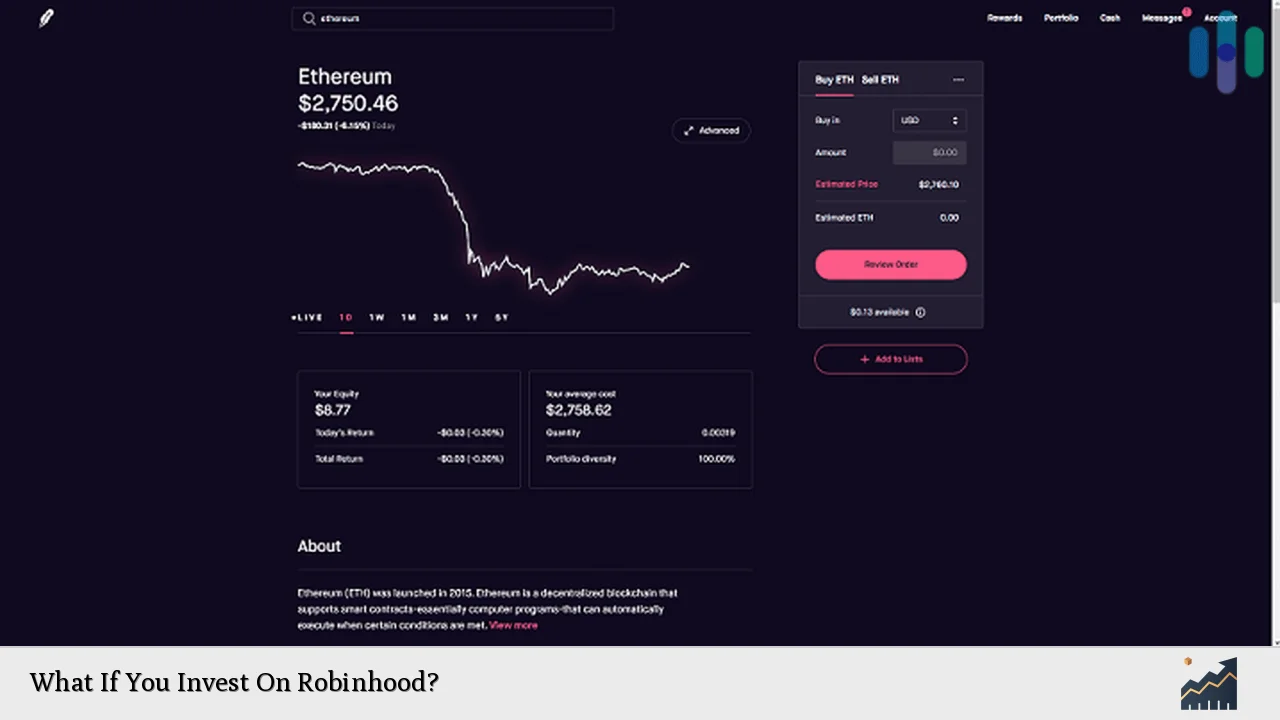

Investing on Robinhood offers a unique opportunity for individuals looking to enter the stock market without the traditional barriers of high fees and complex platforms. Founded in 2014, Robinhood has disrupted the financial services industry by providing a commission-free trading platform that appeals primarily to younger, tech-savvy investors. This platform allows users to trade stocks, exchange-traded funds (ETFs), options, and cryptocurrencies directly from their mobile devices or web browsers.

The appeal of Robinhood lies in its user-friendly interface and accessibility. With no minimum account balance required, anyone can start investing with as little as one dollar. This democratization of finance has attracted millions of users, particularly Millennials and Gen Z, who are eager to manage their investments independently. However, while Robinhood simplifies the investing process, it also requires users to be mindful of their strategies and the inherent risks involved in trading.

| Feature | Description |

|---|---|

| Commission-Free Trading | No fees for buying or selling stocks, ETFs, options, or cryptocurrencies. |

| Fractional Shares | Allows investment in portions of shares for as little as $1. |

Understanding Robinhood’s Features

Robinhood offers several features that make it attractive to new investors. These include commission-free trading, fractional shares, and a user-friendly mobile app.

- Commission-Free Trading: One of the most significant advantages is that Robinhood does not charge commissions on trades. This model has forced many traditional brokers to follow suit, making investing more affordable for everyone.

- Fractional Shares: Investors can buy fractional shares of stocks and ETFs, allowing them to invest small amounts of money in expensive stocks. This feature is particularly appealing for those who want to diversify their portfolios without needing large sums of capital.

- User-Friendly Interface: The app is designed for ease of use, making it accessible even for those who are new to investing. Users can quickly navigate through various features and execute trades with just a few taps.

Despite these benefits, potential investors should also consider some drawbacks associated with using Robinhood.

Potential Risks and Drawbacks

While investing on Robinhood can be rewarding, there are several risks and drawbacks that users should be aware of:

- Lack of Research Tools: Unlike traditional brokerage firms that provide extensive research and analysis tools, Robinhood’s platform is relatively basic. This can make it challenging for investors to make informed decisions.

- Market Volatility: The ease of trading can lead some users to engage in impulsive trading behaviors. This is particularly true during periods of high market volatility when emotions can drive decisions rather than careful analysis.

- Limited Customer Support: Users have reported difficulties in reaching customer support during critical moments. This can be frustrating for those who need immediate assistance with their accounts or trades.

Investors must weigh these risks against the benefits when deciding whether to use Robinhood as their primary investment platform.

Strategies for Successful Investing on Robinhood

To maximize your investment success on Robinhood, consider implementing the following strategies:

- Diversification: Spread your investments across various sectors and asset classes to minimize risk. A well-diversified portfolio can help cushion against market fluctuations.

- Set Investment Goals: Clearly define your investment objectives—whether they are long-term growth or short-term gains. Having a plan helps you stay focused and avoid emotional trading decisions.

- Educate Yourself: Take advantage of educational resources available within the app or from external sources. Understanding market trends and investment strategies can significantly enhance your decision-making process.

- Use Stop-Loss Orders: Setting stop-loss orders can help limit potential losses by automatically selling a stock when it reaches a certain price. This strategy is crucial during volatile market conditions.

By following these strategies, you can navigate the complexities of investing on Robinhood more effectively.

The Importance of Risk Management

Risk management is a critical aspect of investing that every user should prioritize. Here are some essential practices:

- Assess Your Risk Tolerance: Understand how much risk you are willing to take based on your financial situation and investment goals. This assessment will guide your investment choices.

- Avoid Overleveraging: While margin trading may seem attractive, it increases your risk exposure significantly. Use margin cautiously and only if you fully understand the implications.

- Monitor Your Investments Regularly: Keep track of your portfolio’s performance and be prepared to make adjustments as necessary. Regular monitoring allows you to respond quickly to market changes.

Implementing effective risk management techniques can help protect your investments from unforeseen market shifts.

FAQs About Investing on Robinhood

FAQs About What If You Invest On Robinhood

- Is investing on Robinhood safe?

Robinhood is regulated by the SEC and FINRA; however, like all investments, there are inherent risks involved. - What types of investments can I make on Robinhood?

You can invest in stocks, ETFs, options, and cryptocurrencies through the platform. - Do I need a minimum amount to start investing?

No minimum deposit is required; you can start with as little as $1. - Can I trade fractional shares on Robinhood?

Yes, Robinhood allows you to buy fractional shares starting at $1. - What educational resources does Robinhood offer?

Robinhood provides educational content through its app to help users learn about investing.

Conclusion

Investing on Robinhood presents an exciting opportunity for individuals looking to enter the stock market without traditional barriers such as high fees or complex platforms. With features like commission-free trading and fractional shares, it has become a popular choice among younger investors seeking financial independence. However, it’s essential to approach this platform with caution and implement sound investment strategies while managing risks effectively.

By understanding both the benefits and drawbacks associated with investing on Robinhood, users can make informed decisions that align with their financial goals. Whether you’re a novice investor or someone looking to explore new opportunities in the stock market, Robinhood offers an accessible entry point into the world of investing.