Investing in Bitcoin has become a popular choice among investors seeking high returns in the cryptocurrency market. With the price of Bitcoin fluctuating dramatically, many individuals consider investing significant amounts, often exceeding $10,000. This article explores the implications of such investments, potential risks and rewards, and practical strategies for managing a substantial Bitcoin investment.

Investing over $10,000 in Bitcoin can lead to significant financial outcomes. The volatility of Bitcoin means that while there is potential for high returns, there is also a risk of substantial losses. Investors must understand market dynamics, regulatory changes, and their own financial goals before making such a commitment.

The recent introduction of regulations concerning cryptocurrency transactions adds another layer of complexity. For instance, as of January 1, 2024, any transaction involving $10,000 or more in cryptocurrency must be reported to the IRS within 15 days. This requirement is part of the new $10K Crypto Reporting Rule (6050I), which aims to enhance transparency in cryptocurrency transactions.

| Aspect | Details |

|---|---|

| Investment Amount | $10,000+ |

| Potential Returns | High volatility with potential for significant gains or losses |

| Regulatory Requirement | Must report transactions over $10,000 to the IRS |

Understanding Bitcoin Investment

Investing in Bitcoin involves purchasing the digital currency with the expectation that its value will increase over time. The appeal lies in Bitcoin’s limited supply, which is capped at 21 million coins. This scarcity can drive demand and potentially increase prices as more investors enter the market.

Bitcoin’s price history shows dramatic fluctuations; it has reached all-time highs and experienced significant downturns. For instance, after peaking at nearly $69,000 in November 2021, it fell to around $20,000 by mid-2022. Such volatility can lead to substantial gains or losses for investors who buy in at different times.

Investors are drawn to Bitcoin for various reasons:

- Potential for High Returns: Many see Bitcoin as a way to achieve returns that far exceed traditional investments like stocks or bonds.

- Inflation Hedge: With concerns about inflation and currency devaluation, some view Bitcoin as “digital gold,” a store of value that can protect wealth.

- Technological Innovation: The underlying blockchain technology is seen as revolutionary, with potential applications across numerous industries.

However, investing in Bitcoin also comes with risks:

- Market Volatility: The price can swing dramatically within short periods.

- Regulatory Risks: Changes in government regulations can impact the market significantly.

- Security Concerns: Investors must protect their digital assets from hacking and theft.

Strategies for Investing Over $10,000

When investing more than $10,000 in Bitcoin, it’s essential to adopt a well-thought-out strategy. Here are some effective approaches:

- Dollar-Cost Averaging (DCA): Instead of investing the entire amount at once, consider spreading your investment over time. This method reduces the impact of volatility by buying fixed dollar amounts at regular intervals.

- Long-Term Holding (HODLing): If you believe in Bitcoin’s long-term potential, consider holding onto your investment regardless of short-term price fluctuations. This strategy requires patience and a strong belief in Bitcoin’s future value.

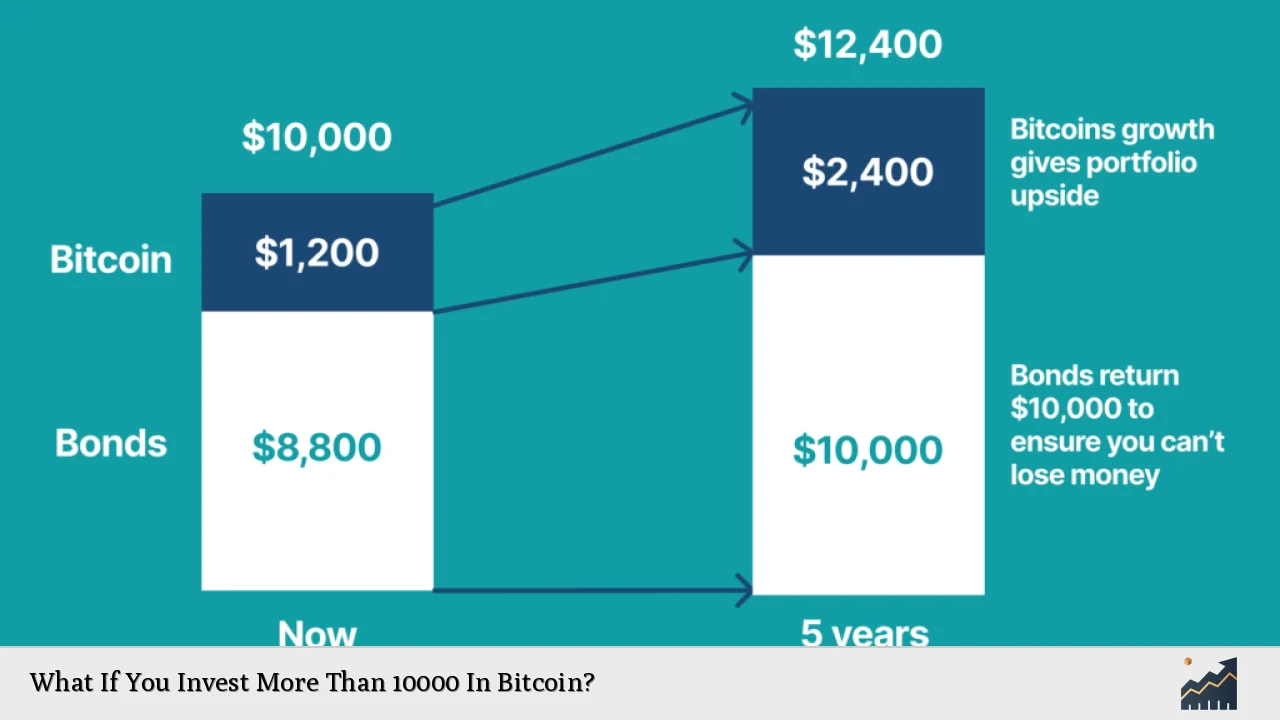

- Diversification: While focusing on Bitcoin is common, diversifying into other cryptocurrencies or asset classes can help mitigate risks. Consider allocating a portion of your investment to established altcoins or traditional assets like stocks and bonds.

- Regular Monitoring: Stay informed about market trends and news that could affect Bitcoin’s price. Regularly review your investment strategy and make adjustments based on market conditions.

Risks Associated with Large Investments

Investing more than $10,000 in Bitcoin carries inherent risks that investors must acknowledge:

- Market Volatility: The cryptocurrency market is known for its extreme price swings. A sudden drop in Bitcoin’s value could significantly impact your investment.

- Regulatory Changes: As governments worldwide continue to develop regulations surrounding cryptocurrencies, any changes could affect market dynamics and investor confidence.

- Security Risks: Storing large amounts of Bitcoin requires secure wallets. Investors must be vigilant against hacking attempts and ensure they use reputable exchanges and wallets.

- Psychological Factors: Large investments can lead to emotional decision-making during market fluctuations. It’s crucial to remain disciplined and stick to your investment strategy.

The Impact of Regulatory Changes

The introduction of new regulations can significantly impact how investors approach large investments in cryptocurrencies like Bitcoin. The $10K Crypto Reporting Rule (6050I) mandates that any transaction exceeding $10,000 be reported to the IRS within 15 days. This requirement aims to enhance transparency but may also deter some investors due to increased scrutiny.

Additionally, regulatory bodies are increasingly focusing on consumer protection and market integrity. As these regulations evolve, they may affect liquidity and trading volumes within the cryptocurrency market.

Investors should stay informed about regulatory developments that could influence their investments:

- Understanding Compliance Requirements: Familiarize yourself with reporting requirements related to cryptocurrency transactions.

- Monitoring Regulatory Trends: Keep an eye on proposed regulations that could impact the broader crypto landscape.

The Future Outlook for Bitcoin Investments

As more individuals consider investing significant amounts in Bitcoin, understanding its future potential is crucial. Analysts have varying predictions regarding Bitcoin’s trajectory:

- Some experts predict that institutional adoption will continue to grow as companies invest a portion of their assets into Bitcoin.

- Others believe that regulatory clarity will bolster investor confidence and lead to increased participation from retail investors.

Despite differing opinions on future price movements, many agree on one thing: Bitcoin has established itself as a legitimate asset class. Its growing acceptance by mainstream financial institutions signals a shift towards broader adoption.

However, potential investors should approach with caution:

- Conduct Thorough Research: Understand the factors influencing Bitcoin’s price movements before making substantial investments.

- Stay Updated on Market Trends: Regularly review news articles and analysis from reputable sources to stay informed about developments affecting the crypto market.

FAQs About What If You Invest More Than 10000 In Bitcoin

- What happens if I invest more than $10,000 in Bitcoin?

Your investment will be subject to market volatility; you may experience significant gains or losses. - Do I need to report my investment if it exceeds $10,000?

Yes, under the new regulations effective January 1, 2024, you must report any transaction over this amount. - Is it safe to invest large amounts in Bitcoin?

While many have successfully invested large sums in Bitcoin, it carries inherent risks including volatility and security concerns. - What strategies should I use for large investments?

Dollar-cost averaging and long-term holding are effective strategies for managing large investments. - How can I protect my investment?

Use secure wallets for storage and stay informed about market trends and security practices.

In conclusion, investing more than $10,000 in Bitcoin presents both opportunities and challenges. By understanding the dynamics of the cryptocurrency market and adopting sound investment strategies while remaining aware of regulatory requirements, investors can navigate this exciting yet volatile landscape effectively.