Investing is a crucial aspect of financial planning, and many individuals face the dilemma of starting their investment journey later than ideal. Whether due to life circumstances, lack of knowledge, or financial constraints, beginning to invest late can create anxiety about achieving financial goals. However, it is essential to understand that while starting late may present challenges, it is never too late to begin investing. This article explores the implications of investing late, strategies to catch up, and the importance of making informed decisions.

| Aspect | Details |

|---|---|

| Investment Delay | Starting investments later than planned can significantly affect long-term financial goals. |

The Implications of Delayed Investing

Investing late can have serious consequences on your financial future. The most significant impact is the loss of compound growth. Compound interest allows your investments to grow exponentially over time, meaning that the earlier you start investing, the more your money can work for you. For instance, if you invest $1,000 at an annual return of 7%, after 30 years, it could grow to approximately $7,612. However, if you delay starting by ten years, that same $1,000 will only grow to about $3,870 over 20 years.

Another critical factor is the increased investment required to reach your financial goals if you start late. For example, if you plan to retire with $1 million and begin investing at age 40 instead of 30, you may need to contribute significantly more each month to achieve that goal. This scenario often leads to stress and potential burnout as individuals scramble to save more in a shorter time frame.

Moreover, delaying investments can lead to missed opportunities in the market. Historically, markets have shown an upward trend over the long term. By waiting to invest, individuals risk missing out on valuable growth periods. Even if markets fluctuate in the short term, being invested allows you to benefit from long-term growth trends.

Strategies for Catching Up on Investments

If you’ve started investing late, there are several strategies you can implement to help make up for lost time.

- Set Clear Goals: Establish specific financial goals for retirement or other investments. Having clear objectives can guide your investment decisions and help maintain focus.

- Maximize Contributions: Take advantage of employer-sponsored retirement plans by contributing enough to receive any available matching contributions. This is essentially free money that can significantly boost your retirement savings.

- Automate Investments: Set up automatic contributions from your paycheck or bank account into your investment accounts. This strategy ensures consistency and reduces the temptation to spend money intended for savings.

- Consider Catch-Up Contributions: If you’re aged 50 or older, many retirement accounts allow for catch-up contributions beyond standard limits. This option can help accelerate your savings as you approach retirement.

- Diversify Your Portfolio: A well-diversified portfolio can balance risk and reward. Consider a mix of stocks, bonds, and other assets that align with your risk tolerance and investment timeline.

- Educate Yourself: Invest time in learning about different investment vehicles and strategies. Knowledge can empower you to make informed decisions that align with your financial goals.

Rethinking Your Budget

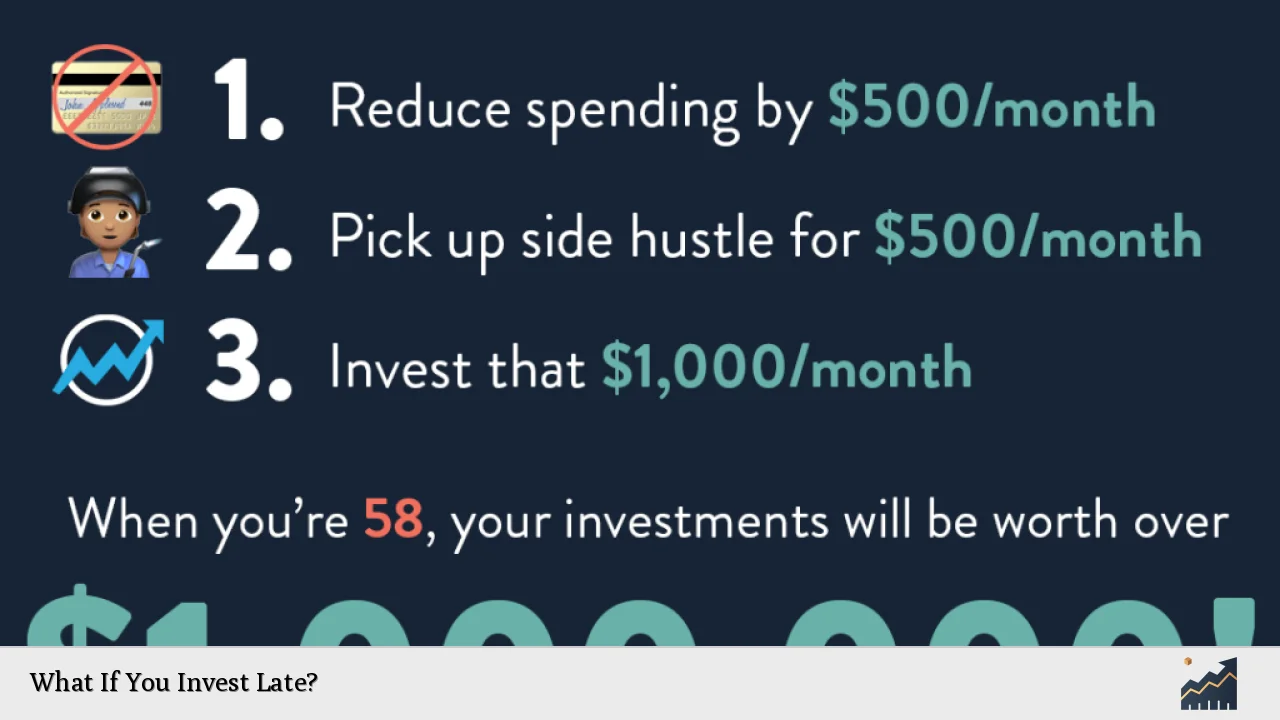

A critical step in making up for lost time in investing is reassessing your budget.

- Identify Areas for Savings: Review your monthly expenses and identify areas where you can cut back. Whether it’s dining out less or canceling unused subscriptions, reallocating these funds towards investments can make a significant difference.

- Increase Income: Consider side jobs or freelance opportunities that can supplement your income. The additional earnings can be directed towards investments.

- Emergency Fund Priority: Before aggressively investing, ensure you have an emergency fund covering three to six months of living expenses. This safety net prevents the need to withdraw from investments during emergencies.

- Debt Management: Pay down high-interest debts first. The interest on these debts often exceeds potential investment returns; thus, eliminating them should be a priority before focusing on investment growth.

The Importance of Consistency

Consistency is vital in investing, especially when starting late.

- Regular Contributions Matter: Even small amounts invested regularly can accumulate over time due to compounding effects. Commit to a consistent investment schedule regardless of market conditions.

- Stay Informed About Market Trends: Keeping abreast of market trends helps investors make informed decisions about when to buy or sell assets without succumbing to emotional reactions during market volatility.

- Review Your Investments Periodically: Regularly assess your portfolio’s performance and adjust as necessary based on changing financial goals or market conditions.

Understanding Risk Tolerance

Understanding your risk tolerance is crucial when investing late in life.

- Assess Your Comfort Level: Determine how much risk you are willing to take based on your age, financial situation, and investment goals. Younger investors may afford higher risks due to a longer time horizon; however, those closer to retirement may prefer safer options.

- Adjust Investments Accordingly: As you age or as your financial situation changes, adjust your investment strategy accordingly. A more conservative approach may be necessary as retirement approaches.

The Role of Professional Guidance

Seeking professional advice can be beneficial when navigating late investments.

- Financial Advisors Can Help: A certified financial planner can provide personalized advice tailored to your unique situation and goals. They can help create a comprehensive plan that considers all aspects of your finances.

- Investment Education Resources: Utilize resources such as books, online courses, or workshops that focus on investing basics and strategies for late starters.

FAQs About What If You Invest Late

- Is it too late for me to start investing?

No, it’s never too late; starting now is better than not starting at all. - How much should I invest if I start late?

The amount depends on your goals; consider maximizing contributions based on what you can afford. - What are catch-up contributions?

Catch-up contributions allow individuals aged 50 and older to contribute extra amounts into retirement accounts. - Should I prioritize paying off debt before investing?

Yes; focus on high-interest debt first as it typically costs more than potential investment returns. - Can automated investing help me stay consistent?

Absolutely; automating contributions helps ensure regular investments without needing constant attention.

Investing late does not mean all hope is lost; with strategic planning and consistent efforts, it is possible to build a substantial portfolio even with a delayed start. By understanding the implications of delayed investing and implementing effective strategies such as budgeting adjustments and professional guidance, individuals can work towards achieving their financial goals despite starting later than desired.