Investing in Tesla, Inc. (TSLA) presents an intriguing opportunity for individuals interested in the electric vehicle (EV) market and sustainable energy solutions. As a pioneer in the automotive and clean energy sectors, Tesla has established itself as a leader in innovation, attracting a diverse range of investors. This article explores the potential benefits and risks associated with investing in Tesla, providing insights into the company's market position, financial performance, and future outlook.

Tesla's stock has gained significant attention due to its rapid growth and the charismatic leadership of CEO Elon Musk. Investors are drawn to Tesla not only for its cutting-edge technology and ambitious goals but also for its potential to revolutionize the transportation sector. However, investing in Tesla is not without its challenges. Understanding the intricacies of the stock, market trends, and the broader economic environment is crucial for making informed investment decisions.

| Key Factor | Details |

|---|---|

| Company | Tesla, Inc. |

| Ticker Symbol | TSLA |

| Market Cap | $1.32 trillion (as of recent data) |

| Industry | Electric Vehicles and Clean Energy |

Understanding Tesla's Market Position

Tesla operates in a rapidly evolving market characterized by increasing demand for electric vehicles and renewable energy solutions. The company's primary products include electric cars, energy storage systems, solar panels, and related technologies. As environmental concerns grow globally, Tesla is well-positioned to capitalize on the shift towards sustainable transportation.

The company's market position is bolstered by several key factors:

- Innovative Technology: Tesla is renowned for its advanced technology, including autonomous driving capabilities and high-performance electric vehicles. This innovation attracts tech-savvy consumers who prioritize cutting-edge features.

- Brand Loyalty: Tesla has cultivated a strong brand identity associated with sustainability and luxury. Many consumers view owning a Tesla as a status symbol, enhancing customer loyalty.

- Global Expansion: As Tesla continues to expand its production facilities worldwide, including new factories in Europe and Asia, it increases its market reach and revenue potential.

Despite these advantages, potential investors should also consider the competitive landscape. Traditional automakers are increasingly entering the EV market, posing challenges to Tesla's dominance.

Financial Performance and Growth Potential

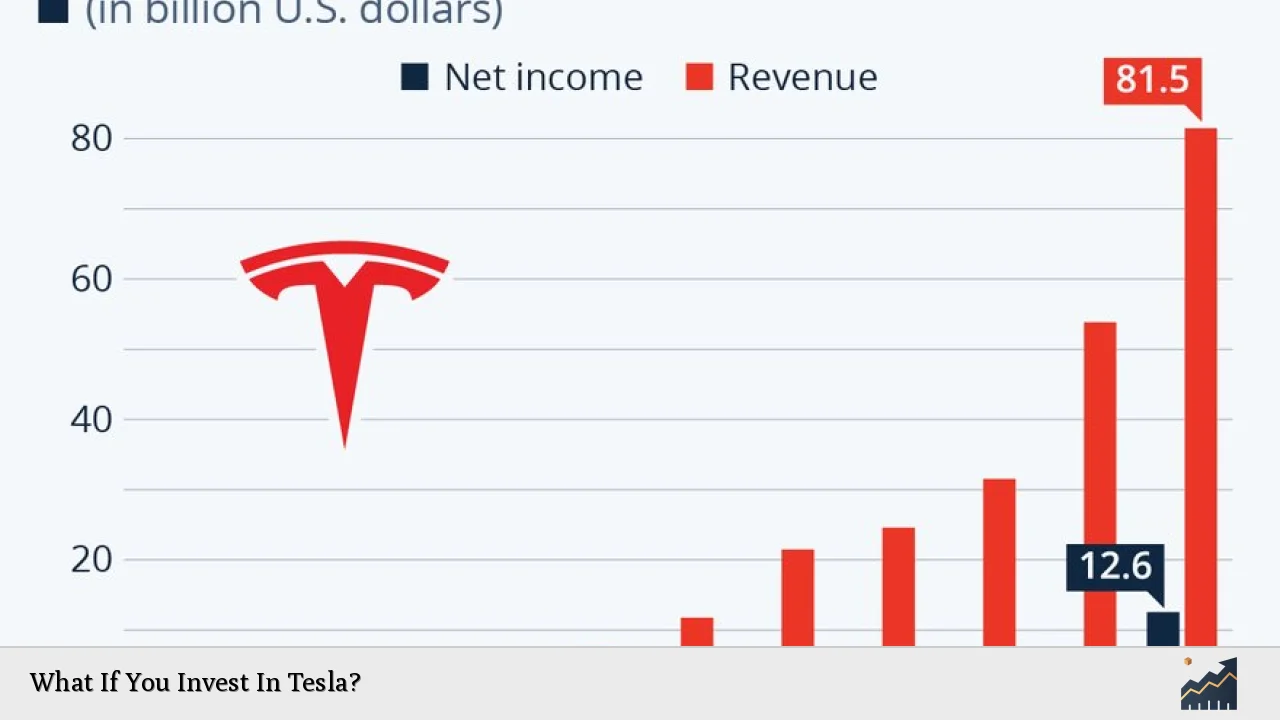

Tesla's financial performance has been a focal point for investors. The company has experienced substantial revenue growth over recent years, driven by rising demand for electric vehicles. In Q2 2024, Tesla reported revenues of $25.5 billion, reflecting a 2.3% increase year-over-year. However, its profit margins have faced pressure due to increased competition and rising production costs.

Key financial metrics to consider include:

- Earnings Per Share (EPS): As of recent reports, Tesla's EPS was $3.64 with a price-to-earnings (P/E) ratio of 112.6. These figures indicate that while investors are optimistic about future growth, they are also paying a premium for shares.

- Market Capitalization: With a market cap exceeding $1 trillion, Tesla remains one of the most valuable companies globally. This valuation reflects investor confidence in its long-term growth prospects.

- Investment in Innovation: Tesla continues to invest heavily in research and development (R&D), focusing on battery technology and autonomous driving capabilities. These investments are crucial for maintaining its competitive edge.

While Tesla's growth trajectory appears promising, potential investors should remain cautious about fluctuations in profitability and market conditions.

Risks Associated with Investing in Tesla

Investing in Tesla carries inherent risks that must be carefully evaluated:

- Market Volatility: TSLA stock is known for its volatility, influenced by various factors such as market sentiment and macroeconomic conditions. Investors should be prepared for price fluctuations.

- Competition: The EV market is becoming increasingly crowded as traditional automakers launch their electric models. This competition could impact Tesla's market share and profitability.

- Dependence on Elon Musk: Tesla's brand is closely tied to Elon Musk's vision and leadership. Any changes in his involvement or public perception could significantly affect investor confidence.

- Production Challenges: Scaling production to meet demand while maintaining quality can be challenging. Delays or issues at manufacturing facilities may impact sales performance.

Understanding these risks is essential for making informed investment decisions regarding Tesla stock.

How to Invest in Tesla Stock

Investing in Tesla stock involves several steps that ensure you make informed decisions:

1. Choose an Investment Platform: Select a brokerage that aligns with your investment strategy. Popular options include online brokerages like E*TRADE or mobile trading apps like Robinhood.

2. Open an Account: Create an investment account by providing personal information such as your social security number and financial details.

3. Fund Your Account: Deposit funds into your brokerage account using methods like bank transfers or credit cards.

4. Research Before Buying: Analyze Tesla’s financial health by reviewing earnings reports, analyst ratings, and industry trends.

5. Place Your Order: Decide how many shares you want to purchase and choose between different order types (market or limit orders).

6. Monitor Your Investment: Regularly track your investment’s performance through your brokerage platform to make informed decisions about buying or selling shares.

By following these steps, you can strategically invest in Tesla while managing associated risks effectively.

Long-Term Investment Strategies

Investing in Tesla may require a long-term perspective due to the nature of the automotive industry and technological advancements:

- Diversification: Avoid concentrating your investments solely on Tesla; consider diversifying your portfolio across various sectors to mitigate risks.

- Dollar-Cost Averaging: This strategy involves buying shares at regular intervals regardless of price fluctuations, reducing the impact of volatility on your overall investment.

- Stay Informed: Keep up with industry trends, technological advancements, and regulatory changes that could impact Tesla’s business model.

By adopting these strategies, investors can position themselves for potential long-term gains while minimizing risks associated with short-term volatility.

FAQs About Investing In Tesla

- What is the best way to buy Tesla stock?

The best way to buy Tesla stock is through an online brokerage account that offers low fees and useful trading tools. - Is investing in Tesla risky?

Yes, investing in Tesla carries risks such as market volatility and competition from other automakers. - What are the benefits of investing in Tesla?

The benefits include exposure to innovative technology and potential long-term growth as demand for electric vehicles increases. - Should I invest in multiple stocks or just Tesla?

Diversifying your investments across multiple stocks can help mitigate risk compared to investing solely in one company. - How often should I review my investment in Tesla?

You should review your investment regularly to assess performance and adjust your strategy based on market conditions.

In conclusion, investing in Tesla presents both opportunities and challenges that require careful consideration. By understanding the company's market position, financial performance, associated risks, and effective investment strategies, individuals can make informed decisions about whether to invest in this innovative company at the forefront of sustainable transportation.