Investing in cryptocurrency has become a popular topic in recent years, attracting both seasoned investors and newcomers alike. Cryptocurrencies, such as Bitcoin and Ethereum, have gained significant attention due to their potential for high returns and the innovative technology behind them. However, investing in this volatile market comes with its own set of risks and rewards that potential investors must understand.

Cryptocurrency operates on decentralized networks using blockchain technology, which allows for secure and transparent transactions. This digital asset class has grown rapidly, with thousands of cryptocurrencies available for trading. The allure of cryptocurrency investment lies not only in the potential for substantial financial gain but also in the opportunity to be part of a technological revolution.

Investors should approach cryptocurrency with caution and a well-informed strategy. Understanding the different ways to invest, the associated risks, and effective management strategies is crucial for success in this dynamic market.

| Aspect | Details |

|---|---|

| Market Volatility | Cryptocurrencies can experience extreme price fluctuations. |

| Investment Methods | Investing can be done directly or through funds like ETFs. |

Understanding Cryptocurrency Investment

Investing in cryptocurrency involves purchasing digital coins or tokens with the expectation that their value will increase over time. Unlike traditional investments, cryptocurrencies are not regulated by any central authority, which contributes to their volatility. This lack of regulation means that prices can soar or plummet based on market sentiment, news events, or regulatory developments.

The most popular cryptocurrencies include Bitcoin, Ethereum, and Ripple. Each has its unique features and use cases, making it essential for investors to research and understand what they are investing in. For instance, Bitcoin is often viewed as a store of value, while Ethereum is known for its smart contract functionality.

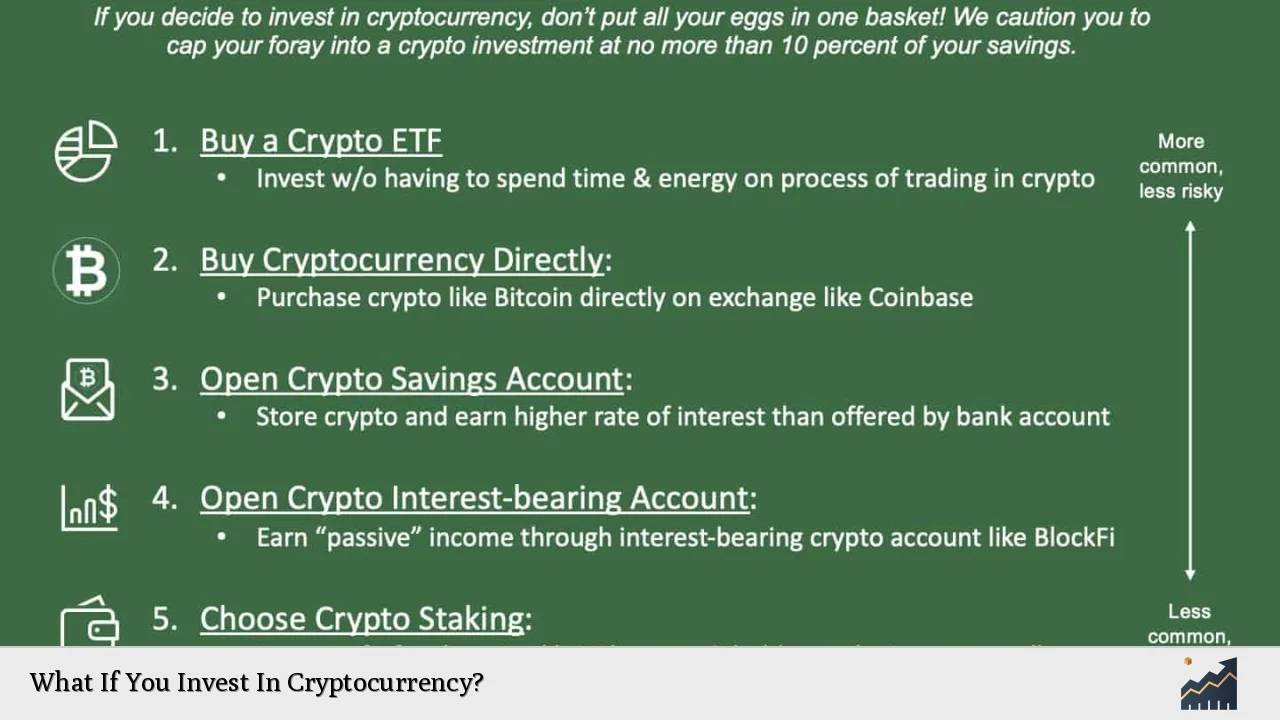

Investors must also be aware of the various methods available for investing in cryptocurrencies. These methods include buying coins directly from exchanges, investing in cryptocurrency exchange-traded funds (ETFs), or purchasing stocks of companies involved in the crypto sector.

How to Start Investing in Cryptocurrency

Starting your cryptocurrency investment journey requires several key steps:

- Choose a Reliable Exchange: Selecting a reputable cryptocurrency exchange is crucial for ensuring security and ease of use. Look for platforms with strong security measures, user-friendly interfaces, and positive reviews from other investors.

- Create an Account: After selecting an exchange, you’ll need to create an account. This process usually involves providing personal information and verifying your identity through KYC (Know Your Customer) protocols.

- Fund Your Account: Once your account is set up, you can fund it using various payment methods like bank transfers or credit/debit cards. Ensure you understand any fees associated with deposits.

- Select Your Investments: Research different cryptocurrencies to determine which ones align with your investment strategy. Consider factors such as market capitalization, historical performance, and technological innovation.

- Make Your Purchase: After selecting your cryptocurrencies, place your order through the exchange platform. You can choose between market orders (buying at current prices) or limit orders (setting a specific price).

- Secure Your Investments: After purchasing cryptocurrencies, consider transferring them to a secure wallet rather than leaving them on the exchange. Hardware wallets offer enhanced security against hacks.

Risks Associated with Cryptocurrency Investment

While investing in cryptocurrency can yield high returns, it is essential to recognize the inherent risks involved:

- Market Volatility: Cryptocurrencies are known for their extreme price swings. Prices can fluctuate dramatically within short periods, leading to potential losses.

- Regulatory Risks: The regulatory environment surrounding cryptocurrencies is constantly evolving. Changes in regulations can impact market access and affect prices.

- Security Concerns: Cryptocurrency exchanges can be vulnerable to hacking attempts. Investors must take precautions to secure their assets through wallets and two-factor authentication.

- Lack of Consumer Protections: Unlike traditional financial markets, cryptocurrencies often lack regulatory oversight, which means investors have limited recourse if something goes wrong.

To mitigate these risks, it’s advisable to diversify your investment portfolio by allocating only a small percentage of your total investments to cryptocurrencies. This way, you can participate in the potential upside without exposing yourself to excessive risk.

Strategies for Successful Cryptocurrency Investing

To enhance your chances of success in cryptocurrency investing, consider implementing the following strategies:

- Do Your Research: Before investing in any cryptocurrency, conduct thorough research on its technology, use case, team behind it, and market trends. Understanding what drives value will help you make informed decisions.

- Diversify Your Portfolio: Just as with traditional investments, diversification is key in crypto investing. Spread your investments across multiple cryptocurrencies to reduce risk.

- Set Clear Investment Goals: Determine what you want to achieve with your investments—whether it’s short-term gains or long-term wealth accumulation—and develop a strategy accordingly.

- Use Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount into cryptocurrencies over time rather than making a lump-sum investment. This approach helps mitigate the impact of volatility by averaging out purchase prices.

- Stay Informed: Keep up-to-date with news related to the cryptocurrency market and regulatory developments that may affect your investments. Being informed will help you make timely decisions.

Analyzing Market Trends

Understanding market trends is crucial for successful cryptocurrency investing. Investors should familiarize themselves with technical analysis tools that help identify price patterns and trends:

- Candlestick Charts: These charts visually represent price movements over time and help traders identify trends based on opening and closing prices.

- Support and Resistance Levels: Support levels indicate where prices tend to stop falling due to buying interest, while resistance levels indicate where prices tend to stop rising due to selling pressure.

- Technical Indicators: Common indicators like moving averages can help investors identify trends and potential entry or exit points based on historical price data.

By combining technical analysis with fundamental research—such as evaluating project viability—investors can make more informed decisions about when to buy or sell their holdings.

FAQs About What If You Invest In Cryptocurrency

- What is cryptocurrency?

Cryptocurrency is a digital asset designed to work as a medium of exchange using cryptography for secure transactions. - How do I start investing in cryptocurrency?

Begin by choosing a reliable exchange, creating an account, funding it, selecting cryptocurrencies to invest in, and making purchases. - What are the risks involved in cryptocurrency investment?

The main risks include market volatility, regulatory changes, security vulnerabilities, and lack of consumer protections. - How can I secure my cryptocurrency investments?

Store your assets in secure wallets rather than leaving them on exchanges; consider hardware wallets for added security. - Is it advisable to invest all my money into cryptocurrency?

No; it’s important only to invest what you can afford to lose and diversify your portfolio across various asset classes.

Investing in cryptocurrency presents exciting opportunities but requires careful consideration and strategic planning. By understanding the market dynamics and employing sound investment practices, individuals can navigate this evolving landscape effectively while minimizing risks associated with this emerging asset class.