Investing Health Savings Account (HSA) funds can be a powerful strategy to grow your medical savings and potentially boost your retirement nest egg. HSAs offer unique triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. When you invest HSA funds, you’re leveraging these benefits to potentially increase your long-term savings significantly.

Before diving into HSA investments, it’s crucial to understand the basics. HSAs are available to individuals with high-deductible health plans (HDHPs) and allow you to set aside money for medical expenses. While many people use HSAs for current medical costs, investing the funds can lead to substantial growth over time.

| HSA Feature | Benefit |

|---|---|

| Tax-deductible contributions | Reduce your taxable income |

| Tax-free growth | Earnings compound without tax burden |

| Tax-free withdrawals | For qualified medical expenses |

Understanding HSA Investment Options

When you decide to invest your HSA funds, you’ll typically have access to a range of investment options similar to those in a 401(k) or IRA. These may include:

- Mutual funds

- Exchange-traded funds (ETFs)

- Stocks

- Bonds

Many HSA providers require a minimum balance in your cash account before you can start investing. This threshold is often around $1,000 to $2,000, ensuring you have sufficient funds for immediate medical needs.

Selecting Your Investments

Choosing the right investments for your HSA depends on several factors:

- Your risk tolerance

- Investment time horizon

- Current and future medical needs

- Overall financial goals

For those with a long-term perspective, a diversified portfolio of stock and bond funds may be appropriate. If you’re closer to retirement or anticipate needing the funds sooner, a more conservative approach with a higher allocation to bonds and cash equivalents might be prudent.

Some HSA providers offer target-date funds or professionally managed portfolios, which can simplify the investment process. These options automatically adjust your asset allocation based on your age or risk profile.

Potential Benefits of Investing HSA Funds

Investing your HSA funds can lead to significant long-term growth, potentially outpacing inflation and increasing your medical savings substantially. Here are some key benefits:

- Compound growth: By investing early and consistently, you can take advantage of compound interest, potentially growing your HSA balance significantly over time.

- Increased savings for retirement: HSAs can serve as an additional retirement account, complementing your 401(k) or IRA.

- Flexibility: Unlike Flexible Spending Accounts (FSAs), HSAs have no “use it or lose it” provision, allowing your investments to grow indefinitely.

- Potential for higher returns: Over the long term, invested funds may yield higher returns compared to keeping your HSA in a low-interest savings account.

Tax Advantages in Action

The tax benefits of investing HSA funds become more apparent when you consider the long-term impact. For example, if you contribute $3,000 annually to your HSA and invest it with an average annual return of 7%, after 20 years, you could potentially have over $120,000, all of which can be used tax-free for qualified medical expenses.

Risks and Considerations

While investing HSA funds offers potential benefits, it’s important to be aware of the risks:

- Market volatility: Like any investment, HSA investments are subject to market fluctuations and potential losses.

- Fees: Some HSA providers charge additional fees for investment accounts or specific investment options.

- Liquidity concerns: Invested funds may not be immediately available for medical expenses, potentially requiring you to sell investments at inopportune times.

- Minimum balance requirements: Maintaining the required cash balance can limit the amount available for investing.

Balancing Current Needs and Future Growth

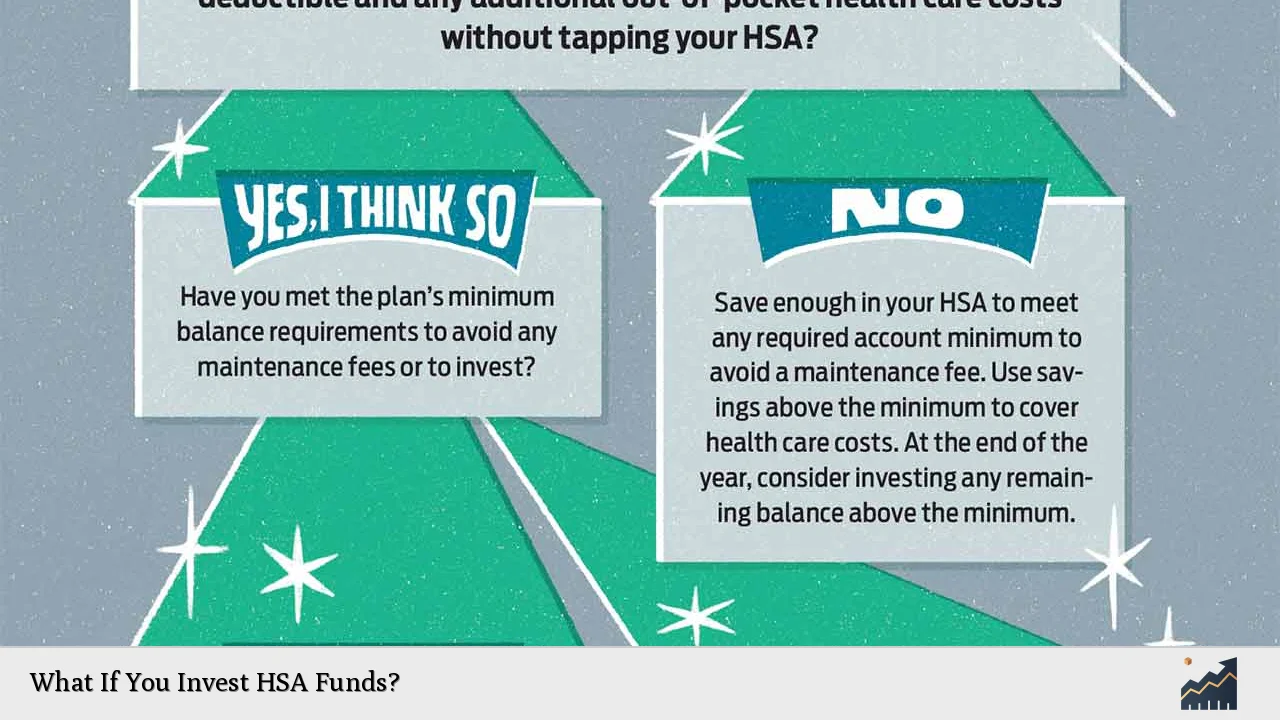

One of the challenges of investing HSA funds is balancing immediate medical needs with long-term growth potential. It’s crucial to maintain sufficient cash reserves for expected medical expenses while investing the remainder for future needs.

A common strategy is to keep enough cash in your HSA to cover your annual deductible and invest the rest. This approach ensures you have funds available for current medical costs while allowing the excess to grow over time.

Strategies for Maximizing HSA Investments

To make the most of your HSA investments, consider these strategies:

- Maximize contributions: Contribute the maximum allowed amount to your HSA each year to take full advantage of tax benefits and investment potential.

- Pay medical expenses out-of-pocket: If possible, pay for current medical expenses from your regular income and let your HSA investments grow tax-free.

- Rebalance regularly: Review and adjust your investment allocation periodically to maintain your desired risk level and investment strategy.

- Consider your overall portfolio: Treat your HSA investments as part of your broader investment portfolio, ensuring they align with your overall financial goals and risk tolerance.

- Keep good records: Maintain detailed records of medical expenses, even if you don’t reimburse yourself immediately. This allows you to withdraw funds tax-free in the future for past expenses.

Long-Term Perspective

Taking a long-term view with your HSA investments can be particularly beneficial. By treating your HSA as a retirement health savings vehicle, you can potentially accumulate a significant sum to cover healthcare costs in retirement, when medical expenses often increase.

Choosing the Right HSA Provider for Investments

Not all HSA providers offer investment options, and those that do may have varying features and fees. When selecting an HSA provider for investments, consider:

- Investment options: Look for a provider offering a diverse range of low-cost investment options.

- Fees: Compare account maintenance fees, investment fees, and transaction costs.

- Minimum balance requirements: Choose a provider with a reasonable minimum balance requirement for investing.

- User experience: Opt for a provider with a user-friendly platform for managing your investments.

- Integration with other accounts: Some providers offer the ability to view your HSA alongside other investment accounts, providing a holistic view of your finances.

FAQs About What If You Invest HSA Funds

- Can I lose money by investing my HSA funds?

Yes, like any investment, HSA investments can lose value due to market fluctuations. - How much of my HSA should I invest?

Consider investing funds exceeding your annual deductible or anticipated medical expenses. - Are there penalties for withdrawing invested HSA funds?

No penalties for qualified medical expenses, but taxes and penalties apply for non-medical withdrawals before age 65. - Can I invest in individual stocks with my HSA?

Some HSA providers allow individual stock investments, but many limit options to mutual funds and ETFs. - What happens to my HSA investments if I change jobs?

Your HSA, including investments, remains yours regardless of employment changes.

Investing HSA funds can be a powerful strategy for long-term health and wealth management. By understanding the benefits, risks, and strategies associated with HSA investments, you can make informed decisions that align with your financial goals and healthcare needs. Remember to consider your individual circumstances, consult with financial professionals when necessary, and regularly review your investment strategy to ensure it continues to meet your evolving needs.