Investing your Health Savings Account (HSA) can be a strategic move for both immediate and future financial health. HSAs are unique because they offer triple tax advantages: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free. As such, many individuals view HSAs not just as a means to cover medical expenses but as a valuable investment vehicle that can help grow wealth over time. However, many people do not take full advantage of this opportunity due to lack of knowledge or understanding of how to effectively invest their HSA funds.

When considering investing your HSA, it’s essential to understand the various investment options available, the associated risks, and the best practices for managing these investments. This article will explore these aspects in detail, providing a comprehensive guide on how to maximize your HSA through investment.

| Aspect | Details |

|---|---|

| Tax Benefits | Triple tax advantage: contributions, growth, and withdrawals for medical expenses are tax-free. |

| Investment Options | Stocks, bonds, mutual funds, ETFs, and more. |

Understanding HSA Investment Basics

Investing within an HSA is similar to investing in other accounts like a 401(k) or IRA. However, there are specific considerations unique to HSAs. First and foremost, you must have a minimum balance in your HSA cash account before you can start investing. This threshold varies by provider but is often around $1,000 to $2,000. Once you meet this requirement, you can begin allocating funds toward various investment options.

One of the important factors to consider when investing your HSA is your time horizon. If you plan to use your HSA for immediate medical expenses, it may not be wise to invest heavily in volatile assets like stocks. Conversely, if you are looking at long-term growth—such as saving for healthcare costs in retirement—investing in higher-risk assets may yield better returns over time.

Additionally, understanding your risk tolerance is crucial. Some individuals may prefer safer investments such as bonds or money market funds, while others may be comfortable with the risks associated with stocks and mutual funds.

Types of Investments Available for HSAs

When it comes to investing your HSA funds, there are several options available:

- Stocks: Investing in individual stocks can offer high returns but comes with increased risk. It’s essential to research companies thoroughly before making any investments.

- Mutual Funds: These funds pool money from multiple investors to purchase a diversified portfolio of stocks or bonds. They can be actively managed or index-based.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks. They often have lower fees than mutual funds.

- Bonds: Generally considered safer than stocks, bonds can provide steady income through interest payments.

- Money Market Funds: These are low-risk investments that provide liquidity and stability but typically offer lower returns than other options.

Choosing the right mix of these investments depends on your financial goals and how soon you plan to use the funds. For instance, if you expect significant medical expenses soon, keeping a larger portion of your HSA in cash or low-risk investments may be prudent.

Managing Your HSA Investments

Once you’ve decided how to allocate your HSA funds among various investment options, it’s crucial to manage those investments effectively. Here are some best practices:

- Regularly Review Your Portfolio: Markets fluctuate; therefore, it’s essential to review your investment portfolio regularly and make adjustments as needed based on performance and changing financial goals.

- Consider Automatic Rebalancing: Many HSA providers offer automatic rebalancing features that help maintain your desired asset allocation without requiring constant oversight.

- Stay Informed: Keep up with market trends and economic indicators that could impact your investments. This knowledge will help you make informed decisions about when to buy or sell assets.

- Utilize Professional Advice: If you’re uncertain about how to manage your investments or which options are best for you, consider consulting with a financial advisor who specializes in HSAs.

The Importance of Cash Reserves

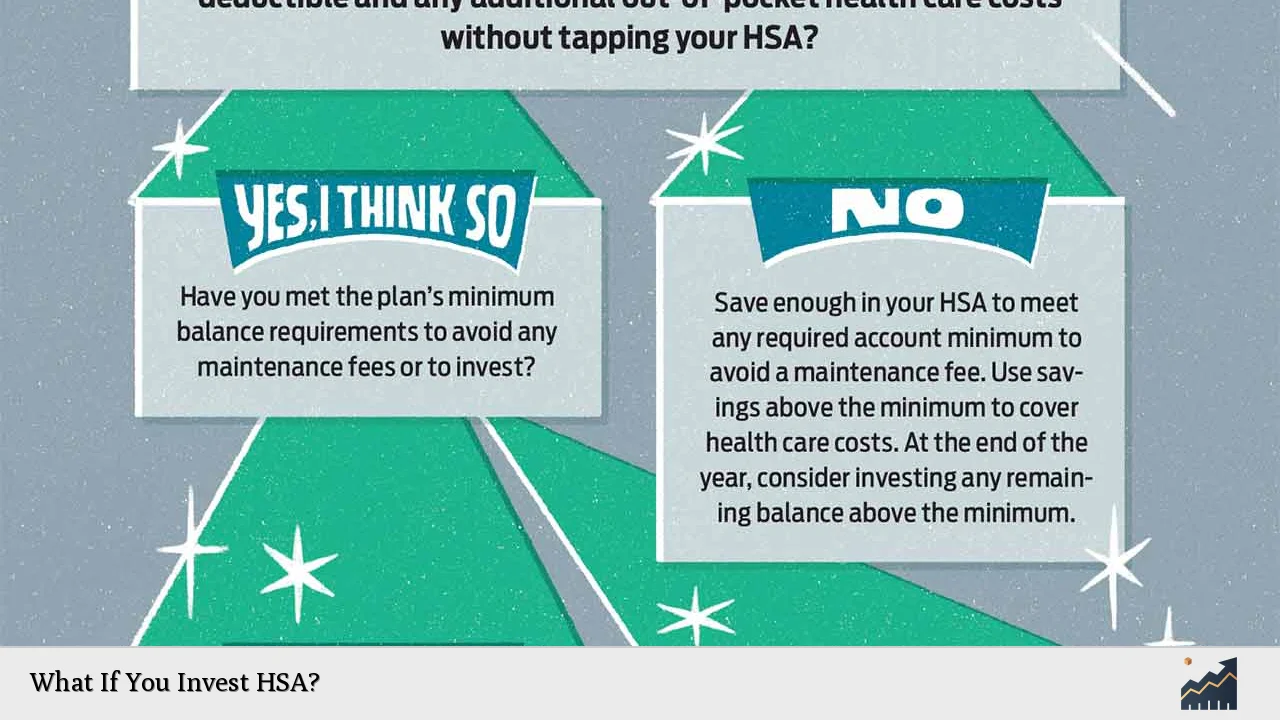

While investing can enhance the growth potential of your HSA funds, maintaining an adequate cash reserve is equally important. This reserve acts as a safety net for unexpected medical expenses that may arise before you can liquidate any investments.

Establishing a “cash target” within your HSA can help ensure that you have enough liquidity available for immediate needs while allowing excess funds to be invested for growth. For example:

- If you have $5,000 in your HSA and set a cash target of $2,500, you would invest the remaining $2,500.

This strategy balances the need for immediate access to cash while still taking advantage of investment opportunities.

Tax Implications of HSA Investments

One of the most compelling reasons to invest through an HSA is the favorable tax treatment it offers compared to other investment accounts. Contributions made into an HSA are tax-deductible up to certain limits set by the IRS each year. Moreover:

- Any earnings from investments within the account grow tax-free.

- Withdrawals made for qualified medical expenses are also tax-free.

This triple tax advantage makes HSAs one of the most efficient vehicles for saving and investing money intended for healthcare costs.

However, it’s crucial to keep records of any withdrawals made from the account for medical expenses to ensure they qualify under IRS rules. Failure to do so could result in taxes and penalties on non-qualified withdrawals.

How to Get Started with Investing Your HSA

To begin investing your HSA funds effectively:

1. Assess Your Current Financial Situation: Determine how much money you can afford to keep in cash versus what can be invested.

2. Research Your Options: Look into different investment vehicles offered by your HSA provider and understand their associated risks and fees.

3. Set Up Your Investment Account: Once you’ve met the minimum balance requirement, follow your provider’s instructions for setting up an investment account within your HSA.

4. Choose Your Investments: Based on your risk tolerance and financial goals, select a diversified mix of assets.

5. Monitor and Adjust: Regularly review your portfolio’s performance and make adjustments as necessary based on market conditions or changes in personal circumstances.

By following these steps and remaining informed about both market trends and personal financial needs, you can maximize the benefits of investing within your Health Savings Account.

FAQs About What If You Invest HSA

- What types of investments can I make with my HSA?

You can invest in stocks, bonds, mutual funds, ETFs, and money market funds. - How do I start investing my HSA funds?

First ensure you’ve met the minimum balance requirement; then follow your provider’s process for setting up an investment account. - What is the minimum balance required before I can invest?

This varies by provider but typically ranges from $1,000 to $2,000. - Are there any tax benefits associated with investing my HSA?

Yes! Contributions are tax-deductible; earnings grow tax-free; withdrawals for qualified medical expenses are also tax-free. - How often should I review my HSA investments?

You should review them regularly—at least annually—to ensure they align with your financial goals.