Investing in mutual funds has become a popular choice among individuals looking to grow their wealth over time. One innovative approach to mutual fund investing is the Daily Systematic Investment Plan (SIP). This method allows investors to contribute a fixed amount every business day, rather than the traditional monthly investment. Daily SIPs can enhance the benefits of mutual fund investing by providing a disciplined approach, better cost averaging, and the power of compounding.

The concept of daily investments aligns with the idea that consistent, small contributions can lead to significant growth over time. By participating in the market daily, investors can take advantage of price fluctuations and potentially increase their returns. This strategy is particularly appealing to those who may have irregular income streams or prefer more frequent investment opportunities.

| Feature | Description |

|---|---|

| Investment Frequency | Daily contributions on business days |

| Cost Averaging | Reduces the impact of market volatility |

Investing daily in mutual funds can be an effective way to build wealth, but it also requires careful planning and understanding of personal financial goals. This article will explore the benefits, strategies, and considerations for those interested in daily mutual fund investments.

Benefits of Daily Mutual Fund Investments

Daily investments in mutual funds offer several advantages that can enhance an investor’s overall experience and potential returns.

- Rupee Cost Averaging: By investing daily, investors can average out their purchase costs over time. This means that when prices are low, more units are bought, and when prices are high, fewer units are purchased. This strategy helps mitigate the impact of market volatility.

- Increased Compounding Potential: Daily SIPs allow for returns to be compounded more frequently. The earlier an investment is made, the sooner it begins to generate returns, leading to exponential growth over time.

- Flexibility and Convenience: Daily SIPs offer flexibility for investors who may not have a fixed monthly budget. It allows them to invest smaller amounts regularly without waiting for a specific date each month.

- Discipline in Investing: Committing to a daily investment routine fosters discipline. It encourages regular saving habits and helps investors stay focused on their long-term financial goals.

Investors should also consider how these benefits align with their personal financial objectives and risk tolerance.

How to Start Investing Daily in Mutual Funds

Starting a daily SIP in mutual funds involves several straightforward steps that can help streamline the process.

- Identify Financial Goals: Before beginning any investment journey, it is crucial to define your financial objectives. Are you saving for retirement, a child’s education, or a major purchase? Clear goals will guide your investment choices.

- Assess Risk Tolerance: Understanding your risk appetite is essential. Different mutual funds come with varying levels of risk. Choose funds that align with your comfort level regarding market fluctuations.

- Select Appropriate Funds: Research various mutual funds available for daily SIPs. Look for those with strong historical performance, low expense ratios, and alignment with your investment goals.

- Set Up Your Daily SIP: Once you have selected your funds, set up your daily SIP through a financial institution or online platform. Most platforms allow you to automate your investments for convenience.

- Monitor Your Investments: Regularly reviewing your portfolio is vital to ensure it remains aligned with your goals and market conditions. Adjustments may be necessary as circumstances change.

By following these steps, investors can effectively initiate their daily mutual fund investment journey.

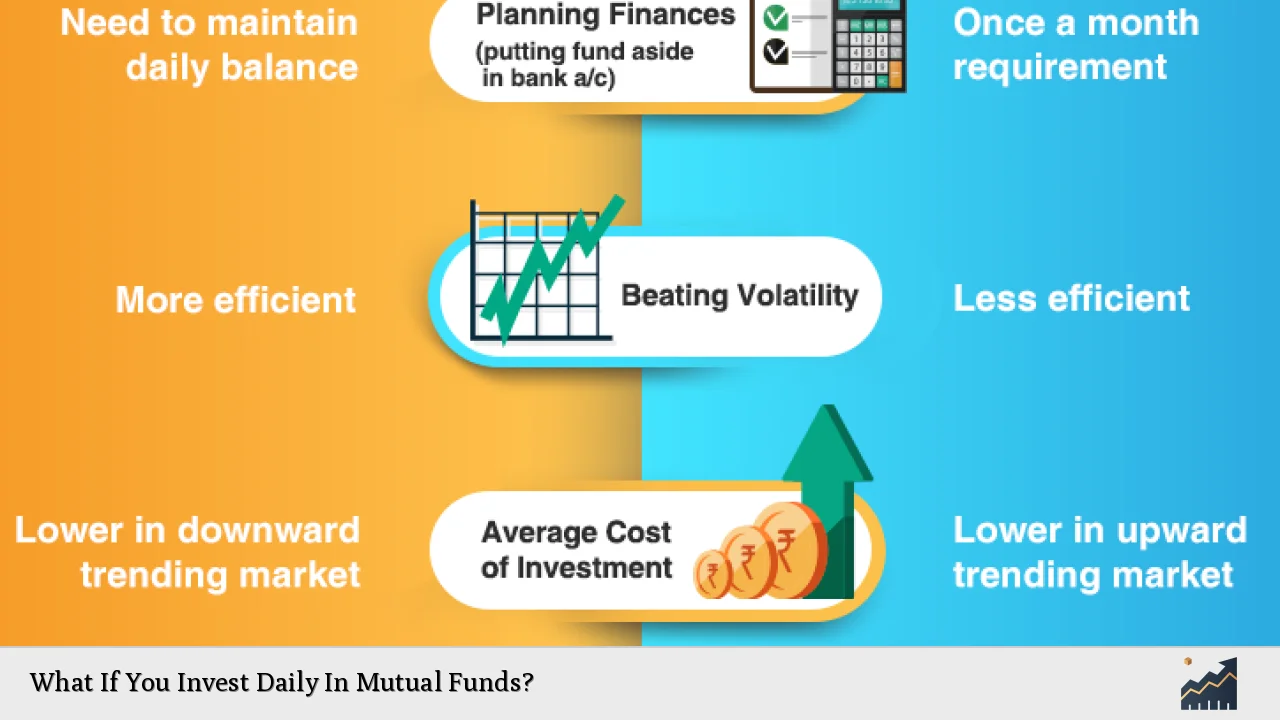

Comparison of Daily SIP vs Monthly SIP

While both daily and monthly SIPs serve similar purposes in facilitating regular investments in mutual funds, they have distinct characteristics that may influence an investor’s choice.

| Aspect | Daily SIP | Monthly SIP |

|---|---|---|

| Investment Frequency | Every business day | Once a month |

| Cost Averaging | More frequent averaging | Less frequent averaging |

| Convenience | Requires automation | Easier management |

| Monitoring Effort | More frequent tracking needed | Less frequent tracking needed |

| Behavioral Impact | Can deter impulsive decisions | Might lead to impulsive decisions during market highs/lows |

Choosing between daily and monthly SIPs depends on individual preferences regarding convenience, monitoring capabilities, and financial habits.

Potential Challenges of Daily Mutual Fund Investments

Despite the numerous benefits associated with daily investments in mutual funds, there are challenges that investors should be aware of before committing to this strategy.

- Tracking Complexity: Daily investments require more frequent monitoring compared to monthly contributions. This can add complexity for those who prefer a simpler approach to investing.

- Market Volatility Exposure: While rupee cost averaging helps mitigate risks, investing every day also means exposure to short-term market fluctuations that could affect returns.

- Automated Processes: Setting up automated daily investments may lead some investors to overlook their portfolios or fail to adjust their strategies as needed over time.

Investors should weigh these challenges against the benefits when deciding whether a daily SIP aligns with their financial strategy.

Strategies for Maximizing Returns with Daily Mutual Fund Investments

To optimize returns from daily mutual fund investments, consider implementing these strategies:

- Diversify Your Portfolio: Spread investments across different types of mutual funds (equity, debt, hybrid) to manage risk effectively while aiming for higher returns.

- Stay Informed About Market Trends: Keeping up-to-date with market conditions can help you make informed decisions about when to adjust your investments or switch funds if necessary.

- Review Performance Regularly: Periodically assess how your selected funds are performing against benchmarks and peers. Make adjustments if certain funds consistently underperform.

- Reinvest Dividends: Consider reinvesting any dividends received from your mutual funds back into the same or other funds to enhance compounding effects over time.

By adopting these strategies, investors can work towards maximizing their potential returns while managing risks associated with daily mutual fund investments.

FAQs About Daily Mutual Fund Investments

- What is a Daily Systematic Investment Plan (SIP)?

A Daily SIP allows investors to invest a fixed amount every business day into mutual funds. - How does dollar-cost averaging work with Daily SIPs?

This method averages out the cost of buying units by purchasing more when prices are low and less when prices are high. - Can I change my investment amount in a Daily SIP?

Yes, most platforms allow you to modify your investment amount as needed. - Are there any fees associated with Daily SIPs?

Yes, like all mutual fund investments, there may be fees involved; it’s essential to review them beforehand. - Is it better to invest daily or monthly in mutual funds?

This depends on personal preference; daily investments offer more flexibility while monthly ones may be easier to manage.

Investing daily in mutual funds through a systematic approach like a Daily SIP offers unique advantages that cater to different investor needs. By understanding both the benefits and challenges associated with this strategy, individuals can make informed decisions that align with their long-term financial goals.