Investing cash in stocks can be a strategic move for individuals looking to grow their wealth over time. By purchasing shares of publicly traded companies, investors hope to benefit from capital appreciation and dividends. This process involves understanding the stock market, choosing the right stocks, and managing risks effectively.

The stock market offers various opportunities for both novice and experienced investors. With the right approach, investing in stocks can lead to significant financial gains. However, it’s essential to recognize that stock investments come with inherent risks, including market volatility and potential losses.

In this article, we will explore the key aspects of investing cash in stocks, including how to get started, strategies for success, and common pitfalls to avoid.

| Aspect | Description |

|---|---|

| Investment Goals | Define your financial objectives before investing. |

| Risk Tolerance | Assess your comfort level with potential losses. |

Understanding the Stock Market

The stock market is a platform where shares of publicly traded companies are bought and sold. It serves as a marketplace for investors to trade ownership stakes in businesses. The prices of stocks fluctuate based on supply and demand dynamics, influenced by various factors such as company performance, economic conditions, and investor sentiment.

Investing in stocks allows individuals to participate in the growth of companies. When you buy a share, you become a partial owner of that company. If the company performs well, its stock price may increase, leading to potential profits when sold. Conversely, if the company faces challenges or if the market declines, the value of your investment may decrease.

To navigate the stock market effectively, investors should familiarize themselves with key concepts such as market capitalization, dividends, and price-to-earnings (P/E) ratios. Understanding these terms can help investors make informed decisions.

Getting Started with Stock Investment

Before diving into stock investment, it is crucial to establish a solid foundation. Here are essential steps to get started:

- Set Clear Investment Goals: Determine what you want to achieve through investing in stocks. Are you saving for retirement, a major purchase, or simply looking to grow your wealth?

- Choose an Investment Account: Select a brokerage account that suits your needs. There are various options available, including traditional brokerages and online platforms that offer lower fees.

- Fund Your Account: Deposit cash into your brokerage account. Some platforms allow you to start with minimal funds or even fractional shares.

- Research Stocks: Investigate potential investments by analyzing company performance, industry trends, and financial health.

- Diversify Your Portfolio: Avoid putting all your money into one stock. Diversifying across different sectors can reduce risk.

Investing requires patience and discipline. It’s essential to stay informed about market trends and continuously evaluate your investment strategy.

Strategies for Successful Investing

To maximize returns while minimizing risks, consider implementing these investment strategies:

- Buy-and-Hold Strategy: This long-term approach involves purchasing stocks and holding them for an extended period. It allows investors to ride out market fluctuations and benefit from overall growth.

- Dollar-Cost Averaging: This strategy entails investing a fixed amount regularly regardless of stock prices. It helps mitigate the impact of volatility by averaging out purchase costs over time.

- Value Investing: Focus on identifying undervalued stocks with strong fundamentals. This strategy aims to buy low and sell high when the stock’s true value is recognized by the market.

- Growth Investing: Target companies expected to grow at an above-average rate compared to their industry peers. These stocks may not pay dividends but offer significant capital appreciation potential.

Each strategy has its advantages and risks; therefore, it’s important to choose one that aligns with your investment goals and risk tolerance.

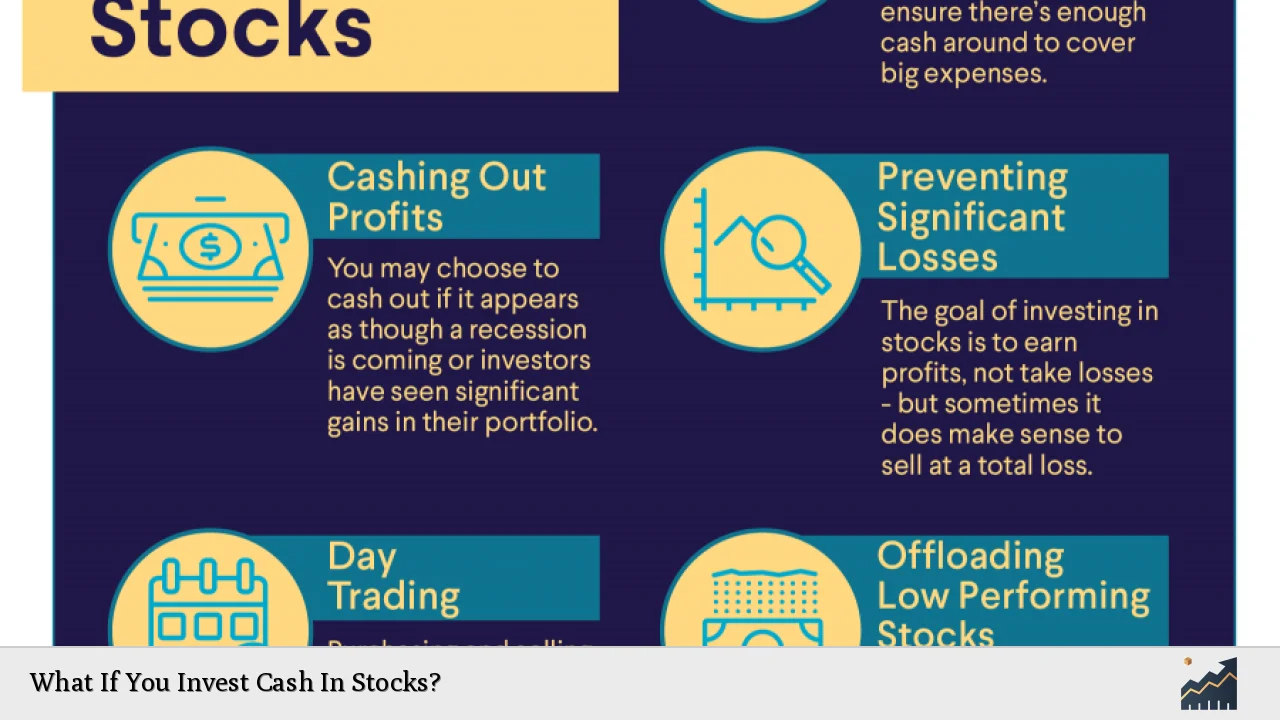

Common Pitfalls to Avoid

While investing in stocks can be rewarding, there are several common mistakes that investors should avoid:

- Emotional Trading: Making impulsive decisions based on fear or greed can lead to poor investment outcomes. Stick to your strategy rather than reacting emotionally to market movements.

- Neglecting Research: Failing to conduct thorough research before investing can result in significant losses. Always analyze a company’s fundamentals before purchasing its shares.

- Timing the Market: Trying to predict short-term market movements is often futile. Instead of timing trades, focus on long-term growth strategies.

- Overtrading: Frequent buying and selling can lead to high transaction costs and taxes that erode profits. Maintain a balanced approach by avoiding excessive trading activity.

By being aware of these pitfalls and adopting a disciplined approach, investors can enhance their chances of success in the stock market.

The Importance of Diversification

Diversification is a key principle in investing that involves spreading investments across various assets or sectors. This strategy helps reduce risk by ensuring that poor performance in one area does not significantly impact your overall portfolio.

When investing in stocks:

- Consider allocating funds across different sectors (e.g., technology, healthcare, consumer goods).

- Include various asset classes such as bonds or real estate investment trusts (REITs) alongside stocks.

- Adjust your portfolio periodically based on changing market conditions or personal financial goals.

A well-diversified portfolio can help cushion against volatility while providing opportunities for growth across multiple fronts.

Monitoring Your Investments

Once you’ve invested cash in stocks, it’s essential to monitor your portfolio regularly:

- Review performance metrics such as total return on investment (ROI) and compare them against benchmarks.

- Stay updated on news related to companies within your portfolio as well as broader economic indicators.

- Reassess your investment strategy periodically based on changing financial goals or market conditions.

Monitoring allows you to make informed decisions about when to buy more shares or sell underperforming assets.

FAQs About What If You Invest Cash In Stocks

- What are the benefits of investing cash in stocks?

Investing in stocks can lead to capital appreciation and dividends over time. - How much money do I need to start investing?

You can start with any amount; many brokerages allow investments with minimal funds. - What is a diversified portfolio?

A diversified portfolio spreads investments across various assets or sectors to reduce risk. - Is it better to invest long-term or short-term?

Long-term investing generally yields better returns due to compounding growth. - How do I choose which stocks to invest in?

Research company fundamentals, industry trends, and financial health before making decisions.

Investing cash in stocks offers numerous opportunities for wealth accumulation but requires careful planning and execution. By understanding key principles such as diversification, monitoring investments, and avoiding common pitfalls, investors can enhance their chances of achieving financial success through stock investments.