Investing capital gains tax can be a strategic move to defer or potentially reduce your tax liability while growing your wealth. This approach involves reinvesting the proceeds from a capital gain into specific investment vehicles or opportunities before paying the associated taxes. By doing so, investors can potentially benefit from tax advantages and continued investment growth.

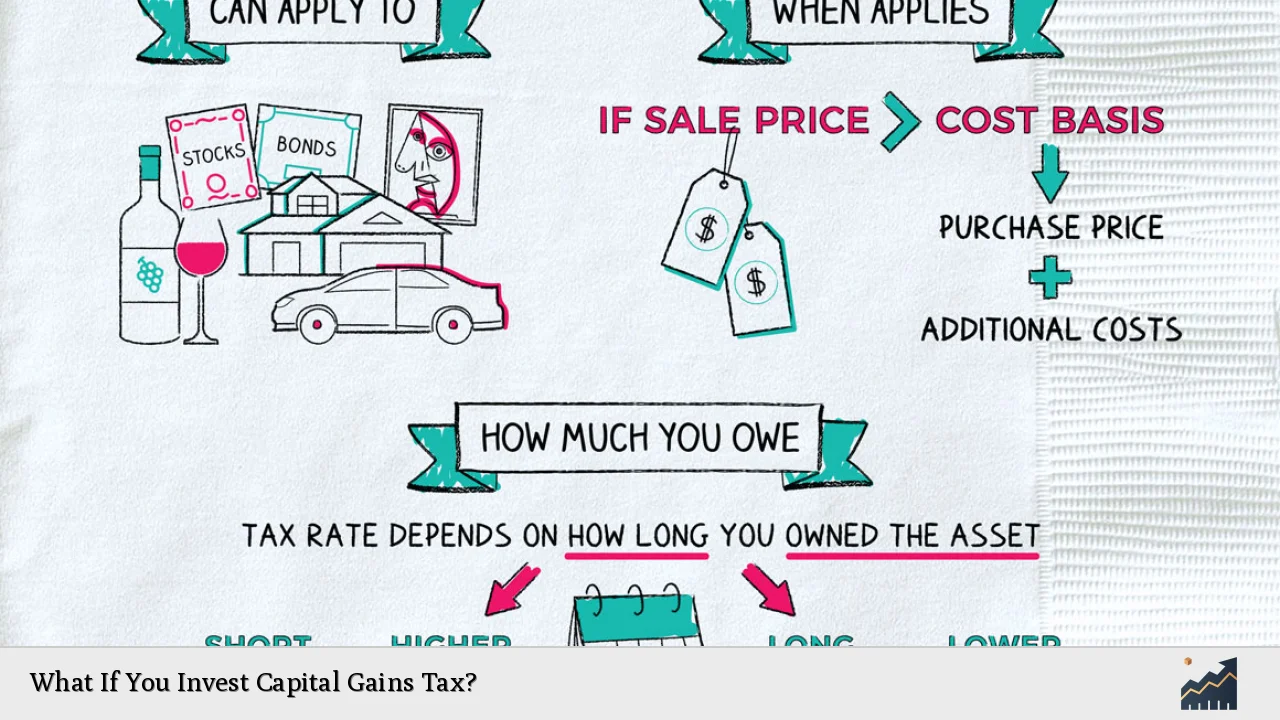

Capital gains tax (CGT) is levied on the profit made from selling an asset that has increased in value. The tax rate varies depending on factors such as your income level, the type of asset, and how long you’ve held it. For many investors, finding ways to minimize or defer this tax can significantly impact their overall returns.

Here’s a quick overview of some key aspects of investing capital gains tax:

| Aspect | Description |

|---|---|

| Tax Deferral | Postpone paying CGT by reinvesting gains |

| Potential Tax Reduction | Some investments offer CGT discounts or exemptions |

| Investment Growth | Reinvested gains can generate additional returns |

| Compliance Requirements | Must adhere to specific rules and timelines |

Strategies for Investing Capital Gains Tax

There are several strategies you can employ to invest your capital gains and potentially reduce your tax burden. Each approach has its own set of rules and benefits, so it’s crucial to understand how they work and which might be most suitable for your financial situation.

1031 Exchanges

One popular method for deferring capital gains tax, particularly for real estate investors, is the 1031 exchange. This strategy allows you to sell an investment property and use the proceeds to purchase a similar property without immediately triggering a tax event. The key benefits of a 1031 exchange include:

- Tax deferral: Postpone paying capital gains tax on the sale of your property

- Potential for increased cash flow: Upgrade to a property with better income potential

- Estate planning advantages: Pass on appreciated property to heirs with a stepped-up basis

To qualify for a 1031 exchange, you must adhere to strict timelines and rules set by the IRS. For instance, you must identify a replacement property within 45 days of selling your original property and complete the purchase within 180 days.

Qualified Opportunity Zones

Investing in Qualified Opportunity Zones (QOZs) is another strategy for deferring and potentially reducing capital gains tax. This program, created by the Tax Cuts and Jobs Act of 2017, encourages investment in economically distressed communities. Key benefits include:

- Tax deferral: Postpone paying capital gains tax until 2026 or when you sell your QOZ investment, whichever comes first

- Partial tax forgiveness: Hold the investment for at least 5 years to receive a 10% reduction in the deferred gain

- Potential tax-free growth: If held for at least 10 years, any appreciation on the QOZ investment may be tax-free

To take advantage of QOZ benefits, you must invest your capital gains into a Qualified Opportunity Fund within 180 days of realizing the gain. It’s important to note that while QOZs offer significant tax advantages, they also come with risks associated with investing in developing areas.

Reinvesting in Your Business

For entrepreneurs and business owners, reinvesting capital gains back into your business can be a smart way to defer taxes and fuel growth. This strategy can involve:

- Expanding operations: Use the funds to open new locations or enter new markets

- Upgrading equipment: Invest in new technology or machinery to improve efficiency

- Hiring talent: Bring on new employees to drive innovation and growth

By reinvesting in your business, you’re not only deferring taxes but also potentially increasing the value of your company. However, it’s crucial to ensure that these investments align with your overall business strategy and have the potential for a strong return on investment.

Tax-Advantaged Investment Accounts

Utilizing tax-advantaged investment accounts is another effective way to manage capital gains tax. These accounts offer various benefits that can help you grow your wealth while minimizing your tax burden.

Individual Retirement Accounts (IRAs)

Traditional and Roth IRAs are popular vehicles for long-term investing. While they don’t directly allow you to invest capital gains tax, they can be part of a broader strategy to manage your tax liability:

- Traditional IRA: Contributions may be tax-deductible, and growth is tax-deferred until withdrawal

- Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals are tax-free

By strategically allocating investments between taxable accounts and IRAs, you can potentially reduce your overall tax burden and maximize long-term growth.

401(k) Plans

If you have access to a 401(k) plan through your employer, consider increasing your contributions when you realize capital gains. While this doesn’t directly invest your capital gains tax, it can help offset the tax impact by reducing your taxable income for the year.

Health Savings Accounts (HSAs)

For those with high-deductible health plans, Health Savings Accounts offer a triple tax advantage:

- Contributions are tax-deductible

- Growth is tax-free

- Qualified withdrawals for medical expenses are tax-free

While HSAs are primarily designed for healthcare expenses, they can also serve as a long-term investment vehicle, potentially helping you manage your overall tax liability.

Considerations and Risks

While investing capital gains tax can offer significant benefits, it’s important to be aware of the potential risks and considerations:

- Market risk: Reinvesting gains exposes you to market fluctuations

- Liquidity concerns: Some strategies may tie up your funds for extended periods

- Complexity: Certain investment vehicles require careful navigation of tax rules

- Opportunity cost: Deferring taxes means forgoing the use of those funds for other purposes

- Future tax rates: Tax rates may change, potentially impacting the benefits of tax deferral

It’s crucial to carefully evaluate your financial goals, risk tolerance, and overall investment strategy before deciding how to invest your capital gains tax. Consulting with a qualified financial advisor or tax professional can help you make informed decisions tailored to your specific situation.

Impact on Long-Term Financial Planning

Investing capital gains tax can have a significant impact on your long-term financial planning. By deferring taxes and potentially reducing your overall tax liability, you may be able to:

- Accelerate wealth accumulation: More money remains invested, potentially generating higher returns over time

- Enhance retirement savings: Strategic use of tax-advantaged accounts can boost your retirement nest egg

- Create a legacy: Careful planning can help you maximize the wealth you pass on to heirs

- Support philanthropic goals: Some strategies allow you to combine tax benefits with charitable giving

However, it’s important to balance tax considerations with your overall investment strategy and risk management. Overemphasizing tax avoidance at the expense of diversification or liquidity could lead to suboptimal outcomes.

FAQs About What If You Invest Capital Gains Tax

- Can I completely avoid paying capital gains tax by reinvesting?

While reinvesting can defer taxes, complete avoidance is rare and depends on specific circumstances and investment vehicles. - How long do I need to hold an investment to qualify for long-term capital gains rates?

Generally, you must hold an investment for more than one year to qualify for preferential long-term capital gains tax rates. - Are there limits to how much I can invest in tax-advantaged accounts?

Yes, most tax-advantaged accounts have annual contribution limits set by the IRS, which can change from year to year. - What happens if I need to access funds invested for tax deferral?

Accessing funds early may trigger taxes and potential penalties, depending on the specific investment vehicle and circumstances. - How does investing capital gains tax affect my overall investment strategy?

It can impact asset allocation, risk exposure, and liquidity, requiring careful integration with your broader financial plan.