In the competitive field of investment banking, academic performance, particularly your Grade Point Average (GPA), plays a significant role in securing interviews and job offers. Investment banks often use GPA as a preliminary screening tool to differentiate among a large pool of applicants. While the specific GPA requirements can vary by bank and year, a general benchmark has emerged that aspiring investment bankers should aim for.

Most major investment banks, including bulge bracket firms like Goldman Sachs, Morgan Stanley, and J.P. Morgan, typically look for candidates with a GPA of 3.5 or higher on a 4.0 scale. Recent trends indicate that for elite boutiques and top-tier firms, a GPA closer to 3.7 or even 3.8 is becoming increasingly common among successful candidates. This trend reflects the heightened competition for positions in the industry, especially as banks continue to receive thousands of applications for limited openings.

| Key Concept | Description/Impact |

|---|---|

| GPA Thresholds | Most top-tier banks prefer candidates with GPAs of 3.5 or higher; elite firms may expect 3.7 or above. |

| Target vs Non-Target Schools | Candidates from target schools may have more leeway with slightly lower GPAs compared to those from non-target institutions. |

| Field of Study | Technical majors (e.g., engineering, mathematics) are often favored over liberal arts degrees, even with similar GPAs. |

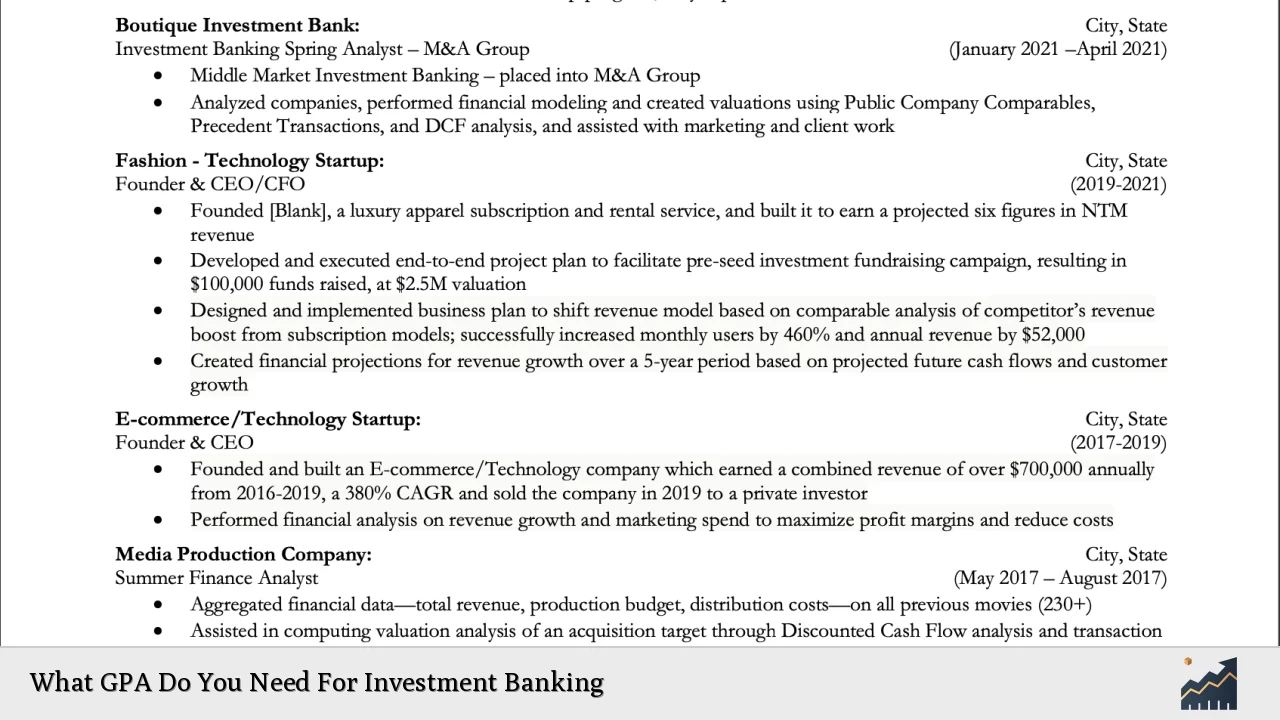

| Internship Experience | Relevant internships can significantly enhance a candidate’s profile, sometimes compensating for a lower GPA. |

| Long-Term Impact | A strong GPA remains relevant even years after graduation and can influence future career opportunities. |

Market Analysis and Trends

The investment banking sector is experiencing steady growth, with a projected increase in job openings due to workforce transitions and retirements. According to the U.S. Bureau of Labor Statistics, employment in investment banking is expected to grow by 7% from 2022 to 2032, which outpaces the average growth rate for all occupations.

Current Market Statistics

- Average Salary: As of 2024, the average salary for an investment banker in the U.S. is approximately $172,531.

- Job Openings: There are expected to be about 40,100 job openings annually, primarily driven by retirements.

- Top Locations: New York City remains the leading hub for investment banking jobs, accounting for 21.1% of total postings.

Trends Influencing Recruitment

- Increased Competition: The trend towards higher GPA requirements reflects increasing competition among candidates who often come equipped with relevant internships and strong academic records.

- Diversity in Hiring: Firms are increasingly looking for diverse backgrounds and experiences beyond just academic performance.

Implementation Strategies

To improve your chances of securing a position in investment banking, consider implementing the following strategies:

- Maintain a High GPA: Aim for at least a 3.5 GPA throughout your academic career. Focus on courses that enhance analytical skills such as finance, economics, and quantitative methods.

- Gain Relevant Experience: Secure internships at reputable banks or financial institutions during your studies. These experiences are crucial as they demonstrate practical application of academic knowledge.

- Network Effectively: Build connections within the industry through networking events, alumni associations, and professional organizations. Personal connections can sometimes help bypass stringent GPA filters.

- Develop Technical Skills: Proficiency in financial modeling and tools like Excel is essential. Consider taking additional courses or certifications that bolster your technical skills.

Risk Considerations

While aiming for a high GPA is important, it’s essential to recognize that it is not the sole determinant of success in investment banking:

- Overemphasis on GPA: Focusing too much on maintaining a high GPA at the expense of gaining practical experience can be detrimental.

- Diverse Skill Sets: Investment banks value soft skills such as communication and teamwork alongside technical prowess; neglecting these can limit opportunities.

Regulatory Aspects

Investment banks operate under strict regulatory frameworks that govern their hiring practices:

- Equal Opportunity Employment: Firms must comply with equal opportunity regulations during recruitment processes.

- Transparency in Hiring Practices: Many firms are moving towards more transparent hiring practices that consider diverse backgrounds and experiences rather than solely academic metrics.

Future Outlook

The future of investment banking looks promising as it continues to evolve with market demands:

- Technological Integration: The rise of fintech and AI is reshaping how investment banks operate, creating new opportunities for tech-savvy candidates.

- Sustainability Focus: There is an increasing emphasis on sustainable finance, which may influence hiring trends towards candidates knowledgeable in environmental finance.

Frequently Asked Questions About What GPA Do You Need For Investment Banking

- What is the minimum GPA required for investment banking?

The minimum GPA typically required by top investment banks is around 3.5 on a 4.0 scale. - Do non-target schools have different GPA requirements?

Yes, candidates from non-target schools may need to achieve higher GPAs to compete effectively. - Is internship experience more important than GPA?

While both are important, relevant internship experience can significantly enhance your candidacy even if your GPA is slightly below average. - How long should I keep my GPA on my resume?

You should keep your GPA on your resume well beyond graduation if it remains strong; it can positively impact future job opportunities. - Do technical degrees matter in investment banking?

Candidates with degrees in technical fields such as engineering or mathematics are often viewed favorably due to their analytical skills. - Can I still get hired with a low GPA?

Yes, but you will need to compensate with strong internship experience or exceptional skills in other areas. - How does my major affect my chances?

Candidates majoring in finance or related fields generally have an advantage; however, strong analytical skills from other majors can also be valuable. - What other qualities do banks look for besides GPA?

Banks also value leadership experience, communication skills, and technical proficiency.

In summary, while maintaining a strong GPA is crucial for aspiring investment bankers, it should be complemented by relevant experience and skill development to navigate the competitive landscape effectively. Understanding market trends and adapting strategies accordingly will enhance your prospects in this dynamic field.