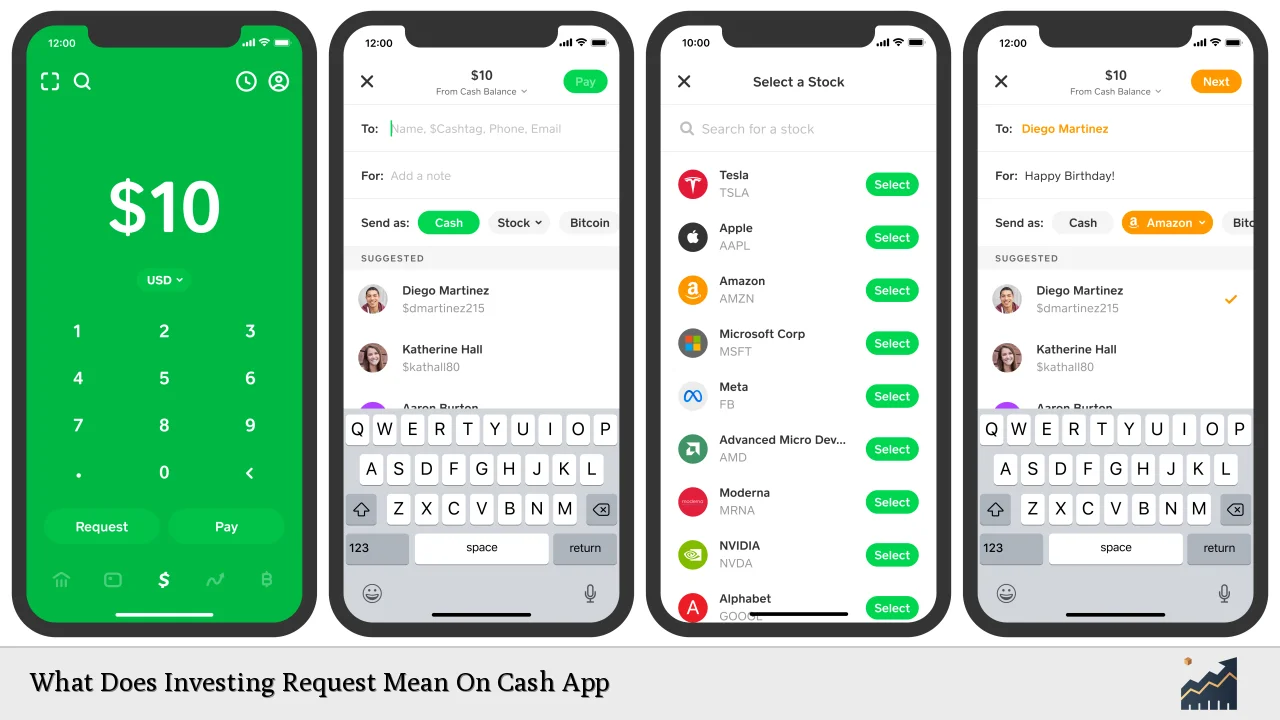

Cash App has transformed from a simple peer-to-peer payment platform into a multifaceted financial services application, allowing users to invest in stocks and exchange-traded funds (ETFs) directly from their mobile devices. One of the features that users may encounter is the “Investing Request.” This feature is linked to Cash App’s unique structure of sponsored accounts, where users must receive approval from a sponsor to access investing functionalities. Understanding this feature is crucial for both new and experienced investors looking to navigate the Cash App ecosystem effectively.

| Key Concept | Description/Impact |

|---|---|

| Investing Request | A request made by a user to a sponsor for approval to access investment features on Cash App. |

| Sponsor Role | The sponsor, typically an adult or guardian, must approve the user’s request, allowing them to invest in stocks and ETFs. |

| Account Structure | Cash App uses a unique account structure where investing capabilities are controlled through sponsorship, enhancing safety and compliance. |

| Investment Options | Users can invest in fractional shares of over 1,800 stocks and ETFs with as little as $1. |

| Custodial Accounts | Sponsored accounts serve as custodial accounts for minors, providing them with investment experience under supervision. |

Market Analysis and Trends

The rise of mobile investing platforms like Cash App reflects broader trends in the financial services industry. The democratization of investing has made it accessible to a wider audience, particularly younger investors who prefer mobile solutions.

Current Market Statistics

- Growth in Users: Cash App reached 55 million monthly active users in 2023, showcasing its popularity among consumers.

- Revenue Growth: The platform generated $14.3 billion in revenue in 2023, a 34.9% increase from the previous year, largely driven by its investment features and Bitcoin trading.

- Investment Activity: Users can invest with as little as $1, making it feasible for individuals with limited capital to enter the stock market.

Trends Influencing Investment Behavior

- Fractional Shares: The ability to purchase fractional shares has lowered the barrier to entry for investors, allowing them to diversify their portfolios without needing substantial capital.

- Increased Financial Literacy: Educational resources and tools integrated into Cash App help users make informed investment decisions.

Implementation Strategies

To effectively utilize the investing features on Cash App, users should consider the following strategies:

- Set Clear Investment Goals: Define your investment objectives—whether it’s saving for retirement, funding education, or simply growing wealth.

- Diversify Investments: Take advantage of fractional shares to build a diversified portfolio across different sectors without significant financial commitment.

- Regular Contributions: Implement a strategy of regular investments (dollar-cost averaging) to mitigate market volatility impacts.

- Monitor Market Trends: Utilize Cash App’s market alerts and analyst opinions to stay informed about potential investment opportunities.

Risk Considerations

While investing through Cash App offers numerous advantages, it also comes with risks that users must be aware of:

- Market Volatility: Stocks and ETFs can be subject to significant price fluctuations. Investors should be prepared for potential losses.

- Limited Investment Options: Cash App currently does not support mutual funds or options trading, which may limit some investors’ strategies.

- Regulatory Risks: As financial technology evolves, regulatory scrutiny increases. Users should stay informed about changes that could affect their investments.

Regulatory Aspects

Cash App Investing operates under strict regulatory frameworks designed to protect investors:

- Brokerage Regulation: Cash App Investing LLC is a member of FINRA and SIPC, providing investor protection through insurance on securities held in accounts.

- Know Your Customer (KYC): The platform requires adequate customer verification processes to comply with anti-money laundering regulations.

- Sponsorship Compliance: The requirement for sponsors to approve investment requests ensures that minors receive guidance and oversight in their investing activities.

Future Outlook

The future of investing through platforms like Cash App looks promising:

- Expansion of Features: As competition grows among fintech companies, Cash App may expand its investment offerings to include more asset classes and advanced trading tools.

- Increased User Engagement: With financial literacy initiatives gaining traction, more users are likely to engage with investment features on mobile platforms.

- Technological Advancements: Innovations such as artificial intelligence could enhance investment strategies by providing personalized recommendations based on user behavior and market trends.

Frequently Asked Questions About What Does Investing Request Mean On Cash App

- What is an Investing Request on Cash App?

An Investing Request is a submission made by a user seeking approval from their sponsor to access stock and ETF trading features on Cash App. - Who can be a sponsor?

A sponsor is typically an adult or guardian who has a Cash App account and can oversee the investments made by the user. - Can I invest without a sponsor?

No, users must have their Investing Requests approved by a sponsor before they can access investment features on Cash App. - What types of investments can I make?

You can invest in fractional shares of stocks and ETFs available on the platform. - Is there a minimum amount required to start investing?

You can start investing with as little as $1 through fractional shares. - Are there any fees associated with investing on Cash App?

Cash App offers commission-free trading for stocks and ETFs; however, other fees may apply for different services. - How does Cash App ensure my investments are secure?

Cash App Investing is regulated by FINRA and SIPC, providing protections similar to those offered by traditional brokerage firms. - What happens if my Investing Request is denied?

If your request is denied, you will not be able to access the investing features until approved by your sponsor.

Understanding what an Investing Request means within the context of Cash App is essential for navigating this increasingly popular financial platform. By leveraging its unique features responsibly while being aware of associated risks and regulatory requirements, users can effectively participate in the growing landscape of mobile investing.