Investing in cryptocurrency has gained significant traction in recent years, attracting a diverse range of investors. Cryptocurrencies, such as Bitcoin and Ethereum, have emerged as alternative investment vehicles, often viewed as digital gold or speculative assets. This article explores the various aspects of cryptocurrency investing, including the types of investments available, strategies for success, and essential considerations for potential investors.

Cryptocurrency investments can be broadly categorized into different types, including direct investments in coins and tokens, participation in Initial Coin Offerings (ICOs), and engagement in decentralized finance (DeFi) projects. Each investment type carries its own risks and rewards, making it crucial for investors to conduct thorough research before committing their funds.

Understanding the landscape of cryptocurrency investing is vital for making informed decisions. The market is characterized by volatility and rapid changes, which can lead to substantial gains or losses. Therefore, having a solid grasp of the fundamentals, as well as effective strategies for managing risks, is essential for anyone looking to invest in this space.

| Investment Type | Description |

|---|---|

| Direct Cryptocurrency Purchase | Buying coins like Bitcoin or Ethereum directly through exchanges. |

| Initial Coin Offerings (ICOs) | Investing in new cryptocurrencies before they are publicly available. |

| Decentralized Finance (DeFi) | Participating in financial services built on blockchain technology. |

Types of Cryptocurrency Investments

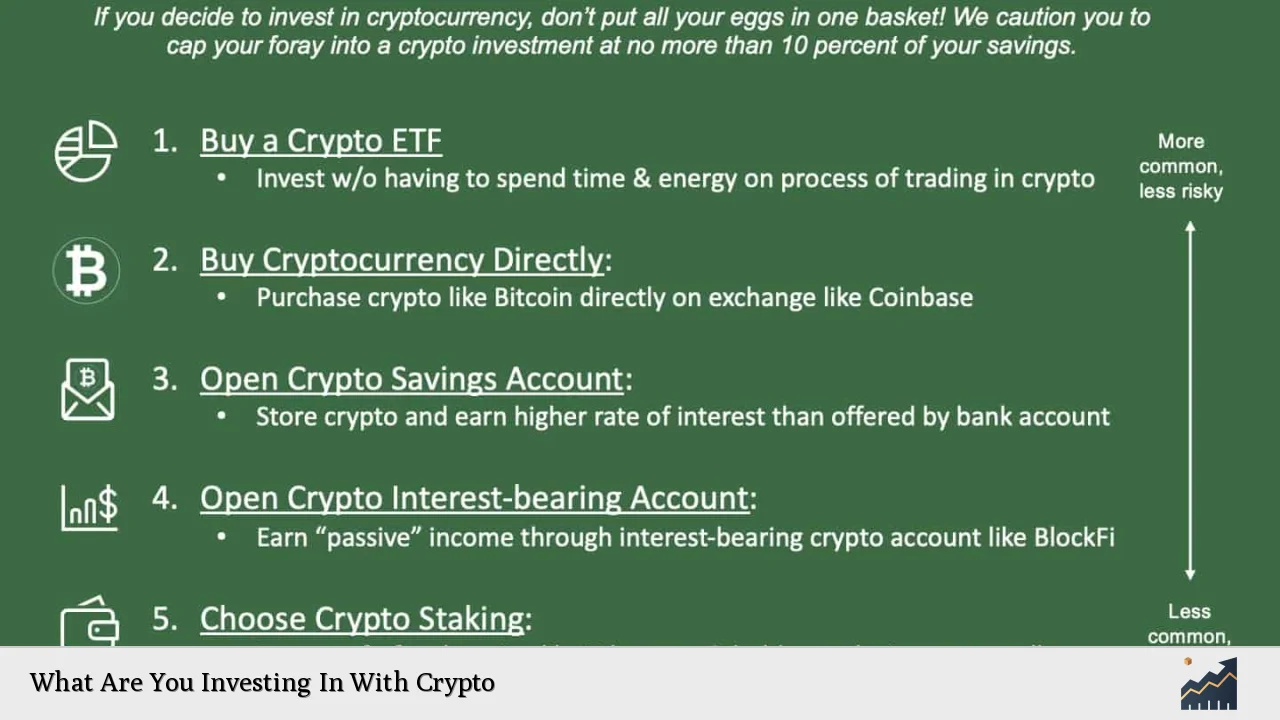

Investors can choose from various types of cryptocurrency investments based on their risk tolerance and investment goals. Here are some common options:

- Direct Purchase: This involves buying established cryptocurrencies like Bitcoin or Ethereum through exchanges. These coins are generally seen as more stable compared to newer tokens.

- Altcoins: Investors may also consider investing in alternative cryptocurrencies (altcoins) that offer unique features or potential growth opportunities. However, these can be riskier due to their volatility.

- Initial Coin Offerings (ICOs): ICOs allow investors to purchase tokens from new projects before they launch. While this can lead to high rewards if the project succeeds, it also carries significant risks due to the potential for scams or project failures.

- Staking: Some cryptocurrencies offer staking options where investors can lock up their coins to earn rewards over time. This method can provide passive income but requires understanding the specific staking mechanisms.

- Decentralized Finance (DeFi): DeFi platforms offer various financial services without intermediaries, allowing users to lend, borrow, or earn interest on their crypto holdings. Engaging with DeFi can yield high returns but also exposes investors to smart contract risks.

Each investment type presents unique opportunities and challenges. Investors should assess their knowledge level and risk appetite before diving into any specific area.

Strategies for Successful Crypto Investing

Successful cryptocurrency investing requires a well-defined strategy that takes into account market conditions and personal financial goals. Here are some effective strategies:

- Research and Due Diligence: Before investing in any cryptocurrency, conduct thorough research on the project’s fundamentals, team, and market potential. Understanding the technology behind a coin can help gauge its long-term viability.

- Diversification: Spreading investments across different cryptocurrencies can mitigate risks associated with market volatility. A diversified portfolio may include a mix of established coins and promising altcoins.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount regularly regardless of market conditions. Dollar-cost averaging helps reduce the impact of volatility by averaging out purchase prices over time.

- Setting Clear Goals: Define your investment objectives and time horizon. Whether you’re looking for short-term gains or long-term growth will influence your investment choices.

- Risk Management: Establishing stop-loss orders can protect against significant losses by automatically selling assets when they reach a certain price point. It’s essential to set limits based on your risk tolerance.

Implementing these strategies can help investors navigate the complexities of the cryptocurrency market while maximizing their potential returns.

Understanding Market Dynamics

The cryptocurrency market operates differently from traditional financial markets. Understanding these dynamics is crucial for successful investing:

- Volatility: Cryptocurrencies are known for their price fluctuations, which can be influenced by various factors such as market sentiment, regulatory news, and technological developments. Being prepared for rapid changes is essential.

- Market Sentiment: News events can significantly impact crypto prices. Investors should stay informed about industry trends and developments that could affect their investments.

- Regulatory Environment: The regulatory landscape surrounding cryptocurrencies is evolving rapidly. Changes in regulations can affect market access and investor confidence, making it important to stay updated on legal developments.

- Technological Innovations: The blockchain technology underlying cryptocurrencies is continuously evolving. Innovations such as layer-2 solutions or new consensus mechanisms can influence the performance of specific coins.

By understanding these market dynamics, investors can make more informed decisions about when to enter or exit positions in the cryptocurrency space.

Risks Associated with Cryptocurrency Investing

Investing in cryptocurrencies comes with inherent risks that every investor should consider:

- Market Volatility: The high volatility associated with cryptocurrencies means that prices can fluctuate dramatically within short periods. Investors should be prepared for potential losses as well as gains.

- Security Risks: Cybersecurity threats pose significant risks to crypto investors. Hacks of exchanges or wallets can result in substantial losses if proper security measures are not taken.

- Regulatory Risks: As governments worldwide develop regulations around cryptocurrencies, changes in policy could impact market access and the legality of certain activities within the crypto space.

- Lack of Consumer Protections: Unlike traditional financial markets, there are fewer consumer protections in place within the cryptocurrency ecosystem. Investors must exercise caution and conduct due diligence before engaging with any platform or project.

Being aware of these risks allows investors to take appropriate precautions and develop strategies to mitigate potential losses while capitalizing on opportunities within the crypto market.

FAQs About What Are You Investing In With Crypto

- What is the best cryptocurrency to invest in?

The best cryptocurrency often depends on individual goals; however, Bitcoin and Ethereum are commonly recommended for beginners due to their stability. - How do I start investing in cryptocurrency?

Begin by choosing a reliable exchange, creating an account, funding it, and then purchasing your chosen cryptocurrencies. - What are altcoins?

Altcoins refer to any cryptocurrencies other than Bitcoin; they often offer unique features or use cases. - Is it safe to invest in cryptocurrency?

While there are risks involved due to volatility and security issues, following best practices like using secure wallets can enhance safety. - Can I lose all my money investing in crypto?

Yes, due to high volatility; it’s possible to incur significant losses; therefore, only invest what you can afford to lose.

Investing in cryptocurrency presents both opportunities and challenges that require careful consideration and strategic planning. By understanding different investment types, employing effective strategies, acknowledging market dynamics, and being aware of associated risks, investors can navigate this exciting yet volatile landscape successfully.