Venture capital (VC) investment in 2022 experienced a significant transformation compared to previous years, largely influenced by global economic conditions, market volatility, and evolving investor preferences. After a record-setting year in 2021, the landscape shifted dramatically, with many sectors witnessing a decline in funding. However, certain areas remained resilient and even thrived amidst the downturn. This article delves into the sectors attracting VC investment in 2022, highlighting trends and shifts that defined the year.

| Aspect | Detail |

|---|---|

| Global VC Funding | $415.1 billion in 2022 |

| Year-over-Year Change | 35% decrease from 2021 |

Overview of VC Investment Trends

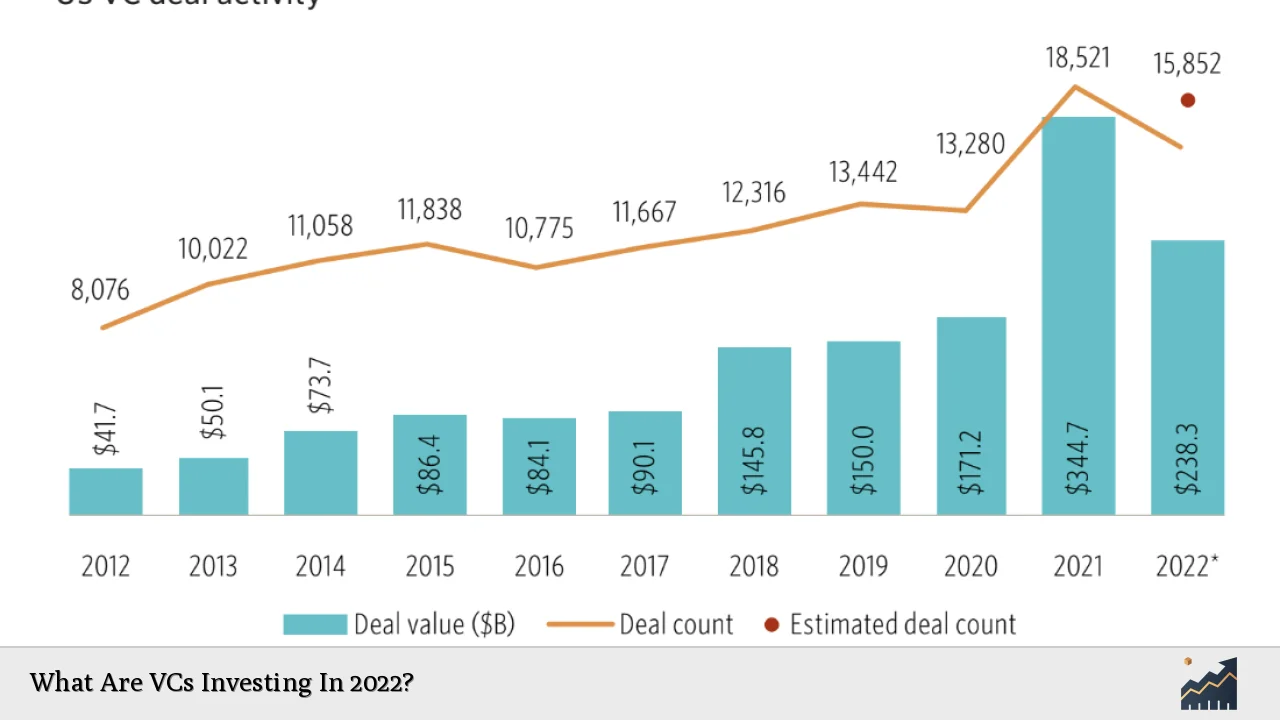

In 2022, global VC funding reached $415.1 billion, reflecting a 35% decrease from the previous year’s record of $630.3 billion. This decline was particularly pronounced in the second half of the year, where Q4 alone saw a staggering 64% drop year-over-year, returning to pre-COVID levels of investment activity. The number of deals also fell sharply, with 7,641 deals completed throughout the year compared to 10,037 in 2021.

Despite these challenges, 2022 still ranked as the second-highest year on record for VC investment. The landscape was marked by a noticeable shift towards early-stage investments as investors became more cautious and focused on startups with strong fundamentals and clear paths to profitability.

The top sectors for VC investment in 2022 included:

- Healthcare

- Information Technology

- Business Services

- Energy

While many sectors experienced declines, healthcare emerged as a significant area of interest due to ongoing advancements in medical technologies and services aimed at addressing chronic diseases and an aging population.

Sector-Specific Insights

Healthcare Sector

The healthcare sector was one of the most robust areas for VC investment in 2022. Despite overall declines in funding levels, healthcare attracted substantial capital due to its critical importance during and after the pandemic. Investment trends indicated a strong focus on biopharma and healthcare services, which accounted for a large portion of funding within this sector.

Key highlights include:

- Healthcare raised the most capital in Q4 2022.

- The sector’s growth was driven by innovations aimed at improving patient outcomes and addressing chronic illnesses.

- Notable investments were made in telehealth technologies and digital health solutions.

Information Technology

The information technology sector also remained a focal point for venture capitalists, although it faced challenges due to market saturation and economic uncertainty. Investments were primarily directed toward companies that offered innovative solutions in areas such as cloud computing, cybersecurity, and software-as-a-service (SaaS).

Significant trends included:

- A continued interest in cybersecurity solutions due to rising threats.

- Investment in cloud services as businesses increasingly shifted operations online.

- A notable decline in mega-round financing compared to previous years.

Energy Sector

The energy sector emerged as a standout performer amid the broader downturn in VC investment. With rising energy costs and increasing global emphasis on sustainability, venture capitalists directed considerable funds toward renewable energy technologies and clean tech solutions.

Key points include:

- The energy sector raised approximately $12.6 billion in total funding for the year.

- Investments were concentrated in electric vehicles (EVs), battery technologies, and alternative power generation methods.

- Government incentives and regulatory support played a crucial role in driving interest within this sector.

Fintech Sector

Fintech continued to attract attention but faced significant challenges throughout the year. The sector saw a marked decline in funding levels as investors became wary of overvaluation and market volatility.

Important insights include:

- Fintech funding dropped significantly, with many startups struggling to secure new investments.

- Investors shifted focus towards companies that demonstrated clear revenue models and sustainable business practices.

- Despite challenges, innovative solutions such as decentralized finance (DeFi) continued to garner interest from select investors.

Geographical Distribution of VC Investment

Americas

In the Americas, particularly the United States, venture capital activity remained robust despite overall declines. The U.S. accounted for nearly 48% of global funding, with significant investments concentrated in major tech hubs like Silicon Valley and New York City.

Key observations include:

- A shift towards early-stage investments as investors sought to mitigate risk.

- Increased scrutiny on profitability led many startups to focus on operational efficiency.

Europe

European venture capital markets also experienced a downturn but showed resilience in specific sectors such as clean tech and health tech. The region saw increased activity surrounding sustainability-focused startups.

Notable trends included:

- A growing number of corporate venture capital units being established.

- Continued interest from investors in companies addressing climate change through innovative solutions.

Asia

Asia’s venture capital landscape faced similar challenges but highlighted opportunities within emerging markets. Notably, China continued to be a hub for large-scale investments despite regulatory hurdles affecting certain sectors.

Key points include:

- Significant megadeals were recorded despite an overall decline in deal volume.

- Investors remained focused on technology-driven startups that could navigate regulatory environments effectively.

Future Outlook for VC Investment

As we move into 2023 and beyond, several trends are likely to shape the future of venture capital investment:

- Increased Focus on Profitability: Investors will prioritize startups demonstrating sustainable business models over those pursuing aggressive growth at all costs.

- Continued Interest in Clean Tech: As climate change remains a pressing global issue, investments in renewable energy technologies are expected to grow.

- Emerging Technologies: Areas such as artificial intelligence (AI), blockchain technology, and cybersecurity will continue to attract significant attention from venture capitalists seeking innovative solutions.

FAQs About What Are VCs Investing In 2022

- What sectors did VCs invest in during 2022?

VCs primarily invested in healthcare, information technology, energy, and business services. - How much did global VC funding drop in 2022?

Global VC funding dropped by 35%, totaling $415.1 billion. - What was the impact of economic conditions on VC investment?

Economic uncertainty led to more cautious investing strategies and a shift towards early-stage companies. - Which region accounted for most VC funding?

The Americas, particularly the United States, accounted for nearly 48% of global VC funding. - What is expected for VC investment trends moving forward?

Investors are expected to focus more on profitability and sustainable business models while continuing to support clean tech initiatives.

In summary, while 2022 presented numerous challenges for venture capitalists globally, certain sectors demonstrated resilience amid economic uncertainty. The focus on sustainable practices and essential services is likely to continue shaping investment strategies moving forward into 2023.