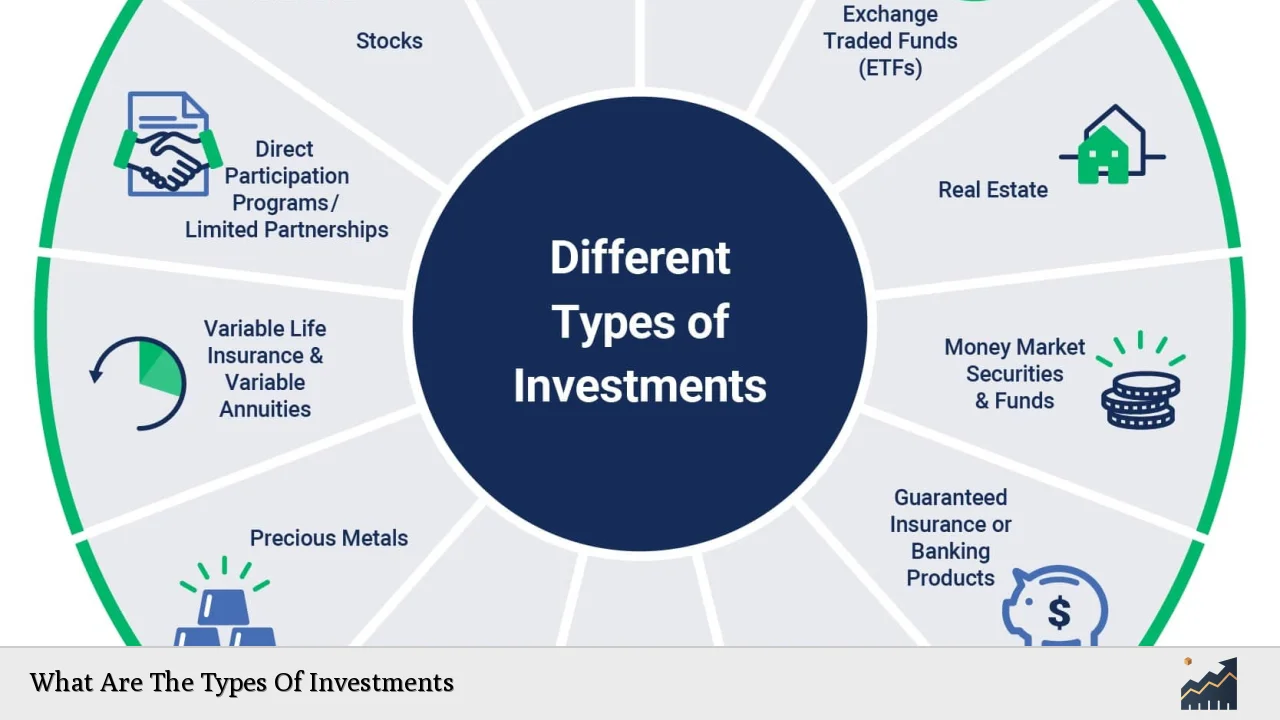

Investing is a crucial aspect of personal finance that allows individuals to grow their wealth over time. Understanding the different types of investments is essential for making informed decisions that align with one’s financial goals and risk tolerance. Investments can be categorized into various asset classes, each with its unique characteristics, risks, and potential returns. This article will explore the primary types of investments available, offering insights into their benefits and drawbacks.

| Investment Type | Description |

|---|---|

| Stocks | Ownership shares in a company. |

| Bonds | Debt securities issued by entities. |

| Mutual Funds | Pooled investments managed by professionals. |

| Exchange-Traded Funds (ETFs) | Funds traded on stock exchanges like stocks. |

| Real Estate | Investment in physical properties. |

| Commodities | Physical goods like gold or oil. |

| Cryptocurrencies | Digital currencies using blockchain technology. |

Stocks

Stocks represent ownership in a company. When you purchase a share of stock, you become a partial owner of that company and can benefit from its growth through price appreciation and dividends. Stocks are typically categorized into two main types: common stocks and preferred stocks. Common stockholders may receive dividends, while preferred stockholders have a higher claim on assets and earnings but typically do not have voting rights.

Investing in stocks can be rewarding but also comes with risks. Stock prices fluctuate based on market conditions, company performance, and economic factors. Investors may experience significant gains or losses depending on these variables. Therefore, it is crucial to conduct thorough research before investing in individual stocks.

Additionally, investors can diversify their stock investments through mutual funds or exchange-traded funds (ETFs), which pool money from multiple investors to buy a diversified portfolio of stocks.

Bonds

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you buy a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered safer than stocks but offer lower potential returns.

There are various types of bonds, including government bonds, corporate bonds, and municipal bonds. Government bonds are backed by the government and are considered low-risk investments. Corporate bonds carry more risk as they depend on the issuing company’s financial stability. Investors should assess their risk tolerance when considering bond investments.

Bonds can provide a steady income stream and help balance a portfolio’s overall risk profile. However, interest rate fluctuations can affect bond prices; when interest rates rise, existing bond prices typically fall.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds offer investors an opportunity to invest in various asset classes without needing extensive knowledge or time to manage individual investments.

Investors can choose from different types of mutual funds based on their investment goals and risk tolerance. For example, some funds focus on growth stocks for capital appreciation, while others may prioritize income through dividend-paying stocks or bonds.

One significant advantage of mutual funds is diversification; by investing in a single fund, investors gain exposure to various securities, reducing the impact of poor performance from any single investment. However, mutual funds often come with management fees that can eat into returns.

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) are similar to mutual funds but trade on stock exchanges like individual stocks. ETFs typically track an index or sector and allow investors to buy and sell shares throughout the trading day at market prices.

ETFs offer several advantages over traditional mutual funds. They generally have lower expense ratios due to their passive management style and provide greater flexibility for trading. Investors can use strategies such as short selling or buying on margin with ETFs.

However, like all investments, ETFs carry risks. The value of an ETF can fluctuate based on the performance of the underlying assets it holds. Investors should carefully consider their investment strategy before including ETFs in their portfolios.

Real Estate

Real estate involves investing in physical properties such as residential homes, commercial buildings, or land. Real estate can generate income through rental payments and appreciate in value over time.

Investing in real estate requires significant capital upfront for property purchases and ongoing maintenance costs. However, it can provide substantial returns through both rental income and property appreciation. Real estate investment trusts (REITs) offer an alternative for those who want exposure to real estate without direct ownership; these companies own and manage income-generating properties.

While real estate can be a lucrative investment option, it also carries risks such as market fluctuations and property management challenges. Investors should conduct thorough market research before committing to real estate investments.

Commodities

Commodities are physical goods such as gold, silver, oil, agricultural products, or natural resources that can be traded on markets. Investing in commodities allows individuals to hedge against inflation or diversify their portfolios.

Investors can gain exposure to commodities through direct purchases or commodity-focused funds such as ETFs or mutual funds that track commodity prices. Commodity prices are influenced by supply and demand dynamics; thus they can be volatile.

While commodities can provide diversification benefits and act as a hedge against inflation during economic downturns, they also come with risks related to price fluctuations due to geopolitical events or changes in market demand.

Cryptocurrencies

Cryptocurrencies represent a new class of digital assets built on blockchain technology. Bitcoin is the most well-known cryptocurrency; however, thousands of other cryptocurrencies exist today.

Investing in cryptocurrencies offers potential high returns due to their volatility; however, they also come with significant risks. The cryptocurrency market is relatively new and unregulated compared to traditional financial markets, leading to price swings based on speculation rather than intrinsic value.

Investors should approach cryptocurrency investments cautiously and consider them only as part of a diversified portfolio due to their speculative nature.

FAQs About Types Of Investments

- What are the main types of investments?

The main types include stocks, bonds, mutual funds, ETFs, real estate, commodities, and cryptocurrencies. - How do I choose the right investment type?

Select investments based on your financial goals, risk tolerance, and investment horizon. - What is the safest type of investment?

Bonds are generally considered safer than stocks but offer lower returns. - Can I invest in real estate without buying property?

Yes, you can invest in real estate through REITs or real estate-focused mutual funds. - What is the difference between mutual funds and ETFs?

Mutual funds trade at the end of the day at net asset value while ETFs trade throughout the day at market prices.

Understanding these various types of investments will empower individuals to make better financial decisions tailored to their unique circumstances. By diversifying across different asset classes—stocks for growth potential; bonds for stability; mutual funds for professional management; real estate for tangible assets; commodities for inflation protection; cryptocurrencies for high-risk opportunities—investors can build robust portfolios that align with their long-term financial objectives.