The investment multiplier is a fundamental concept in economics that describes the relationship between an increase in investment and the resulting increase in national income or GDP. This multiplier effect occurs because an initial increase in spending leads to further rounds of spending as income is generated and re-spent throughout the economy. Understanding the investment multiplier is crucial for policymakers and investors alike, as it helps gauge the broader economic impact of fiscal policies and investment decisions.

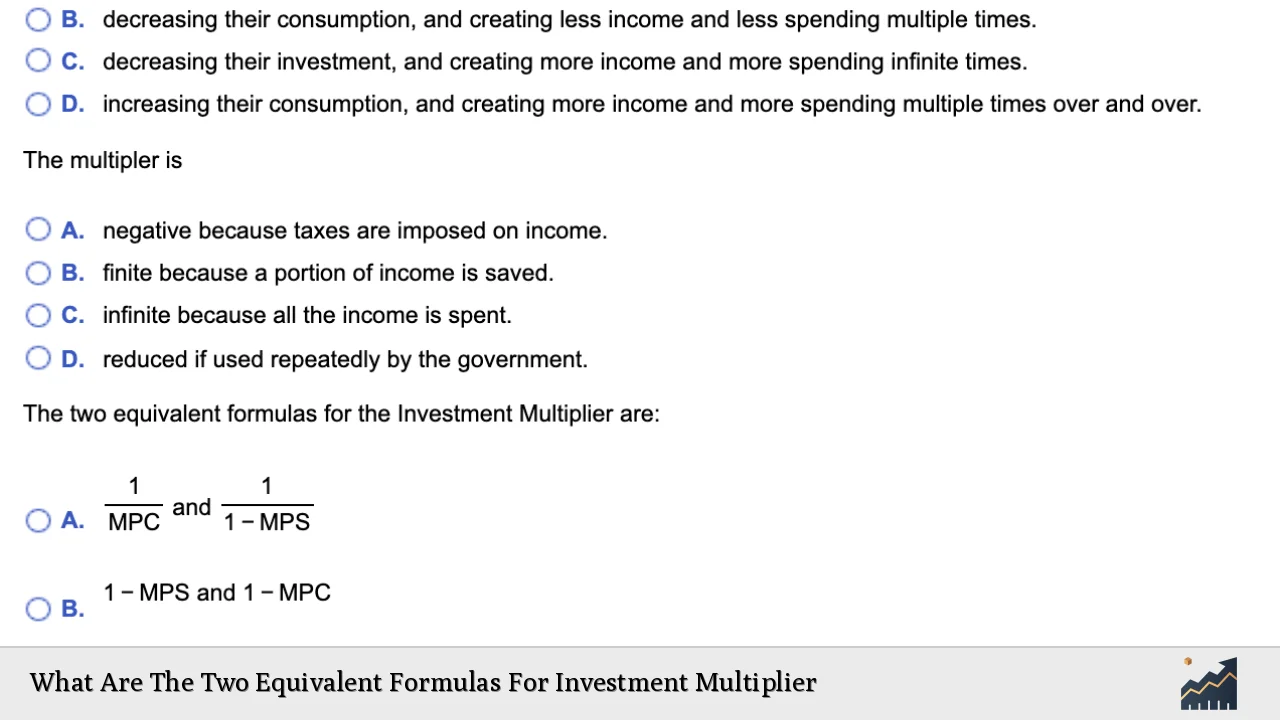

The investment multiplier can be expressed through two equivalent formulas:

- Investment Multiplier (K) = $$ \frac{\Delta Y}{\Delta I} $$ Where:

- $$ \Delta Y $$ = Change in national income (GDP)

- $$ \Delta I $$ = Change in investment

- Investment Multiplier (K) = $$ \frac{1}{1 – MPC} $$ Where:

- MPC = Marginal Propensity to Consume, which represents the fraction of additional income that households spend on consumption.

These formulas highlight how changes in investment levels can lead to proportionally larger changes in overall economic output, illustrating the interconnectedness of spending and income generation within an economy.

| Key Concept | Description/Impact |

|---|---|

| Investment Multiplier | The ratio of change in national income to the change in investment, indicating how much additional income is generated from an initial investment. |

| MPC (Marginal Propensity to Consume) | The percentage of additional income that is spent on consumption, influencing the size of the multiplier effect. |

| MPS (Marginal Propensity to Save) | The percentage of additional income that is saved, used to derive the multiplier as $$ K = \frac{1}{MPS} $$. |

| Multiplier Effect | The phenomenon where an initial increase in spending leads to further increases in consumption and investment, amplifying economic growth. |

Market Analysis and Trends

The investment multiplier plays a significant role in shaping economic policy and understanding market dynamics. In recent years, global economies have experienced varying levels of investment activity influenced by factors such as interest rates, fiscal policies, and consumer confidence.

- Current Trends: As of 2024, many economies are witnessing a cautious recovery from previous downturns, with increased public spending aimed at infrastructure projects. For instance, government investments in renewable energy and technology infrastructure are expected to yield significant multiplier effects, enhancing overall economic productivity.

- Sectoral Insights: Sectors such as construction, technology, and green energy are particularly sensitive to changes in investment levels. A surge in government or private sector investments can lead to job creation and increased consumer spending, further amplifying the multiplier effect.

- Global Comparison: Emerging markets tend to exhibit higher multipliers compared to developed economies due to lower initial levels of capital stock and higher marginal propensities to consume. Recent studies indicate that public investment multipliers can exceed 2 during periods of economic uncertainty, highlighting their potential for stimulating growth.

Implementation Strategies

To effectively leverage the investment multiplier for economic growth, stakeholders must consider several implementation strategies:

- Targeted Investments: Focus on sectors with high multipliers, such as infrastructure development and technology innovation. These areas not only create jobs but also enhance productivity across various industries.

- Public-Private Partnerships (PPPs): Encourage collaboration between government entities and private firms to fund large-scale projects. This approach can increase efficiency and leverage additional private capital.

- Fiscal Stimulus: Utilize fiscal policies that promote increased government spending during economic downturns. This can help stabilize economies by triggering the multiplier effect through enhanced consumer spending.

- Monitoring and Evaluation: Regularly assess the impact of investments on GDP growth using data analytics tools. This allows for timely adjustments to policies and strategies based on observed outcomes.

Risk Considerations

While the investment multiplier presents opportunities for growth, there are inherent risks associated with its application:

- Economic Conditions: The effectiveness of the multiplier can diminish during periods of high inflation or recession when consumer confidence is low. In such scenarios, households may choose to save rather than spend additional income.

- Policy Uncertainty: Fluctuations in fiscal policy or regulatory environments can affect investment decisions. Investors may hesitate if they perceive instability or unpredictability in government actions.

- Global Factors: External factors such as geopolitical tensions or trade disputes can impact domestic investments. These factors may disrupt supply chains or alter consumer demand patterns.

- Overestimation of Multipliers: Analysts must be cautious not to overestimate the potential impact of investments based solely on historical data without considering current market conditions.

Regulatory Aspects

Understanding regulatory frameworks is essential for maximizing the benefits of the investment multiplier:

- Compliance Requirements: Investors should be aware of local regulations governing investments, particularly in sectors like real estate or energy where environmental concerns are paramount.

- Incentives for Investment: Governments often provide tax incentives or subsidies to encourage investments in specific sectors. Familiarity with these incentives can enhance decision-making for investors.

- Monitoring Bodies: Regulatory agencies play a crucial role in overseeing compliance with financial regulations. Investors should maintain transparency and adhere to reporting requirements to mitigate risks associated with non-compliance.

Future Outlook

The future trajectory of the investment multiplier will be shaped by several key trends:

- Technological Advancements: As digital transformation accelerates across industries, investments in technology will likely yield significant multipliers due to enhanced productivity and efficiency gains.

- Sustainability Focus: Growing emphasis on sustainable practices will drive investments into green technologies and renewable energy sources. These sectors are expected to generate substantial economic returns while addressing environmental concerns.

- Global Economic Integration: Increased globalization may lead to more cross-border investments, enhancing the potential for higher multipliers as capital flows into emerging markets seeking growth opportunities.

- Economic Resilience: Policymakers will need to design robust frameworks that enhance resilience against future economic shocks while leveraging multipliers effectively for sustained growth.

Frequently Asked Questions About Investment Multiplier

- What is the investment multiplier?

The investment multiplier measures how much national income increases as a result of an initial increase in investment. - How do you calculate the investment multiplier?

The two primary formulas are $$ K = \frac{\Delta Y}{\Delta I} $$ and $$ K = \frac{1}{1 – MPC} $$. - What factors influence the size of the investment multiplier?

The size is primarily influenced by the marginal propensity to consume (MPC) and marginal propensity to save (MPS). - Why is understanding the investment multiplier important?

It helps policymakers gauge the effectiveness of fiscal policies and understand how initial investments can stimulate broader economic growth. - Can public investments have a different impact than private investments?

Yes, studies show that public investments often have larger multipliers compared to private investments due to their ability to stimulate demand directly. - How does inflation affect the investment multiplier?

High inflation can reduce consumer confidence, leading households to save rather than spend additional income generated from investments. - What role do government policies play in maximizing the investment multiplier?

Effective fiscal policies that promote targeted investments can enhance the multiplier effect by encouraging consumer spending. - Are there any risks associated with relying on the investment multiplier?

Yes, risks include overestimating its effects during uncertain economic conditions or misjudging consumer behavior patterns.

In conclusion, understanding the two equivalent formulas for the investment multiplier provides valuable insights into how initial investments can lead to significant economic growth through subsequent rounds of spending. By leveraging this knowledge effectively within current market contexts, investors and policymakers can make informed decisions that foster sustainable economic development.