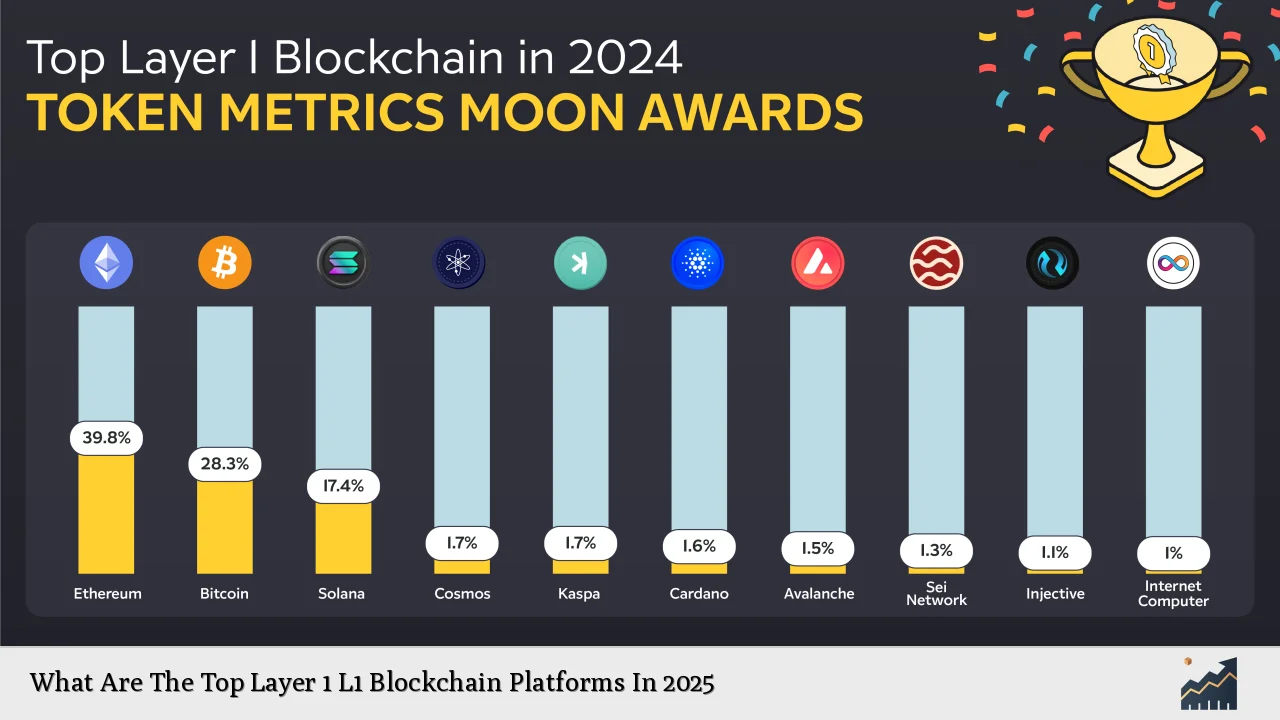

As we approach 2025, the landscape of Layer 1 (L1) blockchain platforms continues to evolve rapidly, driven by technological advancements, increasing institutional adoption, and the ongoing demand for scalable and efficient decentralized applications (dApps). Layer 1 blockchains serve as the foundational networks where transactions are processed and recorded, playing a crucial role in the broader blockchain ecosystem. This article explores the top L1 blockchain platforms expected to dominate in 2025, analyzing their unique features, market trends, and implications for investors and developers.

| Key Concept | Description/Impact |

|---|---|

| Ethereum 2.0 | Ethereum is transitioning to Ethereum 2.0 with significant upgrades aimed at improving scalability and reducing transaction costs through the introduction of sharding and Proof of Stake (PoS) mechanisms. |

| Solana | Known for its high throughput and low transaction fees, Solana processes over 1,000 transactions per second (TPS) and is favored for DeFi and NFT projects despite facing occasional network outages. |

| Avalanche | Avalanche offers modular architecture with speeds up to 4,500 TPS across customizable subnets, making it suitable for enterprise applications and DeFi solutions. |

| Cardano | Cardano emphasizes a research-driven approach to development, focusing on security and scalability through its Ouroboros PoS protocol, positioning itself as a reliable platform for dApps. |

| BNB Chain | Originally Binance Smart Chain, BNB Chain supports high transaction volumes with low fees and is a popular choice for DeFi applications due to its integration with the Binance ecosystem. |

| Near Protocol | Utilizing sharding technology, Near Protocol enhances scalability while maintaining low fees, making it attractive for developers focused on consumer applications and DeFi. |

| Sui | Sui employs a unique Directed Acyclic Graph (DAG) structure enabling rapid transaction processing with minimal latency, ideal for high-frequency trading applications. |

| Aptos | Aptos focuses on user-friendly smart contracts using the Move programming language, aiming to enhance security and efficiency in dApp development. |

| HeLa Labs | A new entrant designed for high-demand industries like gaming and DeFi, HeLa Labs boasts modular architecture that supports rapid transaction processing. |

| Shardeum | This innovative platform utilizes dynamic state sharding to achieve linear scalability while being EVM-compatible, making it suitable for various decentralized applications. |

Market Analysis and Trends

The blockchain market is projected to grow significantly, with estimates suggesting it will expand from USD 20.1 billion in 2024 to USD 248.9 billion by 2029 at a CAGR of approximately 65% . This growth is driven by increased venture capital funding, heightened interest in decentralized finance (DeFi), and the integration of blockchain technology into traditional financial systems.

Key Trends Influencing Layer 1 Blockchains

- Interoperability: As the demand for cross-chain functionality rises, L1 blockchains are increasingly focusing on interoperability solutions. Platforms like Polkadot and Cosmos are leading this charge by enabling seamless communication between different blockchains.

- Institutional Adoption: Major financial institutions are entering the crypto space, with investments projected to exceed $500 billion by 2025 . This trend is likely to drive demand for robust L1 solutions that can support large-scale financial applications.

- Technological Advancements: Innovations such as Ethereum’s upcoming upgrades (Pectra and Verge) aim to enhance scalability and reduce costs significantly . These developments will likely position Ethereum as a more competitive option against emerging L1s.

- Decentralization vs. Performance: The balance between decentralization and performance remains a critical consideration. Platforms like Solana have faced criticism over outages despite their speed advantages. Future L1s will need to address these concerns while maintaining high performance.

Implementation Strategies

For developers looking to leverage these L1 blockchains effectively in their projects:

- Choose Based on Use Case: Select an L1 based on specific project needs—whether speed (Solana), security (Cardano), or flexibility (Avalanche).

- Utilize Layer 2 Solutions: Consider integrating Layer 2 solutions like Optimism or Arbitrum with L1 blockchains to enhance scalability while benefiting from lower transaction costs.

- Focus on Ecosystem Compatibility: Ensure that the chosen blockchain supports interoperability features if cross-chain functionality is essential for your project.

Risk Considerations

Investing in or developing on Layer 1 blockchains carries inherent risks:

- Regulatory Uncertainty: The evolving regulatory landscape poses risks for all blockchain platforms. Compliance with local laws is critical as governments worldwide tighten regulations around cryptocurrencies .

- Market Volatility: The cryptocurrency market is notoriously volatile. Investors should be prepared for significant fluctuations in asset values associated with different L1 platforms.

- Technological Risks: Issues such as network outages or security vulnerabilities can impact platform reliability. Continuous monitoring of technological developments is essential.

Regulatory Aspects

The regulatory environment surrounding cryptocurrencies is becoming increasingly complex:

- Global Regulations: Countries are implementing various regulatory frameworks affecting how L1 blockchains operate. For instance, Australia has introduced enhanced registration requirements for digital asset service providers .

- Compliance Requirements: Blockchain projects must navigate compliance with financial regulations that may require licenses or adherence to specific operational standards.

- Impact of Institutional Involvement: As institutional players enter the space, there may be increased pressure on L1s to comply with stricter regulations that govern traditional financial markets .

Future Outlook

The future of Layer 1 blockchains looks promising as they continue to adapt to market demands:

- Increased Competition: With numerous platforms vying for dominance, innovation will be key. Projects that prioritize user experience, security, and interoperability will likely emerge as leaders.

- Integration with Traditional Finance: As blockchain technology becomes more accepted in traditional finance, L1 platforms will need to develop features that cater specifically to institutional needs.

- Focus on Sustainability: Environmental concerns surrounding blockchain operations are prompting many projects to adopt more sustainable practices. PoS mechanisms are gaining traction as eco-friendly alternatives to traditional mining methods.

Frequently Asked Questions About Top Layer 1 Blockchain Platforms in 2025

- What are Layer 1 blockchains?

Layer 1 blockchains are the foundational networks where all transactions occur directly on the main chain without relying on secondary layers. - Which Layer 1 blockchain is expected to dominate in 2025?

Ethereum is expected to maintain its dominance due to its extensive ecosystem; however, Solana and Avalanche are emerging strong competitors. - How do I choose the right Layer 1 blockchain for my project?

Select based on your project’s needs regarding speed, cost-effectiveness, security features, and community support. - What risks should I consider when investing in Layer 1 blockchains?

Consider regulatory risks, market volatility, technological failures, and competition among platforms. - How does interoperability affect Layer 1 blockchains?

Interoperability allows different blockchains to communicate effectively, enhancing user experience and expanding application possibilities across networks. - Are there any environmentally friendly Layer 1 options?

Yes, many newer platforms utilize Proof of Stake mechanisms which consume significantly less energy compared to traditional Proof of Work systems. - What role do institutional investors play in shaping Layer 1 blockchain platforms?

Institutional investors drive demand for more robust compliance measures and contribute significantly to market liquidity and stability. - How can I stay updated on developments in Layer 1 blockchains?

Follow industry news through reputable financial news outlets, join community forums related to specific blockchains, and subscribe to updates from relevant projects.

In conclusion, as we look towards 2025, understanding the dynamics of Layer 1 blockchain platforms will be crucial for investors and developers alike. By evaluating each platform’s strengths and weaknesses against market trends and regulatory landscapes, stakeholders can make informed decisions that align with their strategic goals.