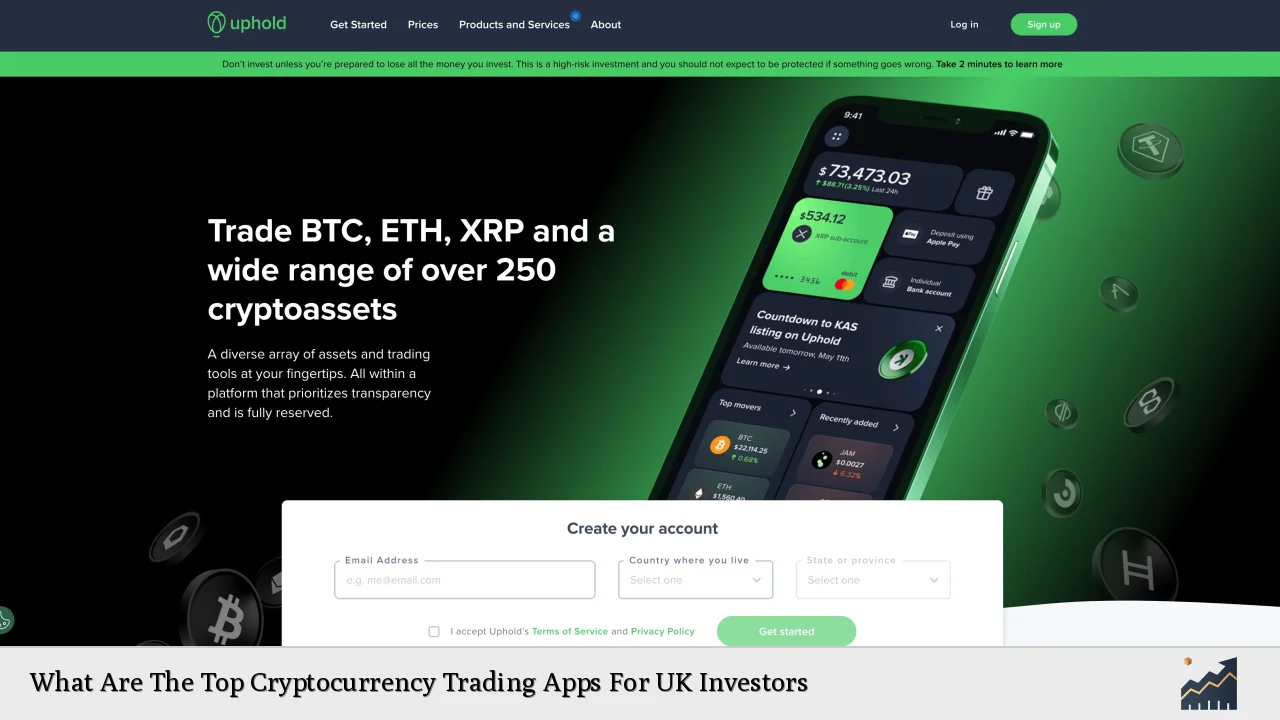

The cryptocurrency landscape in the UK has evolved significantly, driven by increasing investor interest, technological advancements, and regulatory developments. As more individuals seek to enter this dynamic market, selecting the right trading app becomes crucial. This guide provides a comprehensive analysis of the top cryptocurrency trading apps for UK investors, considering factors such as fees, security, user experience, and available features.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The UK cryptocurrency market is projected to generate approximately $1.66 billion in revenue for 2024, reflecting a substantial role in the global digital asset ecosystem. |

| Regulatory Environment | The Financial Conduct Authority (FCA) has implemented new regulations to enhance market integrity and consumer protection, fostering a safer trading environment. |

| Investor Demographics | As of 2024, approximately 13% of UK adults own cryptocurrency, with a notable increase in awareness and participation among younger demographics. |

| Technological Innovations | Advancements in blockchain technology and the introduction of features like staking and DeFi are reshaping investment opportunities within the crypto space. |

Market Analysis and Trends

The UK cryptocurrency market is experiencing transformative growth. A report indicates that the market is projected to reach £2.9 billion ($3.77 billion) by 2027, with a compound annual growth rate (CAGR) of -3.55% from 2024 to 2025. This decline suggests the importance of innovation and sustained investor confidence to navigate future challenges.

The FCA’s recent regulatory framework aims to create a more secure environment for crypto trading by enforcing stricter rules on marketing practices and risk disclosures. This shift is expected to bolster consumer confidence and attract institutional investments, positioning the UK as a leader in crypto regulation.

Current Market Statistics

- Ownership: Approximately 13% of UK adults own cryptocurrencies.

- Bitcoin Ownership: About 7% of the population holds Bitcoin.

- Market Revenue: Expected to generate $1.66 billion in 2024.

- Awareness: Increased from 91% to 93% among the adult population regarding cryptocurrencies.

Implementation Strategies

When choosing a cryptocurrency trading app, investors should consider several strategies:

- Assess Fees: Compare transaction fees across platforms to minimize costs. Some apps charge a flat fee while others apply a percentage-based fee on trades.

- Evaluate Security Features: Look for apps that offer robust security measures such as two-factor authentication (2FA), cold storage options, and insurance against breaches.

- Explore Available Cryptocurrencies: Ensure the app supports a wide range of cryptocurrencies to diversify your portfolio.

- Utilize Educational Resources: Many platforms provide tutorials and market analysis tools that can help users make informed decisions.

Risk Considerations

Investing in cryptocurrencies involves inherent risks due to market volatility and regulatory uncertainties. Key considerations include:

- Market Volatility: Cryptocurrencies can experience significant price fluctuations within short periods.

- Regulatory Risks: Changes in regulations can impact trading conditions and accessibility.

- Security Risks: The threat of hacking and fraud remains prevalent; thus, choosing a secure platform is essential.

Investors should only invest what they can afford to lose and consider seeking professional financial advice before engaging in cryptocurrency trading.

Regulatory Aspects

The FCA’s recent initiatives aim to enhance transparency within the UK’s cryptocurrency markets. Key regulatory measures include:

- Disclosure Requirements: Firms must provide clear information about risks associated with crypto investments.

- Market Abuse Prevention: Enhanced controls are being introduced to prevent fraudulent activities within crypto trading platforms.

These regulations are designed to protect consumers while fostering a competitive marketplace that encourages innovation.

Future Outlook

The future of cryptocurrency trading apps in the UK appears promising, with several trends shaping the landscape:

- Increased Institutional Participation: Major financial institutions are beginning to engage more actively with cryptocurrencies, which could lead to greater legitimacy and stability in the market.

- Technological Advancements: Innovations such as decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) are expanding investment opportunities beyond traditional cryptocurrencies.

- Regulatory Clarity: As regulations become clearer, more investors may feel comfortable entering the market, potentially leading to increased adoption rates.

Investors should remain vigilant about market trends and regulatory changes as they navigate this evolving landscape.

Frequently Asked Questions About Top Cryptocurrency Trading Apps For UK Investors

- What are the best cryptocurrency trading apps for beginners?

Coinbase is often recommended for beginners due to its user-friendly interface and educational resources. - Are there any fees associated with using these apps?

Yes, most trading apps charge fees that can range from fixed amounts to percentage-based fees on transactions. - How secure are cryptocurrency trading apps?

Security varies by platform; look for features like two-factor authentication and cold storage options for added safety. - Can I trade multiple cryptocurrencies on these platforms?

Most top trading apps allow you to trade a variety of cryptocurrencies; however, the range may differ between platforms. - Is it safe to invest in cryptocurrencies?

While investing can be profitable, it carries risks due to volatility and regulatory uncertainties; only invest what you can afford to lose. - What should I consider when choosing a trading app?

Consider factors such as fees, security features, available cryptocurrencies, user interface, and educational resources. - How do I start trading cryptocurrencies?

Create an account on your chosen platform, complete any required verification processes, deposit funds, and start trading. - Are there any tax implications for trading cryptocurrencies in the UK?

Yes, profits from cryptocurrency trading may be subject to capital gains tax; it’s advisable to consult with a tax professional.

This comprehensive overview provides insights into the top cryptocurrency trading apps available for UK investors while addressing current trends, strategies for implementation, risk considerations, regulatory aspects, and future outlooks. By understanding these elements, investors can make informed decisions tailored to their financial goals.