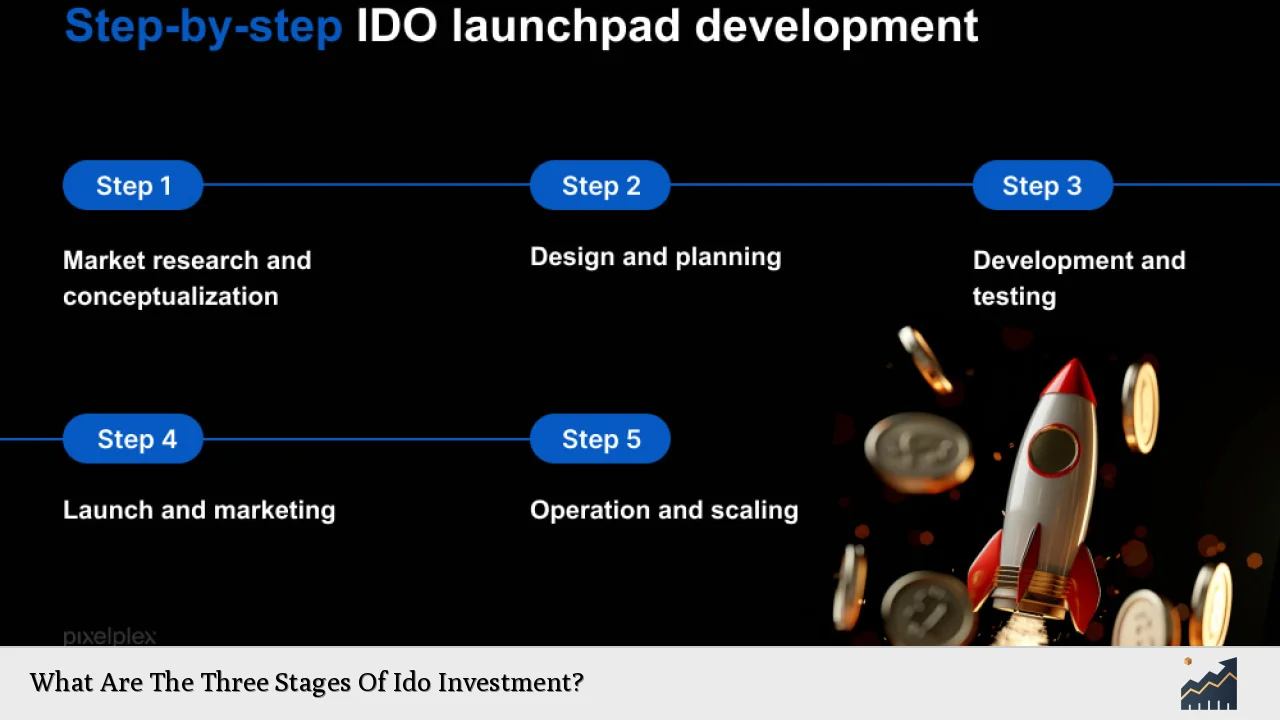

An Initial DEX Offering (IDO) is a fundraising method used by blockchain projects to raise capital through decentralized exchanges (DEXs). It allows projects to launch their tokens directly on a DEX, providing investors with an opportunity to purchase these tokens before they are listed on the open market. The IDO process is characterized by three main stages: preparation, execution, and post-launch activities. Understanding these stages is crucial for both project developers and investors looking to navigate the IDO landscape effectively.

| Stage | Description |

|---|---|

| Preparation | Developing a business strategy and marketing plan. |

| Execution | Conducting the token sale and listing on a DEX. |

| Post-Launch | Supporting token growth and engaging with the community. |

Preparation Stage

The preparation stage is critical for the success of an IDO. It involves several key components that set the foundation for the entire fundraising process.

First, project teams must develop a comprehensive business strategy. This includes defining the project’s goals, target audience, and how funds will be allocated. A well-thought-out strategy helps communicate the project’s vision to potential investors, making it easier to attract interest.

Next, creating marketing collateral is essential. This includes designing a visually appealing website that highlights the project’s unique selling points and drafting a detailed white paper that outlines technical details, tokenomics, and the project’s roadmap. A strong marketing presence can significantly enhance investor interest.

Choosing a suitable DEX launchpad is another vital step in this stage. The launchpad serves as a platform for projects to gain visibility and access a broader investor base. Teams must ensure their project meets the launchpad’s requirements, including compliance with its consensus mechanism and whitelisting processes.

Finally, the team needs to create the cryptocurrency or token that will be sold during the IDO. This involves defining key parameters such as total supply, token name, symbol, and any additional features. Thorough testing of the token’s functionality and security is crucial before moving forward.

Execution Stage

The execution stage encompasses the actual IDO process where tokens are offered to investors. This stage typically begins with a token presale, where early investors who have registered on a whitelist can purchase tokens at a discounted rate. This presale phase generates initial interest and momentum for the project.

Following the presale, the public token sale begins. During this phase, tokens are sold either in batches or through an auction format. In batch sales, predefined volumes and prices are established, while auctions allow for competitive bidding among investors.

Once the token sale concludes, it is essential to establish liquidity on the DEX. The project team allocates part of the raised funds to create liquidity pools using both their tokens and external contributions. This step ensures that there is sufficient liquidity for trading once the token is listed.

After creating liquidity pools, the project team officially lists the token on the DEX. This listing allows investors to buy and sell tokens immediately after the IDO concludes, facilitating an active trading environment.

Post-Launch Activities

The post-launch stage focuses on sustaining momentum after the IDO has concluded. It involves ongoing support for investors and efforts to promote long-term growth for the token.

One of the first tasks post-launch is to engage with the community actively. This includes providing regular updates about project developments, responding to investor inquiries, and fostering discussions within community forums or social media platforms. Building a strong community around a project can enhance investor confidence and encourage token adoption.

Additionally, ongoing marketing efforts are crucial during this phase. The project team should continue promoting their token through various channels to maintain visibility in a competitive market. Strategic partnerships can also help drive demand for the token by integrating it into broader ecosystems or applications.

Finally, monitoring market performance and addressing any issues that arise post-launch is essential for long-term success. This may involve adjusting strategies based on market feedback or investor sentiment.

FAQs About Ido Investment

- What is an Initial DEX Offering (IDO)?

An IDO is a fundraising method where blockchain projects sell their tokens directly on decentralized exchanges. - How does an IDO work?

IDOs involve preparing a business strategy, conducting a token sale on a DEX, and managing post-launch activities. - What are liquidity pools in an IDO?

Liquidity pools are created using raised funds and project tokens to ensure sufficient trading volume after listing. - Why is community engagement important post-IDO?

Active community engagement helps maintain investor interest and promotes long-term adoption of the token. - What should investors look for in an IDO?

Investors should evaluate project fundamentals, team credibility, and marketing strategies before participating in an IDO.

In conclusion, understanding these three stages of IDO investment—preparation, execution, and post-launch activities—is essential for both developers and investors. By following these structured phases diligently, projects can enhance their chances of raising capital successfully while providing investors with valuable opportunities in the ever-evolving cryptocurrency landscape.