The rise of cryptocurrencies has introduced complex tax implications for investors and users alike. As digital assets become increasingly integrated into financial ecosystems, understanding the tax obligations associated with their transactions is crucial. This is particularly relevant for platforms like Kleva, which facilitates decentralized finance (DeFi) activities such as leveraged yield farming. This article explores the tax implications of using Kleva for crypto transactions, providing a comprehensive analysis of current regulations, market trends, and practical strategies for compliance.

| Key Concept | Description/Impact |

|---|---|

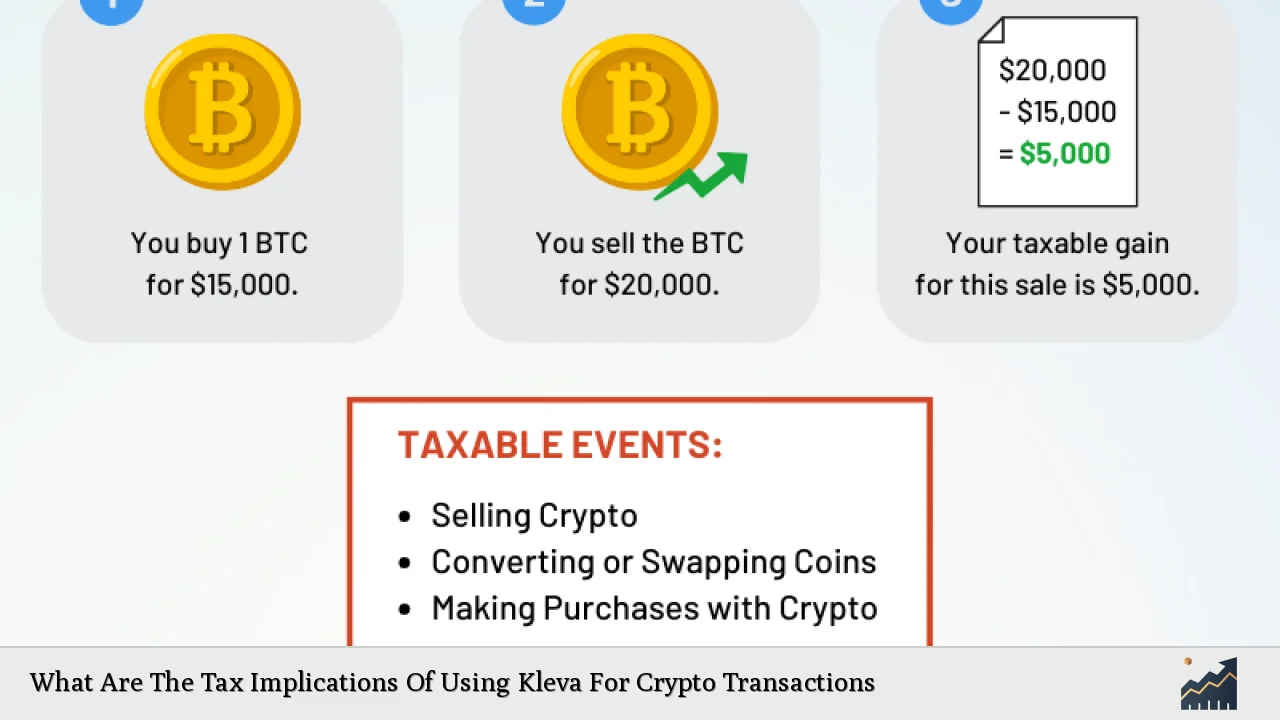

| Taxable Events | Transactions involving cryptocurrencies are generally considered taxable events by the IRS. This includes selling, trading, or using crypto to purchase goods and services. |

| Capital Gains Tax | Profits from the sale or exchange of cryptocurrencies are subject to capital gains tax, which varies based on the holding period (short-term vs. long-term). |

| Income Tax | Any cryptocurrency received as payment, through mining, or staking is treated as ordinary income and taxed at the individual’s income tax rate. |

| Kleva Protocol Specifics | Using Kleva for yield farming or other DeFi activities may trigger both capital gains and income tax obligations depending on the nature of the transactions. |

| Record Keeping | Maintaining accurate records of all transactions is essential for calculating gains/losses and ensuring compliance with tax regulations. |

| Future Regulations | The IRS is expected to enhance reporting requirements for crypto transactions by 2025, making compliance more stringent. |

Market Analysis and Trends

The cryptocurrency market has seen significant fluctuations in recent years, with a current total market capitalization of approximately $2.66 trillion as of late 2024. Notably, Bitcoin has experienced a resurgence, with predictions suggesting it could reach values exceeding $210,000 by 2025 due to factors such as ETF approvals and upcoming halving events.

Kleva Protocol operates within this dynamic landscape, focusing on leveraging yield farming opportunities in decentralized exchanges. As DeFi continues to grow, so do the complexities surrounding taxation. Investors utilizing platforms like Kleva must navigate both capital gains taxes on profits from transactions and income taxes on rewards earned through yield farming.

Implementation Strategies

To effectively manage tax implications when using Kleva, investors should consider implementing the following strategies:

- Maintain Detailed Records: Keep comprehensive records of all transactions conducted through Kleva, including dates, amounts, transaction types (buying, selling, staking), and associated costs.

- Utilize Tax Software: Employ cryptocurrency tax software that can automatically track transactions across various platforms and generate necessary reports for tax filing.

- Understand Tax Brackets: Familiarize yourself with current capital gains tax rates—short-term rates align with ordinary income rates (10-37%), while long-term rates range from 0-20% based on income levels.

- Consult a Tax Professional: Given the evolving nature of cryptocurrency regulations, consulting with a tax advisor experienced in digital assets can provide tailored guidance and ensure compliance with current laws.

Risk Considerations

Investing in cryptocurrencies through platforms like Kleva carries inherent risks that can impact tax obligations:

- Market Volatility: The unpredictable nature of cryptocurrency prices can lead to significant capital gains or losses within short periods. Investors must be prepared to report these fluctuations accurately.

- Regulatory Changes: As governments worldwide tighten regulations surrounding cryptocurrencies, staying informed about potential changes in tax laws is crucial for compliance.

- Operational Risks: Engaging in DeFi activities involves smart contract risks that could lead to financial loss. Such losses may offset gains but require careful documentation to claim on taxes.

Regulatory Aspects

In the United States, the IRS treats cryptocurrencies as property for tax purposes. This classification means that most transactions involving crypto are subject to capital gains taxation. Key regulatory points include:

- Taxable Events: Selling crypto for fiat currency or trading one cryptocurrency for another triggers a taxable event. Each transaction must be reported regardless of whether it results in a gain or loss.

- Income Reporting: Earnings from yield farming on platforms like Kleva are considered ordinary income and must be reported at their fair market value at the time of receipt.

- Upcoming Regulations: Starting in 2025, all cryptocurrency exchanges will be required to report detailed transaction data to the IRS via new forms like 1099-DA. This change aims to improve compliance and reduce tax evasion within the crypto space.

Future Outlook

The future of cryptocurrency taxation appears increasingly complex but also more structured as regulatory frameworks evolve. Predictions indicate that:

- Increased Compliance Requirements: With enhanced reporting obligations coming into effect in 2025, users of platforms like Kleva will need to be proactive in maintaining accurate records and understanding their tax liabilities.

- Market Growth: As DeFi continues to expand, more investors will engage with protocols like Kleva. This growth will likely lead to increased scrutiny from regulators focused on ensuring proper reporting and compliance.

- Technological Innovations: Advances in blockchain technology may facilitate better tracking of transactions and simplify compliance processes for investors.

Frequently Asked Questions About What Are The Tax Implications Of Using Kleva For Crypto Transactions

- What constitutes a taxable event when using Kleva?

A taxable event includes selling your crypto assets for fiat currency or trading one cryptocurrency for another while using Kleva. - How is capital gains tax calculated?

Capital gains tax is calculated based on the difference between your cost basis (the original purchase price) and the selling price at the time of disposal. - Do I need to report every transaction?

Yes, all transactions involving cryptocurrencies must be reported to ensure compliance with IRS regulations. - What if I incur losses while using Kleva?

Capital losses can offset capital gains; however, you must keep detailed records of these losses for reporting purposes. - Are there specific forms I need to file?

You will typically use Form 8949 to report capital gains and losses from your crypto transactions. - Will future regulations affect my current holdings?

While current holdings remain unchanged, future regulations may impact how you report transactions starting in 2025. - Is it advisable to consult a tax professional?

Yes, consulting a tax professional can provide personalized advice tailored to your specific circumstances regarding crypto investments. - How does Kleva’s yield farming affect my taxes?

Earnings from yield farming are treated as ordinary income and taxed accordingly based on their fair market value at receipt.

In conclusion, navigating the tax implications of using Kleva for crypto transactions requires careful consideration of current regulations and proactive record-keeping practices. By staying informed about market trends and regulatory changes, investors can effectively manage their tax liabilities while participating in the growing DeFi landscape.