Decentralized Finance (DeFi) has emerged as a revolutionary force in the financial landscape, offering innovative ways to engage with digital assets. However, as with any investment, understanding the tax implications is crucial for investors. DeFi transactions can trigger various tax liabilities, including capital gains and ordinary income taxes, depending on the nature of the transaction and the jurisdiction in which the investor operates. This article aims to provide a comprehensive overview of the tax implications of DeFi investments, addressing key concepts, current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

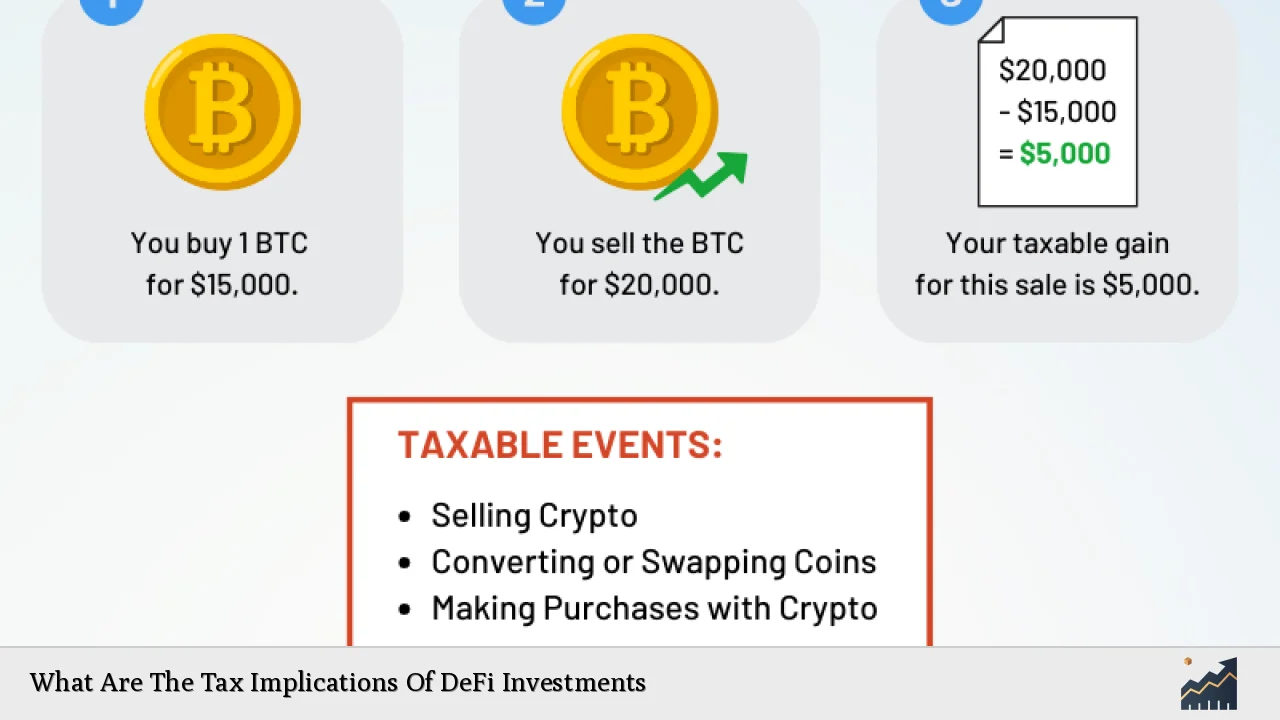

| Taxable Events | Transactions such as selling, swapping, or earning rewards in DeFi can trigger capital gains or ordinary income taxes. |

| Capital Gains Tax | Profits from selling or disposing of digital assets are subject to capital gains tax; rates vary based on holding period. |

| Ordinary Income Tax | Earnings from staking, lending, or liquidity provision are generally taxed as ordinary income when received. |

| Record Keeping | Investors must maintain detailed records of all transactions for accurate tax reporting and compliance. |

| Professional Assistance | Due to the complexity of DeFi taxation, seeking professional tax advice is recommended to navigate potential pitfalls. |

Market Analysis and Trends

The DeFi market has witnessed significant growth in recent years. From July 2023 to June 2024, the Total Value Locked (TVL) in DeFi surged from approximately $50 billion to over $100 billion. This growth was primarily driven by asset price appreciation and innovations such as liquid staking protocols. As more investors engage with DeFi platforms, understanding the tax implications becomes increasingly vital.

Current Market Statistics

- Market Size (2024): Estimated at USD 46.61 billion.

- Projected Growth: Expected to reach USD 78.47 billion by 2029, growing at a CAGR of 10.98%.

- Key Drivers: Increased adoption of Ethereum-based applications and the rise of Layer 2 solutions.

The expansion of DeFi has also led to greater scrutiny from regulatory bodies, emphasizing the need for clarity regarding tax obligations.

Implementation Strategies

Investors should adopt several strategies to effectively manage their DeFi investments while minimizing tax liabilities:

- Maintain Detailed Records: Keeping comprehensive records of all transactions is essential for accurate tax reporting.

- Understand Taxable Events: Familiarize yourself with what constitutes a taxable event in your jurisdiction. This includes sales, swaps, and earning rewards.

- Utilize Tax-Loss Harvesting: Offset capital gains by selling underperforming assets.

- Consider Holding Periods: Long-term capital gains are generally taxed at lower rates than short-term gains. Holding assets for over a year can significantly reduce tax liabilities.

- Explore Tax-Advantaged Accounts: Utilizing accounts like IRAs for crypto investments may defer or minimize taxes on gains.

Risk Considerations

Investing in DeFi carries inherent risks that can complicate tax obligations:

- Volatility: The highly volatile nature of cryptocurrencies can lead to significant fluctuations in asset value, impacting capital gains calculations.

- Complex Transactions: Activities such as yield farming and liquidity provision often involve multiple transactions that can complicate tax reporting.

- Regulatory Changes: As governments adapt to the evolving landscape of digital finance, changes in regulations could affect tax obligations.

Investors should remain vigilant about these risks and consider consulting with financial professionals to navigate potential challenges effectively.

Regulatory Aspects

Tax treatment for DeFi transactions varies by jurisdiction but generally falls under existing cryptocurrency regulations. In the U.S., the IRS classifies digital assets as property, meaning that transactions can trigger capital gains taxes. Key points include:

- Capital Gains Tax: Profits from selling or exchanging cryptocurrencies are subject to capital gains tax.

- Ordinary Income Tax: Earnings from staking or providing liquidity are typically taxed as ordinary income at the time they are received.

- Mandatory Reporting: The IRS requires all virtual currency transactions to be reported on tax returns, regardless of gain or loss status.

In Australia, similar principles apply under guidance from the Australian Taxation Office (ATO), which emphasizes that whether a transaction is classified as capital gains or income depends on specific circumstances surrounding each transaction.

Future Outlook

As DeFi continues to evolve and attract more participants, it is likely that regulatory frameworks will become more defined. Investors should anticipate changes that could impact taxation:

- Increased Regulation: Governments may introduce clearer guidelines regarding DeFi taxation as they seek to protect investors and ensure compliance.

- Enhanced Reporting Requirements: Expect stricter rules around reporting digital asset transactions to improve transparency and accountability.

- Emerging Technologies: Innovations within DeFi may lead to new types of taxable events that require careful consideration by investors and regulators alike.

Investors should stay informed about these developments and adjust their strategies accordingly to remain compliant while maximizing their investment potential.

Frequently Asked Questions About What Are The Tax Implications Of DeFi Investments

- Do you pay taxes on DeFi investments?

Yes, investors must pay taxes on gains from DeFi crypto transactions. Depending on how long an investor held the investment, these transactions may be subject to short-term or long-term capital gains taxes. - Is interest earned from DeFi taxable?

Yes, interest earned from DeFi platforms is generally considered taxable income by the IRS and must be reported on your tax return. - Are loans taken out through DeFi taxable?

The initial act of borrowing does not trigger a taxable event; however, any earnings generated from those borrowed funds could be subject to taxation. - How do I report my DeFi earnings?

All earnings from DeFi activities must be reported on your tax return using forms such as Form 8949 for capital gains and Schedule 1 for other income. - Can I offset my taxes with losses?

Yes, investors can utilize tax-loss harvesting strategies to offset capital gains by selling underperforming assets. - What should I do if I have complex DeFi transactions?

If you have numerous or complex transactions, it is advisable to consult with a professional accountant who specializes in cryptocurrency taxation. - Are there any upcoming changes in regulations regarding DeFi?

As governments continue to adapt their approaches toward digital finance, investors should stay informed about potential regulatory changes that could impact their tax obligations. - How can I minimize my taxes on DeFi investments?

Strategies include maintaining detailed records, utilizing long-term holding periods for favorable rates, and exploring tax-advantaged accounts.

Understanding the intricate landscape of taxes associated with DeFi investments is essential for individual investors and finance professionals alike. By staying informed about current regulations and employing effective strategies, participants can navigate this evolving market while optimizing their financial outcomes.