Stablecoins have emerged as a significant player in the cryptocurrency market, offering a bridge between traditional finance and the volatile world of digital assets. As of August 2024, the stablecoin market capitalization stood at an impressive $171.63 billion, reflecting growing trust and reliance on these digital currencies as a stable store of value and medium of exchange. However, with this increasing popularity comes inherent risks that must be effectively managed. This comprehensive guide explores the strategies for risk management in stablecoin investments, providing investors and finance professionals with the tools to navigate this evolving landscape.

| Key Concept | Description/Impact |

|---|---|

| Stablecoin Market Cap | $171.63 billion as of August 2024, indicating significant market presence and investor trust |

| Trading Volume | $88.18 billion in mid-July 2024, showcasing active use in trading strategies |

| Risk Factors | Depegging events, regulatory changes, collateral quality, and market volatility |

| AI-Enhanced Risk Management | Utilization of machine learning and data analytics for proactive risk identification and mitigation |

Market Analysis and Trends

The stablecoin market has experienced remarkable growth, with its market capitalization reaching $173 billion by October 2024. This growth is driven by several factors:

- Increased Adoption: Stablecoins are gaining popularity as a medium of exchange and a store of value, particularly in regions with monetary instability or limited access to the US dollar.

- Liquidity Provision: Stablecoins now represent nearly 50% of the total transaction volume among major crypto assets, underscoring their crucial role in providing market liquidity.

- Institutional Interest: Traditional financial players, including PayPal and Sony Bank, have shown interest in stablecoins, hinting at growing mainstream adoption.

- Diverse Use Cases: From international payments to liquidity management and currency fluctuation protection, stablecoins are being leveraged across various financial scenarios.

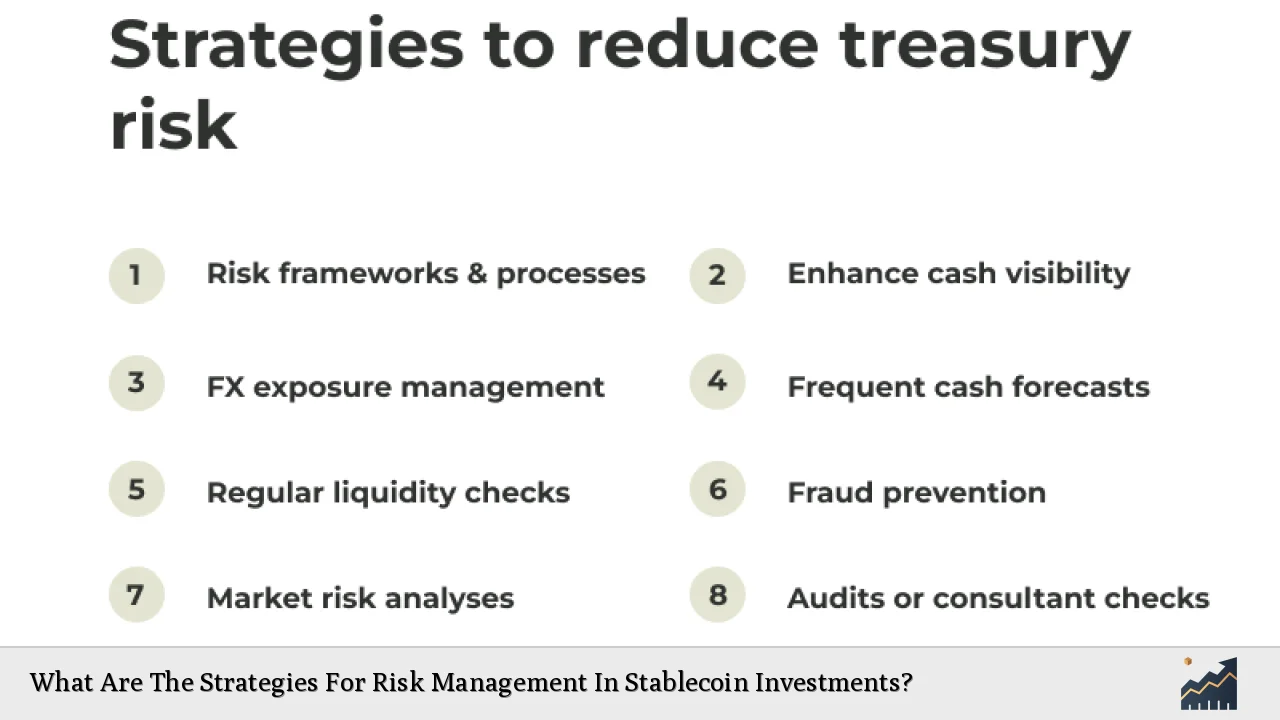

Implementation Strategies

To effectively manage risks in stablecoin investments, consider implementing the following strategies:

1. Diversification

Diversifying your stablecoin portfolio is crucial for mitigating risks associated with individual assets. This strategy involves:

- Asset Allocation: Spread investments across different types of stablecoins, including fiat-backed, crypto-backed, and algorithmic stablecoins.

- Issuer Diversification: Invest in stablecoins from various issuers to reduce exposure to issuer-specific risks.

- Blockchain Diversification: Consider stablecoins issued on different blockchain networks to mitigate network-specific risks.

2. Due Diligence and Research

Thorough research is essential before investing in any stablecoin. Key areas to investigate include:

- Issuer Credibility: Evaluate the reputation, financial stability, and transparency of the stablecoin issuer.

- Collateral Backing: Understand the nature and quality of assets backing the stablecoin.

- Regulatory Compliance: Assess the issuer’s adherence to relevant regulations and legal frameworks.

- Technical Infrastructure: Review the robustness of the stablecoin’s technical architecture and security measures.

3. Liquidity Management

Maintaining adequate liquidity is crucial for stablecoin investments. Strategies include:

- Liquidity Ratios: Monitor and maintain appropriate liquidity ratios to ensure the ability to meet redemption requests.

- Diversified Liquidity Sources: Establish relationships with multiple liquidity providers to ensure access to funds during market stress.

- Automated Liquidity Management: Implement AI-driven systems to forecast liquidity needs and optimize liquidity management strategies.

4. Risk Monitoring and Analytics

Leveraging advanced analytics and AI-powered tools can significantly enhance risk management:

- Real-time Monitoring: Implement systems for continuous monitoring of market conditions, trading volumes, and price movements.

- Predictive Analytics: Utilize machine learning algorithms to identify potential risks before they escalate.

- Stress Testing: Regularly conduct stress tests to assess the resilience of stablecoin investments under various market scenarios.

Risk Considerations

While stablecoins offer relative stability compared to other cryptocurrencies, they are not without risks. Key considerations include:

1. Depegging Risk

The risk of a stablecoin losing its peg to the underlying asset is a primary concern. Historical examples like the collapse of Terra’s UST in May 2022 highlight this risk. Mitigation strategies include:

- Collateral Monitoring: Regularly assess the quality and sufficiency of collateral backing the stablecoin.

- Diversification: Avoid over-concentration in a single stablecoin to limit exposure to depegging events.

- Automated Stabilization Mechanisms: For algorithmic stablecoins, evaluate the robustness of their stabilization algorithms.

2. Counterparty Risk

This risk arises from the potential failure of the stablecoin issuer or custodian. Mitigation approaches include:

- Issuer Due Diligence: Thoroughly investigate the financial health and operational practices of stablecoin issuers.

- Multi-Signature Wallets: Use multi-signature wallets for storing stablecoins to enhance security.

- Insurance: Consider crypto-asset insurance to protect against issuer defaults or hacks.

3. Regulatory Risk

The evolving regulatory landscape poses risks to stablecoin investments. Strategies to manage this risk include:

- Regulatory Monitoring: Stay informed about regulatory developments in relevant jurisdictions.

- Compliance Focus: Prioritize investments in stablecoins that demonstrate strong regulatory compliance.

- Geographic Diversification: Spread investments across stablecoins subject to different regulatory regimes to mitigate jurisdiction-specific risks.

Regulatory Aspects

The regulatory environment for stablecoins is rapidly evolving, with implications for risk management:

- Increased Scrutiny: Regulators worldwide are paying closer attention to stablecoins, with a focus on consumer protection and financial stability.

- Reporting Requirements: Stablecoin issuers may face enhanced reporting and transparency requirements.

- Reserve Standards: Regulators may impose stricter standards for the quality and composition of stablecoin reserves.

Investors should stay informed about regulatory developments and prioritize stablecoins that proactively address regulatory concerns.

Future Outlook

The future of stablecoin investments looks promising, with several trends shaping the landscape:

- Institutional Adoption: Increased institutional interest is likely to drive further growth and innovation in the stablecoin market.

- Technological Advancements: AI and blockchain innovations will enhance risk management capabilities and operational efficiency.

- Regulatory Clarity: As regulatory frameworks mature, clearer guidelines will emerge, potentially fostering greater investor confidence.

- Diversification of Use Cases: Stablecoins are expected to find applications beyond trading, including in cross-border payments and decentralized finance (DeFi) protocols.

- Integration with Traditional Finance: The line between stablecoins and traditional financial instruments may blur, leading to new hybrid products and services.

In conclusion, effective risk management in stablecoin investments requires a multifaceted approach combining thorough research, diversification, advanced analytics, and regulatory awareness. By implementing these strategies and staying informed about market developments, investors can navigate the stablecoin landscape more confidently and potentially reap the benefits of this innovative asset class.

Frequently Asked Questions About What Are The Strategies For Risk Management In Stablecoin Investments?

- What are the main types of stablecoins, and how do their risks differ?

The main types of stablecoins are fiat-collateralized, crypto-collateralized, and algorithmic. Fiat-collateralized stablecoins are backed by traditional currencies and generally considered lower risk. Crypto-collateralized stablecoins are backed by other cryptocurrencies and may be more volatile. Algorithmic stablecoins rely on smart contracts to maintain their peg and can be higher risk due to potential algorithm failures. - How can I assess the credibility of a stablecoin issuer?

To assess a stablecoin issuer’s credibility, examine their transparency in reporting reserves, regulatory compliance, audit history, team expertise, and track record in the industry. Look for regular third-party audits, clear legal frameworks, and open communication about their operations and risk management practices. - What role does liquidity play in stablecoin risk management?

Liquidity is crucial in stablecoin risk management as it affects the ability to maintain the peg and meet redemption requests. High liquidity helps absorb market shocks and reduces the risk of depegging events. Investors should monitor liquidity metrics and favor stablecoins with robust liquidity management strategies. - How can AI and machine learning enhance stablecoin risk management?

AI and machine learning can enhance stablecoin risk management by providing real-time market analysis, predictive modeling for potential risks, automated liquidity management, and pattern recognition for detecting anomalies or fraudulent activities. These technologies enable more proactive and efficient risk mitigation strategies. - What are the key regulatory considerations for stablecoin investments?

Key regulatory considerations include compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, adherence to reserve requirements, reporting standards, and consumer protection measures. Investors should stay informed about regulatory developments in relevant jurisdictions and prioritize stablecoins that demonstrate strong regulatory compliance. - How can I protect my stablecoin investments from cyber threats?

To protect stablecoin investments from cyber threats, use hardware wallets for long-term storage, enable two-factor authentication on exchange accounts, use reputable exchanges with strong security measures, regularly update software and security protocols, and be cautious of phishing attempts. Consider using multi-signature wallets for additional security. - What are the potential impacts of central bank digital currencies (CBDCs) on stablecoin investments?

The introduction of CBDCs could potentially compete with or complement existing stablecoins. CBDCs might offer similar stability benefits with added government backing, potentially impacting stablecoin adoption. However, they could also lead to increased integration between traditional and digital finance, potentially benefiting the broader stablecoin ecosystem. Investors should monitor CBDC developments and assess their potential impact on stablecoin investments.