In the rapidly evolving landscape of cryptocurrency, exchange-based tokens play a significant role in facilitating transactions and providing users with various benefits, such as reduced trading fees and access to exclusive services. However, the security of these tokens is paramount, especially given the increasing frequency of cyberattacks and regulatory scrutiny. This article delves into the comprehensive security measures that exchanges implement to protect their tokens, ensuring user trust and compliance with regulatory standards.

| Key Concept | Description/Impact |

|---|---|

| Two-Factor Authentication (2FA) | Enhances account security by requiring a second form of verification, typically via a mobile device, making unauthorized access significantly more difficult. |

| Cold Storage | Funds are stored offline in cold wallets, which are not connected to the internet, reducing exposure to hacking attempts. |

| Regular Security Audits | Periodic assessments of security protocols and systems help identify vulnerabilities and ensure compliance with best practices. |

| Data Encryption | All sensitive data is encrypted during transmission and storage to prevent unauthorized access and data breaches. |

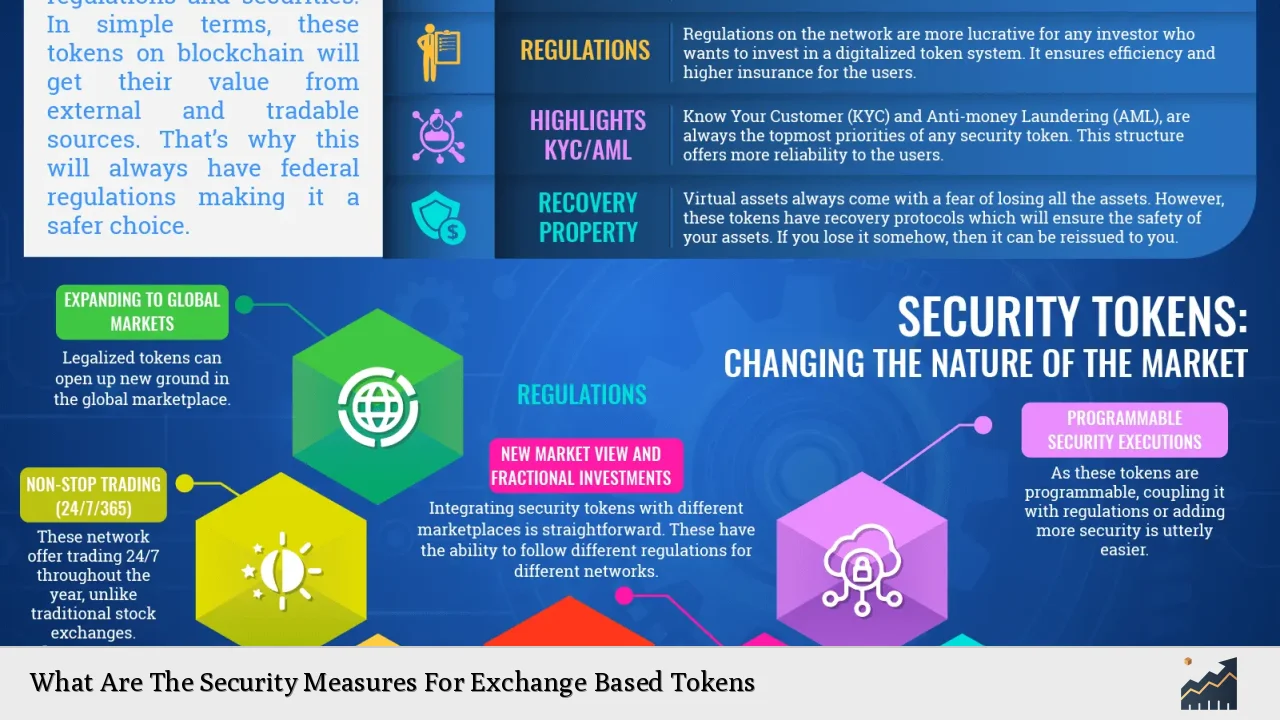

| Compliance with KYC/AML Regulations | Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are implemented to verify user identities and prevent illicit activities. |

| Transaction Monitoring | Real-time monitoring of transactions helps detect suspicious activities indicative of fraud or money laundering. |

| DDoS Protection | Measures are in place to mitigate Distributed Denial of Service (DDoS) attacks that can disrupt exchange operations. |

| User Education | Exchanges often provide resources to educate users on secure practices, such as creating strong passwords and recognizing phishing attempts. |

| Withdrawal Whitelists | This feature allows users to specify approved addresses for withdrawals, adding an extra layer of security against unauthorized transactions. |

| Behavioral Analytics | Monitoring user behavior patterns helps identify anomalies that may indicate account compromise or fraudulent activity. |

Market Analysis and Trends

The cryptocurrency market has witnessed significant growth, with the total market cap reaching approximately $3.52 trillion as of December 2024. This growth has been accompanied by an increase in security risks, leading exchanges to adopt robust security measures for their tokens. Recent trends indicate that:

- Increased Regulatory Scrutiny: Regulatory bodies worldwide are tightening their oversight of cryptocurrency exchanges, emphasizing the need for compliance with KYC and AML regulations. This has led exchanges to enhance their security frameworks significantly.

- Rise in Cyberattacks: High-profile hacks have highlighted vulnerabilities within exchanges. For instance, several exchanges have suffered losses exceeding hundreds of millions due to inadequate security measures. This has prompted a shift towards more stringent security protocols.

- User Demand for Transparency: Investors are increasingly prioritizing platforms that demonstrate a commitment to security. Transparency regarding security practices is becoming a key differentiator among exchanges.

Implementation Strategies

To effectively secure exchange-based tokens, platforms employ a variety of strategies:

- Adoption of Advanced Technologies: Exchanges are investing in cutting-edge technologies such as artificial intelligence (AI) for fraud detection and blockchain analytics for transaction monitoring.

- Regular Penetration Testing: Conducting simulated attacks on their systems helps exchanges identify weaknesses before malicious actors can exploit them.

- Multi-Signature Wallets: Utilizing multi-signature wallets requires multiple private keys for transactions, significantly enhancing the security of stored assets.

- Incident Response Plans: Developing comprehensive incident response strategies ensures that exchanges can quickly address breaches or suspicious activities.

Risk Considerations

Despite implementing robust security measures, several risks persist:

- Human Error: Many breaches occur due to human mistakes, such as falling for phishing scams or using weak passwords. Continuous user education is essential.

- Regulatory Changes: Rapidly evolving regulations can create compliance challenges for exchanges, potentially exposing them to legal risks if they fail to adapt quickly.

- Market Volatility: The inherent volatility in cryptocurrency markets can lead to panic selling or hasty decisions during crises, complicating risk management efforts.

Regulatory Aspects

Regulatory compliance is crucial for maintaining the integrity of exchange-based tokens. Key regulations include:

- KYC Requirements: Exchanges must collect identifying information from users to verify their identities and ensure they are not involved in illicit activities.

- AML Policies: Implementing stringent AML policies helps prevent the use of exchange platforms for money laundering or financing terrorism.

- Data Protection Regulations: Compliance with data protection laws ensures that user information is handled securely and ethically.

Exchanges must stay abreast of changing regulations across jurisdictions to avoid penalties and maintain operational licenses.

Future Outlook

The future of exchange-based tokens will likely be shaped by several factors:

- Increased Institutional Adoption: As more institutional investors enter the cryptocurrency space, there will be heightened demand for secure trading environments.

- Technological Advancements: Innovations such as decentralized finance (DeFi) may influence how exchanges operate and secure their tokens.

- Ongoing Regulatory Developments: The evolving regulatory landscape will continue to impact how exchanges manage security protocols and user trust.

In conclusion, while exchange-based tokens present significant opportunities for investors, ensuring their security is paramount. By implementing comprehensive measures and staying compliant with regulatory standards, exchanges can foster a safer trading environment that attracts both retail and institutional investors.

Frequently Asked Questions About Security Measures For Exchange Based Tokens

- What is two-factor authentication (2FA)?

2FA is a security process that requires users to provide two different authentication factors to verify themselves, significantly enhancing account protection. - How do exchanges protect against DDoS attacks?

Exchanges implement DDoS protection measures such as traffic filtering and rate limiting to ensure platform availability during attack attempts. - What are KYC and AML regulations?

KYC (Know Your Customer) involves verifying user identities to prevent fraud, while AML (Anti-Money Laundering) policies help detect and prevent illegal financial activities. - Why is cold storage important?

Cold storage keeps cryptocurrencies offline, reducing the risk of theft from online hacks. - How often should exchanges conduct security audits?

Regular audits should be conducted at least annually or after significant system changes to ensure ongoing compliance with best practices. - What role does user education play in security?

User education helps individuals recognize potential threats like phishing scams and encourages them to adopt safer online behaviors. - Can behavioral analytics help prevent fraud?

Yes, behavioral analytics track user actions over time to identify unusual patterns that may indicate fraudulent activity. - What should users do if they suspect fraud on an exchange?

If users suspect fraud, they should immediately contact customer support and change their passwords while monitoring their accounts for suspicious activity.

This comprehensive overview highlights the critical importance of security measures for exchange-based tokens in today’s cryptocurrency market. By understanding these measures, investors can make informed decisions while engaging with cryptocurrency platforms.