The collapse of FTX in late 2022 serves as a critical reminder of the importance of robust security practices in the cryptocurrency industry. As one of the largest exchanges, FTX’s downfall was attributed to severe lapses in security protocols, risk management, and regulatory compliance. This article explores the best practices for securing investments and assets within platforms like FTX, emphasizing the lessons learned from its failures.

| Key Concept | Description/Impact |

|---|---|

| Dedicated Security Team | A dedicated team is essential for continuous risk assessment and threat mitigation. |

| Infrastructure Controls | Implementing robust security policies and software development practices can protect against vulnerabilities. |

| Cold Storage Protocols | Storing assets offline significantly reduces the risk of hacking. |

| Multi-Signature Wallets | Requiring multiple approvals for transactions enhances security against unauthorized access. |

| Regular Security Audits | External audits help identify vulnerabilities and ensure compliance with regulations. |

| User Education | Training users on phishing scams and secure practices is crucial for protecting assets. |

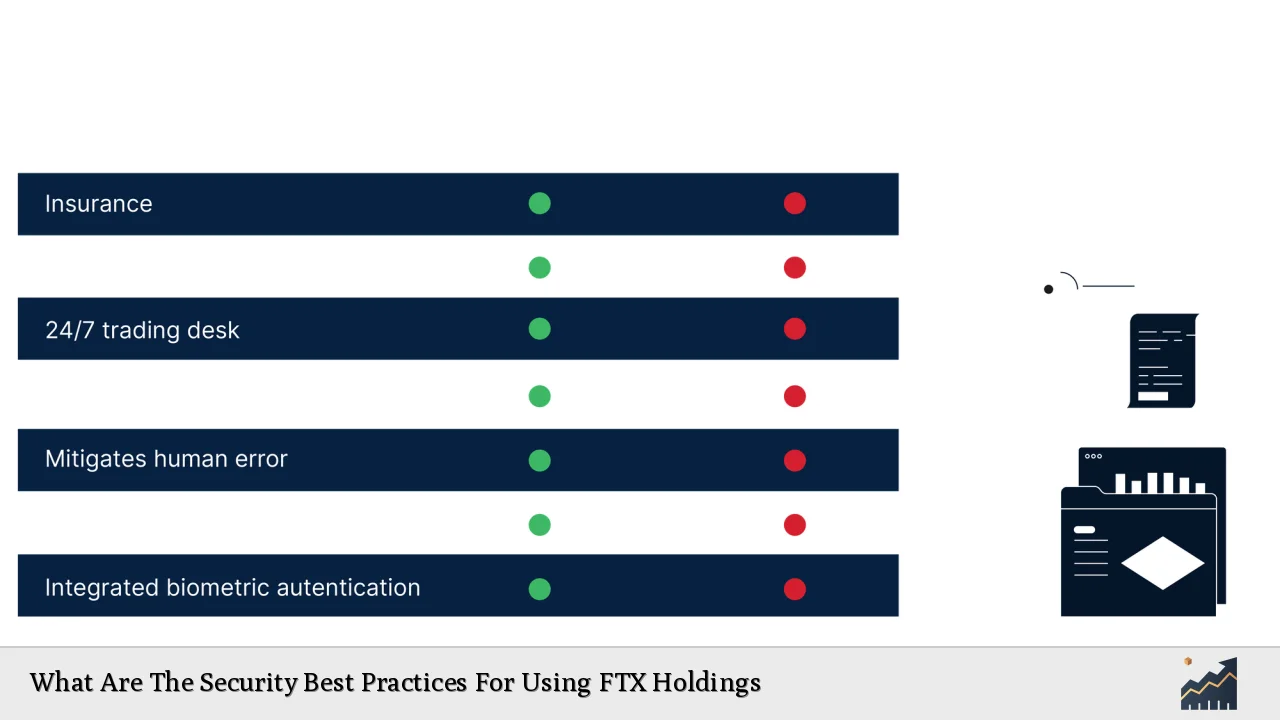

| Insurance Policies | Having insurance can provide compensation in case of breaches, enhancing user trust. |

Market Analysis and Trends

The cryptocurrency market has been volatile, with significant fluctuations in asset values. Following the FTX collapse, investor confidence has wavered, leading to increased scrutiny from regulators. The demand for security in digital asset management has surged, pushing exchanges to adopt stricter measures.

Current Market Statistics

- Market Capitalization: As of December 2024, the global cryptocurrency market cap stands at approximately $1 trillion.

- Trading Volume: Daily trading volumes have stabilized around $50 billion, reflecting cautious optimism among investors.

- Regulatory Developments: Governments worldwide are implementing stricter regulations to enhance transparency and protect investors.

The FTX incident has catalyzed a shift towards more secure trading environments, with many exchanges now prioritizing comprehensive security measures.

Implementation Strategies

To safeguard investments on platforms like FTX, several strategies can be implemented:

Security Team Development

Establishing a dedicated security team is crucial. This team should focus on:

- Conducting regular risk assessments.

- Implementing incident response plans.

- Monitoring for new threats continuously.

Infrastructure Controls

Robust infrastructure controls should include:

- Secure software development life cycles (SDLC).

- Regular updates to security policies.

- Implementation of data encryption protocols.

Cold Storage Solutions

Utilizing cold storage for the majority of assets minimizes exposure to online threats. Best practices include:

- Keeping private keys offline.

- Regularly auditing cold storage practices to ensure compliance with industry standards.

Multi-Signature Wallets

Adopting multi-signature wallets requires multiple approvals for transactions, which helps prevent unauthorized access. This practice can significantly reduce risks associated with single points of failure.

Regular Security Audits

Conducting external audits by reputable firms helps identify vulnerabilities and ensures compliance with regulatory standards. These audits should be performed at least annually or after any significant operational changes.

Risk Considerations

Investors must be aware of various risks associated with using cryptocurrency exchanges:

- Cybersecurity Threats: Exchanges are prime targets for hackers. Implementing advanced security measures is essential to mitigate these risks.

- Operational Risks: Poor internal controls can lead to mismanagement of funds and operational failures.

- Market Risks: The inherent volatility in cryptocurrency prices can lead to significant financial losses.

Investors should remain vigilant and continuously educate themselves about potential risks associated with their investments.

Regulatory Aspects

The regulatory landscape for cryptocurrencies is evolving rapidly. Key considerations include:

- Compliance Requirements: Exchanges must comply with anti-money laundering (AML) and know your customer (KYC) regulations to prevent fraud and protect investors.

- Licensing: Operating without proper licenses can expose exchanges to legal risks and operational challenges.

- Reporting Obligations: Regular reporting to regulatory bodies enhances transparency and builds trust among users.

Regulatory compliance not only protects investors but also strengthens the overall integrity of the cryptocurrency market.

Future Outlook

The future of cryptocurrency exchanges like FTX hinges on their ability to adapt to changing market conditions and regulatory environments. Key trends include:

- Increased Regulation: As governments introduce stricter regulations, exchanges will need to enhance their compliance frameworks.

- Technological Advancements: Innovations in blockchain technology may lead to more secure trading platforms that prioritize user safety.

- Investor Education: A focus on educating investors about safe trading practices will be crucial in rebuilding trust in the market.

The lessons learned from FTX’s collapse are invaluable. By adopting best practices in security, risk management, and regulatory compliance, future exchanges can create a safer environment for investors.

Frequently Asked Questions About Security Best Practices For Using FTX Holdings

- What are the essential security measures for using cryptocurrency exchanges?

Essential measures include using strong passwords, enabling two-factor authentication (2FA), employing cold storage solutions, and conducting regular security audits. - How can I protect my assets from hacking?

Utilizing multi-signature wallets, keeping most funds in cold storage, and regularly updating software can significantly reduce hacking risks. - What role does regulation play in cryptocurrency exchanges?

Regulation ensures compliance with laws designed to protect investors from fraud and mismanagement while enhancing market integrity. - Why are dedicated security teams important?

A dedicated team focuses on continuous monitoring, risk assessment, and incident response, which are critical for safeguarding digital assets. - How often should security audits be conducted?

Security audits should be conducted at least annually or whenever there are significant operational changes within the exchange. - What is cold storage?

Cold storage refers to keeping cryptocurrencies offline to protect them from online threats such as hacking. - How does multi-signature technology enhance security?

Multi-signature technology requires multiple approvals for transactions, making it harder for unauthorized users to access funds. - What should I do if I suspect my account has been compromised?

If you suspect your account has been compromised, immediately change your password, enable 2FA if not already done, and contact customer support for assistance.

By understanding these best practices and implementing them effectively, individual investors and finance professionals can navigate the complexities of investing in cryptocurrencies while minimizing risks associated with platforms like FTX.