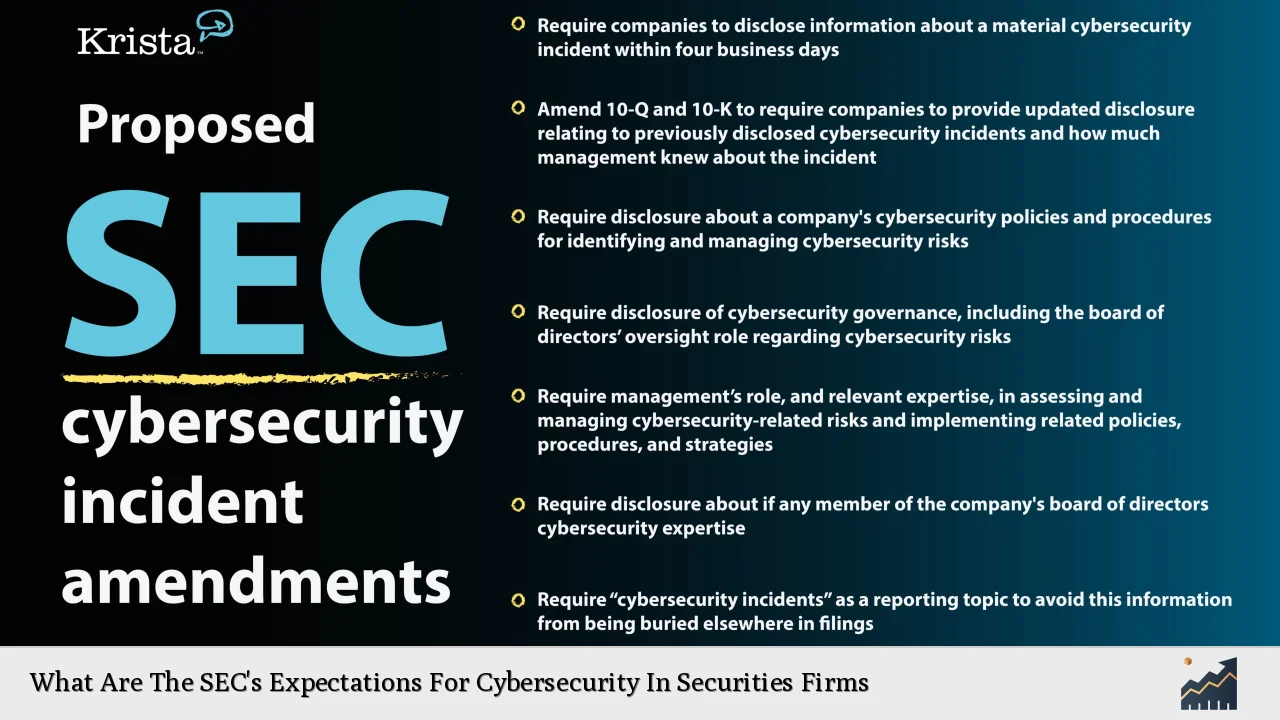

The Securities and Exchange Commission (SEC) has increasingly recognized the critical importance of cybersecurity in safeguarding the integrity of financial markets and protecting investor data. In July 2023, the SEC adopted new rules mandating that public companies disclose material cybersecurity incidents and provide detailed information regarding their cybersecurity risk management strategies. This regulatory shift reflects a growing awareness of the vulnerabilities faced by financial institutions and the need for robust governance frameworks to address these risks.

| Key Concept | Description/Impact |

|---|---|

| Material Cybersecurity Incidents | Companies must disclose any cybersecurity incidents deemed material within four business days, enhancing transparency and accountability. |

| Annual Risk Management Disclosures | Firms are required to detail their cybersecurity risk management processes, strategies, and governance in annual reports, promoting proactive risk assessment. |

| Board Oversight Requirements | The SEC mandates disclosure of board-level oversight of cybersecurity risks, ensuring that senior management is actively involved in risk governance. |

| Compliance Timelines | New disclosure requirements take effect for fiscal years ending on or after December 15, 2023, with varying compliance deadlines for smaller firms. |

| Regulatory Enforcement | Non-compliance with these rules can lead to significant penalties, legal repercussions, and reputational damage for firms. |

Market Analysis and Trends

The financial services sector is one of the most targeted industries for cyberattacks, accounting for nearly 20% of all attacks in 2023. The rise in digital transactions and remote operations has expanded the attack surface for cybercriminals. As a result, investment in cybersecurity solutions is projected to grow significantly. The global cybersecurity market is expected to reach USD 376.55 billion by 2029, growing at a compound annual growth rate (CAGR) of 12.63% from USD 207.77 billion in 2024. This growth is driven by increasing regulatory demands and the need for advanced security measures against evolving threats.

Key trends influencing this landscape include:

- Integration of AI and Machine Learning: Financial firms are leveraging AI to enhance threat detection and response capabilities.

- Increased Regulatory Scrutiny: With the SEC’s new rules, firms must prioritize compliance to avoid penalties.

- Focus on Incident Response: Organizations are investing in incident response plans to ensure quick recovery from breaches.

Implementation Strategies

To comply with the SEC’s expectations, securities firms must adopt comprehensive cybersecurity strategies that encompass the following elements:

- Establishing Governance Frameworks: Companies should create a dedicated cybersecurity governance structure that includes board oversight and clear roles for management.

- Developing Incident Response Plans: Firms must implement robust incident response protocols that allow for rapid identification and reporting of material incidents.

- Conducting Regular Risk Assessments: Continuous evaluation of cybersecurity risks should be integrated into corporate governance practices to identify vulnerabilities proactively.

- Training and Awareness Programs: Regular training sessions for employees on cybersecurity best practices can reduce human error, which is often a leading cause of breaches.

Risk Considerations

Securities firms face various risks associated with cybersecurity breaches:

- Financial Losses: Cyber incidents can lead to significant financial losses due to theft of funds or sensitive information.

- Reputational Damage: Breaches can erode investor trust and damage a firm’s reputation in the market.

- Legal Liabilities: Non-compliance with SEC regulations can result in legal actions, fines, or sanctions against firms.

- Operational Disruption: Cyberattacks can disrupt business operations, leading to service outages and loss of productivity.

Regulatory Aspects

The SEC’s new rules require public companies to disclose their processes for assessing and managing material risks from cybersecurity threats. Key regulatory aspects include:

- Disclosure Requirements: Companies must report material incidents on Form 8-K within four business days and include detailed risk management disclosures in their annual reports (Form 10-K).

- Board Oversight: Firms are required to demonstrate that their boards have adequate oversight over cybersecurity risks and management practices.

- International Compliance: Foreign private issuers must adhere to similar disclosure requirements under Form 6-K and Form 20-F.

These regulations aim to enhance transparency in how firms manage cyber risks while ensuring that investors are informed about potential vulnerabilities affecting their investments.

Future Outlook

As cyber threats continue to evolve, the SEC’s focus on cybersecurity will likely intensify. Firms can expect ongoing updates to regulatory requirements as technology advances and new threats emerge. Key considerations for the future include:

- Adaptive Compliance Strategies: Firms should develop flexible compliance frameworks that can adapt to changing regulations and emerging threats.

- Investment in Advanced Technologies: Continued investment in cutting-edge security technologies will be crucial for protecting sensitive information.

- Collaboration with Regulators: Engaging with regulatory bodies will help firms stay informed about best practices and compliance expectations.

In conclusion, securities firms must prioritize cybersecurity as a core component of their operational strategy. By implementing robust governance frameworks, enhancing incident response capabilities, and adhering to regulatory requirements set forth by the SEC, firms can better protect themselves against cyber threats while maintaining investor confidence.

Frequently Asked Questions About What Are The SEC’s Expectations For Cybersecurity In Securities Firms

- What are the new SEC rules regarding cybersecurity?

The SEC now requires public companies to disclose material cybersecurity incidents within four business days and provide detailed information about their risk management strategies annually. - How does the SEC define a material cybersecurity incident?

A material incident is one that could significantly impact an organization’s financial performance or investor decision-making. - What are the consequences of non-compliance with these regulations?

Firms may face substantial fines, legal actions, and reputational damage if they fail to comply with SEC regulations. - When do these new disclosure requirements take effect?

The requirements will apply starting with fiscal years ending on or after December 15, 2023. - How can firms prepare for these new regulations?

Firms should establish governance frameworks, develop incident response plans, conduct regular risk assessments, and implement training programs. - What role does board oversight play in cybersecurity compliance?

The SEC mandates that boards have oversight over cybersecurity risks and management practices as part of their governance responsibilities. - Are foreign companies subject to these same rules?

Yes, foreign private issuers must comply with similar disclosure requirements under Form 6-K and Form 20-F. - What trends are shaping the future of cybersecurity in financial services?

Key trends include increased regulatory scrutiny, integration of AI technologies, and a focus on incident response capabilities.

This comprehensive overview highlights the SEC’s expectations regarding cybersecurity in securities firms. By understanding these regulations and implementing effective strategies, firms can navigate the complex landscape of cyber threats while ensuring compliance with evolving standards.