Investing in cryptocurrency has gained significant traction in recent years, but for retirees and those nearing retirement, the risks associated with this volatile asset class can be particularly concerning. With the potential for high returns comes a host of risks that can jeopardize financial security in retirement. This article explores the various risks involved in cryptocurrency investment for retirees, backed by current market trends, expert opinions, and regulatory insights.

| Key Concept | Description/Impact |

|---|---|

| Volatility | Cryptocurrencies are known for their extreme price fluctuations. For instance, Bitcoin’s price can swing dramatically within a single day, posing a risk to those who rely on stable income streams during retirement. |

| Lack of Regulation | The cryptocurrency market is largely unregulated, which increases the risk of fraud and market manipulation. This lack of oversight can lead to significant losses for investors who are not vigilant. |

| Liquidity Risk | Many cryptocurrencies can be illiquid, meaning that retirees may struggle to sell their holdings quickly without incurring substantial losses. |

| Fraud and Scams | The rise of cryptocurrency has been accompanied by an increase in fraud cases. In 2023 alone, the FBI reported over 69,000 complaints related to crypto fraud, leading to losses exceeding $5.6 billion. |

| Tax Implications | Investments in cryptocurrencies can have complex tax consequences. Retirees may face unexpected tax liabilities when they sell or trade their crypto assets. |

| Market Sentiment Dependency | The value of cryptocurrencies is heavily influenced by market sentiment and news cycles, which can lead to unpredictable investment outcomes. |

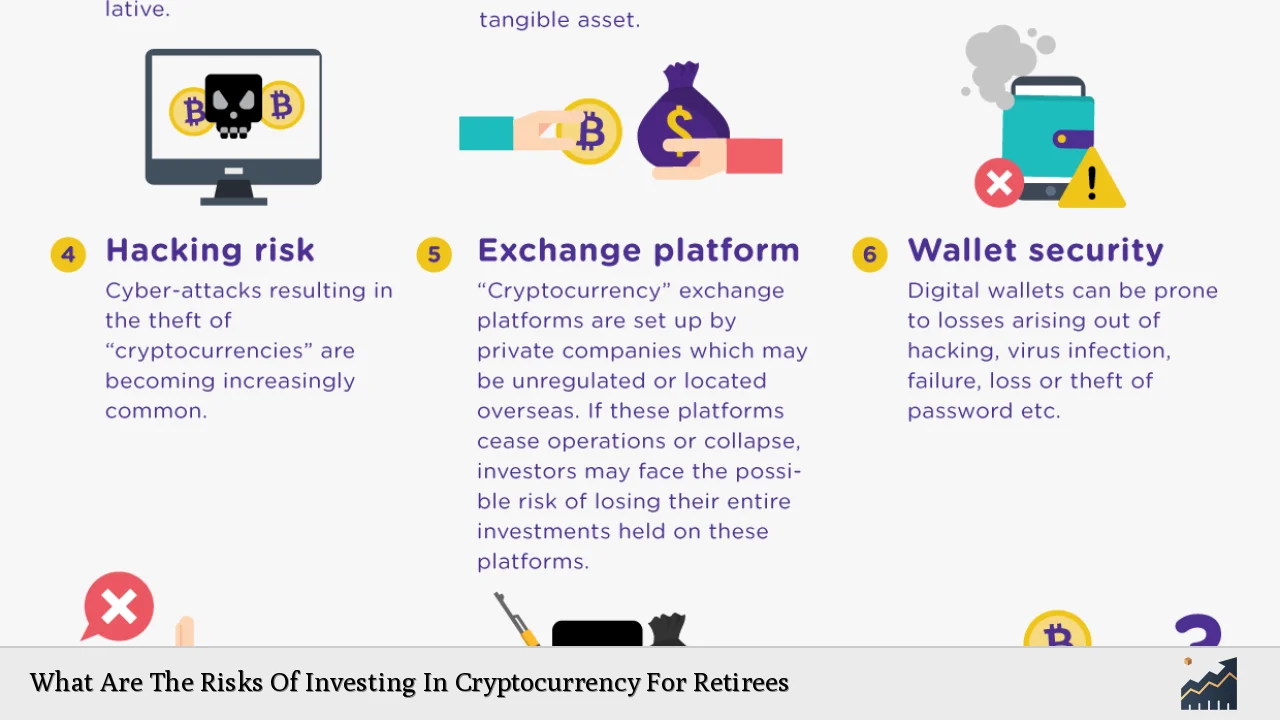

| Technological Risks | Investing in cryptocurrencies requires a certain level of technological literacy. Retirees may find it challenging to navigate wallets, exchanges, and security measures necessary to protect their investments. |

| Potential for Total Loss | The risk of losing the entire investment is significant in cryptocurrencies due to their speculative nature and market volatility. |

Market Analysis and Trends

The cryptocurrency market has experienced significant growth and transformation over the past few years. As of December 2024, the total market capitalization of cryptocurrencies stands at approximately $2.66 trillion, reflecting a resurgence following previous downturns. Bitcoin has recently hit an all-time high above $107,700, driven by increased institutional interest and the approval of spot Bitcoin ETFs by regulatory bodies like the SEC.

Current Trends

- Institutional Adoption: More institutional investors are entering the crypto space, seeking higher returns amid stagnant traditional market performance. This trend raises concerns about exposure risks for retirement funds.

- Regulatory Developments: Governments worldwide are moving towards more stringent regulations regarding cryptocurrencies. The European Union’s Markets in Crypto-Assets regulation (MiCA) is one example of how regulatory frameworks are evolving to provide better investor protections.

- Emerging Technologies: Innovations such as AI-linked cryptocurrencies and tokenization of real-world assets are gaining traction. These developments could reshape investment strategies but also introduce new risks.

Implementation Strategies

For retirees considering cryptocurrency investments, it is crucial to adopt a cautious approach:

- Diversification: Limit exposure to crypto assets within a broader portfolio. Experts recommend allocating no more than 5% to 10% of retirement savings to cryptocurrencies.

- Education: Stay informed about cryptocurrency markets and technologies. Understanding how these assets work can help mitigate risks associated with scams and technological failures.

- Professional Guidance: Consult with financial advisors who have expertise in both traditional investments and cryptocurrencies to tailor an investment strategy that aligns with retirement goals.

Risk Considerations

Retirees must carefully evaluate several risk factors before investing in cryptocurrencies:

- Market Volatility: The rapid price changes can lead to significant losses. For example, Bitcoin’s price dropped over 17% in a single day last December.

- Regulatory Uncertainty: The evolving regulatory landscape poses challenges for crypto investors. Changes in laws could impact asset values and trading practices.

- Fraud Risks: With increasing reports of scams targeting older investors, it is vital for retirees to verify the legitimacy of investment platforms and avoid unsolicited offers.

Regulatory Aspects

The regulatory environment surrounding cryptocurrencies is complex and continues to evolve:

- U.S. Department of Labor Concerns: The Department has expressed concerns regarding the inclusion of cryptocurrencies in retirement plans due to their speculative nature and potential for significant losses.

- Investor Protections: Regulatory bodies are working towards establishing frameworks that protect investors from fraud while ensuring transparency in crypto transactions.

- Compliance Requirements: As regulations tighten, investors must ensure that they comply with any new laws governing cryptocurrency investments.

Future Outlook

Looking ahead, the future of cryptocurrency investments for retirees remains uncertain but filled with potential:

- Continued Growth: As institutional interest grows and regulatory frameworks develop, some analysts predict that cryptocurrencies could become more stable investment options over time.

- Technological Advancements: Innovations such as decentralized finance (DeFi) could open new avenues for investment but also introduce additional complexities.

- Increased Regulation: Stricter regulations may enhance investor confidence but could also limit some aspects of trading flexibility within the crypto space.

Frequently Asked Questions About What Are The Risks Of Investing In Cryptocurrency For Retirees

- What is the biggest risk associated with investing in cryptocurrency?

Volatility is often cited as the most significant risk; prices can fluctuate wildly within short periods, leading to potential losses. - How much should retirees invest in cryptocurrency?

Experts generally recommend limiting crypto investments to no more than 5% to 10% of total retirement savings. - Are there any protections against fraud when investing in cryptocurrency?

The lack of regulation means there are fewer protections compared to traditional investments; thorough research and verification are essential. - What tax implications should retirees be aware of?

Selling or trading cryptocurrencies may trigger capital gains taxes; it’s crucial to consult with a tax professional regarding specific liabilities. - How can retirees protect themselves from scams?

Seniors should verify investment platforms’ legitimacy, avoid unsolicited offers, and seek advice from trusted financial advisors. - Is it too late to invest in cryptocurrency?

The market continues to evolve; however, potential investors should assess their risk tolerance and investment goals before entering. - What should retirees do if they experience significant losses?

Consulting with a financial advisor is recommended to reassess investment strategies and consider options for recovery. - Can cryptocurrencies be part of a diversified retirement portfolio?

Yes, but they should only represent a small portion of the overall portfolio due to their high-risk nature.

In conclusion, while investing in cryptocurrency presents opportunities for growth, retirees must navigate numerous risks that could threaten their financial security. A well-informed approach that includes diversification, education, professional guidance, and awareness of regulatory developments will be essential for those considering this asset class as part of their retirement strategy.