Investing in GameFi, a sector that merges gaming with decentralized finance (DeFi), presents a unique blend of opportunities and challenges for investors. As the market continues to evolve, understanding the potential rewards and inherent risks is crucial for both seasoned investors and newcomers. This article delves into the current landscape of GameFi investments, providing a comprehensive analysis of market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The global GameFi market is projected to reach $19.584 billion in 2024, growing at a CAGR of 29.5% through 2031. |

| Investment Opportunities | GameFi offers unique investment avenues through asset ownership, financial rewards from gameplay, and diversification into both gaming and cryptocurrency sectors. |

| High Failure Rates | Approximately 93% of GameFi projects fail within their first four months, highlighting significant risks in this space. |

| Volatility of Assets | The value of in-game assets and cryptocurrencies can fluctuate dramatically, exposing investors to potential losses. |

| Regulatory Uncertainty | Lack of clear regulations can lead to legal risks and impact the viability of GameFi projects. |

| Security Vulnerabilities | GameFi platforms are susceptible to hacks and exploits, risking the loss of digital assets for investors. |

| Sustainability Concerns | The economic models of many GameFi projects are unsustainable, often resembling Ponzi schemes that rely on new investments to pay returns. |

Market Analysis and Trends

The GameFi sector has experienced rapid growth but also significant volatility. In 2024, the global GameFi market is expected to reach approximately $19.584 billion, with a compound annual growth rate (CAGR) of 29.5% projected until 2031. The Asia-Pacific region leads in user engagement, with daily active users (DAU) reaching around 4.5 million.

Current Market Statistics

- Market Size: The GameFi market was valued at $6.49 billion in 2023 and is anticipated to grow significantly.

- Investment Trends: Venture capital funding in GameFi reached $859 million in 2024, reflecting a cautious approach compared to previous years.

- User Engagement: Despite the decline in project viability, user engagement remains robust with millions participating in various platforms.

Key Drivers of Growth

- Integration of Traditional Gaming: Major gaming companies are entering the GameFi space, enhancing credibility and attracting mainstream players.

- Innovative Gameplay Models: The evolution towards more engaging gameplay experiences is likely to sustain interest among players and investors alike.

Implementation Strategies

For investors looking to navigate the GameFi landscape effectively, several strategies can be employed:

- Diversification: Spread investments across multiple GameFi projects to mitigate risks associated with individual project failures.

- Research and Due Diligence: Thoroughly assess the development teams behind projects, their roadmaps, and community engagement before investing.

- Focus on Sustainable Models: Identify projects that demonstrate clear utility beyond speculative trading, such as those offering genuine gameplay experiences or innovative economic models.

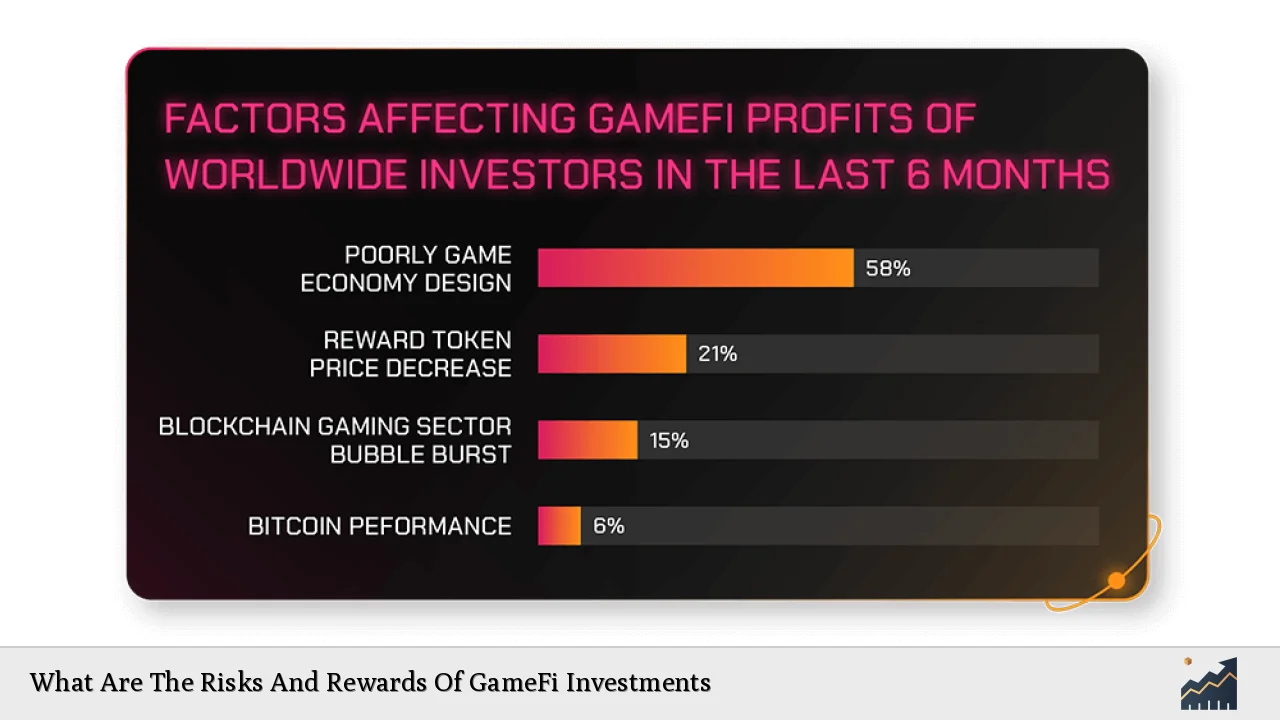

Risk Considerations

Investing in GameFi carries substantial risks that must be carefully evaluated:

Market Volatility

The cryptocurrency market’s inherent volatility extends to GameFi assets. Prices can swing wildly based on market sentiment or project news, leading to potential financial losses for investors who are not prepared for these fluctuations.

High Failure Rates

A staggering 93% of GameFi projects fail within their first four months. This high attrition rate underscores the speculative nature of many ventures within this space. Investors should be aware that even well-promoted projects may not achieve long-term viability.

Regulatory Challenges

The regulatory environment surrounding cryptocurrencies and blockchain technology remains uncertain. Changes in regulations could adversely affect the operational capabilities of GameFi projects or lead to legal repercussions for investors.

Security Risks

GameFi platforms have been targets for cyberattacks. Investors must prioritize security by using reputable platforms and safeguarding their private keys to prevent asset loss from hacks or exploits.

Regulatory Aspects

The regulatory landscape for GameFi is still developing. While some countries have begun implementing frameworks for cryptocurrencies and blockchain technologies, many jurisdictions remain ambiguous about how these regulations apply specifically to gaming and DeFi integrations.

- Compliance Risks: Investors should be aware that regulatory changes could impact project operations or lead to sudden shifts in asset value.

- Legal Protections: Without clear regulations, investors may find it challenging to seek recourse in cases of fraud or project abandonment.

Future Outlook

Despite the challenges faced by the GameFi sector, there are signs that it may evolve into a more sustainable model:

- Focus on Quality Projects: As investor sentiment shifts towards sustainability, there will likely be an emphasis on quality over quantity in project launches.

- Emerging Business Models: Innovations such as play-to-earn models that offer genuine value beyond mere speculation may gain traction.

- Increased Regulation: As governments worldwide begin to clarify their stances on cryptocurrencies and blockchain technology, clearer regulations could foster a more stable investment environment.

Frequently Asked Questions About What Are The Risks And Rewards Of GameFi Investments

- What are the main rewards of investing in GameFi?

Investors can benefit from financial rewards through gameplay earnings, asset ownership that appreciates over time, and diversification into both gaming and cryptocurrency sectors. - What risks should I be aware of before investing?

The primary risks include high failure rates among projects, market volatility leading to potential losses, regulatory uncertainty affecting project viability, and security vulnerabilities associated with digital assets. - How can I mitigate risks when investing in GameFi?

Diversifying investments across multiple projects, conducting thorough research on each project’s fundamentals, and focusing on sustainable business models can help mitigate risks. - Is it safe to invest in GameFi?

While there are opportunities for profit, investing in GameFi carries significant risks due to its volatile nature and high failure rates; thus caution is advised. - What is the future outlook for GameFi?

The future may see a shift towards more sustainable models as investor focus changes from speculative gains to quality gameplay experiences. - How does regulation affect my investment?

Regulatory changes can impact project operations and asset values; staying informed about legal developments is crucial for investors. - What should I look for when choosing a GameFi project?

Look for strong development teams with clear roadmaps, community engagement levels, innovative gameplay mechanics, and transparent economic models. - Can I lose all my investment in a failed project?

Yes, due diligence is essential as many projects fail; understanding this risk is critical before committing funds.

Investing in GameFi presents both exciting opportunities and significant challenges. By understanding the dynamics at play within this emerging sector—alongside diligent research—investors can better navigate its complexities while seeking potential rewards.