In the current economic landscape, high-net-worth individuals (HNWIs) and wealthy investors are strategically diversifying their portfolios to capitalize on emerging trends and opportunities. The investment strategies of the affluent reflect a blend of traditional assets and innovative sectors, driven by technological advancements, sustainability concerns, and shifting economic conditions. As we look into 2025, several key areas are attracting significant interest from the wealthy.

| Investment Area | Key Insights |

|---|---|

| Artificial Intelligence (AI) | Rapid growth in AI technologies is creating lucrative investment opportunities. |

| Real Estate | Investments in real estate, particularly REITs, are gaining traction for income stability. |

| ESG Investments | Ethical investments are on the rise, with a focus on sustainability and green energy. |

| Cryptocurrencies | Renewed interest in digital currencies is evident as market conditions stabilize. |

| Biotechnology | The aging population drives demand for pharmaceutical and biotech innovations. |

Investment in Technology

The technology sector remains a cornerstone of wealth accumulation for affluent investors. Artificial intelligence (AI) stands out as a primary focus area. The global AI market is projected to grow at an impressive rate, with estimates suggesting a compound annual growth rate (CAGR) of around 30% over the next few years. Major companies like Nvidia have seen significant stock price increases due to their pivotal roles in AI development, making them attractive investments.

Moreover, advancements in quantum computing and biotechnology are also drawing attention. Investors are keen on firms that are innovating in these fields, particularly those that demonstrate strong growth potential through unique technologies or solutions. The increasing reliance on technology across all sectors makes tech stocks a favored choice among the wealthy.

Real Estate Investments

Real estate continues to be a preferred asset class for many affluent individuals. The appeal lies not only in potential appreciation but also in generating consistent rental income. Real Estate Investment Trusts (REITs) have gained popularity as they offer a way to invest in real estate without direct ownership of properties. This allows investors to benefit from real estate market growth while maintaining liquidity.

Additionally, buy-to-let properties are still considered a solid investment strategy. Despite fluctuations in the economy, the property market has shown resilience, providing a reliable source of income through rental payments. Investors are advised to stay informed about interest rates and market trends to maximize their returns.

ESG and Sustainable Investments

The trend towards Environmental, Social, and Governance (ESG) investing is becoming increasingly prominent among wealthy investors. There has been a notable increase in ESG fund inflows, driven by both ethical considerations and the recognition of long-term financial benefits associated with sustainable practices.

Investors are particularly interested in sectors like renewable energy and green bonds as they align with global sustainability goals. The SEBI mandate for ESG disclosures by companies has further fueled this trend, making it easier for investors to assess potential investments based on their ethical impact.

Cryptocurrencies

Following a period of volatility, cryptocurrencies are witnessing renewed interest from wealthy investors. The stabilization of major digital currencies such as Bitcoin has led many to view cryptocurrencies as viable long-term investments. This is especially true as regulatory environments become clearer and more favorable under new political administrations.

Investors see cryptocurrencies not just as speculative assets but also as potential hedges against inflation and currency devaluation. Wealthy individuals are increasingly looking to diversify their portfolios with digital assets while considering the associated risks.

Biotechnology and Pharmaceuticals

The aging global population presents significant opportunities in the biotechnology and pharmaceutical sectors. Companies developing innovative treatments for age-related diseases are likely to see increased demand for their products. This sector is particularly attractive due to its potential for high returns driven by breakthroughs in medical research.

Investors are focusing on firms that specialize in anti-aging therapies and chronic disease management solutions. Additionally, biotechnology companies that successfully navigate clinical trials stand to benefit significantly from growing healthcare expenditures.

Diversification Strategies

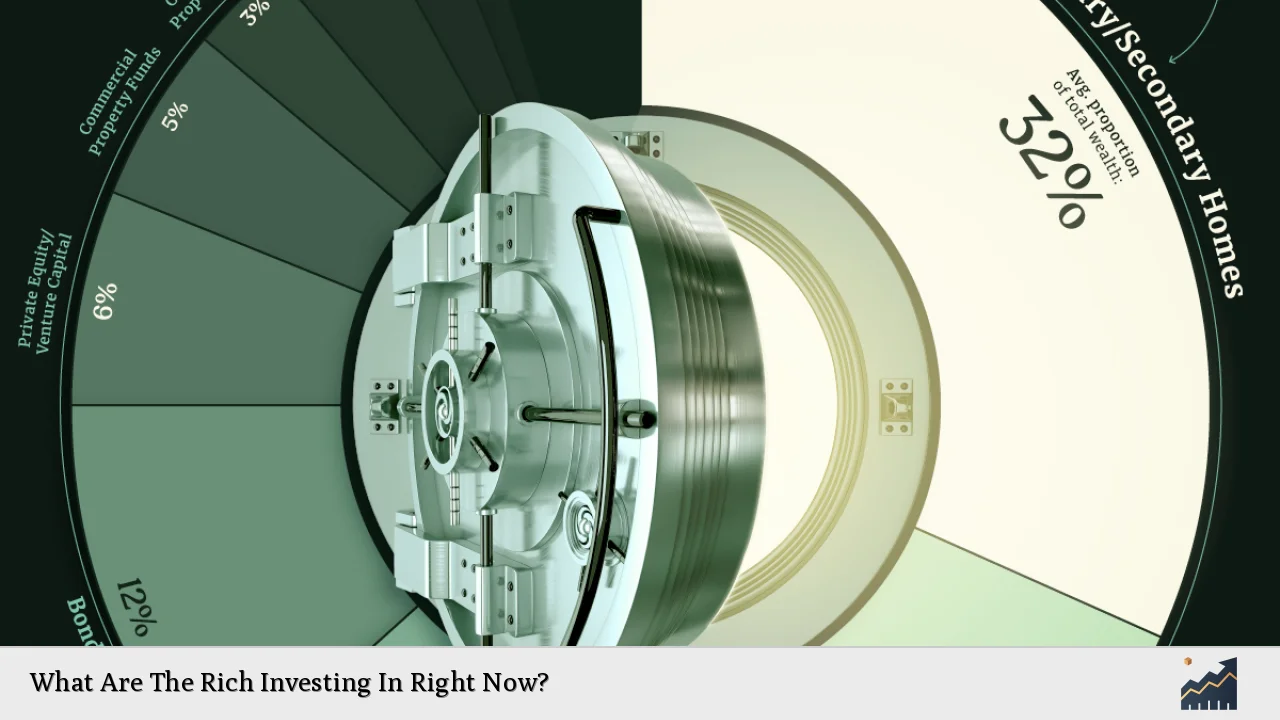

Wealthy investors understand the importance of diversification in mitigating risks associated with market volatility. A well-rounded portfolio typically includes a mix of traditional assets like stocks and bonds alongside alternative investments such as commodities or collectibles.

In 2025, affluent individuals are expected to continue diversifying across asset classes and geographies to reduce exposure to any single economic downturn. This approach not only helps protect wealth but also positions investors to take advantage of emerging trends across different markets.

Conclusion: Navigating Future Trends

As we move into 2025, wealthy investors will likely continue adapting their strategies to navigate an evolving economic landscape characterized by technological advancements and socio-economic changes. By focusing on sectors such as AI, real estate, ESG investments, cryptocurrencies, and biotechnology, they can position themselves for long-term success.

Investors should remain vigilant about emerging trends while ensuring their portfolios reflect both their financial goals and personal values. Staying informed about market dynamics will be crucial for making strategic investment decisions that align with future opportunities.

FAQs About What Are The Rich Investing In Right Now?

- What sectors are currently popular among wealthy investors?

Technology, real estate, ESG investments, cryptocurrencies, and biotechnology are currently popular sectors. - Why is AI a focal point for investments?

The rapid growth of AI technologies presents substantial opportunities for high returns. - How do REITs benefit investors?

REITs provide exposure to real estate markets while offering liquidity and income generation without direct property ownership. - What drives interest in ESG investing?

The combination of ethical considerations and potential long-term financial benefits drives interest in ESG investing. - Are cryptocurrencies considered safe investments?

While cryptocurrencies can offer high returns, they come with significant risks that require careful consideration.