Conflux is an innovative blockchain network designed to enhance scalability and efficiency in decentralized applications. As the cryptocurrency market continues to evolve, understanding Conflux’s unique features and resources is essential for investors and developers alike. This article provides a comprehensive overview of the resources available for learning about Conflux, covering market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Conflux Network Overview | A public blockchain that utilizes a unique Tree-Graph consensus mechanism to achieve high throughput and low latency, enabling thousands of transactions per second. |

| Developer Resources | Includes comprehensive documentation, SDKs, and tutorials available on the Conflux Developer Portal for building decentralized applications. |

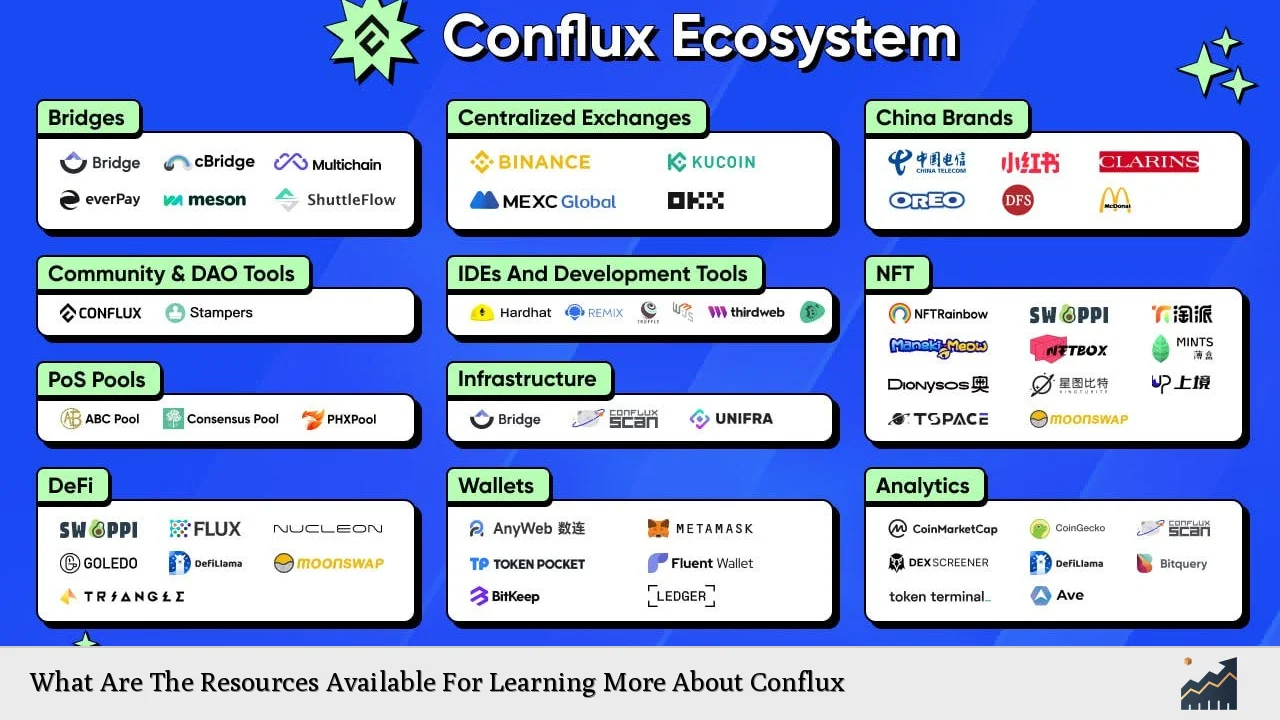

| Market Positioning | Conflux aims to bridge the gap between Western and Eastern blockchain ecosystems, focusing on regulatory compliance and partnerships with major institutions. |

| Investment Potential | The CFX token serves as the native currency for transaction fees and staking, with market predictions suggesting gradual price increases over the next few years. |

| Community Engagement | Active community forums and social media channels provide platforms for discussions, updates, and peer support among developers and investors. |

Market Analysis and Trends

The Conflux Network has positioned itself uniquely within the blockchain landscape. It operates under a dual-token economy where CFX is used for transaction fees while another token facilitates governance. Recent market statistics indicate that Conflux has a market capitalization of approximately €905 million, with ongoing trading volume reflecting active investor interest.

Analysts predict a positive trajectory for CFX, forecasting a price increase to around €0.4400 by the end of 2024, driven by growing adoption and technological advancements. The network’s ability to process up to 4,000 transactions per second significantly enhances its appeal compared to traditional blockchains like Bitcoin and Ethereum.

Current trends show that institutional interest in blockchain technology is rising, particularly in regions like Asia where Conflux has established partnerships with major corporations such as China Telecom and Tsinghua University. This strategic positioning may enhance its credibility and adoption in both public and private sectors.

Implementation Strategies

Investors looking to engage with Conflux can leverage various resources:

- Developer Documentation: The Conflux Developer Portal offers extensive guides on how to build applications on the network. Tutorials cover everything from setting up wallets to deploying smart contracts.

- Community Programs: Conflux organizes live learning sessions that blend self-paced video learning with interactive group discussions. These sessions are tailored for developers at all levels.

- SDKs: Conflux provides several software development kits (SDKs) that facilitate integration with existing applications. The JavaScript SDK is particularly notable for its comprehensive features.

- Hackathons: Engaging in hackathons hosted by Conflux can provide practical experience while fostering innovation within the community.

Risk Considerations

Investing in cryptocurrencies like CFX carries inherent risks:

- Market Volatility: The cryptocurrency market is known for its price volatility. Investors should be prepared for significant fluctuations in asset value.

- Regulatory Risks: As a blockchain operating in China, Conflux must navigate complex regulatory landscapes that could impact its operations and market perception.

- Technological Risks: While Conflux’s technology is advanced, any potential bugs or vulnerabilities could pose risks to user funds or network integrity.

To mitigate these risks, investors are encouraged to conduct thorough research and consider diversifying their portfolios across various assets.

Regulatory Aspects

Conflux operates within a regulatory framework designed to comply with local laws while promoting decentralization. Its partnerships with academic institutions and corporations enhance its legitimacy in the eyes of regulators.

The network’s commitment to transparency is evident through its public documentation of governance structures and economic models. Investors should remain informed about any changes in regulatory policies that could affect blockchain operations in their respective regions.

Future Outlook

The future of Conflux appears promising based on current trends:

- Technological Advancements: Continuous improvements in network capabilities are expected as development teams work on enhancing performance metrics.

- Market Expansion: With increasing global interest in blockchain technology, particularly from institutional investors, Conflux is well-positioned to capture new markets.

- Sustainability Initiatives: The recent focus on sustainability within technology sectors may benefit Conflux as it aligns itself with environmentally conscious practices through efficient manufacturing solutions.

Analysts project steady growth for CFX over the next few years, with potential price targets reaching €0.6000 by mid-2026 based on current market dynamics.

Frequently Asked Questions About What Are The Resources Available For Learning More About Conflux

- What is Conflux?

Conflux is a high-performance public blockchain network designed to facilitate fast transactions using a unique Tree-Graph consensus mechanism. - How can I start learning about Conflux?

The best way to start is by visiting the Conflux Developer Portal which offers comprehensive documentation and tutorials. - What resources does Conflux provide for developers?

Conflux provides SDKs, detailed documentation, community forums, live sessions, and hackathons for developers at all skill levels. - What are the investment prospects for CFX?

Analysts predict gradual price increases due to growing adoption, with potential targets of €0.4400 by the end of 2024. - How does regulatory compliance affect Conflux?

Conflux operates under China’s regulatory framework which enhances its credibility but also requires navigating complex legal landscapes. - What are the risks associated with investing in CFX?

The primary risks include market volatility, regulatory changes, and potential technological vulnerabilities. - Where can I find current market statistics for CFX?

You can find real-time statistics on various cryptocurrency exchanges or financial news platforms that track cryptocurrency performance. - How does community engagement benefit users?

Active community forums allow users to share insights, seek help from peers, and stay updated on developments within the Conflux ecosystem.

This comprehensive overview aims to equip individual investors and finance professionals with essential knowledge about Conflux’s resources while addressing key aspects of investment strategy and risk management.