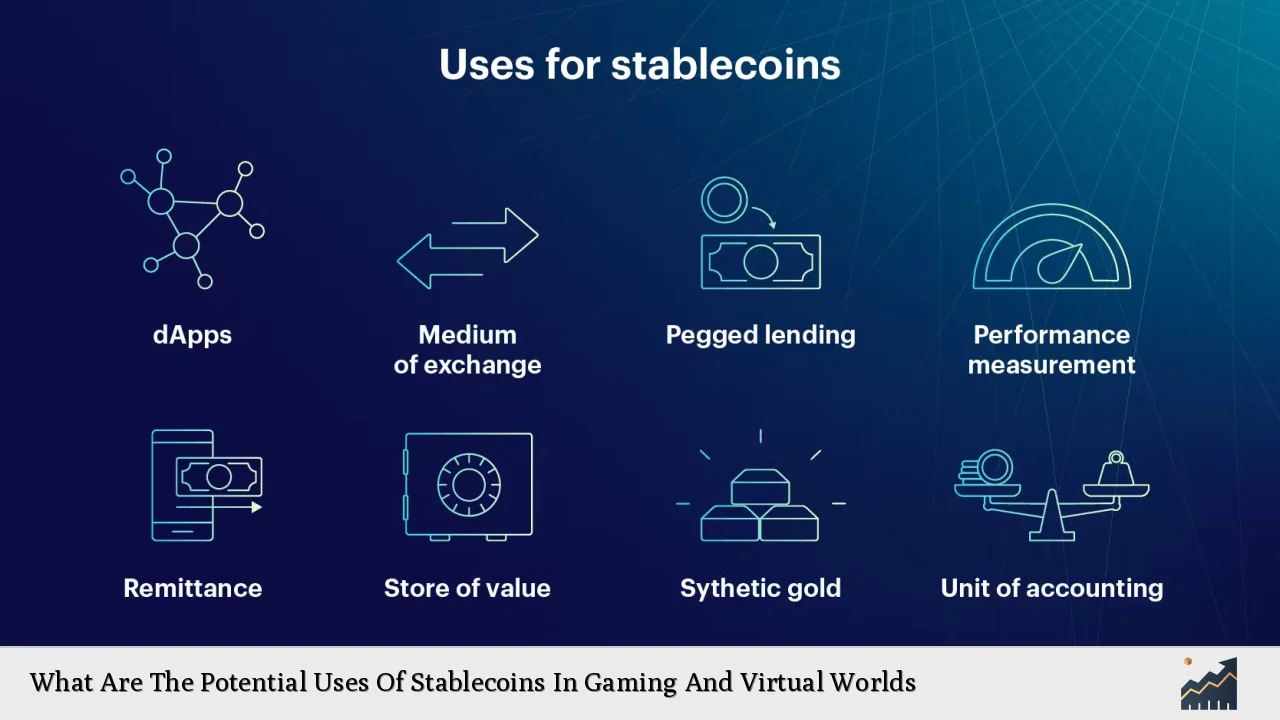

The convergence of stablecoins, gaming, and virtual worlds is ushering in a new era of digital economies. As blockchain technology continues to evolve, stablecoins are emerging as a powerful tool for facilitating transactions, creating new economic models, and enhancing user experiences in gaming and virtual environments. This comprehensive analysis explores the myriad potential uses of stablecoins in these digital realms, offering insights into how they are reshaping the landscape of interactive entertainment and virtual economies.

| Key Concept | Description/Impact |

|---|---|

| In-game Purchases | Stablecoins enable faster, cost-effective transactions for virtual goods and services |

| Cross-game Interoperability | Assets and currencies can be transferred seamlessly between different games and platforms |

| Player-to-Player Trading | Facilitates secure, peer-to-peer exchanges of virtual assets without intermediaries |

| Real-world Value for Virtual Assets | Enables the conversion of in-game earnings and assets to real-world currency |

| Decentralized Finance (DeFi) in Gaming | Introduces lending, borrowing, and yield farming within virtual economies |

Market Analysis and Trends

The integration of stablecoins in gaming and virtual worlds is gaining significant traction. As of 2024, the stablecoin market capitalization has reached over $160 billion, with a transaction volume of $7 trillion settled on blockchains in 2023. This growth is particularly pronounced in emerging markets, where traditional financial systems may be less accessible or reliable.

The gaming industry, valued at over $300 billion globally, is increasingly embracing blockchain technology and cryptocurrencies. Stablecoins, with their price stability and ease of use, are becoming a preferred medium of exchange in this sector. The convergence of gaming and blockchain is giving rise to new economic models, such as play-to-earn games, where players can earn real-world value through their in-game activities.

Virtual worlds, often referred to as metaverses, are also experiencing rapid growth. These digital realms are becoming hubs for social interaction, commerce, and entertainment. The global metaverse market is projected to reach $800 billion by 2024, with stablecoins playing a crucial role in facilitating economic activities within these virtual spaces.

Implementation Strategies

To effectively integrate stablecoins into gaming and virtual worlds, developers and platform operators are adopting several key strategies:

In-game Currency Integration

Game developers are incorporating stablecoins as native in-game currencies. This approach allows for seamless transactions within the game ecosystem while providing players with a stable store of value. For example, players can purchase virtual goods, upgrade characters, or participate in in-game economies using stablecoins, with the assurance that the value of their digital assets will remain relatively constant.

Cross-platform Wallets

The development of universal digital wallets that support multiple games and virtual worlds is gaining momentum. These wallets allow users to store and manage their stablecoins across different platforms, enhancing interoperability and user convenience. This strategy is particularly effective in creating a cohesive ecosystem where assets and currencies can be easily transferred between different virtual environments.

Smart Contract Integration

Leveraging smart contracts, game developers are creating automated, trustless systems for managing in-game economies. These contracts can govern everything from item crafting and trading to complex economic simulations. By using stablecoins as the underlying currency, these systems benefit from price stability and real-world value representation.

Decentralized Marketplaces

Virtual worlds are implementing decentralized marketplaces where users can trade virtual assets using stablecoins. These marketplaces operate on blockchain technology, ensuring transparency, security, and ownership verification. The use of stablecoins in these markets reduces volatility risks associated with other cryptocurrencies, making them more attractive to both casual and serious traders.

Risk Considerations

While the integration of stablecoins in gaming and virtual worlds offers numerous benefits, it also presents several risks that must be carefully managed:

Regulatory Uncertainty: The regulatory landscape for stablecoins and virtual assets is still evolving. Changes in regulations could impact the use and value of stablecoins in gaming ecosystems.

Security Vulnerabilities: As with any digital asset, stablecoins are susceptible to hacking and fraud. Robust security measures must be implemented to protect users’ assets and maintain trust in the system.

Market Concentration: The stablecoin market is currently dominated by a few major players. This concentration could lead to systemic risks if any of these entities face financial difficulties or regulatory challenges.

Technical Challenges: Integrating stablecoins into existing game economies and virtual worlds can be technically complex. Issues such as scalability, transaction speed, and user experience must be addressed to ensure smooth adoption.

Economic Imbalances: The introduction of real-world value into virtual economies could lead to unforeseen economic imbalances, potentially affecting gameplay and user experiences.

Regulatory Aspects

The regulatory environment for stablecoins in gaming and virtual worlds is rapidly evolving. Key regulatory considerations include:

Financial Oversight: Regulatory bodies are increasingly scrutinizing stablecoins to ensure they meet financial stability and consumer protection standards. For example, the New York Department of Financial Services has issued guidance for USD-backed stablecoins, setting a precedent for other jurisdictions.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements: Gaming platforms and virtual worlds integrating stablecoins may need to implement robust AML and KYC procedures to comply with financial regulations.

Cross-border Transactions: The use of stablecoins for international transactions in gaming ecosystems may be subject to additional regulatory scrutiny and reporting requirements.

Consumer Protection: Regulators are focusing on ensuring that users of stablecoins in gaming and virtual worlds are adequately protected from fraud, market manipulation, and other risks.

Taxation: The tax implications of earning and trading stablecoins in virtual environments are becoming a focus for tax authorities worldwide. Clear guidance on how these transactions should be reported and taxed is likely to emerge in the near future.

Future Outlook

The future of stablecoins in gaming and virtual worlds looks promising, with several trends likely to shape their evolution:

Increased Adoption: As more users become comfortable with digital currencies, the adoption of stablecoins in gaming and virtual worlds is expected to accelerate. This could lead to the creation of more sophisticated virtual economies and new forms of digital interaction.

Technological Advancements: Improvements in blockchain technology, such as increased scalability and lower transaction costs, will enhance the usability of stablecoins in gaming environments. Layer 2 solutions and sidechains may play a crucial role in addressing current limitations.

Integration with Traditional Finance: We may see increased integration between stablecoin-based virtual economies and traditional financial systems. This could include easier on-ramps and off-ramps for converting between fiat currencies and stablecoins used in games.

New Economic Models: The combination of stablecoins and gaming could give rise to innovative economic models. Play-to-earn games, virtual real estate markets, and decentralized autonomous organizations (DAOs) governing virtual worlds are just the beginning of what’s possible.

Enhanced Interoperability: Future developments are likely to focus on creating seamless interoperability between different games, virtual worlds, and blockchain networks. This could lead to the emergence of a interconnected metaverse economy powered by stablecoins.

Regulatory Clarity: As the regulatory landscape matures, we can expect clearer guidelines and standards for the use of stablecoins in gaming and virtual worlds. This clarity could encourage more mainstream adoption and investment in the sector.

In conclusion, the potential uses of stablecoins in gaming and virtual worlds are vast and transformative. From facilitating in-game transactions to enabling new forms of digital ownership and economic participation, stablecoins are set to play a pivotal role in shaping the future of interactive digital experiences. As technology advances and regulatory frameworks evolve, we can expect to see even more innovative applications emerge, further blurring the lines between virtual and real-world economies.

Frequently Asked Questions About What Are The Potential Uses Of Stablecoins In Gaming And Virtual Worlds

- How do stablecoins differ from other cryptocurrencies in gaming?

Stablecoins offer price stability by being pegged to a reserve asset, usually a fiat currency like the US dollar. This stability makes them more suitable for in-game transactions and virtual economies compared to volatile cryptocurrencies like Bitcoin or Ethereum. - Can I earn real money by playing games that use stablecoins?

Yes, many play-to-earn games allow players to earn stablecoins through gameplay, which can be converted to real-world currency. However, the amount earned can vary greatly depending on the game and market conditions. - Are there any risks associated with using stablecoins in gaming?

While stablecoins are generally more stable than other cryptocurrencies, they still carry risks such as potential regulatory changes, security vulnerabilities, and the financial stability of the stablecoin issuer. - How do stablecoins facilitate cross-game asset transfers?

Stablecoins can serve as a common currency across different games and platforms, allowing players to transfer value between games without the need for complex currency conversions or traditional banking systems. - What impact might stablecoins have on the future of virtual real estate?

Stablecoins could make virtual real estate transactions more accessible and liquid, potentially leading to the development of sophisticated virtual property markets with real-world economic implications. - How are game developers integrating stablecoins into their ecosystems?

Developers are integrating stablecoins through in-game wallets, decentralized marketplaces, and by using them as the base currency for in-game economies. Some are also exploring stablecoin-based reward systems and governance models. - What regulatory challenges do stablecoins face in gaming and virtual worlds?

Key regulatory challenges include ensuring compliance with anti-money laundering laws, protecting consumer rights, addressing tax implications, and maintaining financial stability within virtual economies.