The rise of smart contract platforms has transformed how businesses and individuals engage in transactions, automate processes, and manage agreements. These platforms enable self-executing contracts with the terms of the agreement directly written into code, facilitating trustless interactions without intermediaries. As the ecosystem continues to evolve, numerous partnership opportunities arise for developers, investors, and enterprises looking to leverage blockchain technology. This article explores the current landscape, highlighting market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks for partnerships within smart contract ecosystems.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The smart contract market is projected to grow from USD 2.14 billion in 2023 to USD 2.63 billion in 2024, with a CAGR of 23.1%. |

| Interoperability | Platforms like Polkadot and Cosmos focus on enabling seamless communication between different blockchains, enhancing the utility of smart contracts. |

| Decentralized Finance (DeFi) | The integration of smart contracts with DeFi applications is creating new financial products and services that are more accessible and efficient. |

| AI Integration | Combining AI with smart contracts can enhance security and functionality, leading to more sophisticated decentralized applications. |

| Regulatory Landscape | Regulatory compliance remains a critical factor for partnerships, as firms must navigate varying laws across jurisdictions. |

Market Analysis and Trends

The smart contract ecosystem is experiencing rapid growth driven by various factors:

- Market Size and Projections: The global smart contracts market is expected to reach USD 1.83 billion in 2023 and grow at a CAGR of approximately 23% through 2030. By 2034, it could be valued at nearly USD 1.95 billion, reflecting increasing adoption across sectors such as finance, healthcare, and supply chain management.

- Emergence of DeFi: Decentralized finance has become a significant driver for smart contract platforms. With DeFi applications leveraging smart contracts for lending, borrowing, and trading without intermediaries, there is a growing demand for partnerships that enhance liquidity and user engagement.

- Interoperability Solutions: Platforms like Polkadot and Cosmos are leading efforts to create interoperable ecosystems where different blockchains can communicate seamlessly. This trend opens up partnership opportunities for developers looking to build cross-chain applications.

- Integration with Emerging Technologies: The convergence of AI and machine learning with smart contract platforms is gaining traction. This combination can lead to more intelligent systems capable of adapting to threats or optimizing processes autonomously.

Implementation Strategies

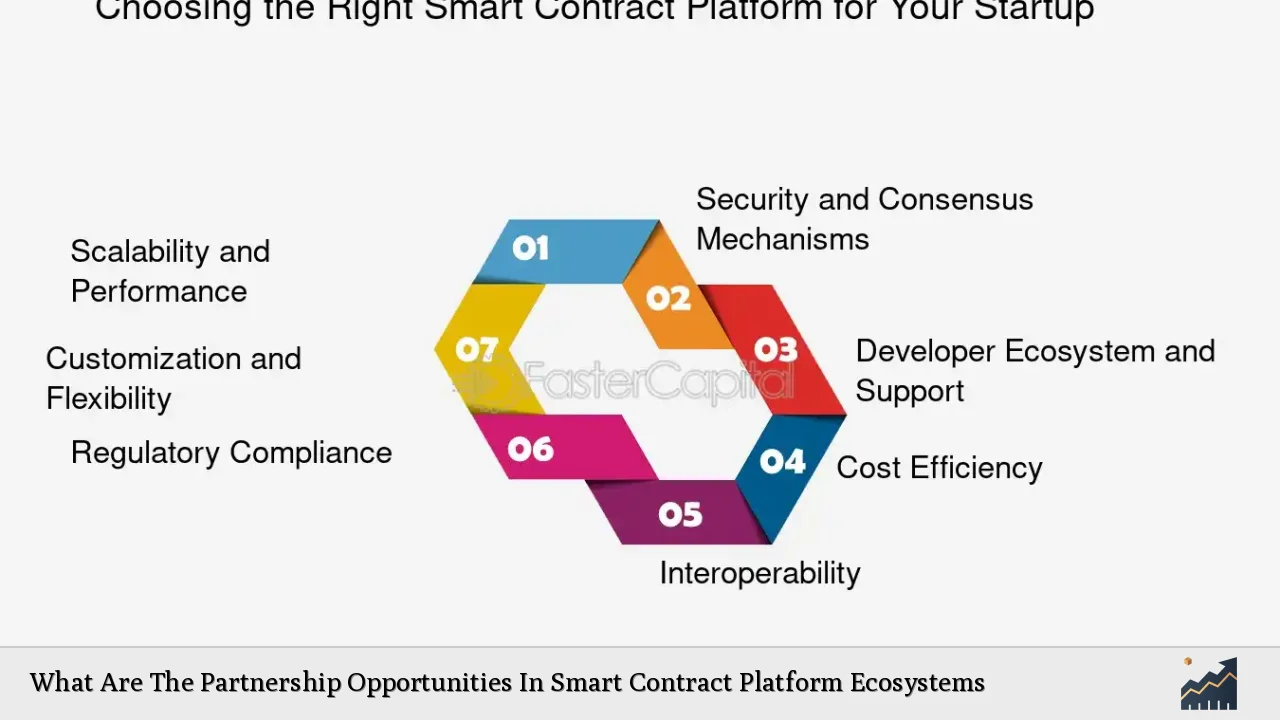

To effectively capitalize on partnership opportunities within smart contract ecosystems:

- Identify Complementary Technologies: Partnerships should focus on integrating technologies that enhance the functionality of smart contracts. For instance, collaborating with AI firms can improve security measures or automate complex decision-making processes.

- Leverage Existing Ecosystems: Engaging with established platforms like Ethereum or Solana allows new projects to tap into existing user bases and developer communities. Utilizing Layer-2 solutions can also help mitigate scalability issues while maintaining low transaction costs.

- Focus on User Experience: Developing user-friendly interfaces that simplify interactions with smart contracts can drive adoption. Partnerships with UX/UI design firms or educational institutions can enhance user engagement.

Risk Considerations

While opportunities abound in the smart contract ecosystem, several risks need careful consideration:

- Regulatory Risks: The evolving regulatory landscape poses challenges for partnerships. Companies must remain compliant with local laws regarding digital assets and data privacy.

- Security Vulnerabilities: Smart contracts are susceptible to coding errors and vulnerabilities that can lead to significant financial losses. Collaborating with cybersecurity firms for audits and ongoing security assessments is crucial.

- Market Volatility: The cryptocurrency market’s inherent volatility can impact projects relying on token economies tied to smart contracts. Partnerships should include risk management strategies to mitigate potential financial impacts.

Regulatory Aspects

Navigating the regulatory environment is essential for successful partnerships in the smart contract ecosystem:

- Compliance Frameworks: Establishing clear compliance frameworks that align with local regulations will be vital for partnerships involving financial services or data handling.

- Engagement with Regulatory Bodies: Proactive engagement with regulators can help shape favorable policies that support innovation while ensuring consumer protection.

- Global Considerations: As many smart contract applications operate across borders, understanding international regulations will be essential for compliance and operational success.

Future Outlook

The future of partnership opportunities within smart contract ecosystems appears promising:

- Continued Market Expansion: As industries increasingly adopt blockchain solutions, the demand for innovative smart contract applications will grow. This trend will likely lead to more partnerships focused on niche markets such as real estate tokenization or supply chain automation.

- Increased Focus on Sustainability: With growing concerns about energy consumption in blockchain operations, partnerships aimed at developing eco-friendly solutions will become more prevalent.

- Advancements in Technology: Ongoing advancements in blockchain technology will facilitate new use cases for smart contracts, driving further collaboration among developers, enterprises, and academic institutions.

Frequently Asked Questions About Partnership Opportunities In Smart Contract Platform Ecosystems

- What are the main benefits of partnering in the smart contract ecosystem?

Partnerships can provide access to new technologies, expand market reach, share resources for development costs, and enhance product offerings through collaboration. - How do regulatory changes impact partnerships?

Regulatory changes can create both risks and opportunities; companies must adapt their strategies to remain compliant while pursuing innovative solutions. - What role does interoperability play in partnership success?

Interoperability allows different platforms to work together seamlessly, increasing the utility of applications built on these ecosystems and attracting more users. - How can companies ensure security when collaborating on smart contracts?

Implementing thorough security audits and engaging cybersecurity experts during development can help mitigate risks associated with vulnerabilities. - What industries are most likely to benefit from smart contract partnerships?

Sectors such as finance, healthcare, supply chain management, real estate, and legal services stand to gain significantly from innovative applications of smart contracts. - Are there specific metrics to evaluate partnership success?

Key performance indicators (KPIs) such as user adoption rates, transaction volumes, revenue growth from joint initiatives, and customer satisfaction scores are essential metrics. - What future trends should partners be aware of?

The integration of AI technologies with blockchain platforms, a focus on sustainability initiatives, and advancements in cross-chain compatibility will shape future partnership dynamics. - How important is user experience in developing partnerships?

User experience is critical; effective partnerships should prioritize creating intuitive interfaces that simplify interactions with complex technologies like smart contracts.

In conclusion, the partnership landscape within smart contract platform ecosystems is rich with opportunities driven by technological advancements and market demands. By strategically navigating this evolving environment—considering regulatory frameworks, implementing robust security measures, and focusing on user-centric designs—investors and developers can unlock significant value through collaboration in this dynamic space.