Exchange-based tokens, often issued by cryptocurrency exchanges, are digital assets that provide various benefits to their holders, such as fee discounts, access to exclusive services, and opportunities for trading. These tokens have gained significant traction in the crypto market, often serving as a vital funding source for exchanges. As the landscape of cryptocurrency continues to evolve, understanding the partnership models associated with these tokens is crucial for investors and finance professionals alike.

| Key Concept | Description/Impact |

|---|---|

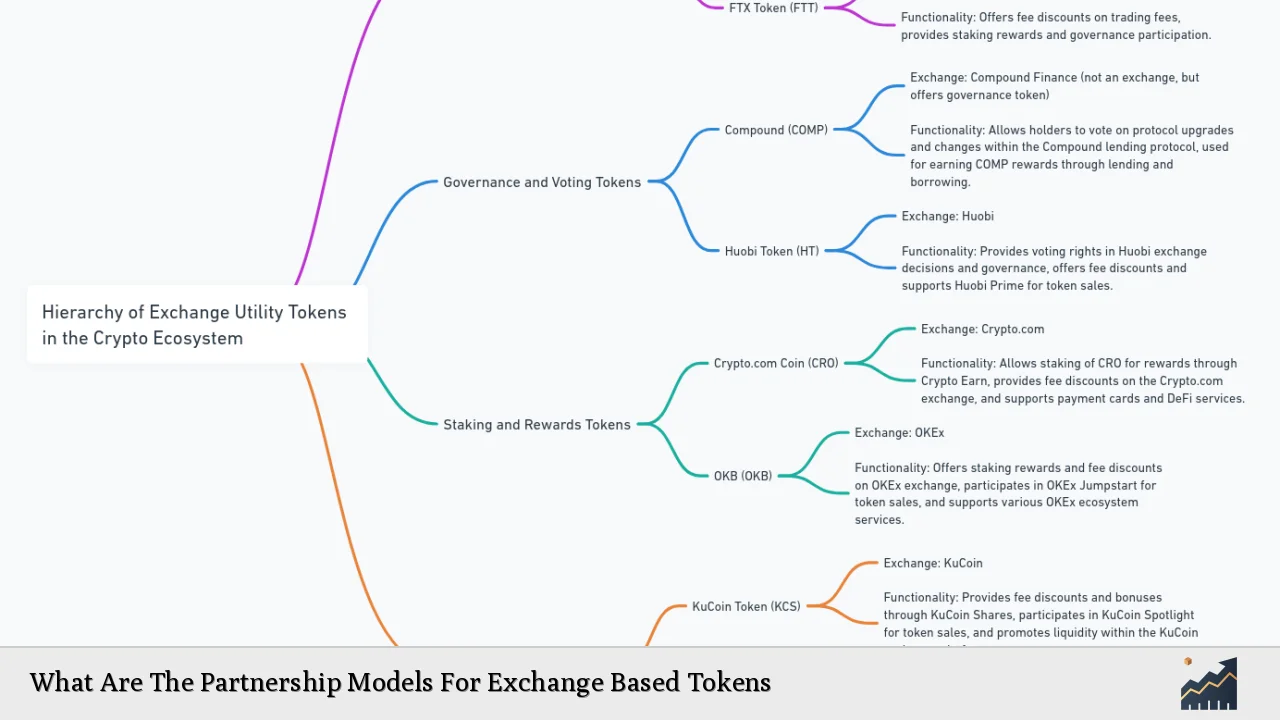

| Utility Tokens | Tokens that provide users with access to a product or service on a platform, often used to incentivize trading and participation. |

| Security Tokens | Tokens that represent ownership in an asset or company and are subject to regulatory oversight. They offer rights such as dividends or profit sharing. |

| Governance Tokens | Tokens that give holders voting rights in the decision-making processes of a project or platform, influencing future developments and policies. |

| Buyback Mechanisms | Exchanges may pledge to buy back their tokens from the market, creating demand and potentially stabilizing prices. This can lead to speculative investment behavior. |

| Partnerships with Other Platforms | Collaborations between exchanges and other blockchain projects can enhance token utility and market reach, often leading to cross-platform benefits. |

| Staking Rewards | Some exchanges offer staking options where users can lock their tokens in return for rewards, thus promoting token retention and reducing circulating supply. |

| Airdrops and Promotions | Exchanges may distribute free tokens to existing users or conduct promotional campaigns to increase user engagement and attract new customers. |

Market Analysis and Trends

The market for exchange-based tokens has experienced significant fluctuations influenced by broader cryptocurrency trends. As of late 2024, the combined market value of these tokens has surpassed $100 billion, reflecting their importance in the crypto ecosystem. However, recent analyses indicate that many newly listed tokens have underperformed due to market saturation and investor skepticism following high-profile exchange collapses like FTX.

Current Trends

- Increased Regulatory Scrutiny: Regulatory bodies are paying closer attention to exchange-based tokens. This scrutiny affects how exchanges structure their token offerings and partnerships.

- Shift Towards Utility: Many exchanges are focusing on enhancing the utility of their tokens by integrating them into various financial products and services.

- Adoption of Decentralized Finance (DeFi): The rise of DeFi has led exchanges to explore partnerships that allow for liquidity provision and yield farming opportunities using their tokens.

- Institutional Interest: There is growing interest from institutional investors in exchange-based tokens as they seek exposure to digital assets through more regulated avenues.

Implementation Strategies

To effectively leverage exchange-based tokens, exchanges must adopt strategic implementation models that align with market demands and regulatory requirements.

Key Strategies

- Token Utility Enhancement: Exchanges should focus on increasing the utility of their tokens by offering diverse use cases such as trading fee discounts, access to exclusive features, or participation in governance.

- Partnership Development: Forming strategic partnerships with other blockchain projects can enhance token visibility and usability. Collaborations can include liquidity pools or joint marketing initiatives.

- Community Engagement: Building a robust community around the token through educational initiatives, forums, and social media engagement can drive adoption and loyalty.

- Incentive Programs: Implementing staking rewards or loyalty programs incentivizes users to hold onto their tokens rather than sell them immediately.

Risk Considerations

Investing in exchange-based tokens carries inherent risks that potential investors should be aware of:

Major Risks

- Market Volatility: Exchange-based tokens are subject to high volatility similar to other cryptocurrencies. Price fluctuations can be influenced by market sentiment, regulatory news, or exchange-specific events.

- Regulatory Risks: Changes in regulations can impact the legality and operational framework of exchange-based tokens. Exchanges must remain compliant with local laws to avoid penalties.

- Liquidity Risks: Some exchange-based tokens may suffer from low liquidity, making it challenging for investors to buy or sell without affecting the market price significantly.

- Operational Risks: Exchanges face risks related to cybersecurity threats, operational failures, or mismanagement that could affect token value and investor confidence.

Regulatory Aspects

The regulatory landscape surrounding exchange-based tokens is evolving rapidly. Regulatory bodies like the SEC have begun implementing stricter guidelines for token offerings to protect investors.

Key Regulatory Considerations

- Securities Classification: Many exchange-based tokens may be classified as securities depending on their structure and use cases. This classification subjects them to stringent regulations regarding issuance and trading.

- Compliance Requirements: Exchanges must adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations when offering their tokens.

- Global Variability: Different jurisdictions have varying regulations regarding cryptocurrencies. Exchanges operating globally must navigate this complex landscape carefully.

Future Outlook

The future of exchange-based tokens appears promising yet complex as they adapt to changing market dynamics and regulatory environments.

Predictions

- Increased Tokenization: The trend towards tokenization of traditional assets will likely drive demand for exchange-based tokens as platforms seek innovative ways to integrate these assets into their ecosystems.

- Enhanced Interoperability: Future developments may focus on improving interoperability between different blockchain networks, allowing exchange-based tokens to function across various platforms seamlessly.

- Institutional Adoption Growth: As institutional interest in cryptocurrencies grows, exchanges that offer robust compliance frameworks will likely see increased investment in their native tokens.

- Technological Innovations: Advances in blockchain technology will continue to shape how exchange-based tokens are utilized within financial markets, potentially leading to new use cases such as decentralized governance models.

Frequently Asked Questions About What Are The Partnership Models For Exchange Based Tokens

- What are exchange-based tokens?

Exchange-based tokens are digital assets issued by cryptocurrency exchanges that provide various benefits like trading fee discounts or access to exclusive services. - How do partnership models work for these tokens?

Partnership models involve collaborations between exchanges and other platforms to enhance token utility, increase visibility, or create joint financial products. - What are the risks associated with investing in exchange-based tokens?

The main risks include market volatility, regulatory changes, liquidity issues, and operational risks related to the exchanges themselves. - How are regulatory aspects affecting exchange-based tokens?

Regulatory scrutiny is increasing; many exchange-based tokens may be classified as securities requiring compliance with strict regulations. - What trends are currently shaping the market for these tokens?

Current trends include increased regulatory scrutiny, a shift towards enhancing token utility, adoption of DeFi practices, and growing institutional interest. - What future developments can we expect for exchange-based tokens?

The future may see increased tokenization of traditional assets, enhanced interoperability among blockchain networks, and further technological innovations. - How can investors assess the value of exchange-based tokens?

Investors should consider factors like utility within the platform, demand dynamics influenced by buyback mechanisms, regulatory compliance status, and overall market conditions. - Are there any notable examples of successful partnership models?

Successful examples include collaborations between exchanges like Binance or KuCoin with DeFi projects that enhance liquidity provision using their native tokens.

This comprehensive analysis provides insights into the partnership models for exchange-based tokens while addressing current trends, risks, regulatory aspects, and future outlooks essential for individual investors and finance professionals navigating this dynamic landscape.