The long-term effects of Brexit on the UK stock market have been a topic of extensive analysis since the referendum in June 2016. The decision to leave the European Union has led to significant shifts in market dynamics, investor sentiment, and economic fundamentals. While some immediate impacts were evident, the broader, long-term consequences continue to unfold, influenced by various factors including economic policies, trade agreements, and global market trends.

| Key Concept | Description/Impact |

|---|---|

| Market Performance | Since the Brexit referendum, the FTSE 100 has underperformed compared to major indices like the S&P 500 and STOXX Europe 600. As of December 2023, the FTSE 100 had grown by only 22% since the referendum, while the S&P 500 increased by 125% during the same period. |

| Currency Volatility | The value of the British pound has experienced significant fluctuations post-Brexit, impacting UK companies’ earnings and investor confidence. A weaker pound generally benefits exporters but raises costs for importers. |

| Investment Shifts | Institutional investors have shifted capital away from UK assets towards markets with better yields, particularly in technology sectors in the US. This trend reflects concerns over long-term growth prospects in the UK post-Brexit. |

| Dividend Yields | The FTSE 100 and FTSE 250 currently offer attractive dividend yields of around 4%, which may appeal to income-focused investors as global interest rates begin to decline. |

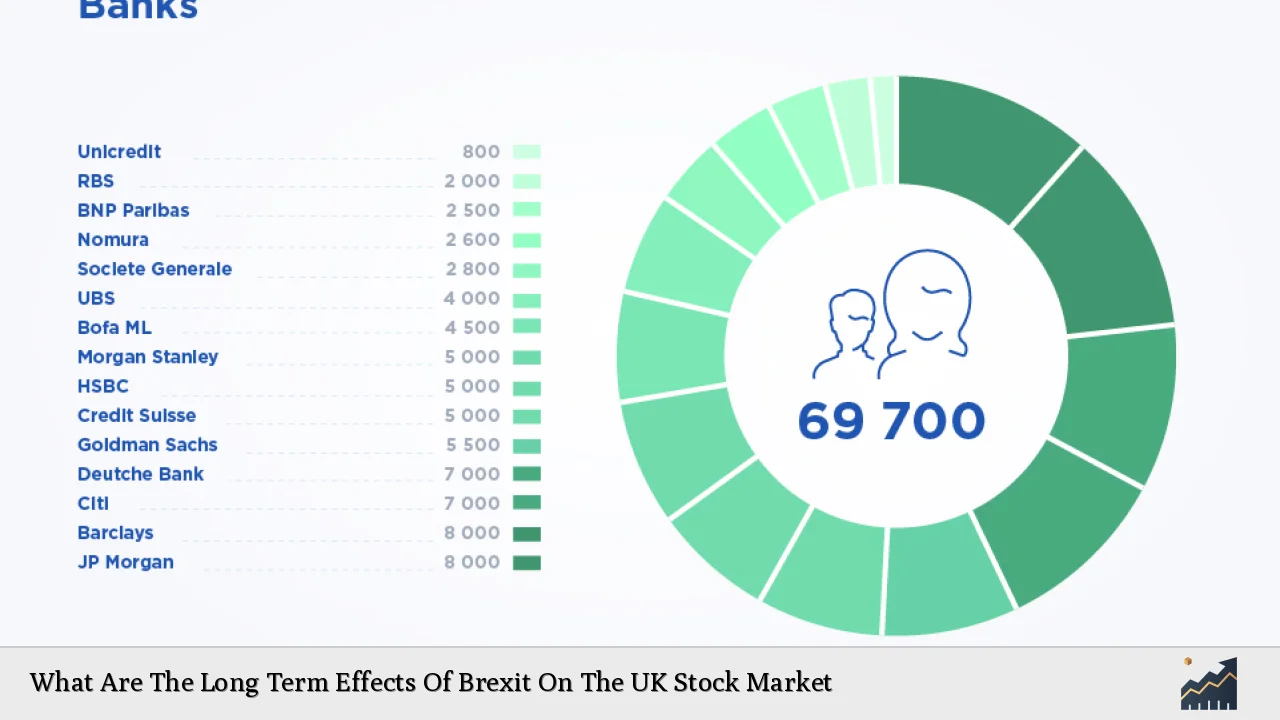

| Regulatory Changes | Brexit has necessitated a reevaluation of regulatory frameworks affecting financial services in the UK, potentially impacting London’s status as a global financial hub. |

| Future Growth Potential | Analysts predict a potential turnaround for UK equities, with Goldman Sachs forecasting average annual returns of 6% over the next five years as market conditions stabilize. |

Market Analysis and Trends

The UK stock market has faced a challenging environment since Brexit, characterized by underperformance relative to other major markets. The FTSE 100 index, which represents the largest companies listed on the London Stock Exchange, has lagged behind indices such as the S&P 500 and STOXX Europe 600.

Historical Performance

- Pre-Brexit vs. Post-Brexit: Between March 2009 and June 2016, investments in both the S&P 500 and FTSE 250 yielded similar returns. However, since Brexit, investments in the S&P have significantly outperformed those in the FTSE.

- Current Trends: As of December 2024, analysts predict that UK equities may outperform their US and EU counterparts due to their current undervaluation and attractive dividend yields.

Factors Influencing Market Dynamics

- Economic Recovery: Following a brief recession attributed to both Brexit uncertainties and COVID-19 impacts, signs of recovery are emerging. The UK’s unemployment rate remains low at around 4.3%, indicating a resilient labor market.

- Investor Sentiment: There is growing optimism among investors regarding potential recovery in UK stocks as they become increasingly attractive due to lower valuations compared to US stocks.

Implementation Strategies

Investors looking to navigate the post-Brexit landscape should consider several strategies:

- Diversification: Given the volatility associated with Brexit-related uncertainties, diversifying portfolios across sectors and geographies can mitigate risks.

- Focus on Dividends: With high dividend yields available from UK stocks, income-focused strategies may be beneficial. Companies with strong cash flows and stable dividends could provide reliable returns.

- Sector Analysis: Identifying sectors that may benefit from a weaker pound or increased domestic consumption can lead to strategic investment opportunities.

Risk Considerations

Investing in the UK stock market post-Brexit comes with its own set of risks:

- Political Uncertainty: Ongoing political developments regarding trade agreements and economic policies can create volatility.

- Economic Indicators: Investors should closely monitor key economic indicators such as inflation rates, GDP growth forecasts, and consumer confidence levels.

- Global Market Influences: The interconnectedness of global markets means that events outside of the UK can significantly impact local stock performance.

Regulatory Aspects

Brexit has prompted significant changes in regulatory frameworks affecting financial markets:

- Financial Services Regulation: The UK’s departure from EU regulations has led to uncertainty regarding passporting rights for financial services firms operating across Europe.

- Market Access: Companies may face new barriers when accessing EU markets, which could impact profitability and stock valuations.

Future Outlook

Looking ahead, several factors will shape the long-term outlook for the UK stock market:

- Predicted Returns: Analysts expect that as economic conditions stabilize and interest rates decline globally, UK equities could yield higher returns than previously anticipated.

- Valuation Gap Closure: The current valuation gap between US and UK stocks presents potential investment opportunities if market sentiment shifts positively towards UK assets.

- Continued Monitoring: Investors should remain vigilant about economic policies post-Brexit that could influence market conditions.

Frequently Asked Questions About What Are The Long Term Effects Of Brexit On The UK Stock Market

- What has been the overall performance of the FTSE 100 since Brexit?

The FTSE 100 has underperformed relative to other major indices like the S&P 500 since Brexit, growing by only about 22% from June 2016 through December 2023. - How has Brexit affected investor sentiment towards UK stocks?

Investor sentiment has been cautious due to ongoing political uncertainties and economic challenges; however, there are signs of renewed interest as valuations appear attractive. - What sectors are likely to benefit from a post-Brexit environment?

Sectors such as exports may benefit from a weaker pound, while domestic-focused companies might see growth as consumer confidence stabilizes. - Are dividend yields from UK stocks attractive?

Yes, current dividend yields for both FTSE 100 and FTSE 250 are around 4%, making them appealing for income-focused investors. - What risks should investors consider when investing in UK stocks post-Brexit?

Key risks include political uncertainty, regulatory changes affecting financial services, and global economic influences that can impact local markets. - How do analysts predict UK stocks will perform in the coming years?

Analysts forecast average annual returns of around 6% for UK stocks over the next five years as conditions improve. - What role does currency volatility play in stock performance?

A fluctuating pound can significantly impact earnings for companies that rely on imports or exports; thus it is crucial for investors to consider currency risk. - Is it advisable for investors to focus solely on UK equities?

Diversification remains key; while there are opportunities within UK equities, balancing investments across different regions can help mitigate risk.

In conclusion, while Brexit has introduced complexities into the UK’s economic landscape and stock market performance, there are emerging opportunities for investors willing to navigate this evolving environment. By understanding market dynamics and implementing strategic investment approaches, individuals can position themselves effectively for potential growth in the coming years.