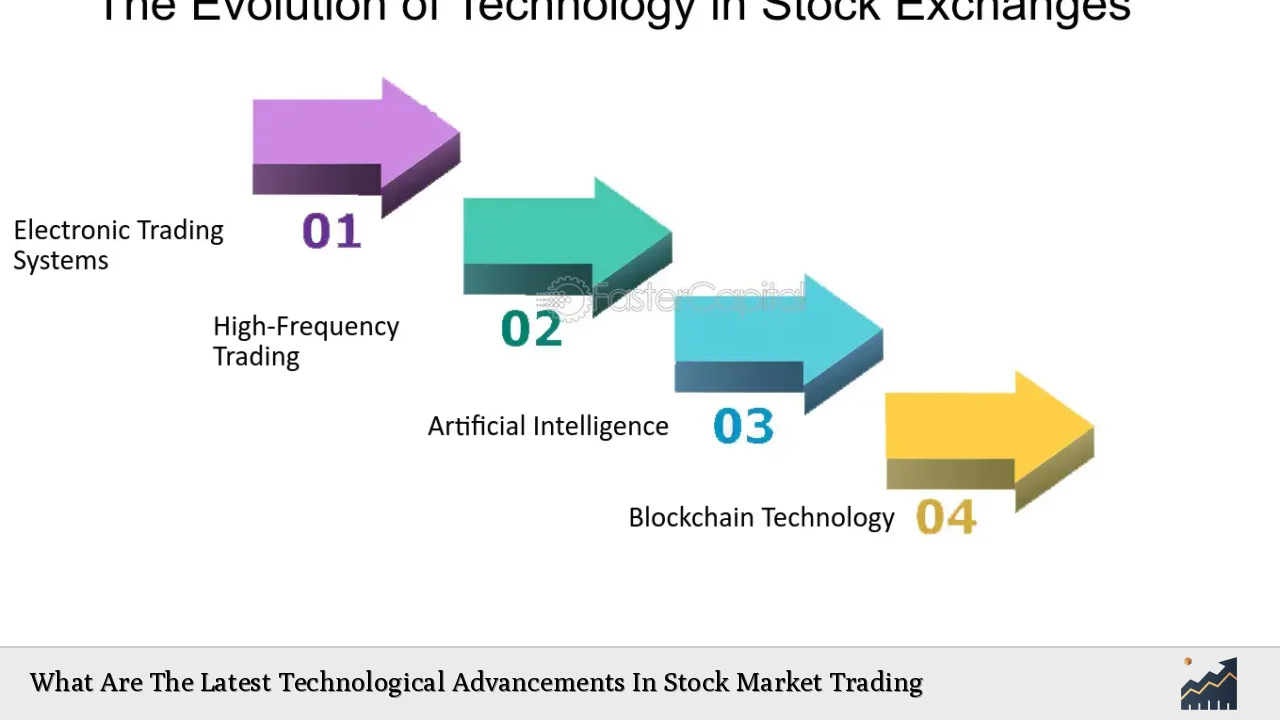

Technological advancements have dramatically reshaped the stock market trading landscape over the past decade, introducing new tools and methodologies that enhance efficiency, accessibility, and decision-making capabilities for investors. From algorithmic trading to artificial intelligence (AI) and blockchain technology, these innovations are not only transforming how trades are executed but also how investors analyze market data and manage their portfolios. This comprehensive analysis delves into the latest trends in stock market trading technology, exploring their implications for individual investors and finance professionals alike.

| Key Concept | Description/Impact |

|---|---|

| Algorithmic Trading | Utilizes complex algorithms to execute trades at high speeds, enhancing market liquidity and reducing transaction costs. |

| Artificial Intelligence (AI) | Employs machine learning and predictive analytics to analyze vast datasets, improve trading strategies, and automate decision-making processes. |

| Blockchain Technology | Offers secure and transparent transaction records, facilitating decentralized finance (DeFi) platforms and reducing reliance on traditional intermediaries. |

| High-Frequency Trading (HFT) | Involves executing thousands of orders in fractions of a second, allowing traders to capitalize on minute price fluctuations. |

| Social Trading Platforms | Enable investors to follow and replicate the strategies of successful traders, fostering a collaborative trading environment. |

| Real-Time Data Analytics | Provides instant access to market data, enabling timely decision-making and improved responsiveness to market changes. |

| Mobile Trading Applications | Facilitates trading from anywhere at any time, increasing accessibility for retail investors and enhancing user experience. |

| Cybersecurity Innovations | Implements advanced security measures to protect sensitive financial data amidst rising digital threats. |

Market Analysis and Trends

The stock trading environment is currently characterized by several key trends driven by technological advancements:

- Increased Retail Participation: The rise of online trading platforms has democratized access to the stock market. According to recent reports, the global stock trading applications market is projected to grow from $44.05 billion in 2023 to $52.89 billion in 2024 at a compound annual growth rate (CAGR) of 20.1%. This growth reflects a significant increase in self-directed investors who prefer managing their portfolios through digital platforms.

- AI Integration: AI technologies are becoming integral to trading strategies. Machine learning algorithms can analyze massive datasets quickly, identifying patterns that human traders might overlook. This capability enhances predictive accuracy regarding stock price movements and market trends.

- Shift Towards Algorithmic Trading: Algorithmic trading has gained traction among institutional investors due to its efficiency in executing large volumes of trades with minimal human intervention. This method has been shown to lower transaction costs significantly while improving execution quality.

- Emergence of Social Trading: Social trading platforms have gained popularity by allowing less experienced traders to mimic the strategies of successful investors. This trend fosters a sense of community among traders while providing educational opportunities for novices.

- Cybersecurity Focus: As digital trading becomes more prevalent, so too does the need for robust cybersecurity measures. Firms are investing heavily in technologies that protect sensitive data from breaches and fraud.

Implementation Strategies

For individual investors and finance professionals looking to leverage these technological advancements, several implementation strategies can be adopted:

- Utilizing Algorithmic Trading Tools: Investors can employ algorithmic trading software that allows them to automate their trading strategies based on predefined criteria. This can help eliminate emotional decision-making and enhance consistency.

- Adopting AI-Powered Analytics: By integrating AI-driven analytics tools into their investment processes, traders can gain insights into market trends and sentiment analysis derived from social media and news sources.

- Engaging with Social Trading Platforms: Newer investors should consider using social trading platforms that allow them to learn from experienced traders while building their own strategies.

- Emphasizing Cybersecurity Measures: Investors must prioritize cybersecurity by using platforms that offer strong encryption methods and two-factor authentication to safeguard their accounts.

Risk Considerations

While technological advancements present numerous opportunities, they also introduce specific risks that must be managed:

- Market Volatility: High-frequency trading can exacerbate market volatility. Rapid buying and selling can lead to sudden price swings that may disadvantage retail investors.

- Algorithmic Biases: Algorithms are only as good as the data they are trained on. Poor-quality data or biased algorithms can lead to erroneous trading decisions.

- Cybersecurity Threats: As reliance on technology increases, so does vulnerability to cyberattacks. Investors must remain vigilant about protecting their personal information.

- Regulatory Compliance: With the rapid evolution of technology in finance, staying compliant with regulations is crucial. Investors should ensure that their trading practices adhere to legal standards set by regulatory bodies like the SEC.

Regulatory Aspects

The regulatory landscape is evolving alongside technological advancements in stock market trading:

- Increased Scrutiny on Algorithmic Trading: Regulatory bodies are closely monitoring algorithmic trading practices due to concerns about market manipulation and systemic risks associated with high-frequency trading.

- Guidelines for AI Use: As AI becomes more prevalent in financial markets, regulators are beginning to establish guidelines ensuring transparency in how algorithms operate.

- Blockchain Regulations: The rise of blockchain technology has prompted discussions around regulatory frameworks for cryptocurrencies and decentralized finance (DeFi), aiming to protect investors while fostering innovation.

Future Outlook

Looking ahead, several trends are expected to shape the future of stock market trading:

- Continued Growth of AI Technologies: As AI capabilities expand, we can expect even more sophisticated predictive models that will enhance investment decision-making processes across various asset classes.

- Integration of Augmented Reality (AR) and Virtual Reality (VR): Future trading platforms may incorporate AR/VR technologies, providing immersive experiences for users during market analysis or training sessions.

- Expansion of Decentralized Finance (DeFi): The DeFi movement is likely to continue growing as more individuals seek alternatives to traditional banking systems, further democratizing access to financial services.

- Focus on Ethical Trading Practices: With increased scrutiny on algorithmic biases and cybersecurity threats, there will be a greater emphasis on ethical considerations within technological implementations in finance.

Frequently Asked Questions About What Are The Latest Technological Advancements In Stock Market Trading

- What is algorithmic trading?

Algorithmic trading uses computer algorithms to automate trade execution based on predefined criteria such as price or volume thresholds. - How does AI impact stock market trading?

AI enhances stock market trading by analyzing vast amounts of data quickly, identifying patterns, predicting price movements, and automating decision-making processes. - What are social trading platforms?

Social trading platforms allow users to follow other traders’ strategies and replicate their trades, providing educational benefits for less experienced investors. - What risks are associated with high-frequency trading?

High-frequency trading can lead to increased market volatility and may disadvantage retail investors due to rapid price fluctuations. - How important is cybersecurity in online trading?

Cybersecurity is crucial in online trading as it protects sensitive financial information from breaches and fraud attempts. - What regulatory challenges exist for new technologies in finance?

The rapid evolution of technology poses challenges related to compliance with existing regulations designed for traditional financial systems. - What future trends should investors watch for?

Investors should watch for advancements in AI technologies, the growth of DeFi platforms, integration of AR/VR in trading environments, and a focus on ethical practices. - How can I start using these technologies as an investor?

You can start by utilizing online brokerage platforms that offer algorithmic tools or AI-driven analytics while ensuring you understand the associated risks.

The integration of technology into stock market trading continues to evolve rapidly. Investors who stay informed about these advancements will be better positioned to navigate the complexities of modern financial markets effectively.