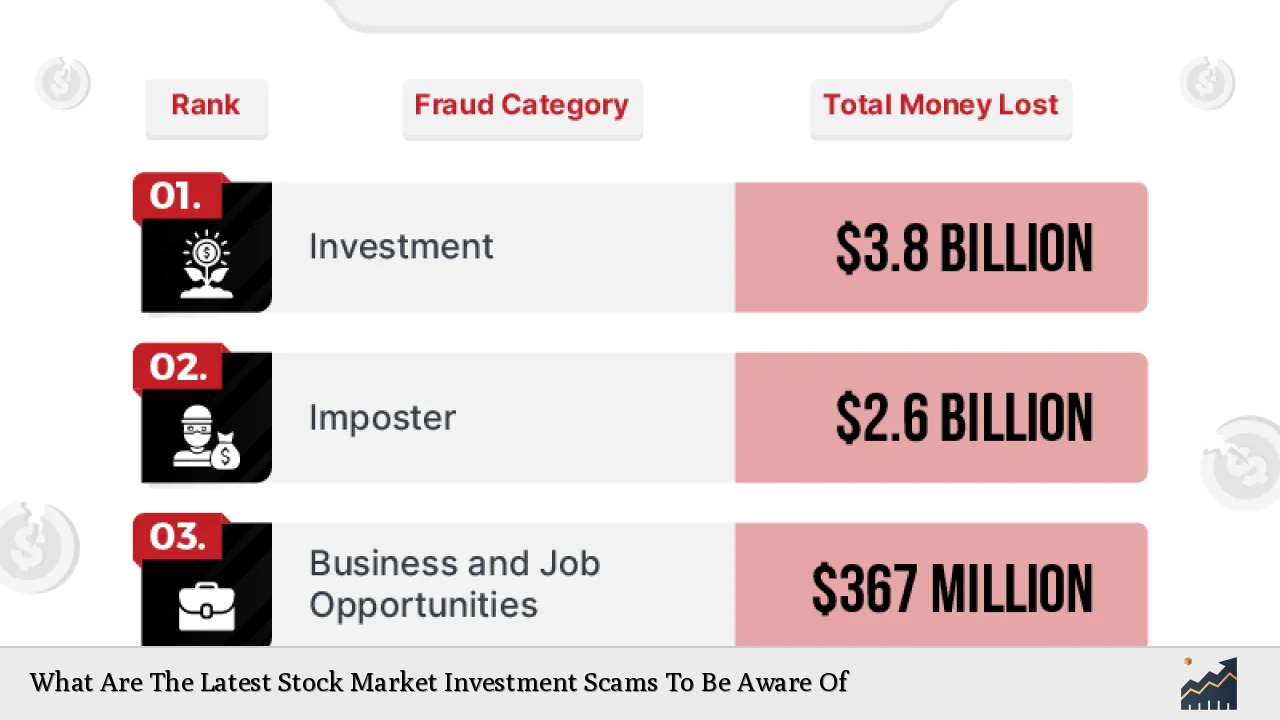

Investment scams have evolved significantly, leveraging technology and social media to target unsuspecting investors. As the stock market continues to attract new participants, especially among retail investors, the prevalence of these scams has surged, making it imperative for individuals to stay informed about the latest threats. In 2024, investment fraud attempts have surged by 76% compared to the previous year, with losses reaching staggering amounts globally. This article explores the latest stock market investment scams, providing detailed insights into their mechanics, impacts, and strategies for protection.

| Key Concept | Description/Impact |

|---|---|

| Online Investment Trading Scams | Scammers create fake trading platforms that promise high returns using sophisticated marketing techniques, often involving fake celebrity endorsements. |

| Pump and Dump Schemes | Fraudsters promote low-priced stocks to inflate their prices before selling off their shares, leaving investors with worthless stocks. |

| Boiler Room Scams | A team of salespeople pressure investors into buying overvalued or non-existent securities through aggressive tactics. |

| Cryptocurrency Scams | Fraudsters exploit the popularity of cryptocurrencies by creating fake exchanges or investment opportunities promising unrealistic returns. |

| AI Voice Scams | Using generative AI, scammers impersonate trusted voices to solicit investments, often leading victims to fraudulent schemes. |

| Pig Butchering Scams | Scammers build relationships on social media to gain trust before introducing fake investment opportunities that lead to significant losses. |

| Affinity Fraud | This scam targets specific communities or groups, leveraging trust to promote Ponzi schemes or other fraudulent investments. |

| Advance Fee Fraud | Investors are charged upfront fees for promised returns that never materialize, often linked to non-existent investments. |

Market Analysis and Trends

The landscape of investment scams is continuously shifting, driven by technological advancements and changes in consumer behavior. In 2024, several trends have emerged:

- Increased Use of Technology: Scammers are utilizing advanced technologies such as artificial intelligence and deepfake videos to create convincing fraudulent schemes. This has made it increasingly difficult for investors to discern legitimate opportunities from scams.

- Social Media as a Primary Channel: A significant number of scams now originate from social media platforms where fraudsters can easily reach potential victims. Reports indicate that 94% of individuals have been targeted by fraudsters through various digital channels in the past year.

- Regulatory Response: Regulatory bodies like the SEC and ASIC have ramped up efforts to combat these scams by coordinating takedowns of fraudulent websites and increasing public awareness campaigns. For instance, ASIC reported removing over 7,300 scam websites in a recent initiative.

- Global Impact: Investment scams are not limited to one region; they are a global issue. For example, in India alone, ₹4,636 crore was siphoned off in stock market trading scams within just nine months of 2024.

Implementation Strategies

To protect yourself against these scams, consider implementing the following strategies:

- Conduct Thorough Research: Always verify the legitimacy of any investment opportunity. Check for registration with regulatory bodies and seek independent reviews.

- Be Skeptical of Promises: If an investment opportunity sounds too good to be true—such as guaranteed high returns or low risk—exercise caution.

- Utilize Technology Wisely: Leverage tools such as financial news apps and scam alert services that provide updates on known scams and fraudulent activities.

- Educate Yourself on Common Scams: Familiarize yourself with different types of scams (e.g., pump and dump, boiler room) so you can recognize red flags.

- Seek Professional Advice: When in doubt, consult with a licensed financial advisor who can provide guidance tailored to your financial goals.

Risk Considerations

Investing always carries risks, but awareness of potential scams can mitigate some financial dangers:

- Financial Loss: Victims of investment scams often face significant financial losses that can take years to recover from.

- Emotional Distress: Falling victim to a scam can lead to emotional distress and loss of trust in legitimate financial institutions.

- Legal Consequences: Engaging with fraudulent platforms may inadvertently involve you in legal issues if those platforms are under investigation.

Regulatory Aspects

Regulatory bodies play a crucial role in combating investment fraud:

- Increased Surveillance: Organizations like the SEC and ASIC are enhancing their surveillance capabilities to identify and shut down fraudulent operations quickly.

- Public Awareness Campaigns: Regulators are actively educating the public about common scam tactics through various outreach initiatives.

- Collaboration with Tech Companies: Partnerships with tech firms aim to improve detection methods for fraudulent advertisements and websites.

Future Outlook

The future of investment scams is likely shaped by ongoing technological advancements:

- Emerging Technologies: As AI continues to evolve, so will the sophistication of scams. Investors must remain vigilant against new tactics that exploit these technologies.

- Regulatory Evolution: Expect more stringent regulations surrounding online trading platforms and increased penalties for those caught perpetrating fraud.

- Consumer Education Initiatives: Ongoing education efforts will be vital in helping investors recognize signs of fraud before they fall victim.

Frequently Asked Questions About What Are The Latest Stock Market Investment Scams To Be Aware Of

- What are common signs of an investment scam?

Common signs include promises of high returns with little risk, pressure tactics urging immediate action, and lack of transparency regarding fees or company information. - How can I protect myself from investment scams?

Research thoroughly before investing, be skeptical of unsolicited offers, use trusted platforms for investments, and consult financial advisors when uncertain. - What should I do if I suspect I’ve been scammed?

Report the incident to your local regulatory body or consumer protection agency immediately and consider contacting your bank or credit card provider. - Are cryptocurrency investments more prone to scams?

Yes, due to their relatively unregulated nature compared to traditional investments, cryptocurrencies attract many fraudulent schemes. - How do regulators respond to investment fraud?

Regulators conduct investigations, shut down fraudulent operations, issue warnings to consumers, and enhance regulations surrounding investment practices. - What role does social media play in investment scams?

Social media is often used by scammers to reach potential victims quickly through targeted ads or direct messaging. - Can I recover my money after falling victim to a scam?

The chances of recovery depend on various factors including the type of scam and whether law enforcement can trace the funds; however, recovery is often challenging. - What types of investments are most commonly associated with scams?

Penny stocks, cryptocurrencies, real estate ventures promising high returns without risk are frequently associated with fraudulent schemes.

Investment scams continue to pose significant risks for individual investors. By staying informed about current trends and employing protective strategies, investors can better navigate this complex landscape. Always approach new opportunities with caution and seek professional advice when necessary.