The blockchain ecosystem is rapidly evolving, with Layer 1 (L1) blockchains at the forefront of innovation. These foundational infrastructures are critical for hosting decentralized applications (dApps), executing smart contracts, and ensuring the security and scalability of blockchain networks. As we move into 2024, several emerging L1 blockchain startups are gaining attention for their unique approaches and potential to disrupt the existing landscape dominated by established players like Ethereum and Solana. This article explores the latest L1 blockchain startups to watch, providing a comprehensive market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Omni Network | A Layer 1 blockchain aiming to unify Ethereum’s fragmented rollup ecosystem, facilitating cross-rollup communication and application development. |

| Aptos | A high-performance L1 blockchain utilizing the Move programming language, designed for scalability and user-friendly decentralized applications. |

| Sei Network | A fast-growing L1 blockchain capable of handling up to 20,000 transactions per second, focusing on efficiency and low-cost operations. |

| Tectum | Claiming speeds of over 1 million transactions per second, Tectum aims to revolutionize transaction processing with zero-fee transactions. |

| Neuraiproject | Integrates IoT with blockchain technology to enhance AI collaboration with IoT devices, targeting a niche market in smart device connectivity. |

| Taraxa Project | An EVM-compatible platform that innovates with asynchronous PBFT consensus for improved scalability without sacrificing security. |

| Cronos | Linked to Crypto.com, this L1 blockchain emphasizes low transaction fees and smart contract support while aiming for significant market share growth. |

| Kaspa | A rapidly growing L1 blockchain utilizing a proof-of-work model that confirms transactions in seconds, appealing to users seeking speed and efficiency. |

Market Analysis and Trends

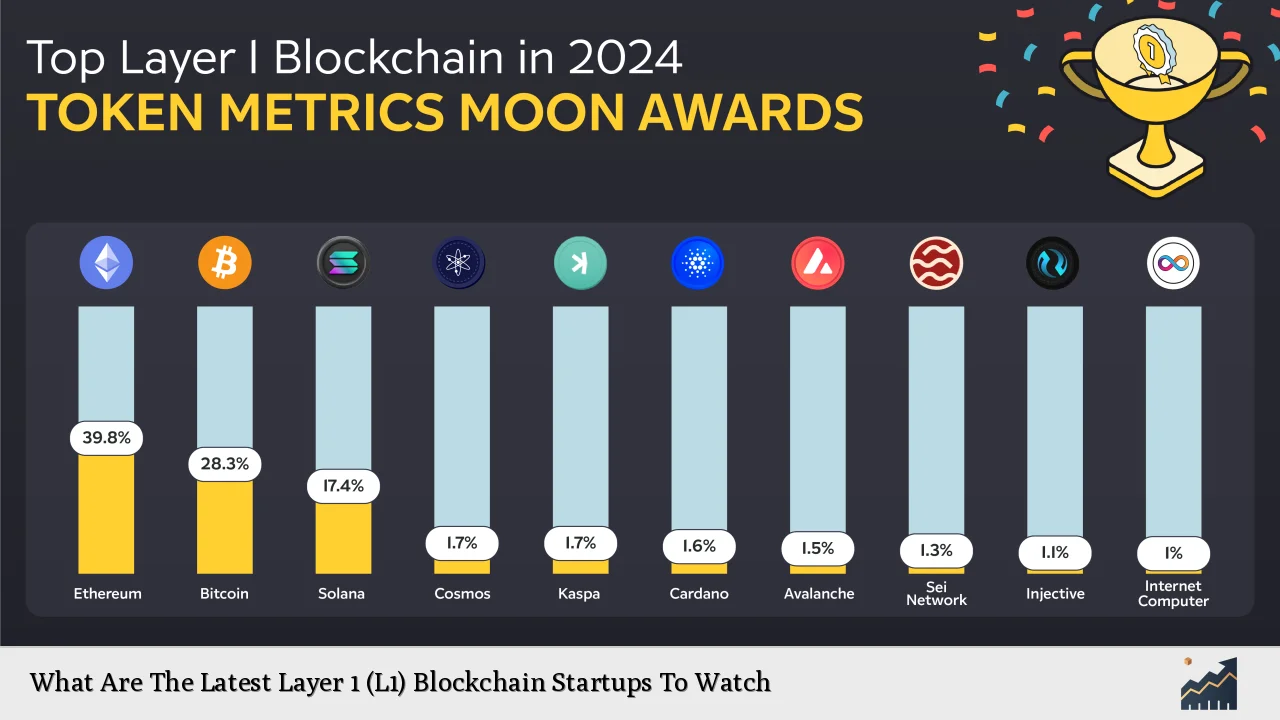

The Layer 1 blockchain market is witnessing a resurgence as investors seek alternatives to established platforms. In Q3 2024 alone, venture capitalists invested approximately $341 million into Layer 1 projects, reflecting a growing confidence in new entrants despite a broader decline in crypto investments.

Current Market Statistics

- Total Market Cap: As of December 2024, the total market cap for Layer 1 cryptocurrencies stands at approximately $2.9 trillion.

- 24-Hour Trading Volume: The trading volume has reached over $263 billion, indicating active market participation.

- Top Gainers: Projects like Sei have shown remarkable growth, increasing by over 3400% since August 2023.

Emerging Trends

- Interoperability: Startups like Omni Network are focusing on creating seamless interoperability between different blockchain ecosystems.

- Efficiency and Scalability: High transaction throughput is a key selling point for new entrants such as Tectum and Sei.

- Sustainability: Many new L1 projects are adopting eco-friendly consensus mechanisms to attract environmentally conscious developers.

Implementation Strategies

Successful implementation of Layer 1 blockchains requires a well-defined strategy that encompasses technology selection, development practices, and community engagement.

Key Strategies

- Adopting Advanced Consensus Mechanisms: Utilizing innovative consensus models like Proof-of-Stake (PoS) or Delegated Proof-of-Stake (DPoS) can enhance scalability while maintaining security.

- Developer-Friendly Ecosystems: Providing robust development tools and documentation can attract developers. For instance, Aptos leverages the Move programming language to simplify dApp development.

- Community Building: Engaging with the community through hackathons, grants, and educational initiatives fosters loyalty and encourages ecosystem growth.

Risk Considerations

Investing in Layer 1 blockchain startups carries inherent risks that potential investors should consider:

Major Risks

- Regulatory Uncertainty: The evolving regulatory landscape poses challenges for compliance. Startups must navigate complex regulations that vary by jurisdiction.

- Market Volatility: The cryptocurrency market is notoriously volatile. Price fluctuations can impact investor sentiment and project viability.

- Technological Vulnerabilities: New protocols may face security risks such as smart contract bugs or vulnerabilities in consensus mechanisms.

Regulatory Aspects

The regulatory environment for Layer 1 blockchains is complex and varies significantly across regions. Startups must be proactive in understanding applicable laws to avoid legal pitfalls.

Key Regulatory Considerations

- Securities Classification: In many jurisdictions, tokens may be classified as securities or utility tokens, affecting how they can be marketed and sold.

- Anti-Money Laundering (AML) Compliance: Startups must implement robust AML procedures to prevent illicit activities while balancing user privacy concerns.

- Data Protection Laws: Compliance with data protection regulations is critical, especially for projects handling sensitive user information.

Future Outlook

The future of Layer 1 blockchains looks promising as technological advancements continue to emerge. Several factors will influence their trajectory:

Predictions

- Increased Adoption of Decentralized Finance (DeFi): As DeFi continues to gain traction, Layer 1 blockchains that support efficient smart contracts will likely see increased usage.

- Interoperability Solutions: Projects focusing on cross-chain compatibility will become essential as users demand seamless experiences across different platforms.

- Sustainability Initiatives: With growing environmental concerns, L1 blockchains that prioritize energy-efficient practices will attract more developers and users.

Frequently Asked Questions About Latest Layer 1 Blockchain Startups To Watch

- What is a Layer 1 blockchain?

A Layer 1 blockchain refers to the base layer of a blockchain network that handles all transactions without relying on any other network. Examples include Bitcoin and Ethereum. - Why are new Layer 1 startups emerging?

New startups are emerging to address scalability issues faced by established blockchains and to offer innovative features tailored to specific use cases. - What should I consider before investing in a Layer 1 startup?

Consider factors such as regulatory compliance, technological robustness, market demand for their solutions, and the team’s experience. - How do Layer 1 blockchains differ from Layer 2 solutions?

Layer 2 solutions are built on top of existing blockchains to enhance scalability and speed without altering the underlying protocol. - Are there risks associated with investing in Layer 1 blockchains?

Yes, risks include regulatory uncertainty, market volatility, technological vulnerabilities, and competition from other projects. - What role do venture capitalists play in the success of these startups?

Venture capitalists provide essential funding that allows startups to develop their technology and scale operations effectively. - How can I stay updated on new developments in the Layer 1 space?

Follow industry news outlets, subscribe to newsletters from crypto analysts, and engage with community forums related to blockchain technology. - What impact do regulations have on Layer 1 startups?

Regulations can significantly affect how these startups operate, influencing their funding strategies, token sales, and overall business models.

In conclusion, as we enter a new era of blockchain technology marked by innovation and disruption, keeping an eye on emerging Layer 1 startups will be crucial for investors looking for promising opportunities in this dynamic landscape. These projects not only aim to solve existing challenges but also pave the way for future developments in decentralized technologies.