Stablecoins have emerged as a pivotal component of the cryptocurrency ecosystem, providing a bridge between traditional finance and digital assets. As their adoption grows, so does the scrutiny from regulators and the need for robust governance frameworks. Recent developments in stablecoin governance reflect a global shift towards regulatory clarity, risk management, and enhanced consumer protection.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Frameworks | The introduction of comprehensive regulations like the EU’s Markets in Crypto-Assets Regulation (MiCA) aims to standardize stablecoin governance across member states, enhancing consumer protection and market integrity. |

| Market Trends | Stablecoins have seen a significant increase in market share, accounting for approximately 6.93% of the total cryptocurrency market, driven by their stability and utility in transactions. |

| Technological Innovations | Projects like BIS’s Project Pyxtrial are exploring technological solutions for monitoring stablecoin reserves, ensuring compliance and transparency in asset backing. |

| Global Regulatory Alignment | There is a growing trend towards harmonizing regulations globally, with jurisdictions like Singapore and the UK working on frameworks that may align closely with MiCA. |

| Consumer Protection Measures | New regulations are emphasizing consumer rights, including clear redemption rights and requirements for issuers to maintain adequate reserves. |

| Risk Management Standards | Stablecoin issuers are being encouraged to adopt stringent risk management practices to mitigate systemic risks associated with their operations. |

Market Analysis and Trends

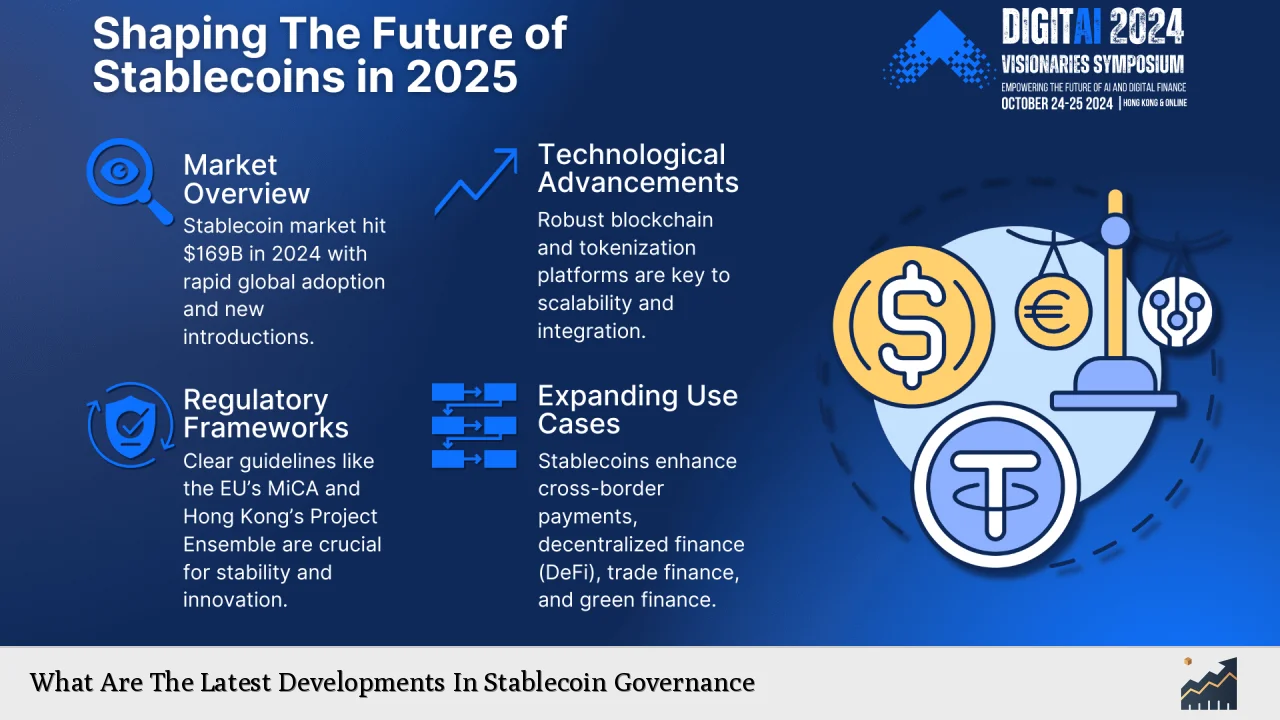

The stablecoin market is experiencing unprecedented growth. As of late 2024, stablecoins represent a significant portion of the cryptocurrency ecosystem, with a total market capitalization exceeding $161 billion. This growth is attributed to several factors:

- Increased Adoption: Stablecoins have gained traction for use in cross-border payments, remittances, and as a means of value transfer within decentralized finance (DeFi) platforms.

- Diversification of Backing Assets: Beyond fiat currencies, stablecoins are increasingly backed by diverse assets such as commodities and equities, which helps to stabilize their value and appeal to a broader range of investors.

- Regulatory Clarity: The implementation of regulations like MiCA in the EU has provided a clearer framework for stablecoin operations, fostering confidence among users and investors.

Current Market Statistics

- Stablecoins accounted for approximately 52.36% of all cryptocurrency transactions between July 2022 and June 2024.

- The market share of compliant stablecoins has surged to an all-time high of 67% following regulatory advancements in Europe.

- Notably, USDT remains the dominant player in the stablecoin market, controlling around 70.9% of the total market capitalization.

Implementation Strategies

To navigate the evolving landscape of stablecoin governance effectively, issuers must adopt comprehensive implementation strategies:

- Compliance with Regulations: Issuers should ensure adherence to local and international regulations such as MiCA and guidelines from financial authorities. This includes maintaining adequate reserves and ensuring transparency in operations.

- Robust Risk Management Frameworks: Establishing strong risk management practices is essential. This involves regular audits of backing assets, implementing controls to prevent fraud, and ensuring liquidity for user redemptions.

- Technological Integration: Utilizing advanced technologies such as blockchain analytics tools can enhance transparency and allow real-time monitoring of reserves.

Risk Considerations

As stablecoins gain popularity, several risks must be addressed:

- Regulatory Risks: The lack of a unified regulatory framework can lead to uncertainty. Issuers must stay informed about potential changes in legislation that could impact their operations.

- Market Volatility: Although designed to be stable, external factors can influence the value of stablecoins. Issuers must have contingency plans to manage these risks effectively.

- Operational Risks: The reliance on technology exposes issuers to cybersecurity threats. Implementing robust security measures is crucial to protect user funds and maintain trust.

Regulatory Aspects

The regulatory landscape for stablecoins is rapidly evolving:

- EU’s MiCA Regulation: Effective from June 30, 2024, MiCA establishes clear guidelines for stablecoin issuers regarding reserve requirements, consumer protections, and operational standards.

- US Regulatory Uncertainty: In contrast to Europe’s proactive stance, the US has yet to finalize comprehensive regulations for stablecoins. Ongoing discussions in Congress may lead to significant changes but remain uncertain amid political challenges.

- Global Harmonization Efforts: Countries like Singapore are developing frameworks that align with MiCA principles. This trend towards global regulatory alignment may facilitate smoother cross-border transactions involving stablecoins.

Future Outlook

The future of stablecoin governance appears promising but complex:

- Increased Institutional Adoption: As regulatory clarity improves, more traditional financial institutions are expected to engage with stablecoins for payments and investment purposes.

- Technological Advancements: Innovations in blockchain technology will likely enhance the functionality and security of stablecoins, making them more appealing to users.

- Projected Market Growth: Analysts predict that the stablecoin market could reach a valuation exceeding $3.4 trillion by 2029 as adoption spreads across various sectors.

In conclusion, while the developments in stablecoin governance present both opportunities and challenges, proactive engagement with regulatory frameworks and risk management practices will be crucial for issuers aiming to thrive in this dynamic environment.

Frequently Asked Questions About What Are The Latest Developments In Stablecoin Governance

- What are stablecoins?

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve asset like fiat currency or commodities. - Why is regulation important for stablecoins?

Regulation ensures consumer protection, enhances market integrity, prevents fraud, and mitigates systemic risks associated with their use. - How does MiCA affect stablecoin issuers?

The Markets in Crypto-Assets Regulation (MiCA) imposes requirements on issuers regarding reserves, consumer rights, and operational standards within the EU. - What risks do stablecoins face?

Stablecoins face regulatory risks due to evolving legislation, market volatility affecting their peg stability, and operational risks related to technology security. - How are technological innovations impacting stablecoins?

Technological advancements improve transparency through real-time monitoring of reserves and enhance security against cyber threats. - What is the future outlook for stablecoins?

The future looks promising with expected growth in institutional adoption and advancements in blockchain technology potentially reaching a valuation exceeding $3.4 trillion by 2029. - How can investors assess the stability of a stablecoin?

Investors should evaluate the issuer’s reserve management practices, compliance with regulations, transparency measures, and historical performance against its peg. - What role do central banks play in the future of stablecoins?

Central banks may influence the development of regulatory frameworks for stablecoins while also exploring Central Bank Digital Currencies (CBDCs) as alternatives.

This comprehensive overview highlights critical developments in stablecoin governance while addressing current trends and future implications for investors and stakeholders alike.