The landscape of securities litigation is continually evolving, with the Securities and Exchange Commission (SEC) at the forefront of enforcing federal securities laws and protecting investors. In recent years, the SEC has intensified its efforts to combat fraud, enhance market integrity, and adapt to emerging challenges in the financial sector. This comprehensive analysis delves into the most recent developments in SEC securities litigation, offering insights into trends, strategies, and implications for market participants.

| Key Concept | Description/Impact |

|---|---|

| Record Financial Remedies | SEC obtained $8.2 billion in FY 2024, a 66% increase from FY 2023 |

| Enforcement Actions | 583 total actions filed in FY 2024, a 26% decline from FY 2023 |

| Whistleblower Program | 45,130 tips received in FY 2024, the highest ever in one year |

| ESG Litigation | Increasing focus on environmental, social, and governance disclosures |

| Cryptocurrency Enforcement | Ramped up efforts in private litigation and SEC actions |

Market Analysis and Trends

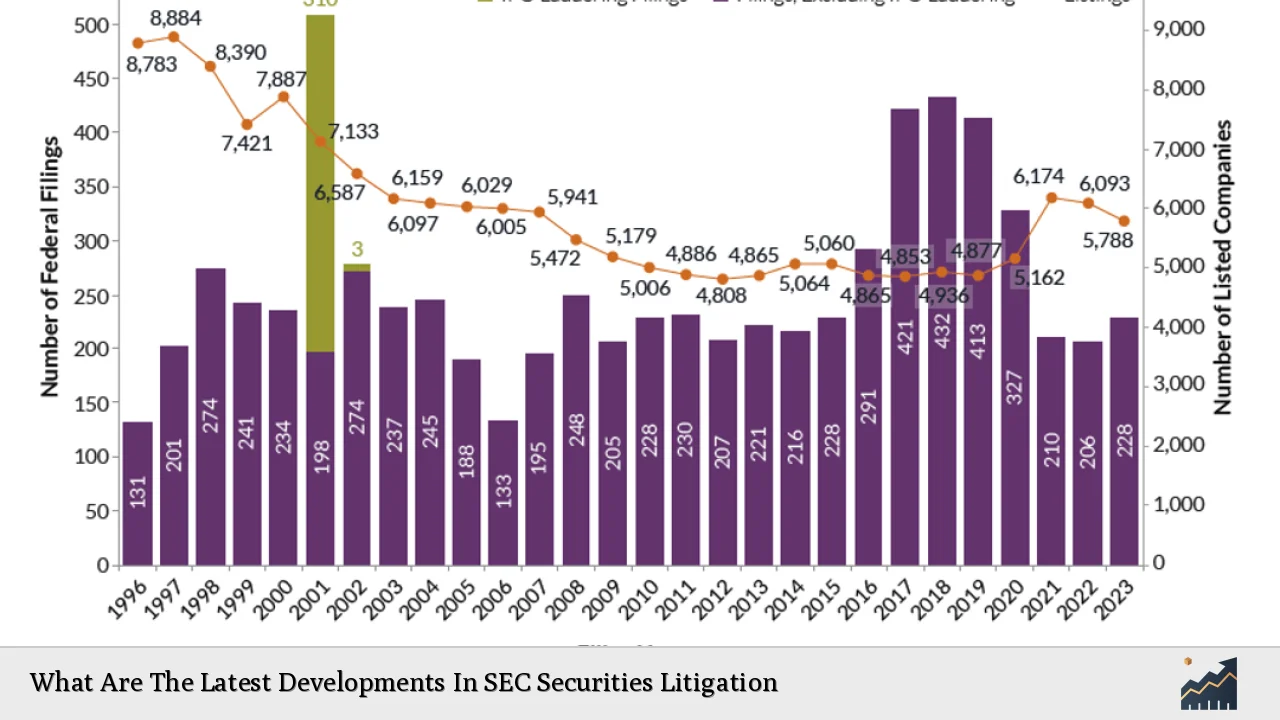

The SEC's enforcement activities in fiscal year 2024 have shown a significant shift in focus and outcomes. While the total number of enforcement actions decreased by 26% compared to the previous year, the financial impact of these actions reached unprecedented levels. The SEC obtained orders for $8.2 billion in financial remedies, marking the highest amount in its history and representing a 66% increase from fiscal year 2023.

This trend suggests that the SEC is prioritizing high-impact cases that result in substantial monetary penalties. The decline in the number of actions filed (583 in FY 2024 compared to 789 in FY 2023) may indicate a more targeted approach, focusing on cases with the potential for significant financial recovery and deterrent effect.

Another notable trend is the continued growth of the SEC's whistleblower program. In fiscal year 2024, the SEC received 45,130 tips, complaints, and referrals, the highest number ever recorded in a single year. This surge in whistleblower activity underscores the program's effectiveness in uncovering potential securities violations and highlights the increasing willingness of individuals to come forward with information.

The types of cases pursued by the SEC have also evolved. There's a growing emphasis on emerging areas such as environmental, social, and governance (ESG) disclosures, cryptocurrency-related fraud, and cybersecurity incidents. These areas reflect the changing landscape of financial markets and the new challenges faced by regulators in protecting investors.

Implementation Strategies

The SEC has adopted several strategies to enhance its enforcement effectiveness:

Proactive Compliance Incentives

The SEC has been encouraging market participants to self-report violations, implement remedial measures, and cooperate meaningfully with investigations. This approach has led to increased self-reporting by public companies, investment advisers, and broker-dealers across various alleged violations, including material misstatements, fraud, and cybersecurity-related control failures.

Focus on Emerging Threats

The SEC has demonstrated agility in addressing new challenges, such as misstatements regarding artificial intelligence and fraudsters using social media for relationship scams. This proactive stance allows the SEC to stay ahead of evolving market risks and protect investors from novel forms of securities fraud.

Enhanced Whistleblower Program

By continuing to reward whistleblowers generously (with $255 million in awards in FY 2024), the SEC maintains a powerful tool for detecting securities violations. The program's success is evident in the record number of tips received, which provides the SEC with valuable leads for potential enforcement actions.

Targeted Enforcement Actions

While the overall number of enforcement actions has decreased, the SEC has focused on high-impact cases that result in significant financial penalties. This strategy allows for more efficient use of resources while still sending a strong deterrent message to potential violators.

Risk Considerations

The evolving nature of SEC enforcement presents several risks for market participants:

Increased Scrutiny of ESG Disclosures: Companies face heightened risks related to their environmental, social, and governance statements. The SEC's focus on this area means that inaccurate or misleading ESG disclosures could lead to enforcement actions.

Cryptocurrency Compliance: The cryptocurrency market remains a high-risk area for securities violations. Market participants in this space must be particularly vigilant about compliance with securities laws, as the SEC continues to ramp up enforcement in this sector.

Cybersecurity Disclosure Risks: With the SEC's increased attention on cybersecurity incidents, companies face potential liability for inadequate disclosures or controls related to cyber risks.

Pure Omissions Liability: The Supreme Court's decision in Macquarie v. Moab Partners clarified that pure omissions are not actionable under Rule 10b-5(b), potentially altering the landscape for disclosure-related litigation.

Regulatory Aspects

Recent regulatory developments have significant implications for securities litigation:

SEC Rule Changes

The SEC has implemented new rules applicable to Special Purpose Acquisition Companies (SPACs), reflecting the increased scrutiny of these investment vehicles. These rules aim to enhance investor protection and transparency in SPAC transactions.

Amendments to Regulation S-P

The SEC has finalized amendments to Regulation S-P, aimed at enhancing data protections. These changes will likely impact how financial institutions handle customer information and may lead to new areas of potential liability.

Clarification on Cybersecurity Disclosures

The SEC has provided guidance on when public companies are required to disclose cybersecurity incidents, emphasizing the importance of timely and accurate reporting of such events.

Future Outlook

Looking ahead, several trends are likely to shape the future of SEC securities litigation:

Continued Focus on Emerging Technologies: As artificial intelligence and blockchain technologies become more prevalent in financial markets, the SEC is expected to increase its scrutiny of related disclosures and practices.

Enhanced Data Analytics: The SEC is likely to leverage advanced data analytics and artificial intelligence to detect potential securities violations more efficiently, potentially leading to more targeted enforcement actions.

Global Coordination: With the increasing interconnectedness of global financial markets, the SEC may seek greater cooperation with international regulators to address cross-border securities violations.

Climate-Related Disclosures: As climate change concerns grow, the SEC is expected to place greater emphasis on climate-related financial disclosures and their accuracy.

Cryptocurrency Regulation: The regulatory framework for cryptocurrencies and digital assets is likely to evolve, potentially leading to new types of enforcement actions in this space.

In conclusion, the latest developments in SEC securities litigation reflect a dynamic regulatory environment adapting to new market realities. While the overall number of enforcement actions has decreased, the record-breaking financial remedies obtained indicate the SEC's commitment to pursuing high-impact cases. Market participants must remain vigilant, particularly in areas such as ESG disclosures, cryptocurrency compliance, and cybersecurity risk management. As the financial landscape continues to evolve, the SEC's enforcement strategies are likely to adapt, presenting both challenges and opportunities for investors and financial institutions alike.

Frequently Asked Questions About What Are The Latest Developments In SEC Securities Litigation

- How has the SEC's enforcement strategy changed in recent years?

The SEC has shifted towards pursuing fewer but higher-impact cases, resulting in record-breaking financial remedies while filing fewer total enforcement actions. There's also an increased focus on emerging areas like ESG disclosures and cryptocurrency-related fraud. - What role does the whistleblower program play in SEC enforcement?

The whistleblower program has become increasingly important, with a record number of tips received in FY 2024. It serves as a crucial tool for detecting potential securities violations and has led to significant enforcement actions. - How is the SEC addressing cryptocurrency-related securities violations?

The SEC has ramped up enforcement efforts in the cryptocurrency space, focusing on both private litigation and SEC actions. This increased scrutiny reflects the growing importance and potential risks associated with digital assets. - What are the implications of the Supreme Court's decision on pure omissions in securities fraud cases?

The Supreme Court ruled that pure omissions are not actionable under Rule 10b-5(b), potentially narrowing the scope of disclosure-related litigation. This decision may impact how companies approach their disclosure practices. - How is the SEC adapting to new technologies in financial markets?

The SEC is increasingly focusing on emerging technologies like artificial intelligence and blockchain. It's also leveraging advanced data analytics to detect potential violations more efficiently. - What should companies be aware of regarding ESG disclosures?

Companies should be particularly cautious about the accuracy and completeness of their ESG disclosures, as this area has become a focus of SEC enforcement. Inaccurate or misleading ESG statements could lead to significant legal and financial consequences. - How might future SEC enforcement trends affect market participants?

Future trends may include increased scrutiny of climate-related disclosures, greater use of data analytics in enforcement, and potentially more global coordination in addressing cross-border securities violations. Market participants should stay informed about these evolving areas to ensure compliance.