Smart contract platforms have revolutionized the way transactions and agreements are executed in a decentralized environment. As these platforms gain traction across various industries, understanding their performance through Key Performance Indicators (KPIs) becomes crucial for investors, developers, and stakeholders. KPIs provide valuable insights into the efficiency, reliability, and overall effectiveness of smart contracts, enabling informed decision-making. This article delves into the key performance indicators for smart contract platforms, exploring market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

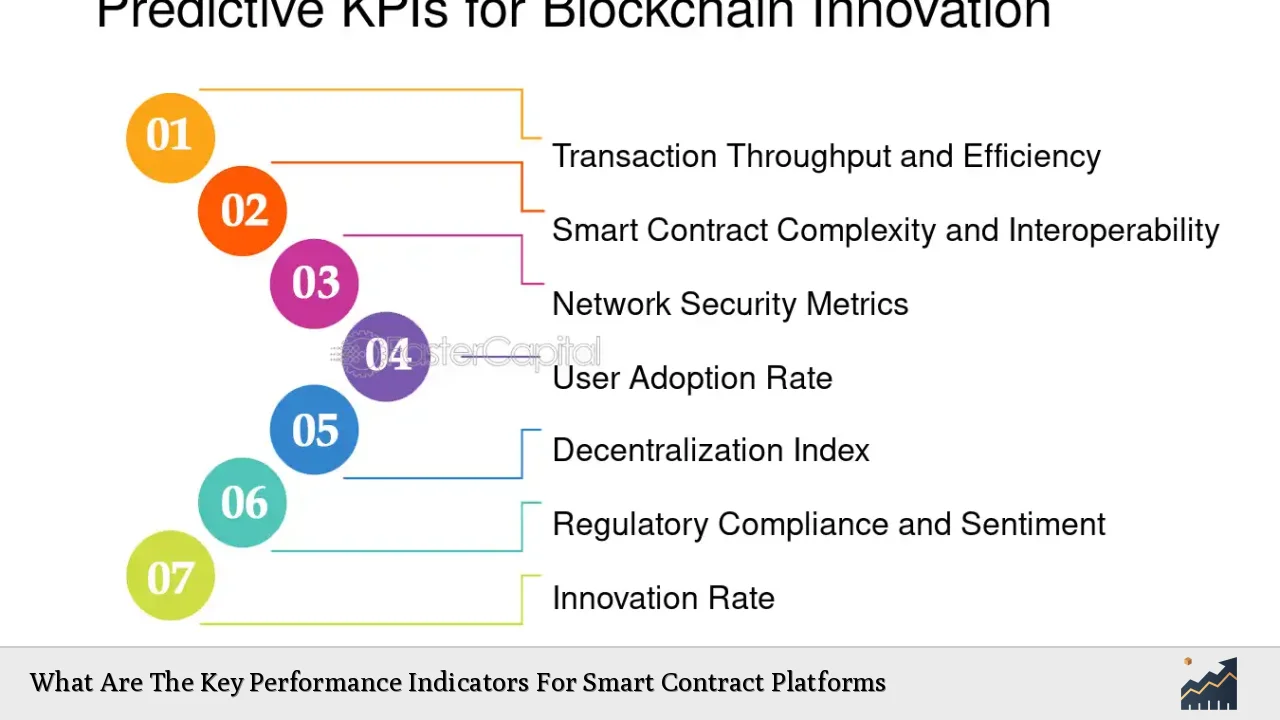

| Transaction Throughput | The number of transactions a smart contract platform can process per second (TPS). Higher throughput indicates better scalability and efficiency. |

| Latency | The time taken for a transaction to be confirmed on the blockchain. Low latency is essential for applications requiring real-time execution. |

| Error Rate | The frequency of failed transactions or executions. A lower error rate signifies higher reliability and user trust in the platform. |

| Execution Cost | The cost associated with executing a smart contract, often measured in ‘gas’ fees. Efficient contracts minimize these costs for users. |

| Security Metrics | Indicators assessing the robustness of smart contracts against vulnerabilities and attacks, including audit results and historical breach data. |

| Scalability | The ability of the platform to handle increasing transaction loads without performance degradation. This is often enhanced through layer-2 solutions. |

| User Adoption Rate | The growth in the number of active users or dApps on the platform. Higher adoption rates indicate greater market acceptance and utility. |

| Interoperability | The capacity of a smart contract platform to interact with other blockchains or systems seamlessly, enhancing its utility across different applications. |

Market Analysis and Trends

The smart contract market is experiencing rapid growth, driven by advancements in blockchain technology and increasing adoption across various sectors. According to recent reports, the global smart contract platforms market was valued at approximately USD 1.21 billion in 2023 and is projected to reach around USD 218.59 billion by 2032, reflecting a staggering compound annual growth rate (CAGR) of 78.12% during this period.

Key trends influencing this market include:

- Increased Automation: Smart contracts automate processes that traditionally require intermediaries, significantly reducing costs and errors.

- Integration with AI: The merging of artificial intelligence with smart contracts is expected to enhance their functionality by enabling adaptive learning and automated decision-making.

- Layer-2 Solutions: To address scalability issues faced by major platforms like Ethereum, layer-2 solutions are being developed to improve transaction speeds and reduce costs.

- Focus on Security: With the rise in cyber threats, there is an increasing emphasis on auditing and securing smart contracts before deployment.

These trends indicate a robust future for smart contract platforms as they evolve to meet market demands.

Implementation Strategies

To effectively leverage smart contract platforms, organizations should consider the following strategies:

- Conduct Thorough Audits: Before deploying any smart contract, perform comprehensive security audits to identify potential vulnerabilities.

- Utilize Layer-2 Solutions: Implement layer-2 solutions to enhance scalability and reduce transaction costs without compromising security.

- Focus on User Experience: Design user-friendly interfaces that simplify interactions with smart contracts to encourage broader adoption.

- Educate Stakeholders: Provide training for developers and users on best practices for creating and interacting with smart contracts to minimize errors.

By adopting these strategies, organizations can maximize the benefits of smart contracts while mitigating associated risks.

Risk Considerations

Despite their advantages, investing in or utilizing smart contract platforms comes with inherent risks:

- Security Vulnerabilities: Smart contracts can be susceptible to bugs or exploits that may lead to significant financial losses.

- Regulatory Uncertainty: The evolving regulatory landscape surrounding blockchain technology can pose compliance challenges for organizations.

- Market Volatility: The cryptocurrency markets can be highly volatile, impacting the value of assets tied to smart contracts.

- Complexity of Integration: Integrating smart contracts with existing systems may require substantial technical expertise and resources.

Understanding these risks is crucial for stakeholders looking to navigate the complexities of smart contract platforms effectively.

Regulatory Aspects

Regulatory frameworks surrounding blockchain technology and smart contracts are still developing globally. Key considerations include:

- Compliance Requirements: Organizations must ensure that their use of smart contracts complies with local laws regarding data protection, financial transactions, and consumer rights.

- Tax Implications: The treatment of transactions executed via smart contracts may vary by jurisdiction, necessitating careful tax planning.

- Licensing Issues: Certain applications of smart contracts may require specific licenses depending on their use case (e.g., financial services).

Staying informed about regulatory changes is essential for organizations operating within this space.

Future Outlook

The future of smart contract platforms looks promising as they continue to evolve alongside technological advancements. Key predictions include:

- Mainstream Adoption: As awareness grows regarding the benefits of blockchain technology, more industries will adopt smart contracts for various applications.

- Enhanced Interoperability: Future developments will likely focus on improving interoperability between different blockchain networks, facilitating seamless interactions across platforms.

- Increased Focus on Sustainability: With growing concerns over energy consumption associated with blockchain operations, there will be a push towards more sustainable practices in developing smart contract platforms.

Overall, as technology progresses and more use cases emerge, the significance of KPIs in evaluating the performance of smart contract platforms will only increase.

Frequently Asked Questions About Key Performance Indicators For Smart Contract Platforms

- What are KPIs in the context of smart contracts?

KPIs are measurable values that indicate how effectively a smart contract platform is achieving its objectives. They help assess performance in areas like transaction speed, cost efficiency, error rates, and user adoption. - How do transaction throughput and latency affect user experience?

Higher transaction throughput allows more transactions to be processed simultaneously, enhancing user experience by reducing wait times. Low latency ensures quick confirmation times for transactions. - What role does security play in evaluating a smart contract platform?

Security metrics are crucial as they reflect how well a platform protects against vulnerabilities and exploits. A secure platform builds trust among users and stakeholders. - Why is scalability important for smart contract platforms?

Scalability ensures that a platform can handle increased demand without performance degradation. This is essential for accommodating growth as more users adopt the technology. - How can organizations mitigate risks associated with using smart contracts?

Organizations can mitigate risks by conducting thorough audits before deployment, utilizing layer-2 solutions for scalability, educating stakeholders about best practices, and staying informed about regulatory changes. - What future trends should investors watch regarding smart contract platforms?

Investors should watch for trends such as increased automation through AI integration, enhanced interoperability between blockchains, greater focus on security audits, and sustainable practices in blockchain operations. - How does user adoption impact the success of a smart contract platform?

User adoption directly influences a platform’s success; higher adoption rates indicate greater utility and acceptance in the market which can lead to increased investment opportunities. - Are there specific industries where smart contracts are particularly beneficial?

Yes, industries such as finance (DeFi), supply chain management, healthcare, real estate, and legal services have seen significant benefits from implementing smart contracts due to their efficiency and transparency.

In conclusion, understanding the key performance indicators for smart contract platforms is vital for stakeholders looking to navigate this rapidly evolving landscape effectively. By focusing on metrics such as transaction throughput, latency, error rates, execution costs, security measures, scalability potential, user adoption rates, and interoperability capabilities—investors can make informed decisions that align with their strategic objectives while maximizing opportunities within this dynamic market.