Understanding the investment stages is crucial for entrepreneurs and investors alike. These stages outline the journey of funding a startup, from its inception to potential public offerings or acquisitions. Each stage represents a different level of maturity for the business and involves various types of investors who are willing to take on specific risks in exchange for potential returns.

The investment journey typically begins with personal resources or funds from family and friends, progressing through several rounds of financing that help the startup grow and scale its operations. The stages include pre-seed, seed, Series A, Series B, Series C, and sometimes additional rounds before an Initial Public Offering (IPO). Each stage has distinct goals, funding amounts, and investor expectations.

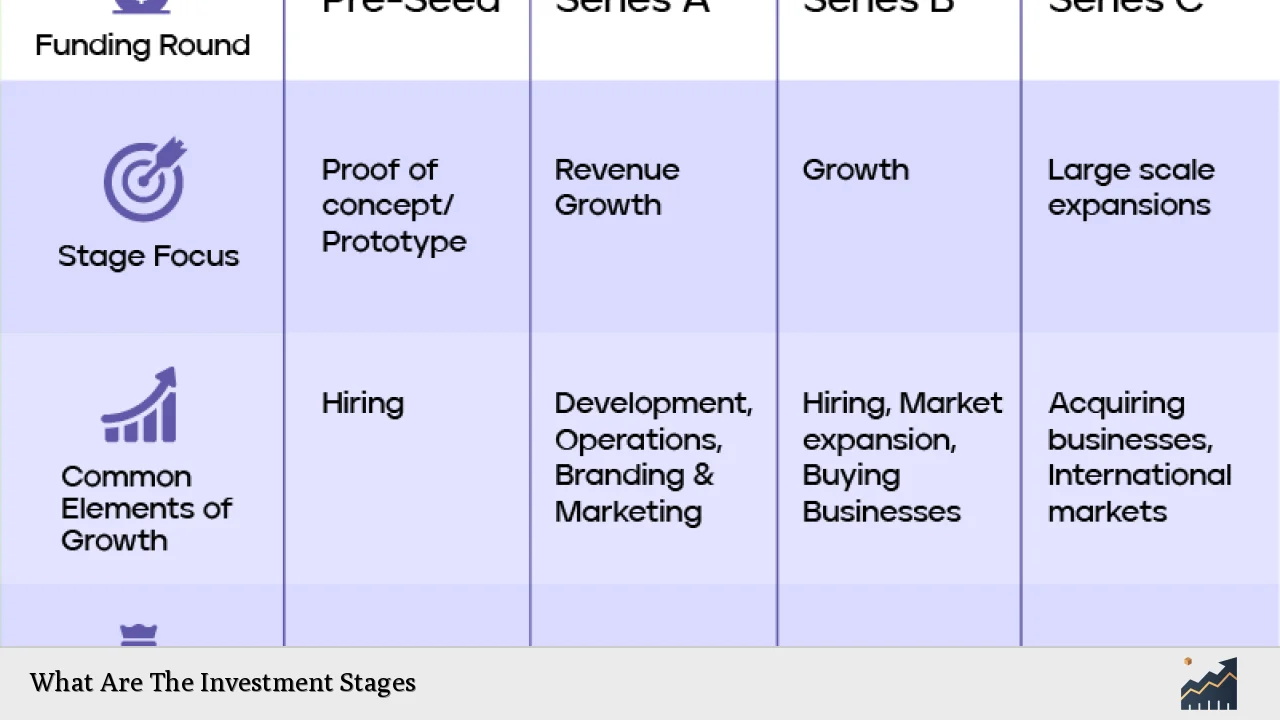

| Investment Stage | Description |

|---|---|

| Pre-Seed | Initial funding to develop a business idea and prototype. |

| Seed | Funding to launch a product and gain early customer traction. |

| Series A | Investment to optimize the product and scale operations. |

| Series B | Funding aimed at expanding market reach and increasing revenue. |

| Series C and Beyond | Investment for further growth, acquisitions, or preparing for IPO. |

Pre-Seed Stage

The pre-seed stage is often considered the very beginning of a startup’s journey. At this phase, entrepreneurs typically rely on their own savings or funds from family and friends. The primary goal is to validate the business idea and develop a minimum viable product (MVP) that can demonstrate potential to future investors.

During this stage, entrepreneurs focus on critical aspects such as market research, developing a business model, and assembling a founding team. It is essential to address questions like whether the idea is viable, how it differs from existing solutions, and what costs will be involved in launching the business. Investors at this stage are usually individuals who believe in the entrepreneur’s vision.

As this phase progresses, startups often seek guidance from mentors or industry experts to refine their concept. This foundational work is crucial as it sets the stage for future funding rounds.

Seed Stage

Once a startup has developed its MVP and gained some initial traction, it enters the seed stage. This phase typically involves raising funds through angel investors or early-stage venture capital firms. The funding amounts can range from $500,000 to $2 million, depending on the startup’s needs and market potential.

The primary focus during the seed stage is on launching the product and acquiring early customers. Funds raised are often used for activities such as product development, marketing efforts, hiring initial team members, and conducting further market research to ensure product-market fit.

Investors in this stage are looking for evidence that the startup can grow significantly. They expect a clear plan outlining how the funds will be used to achieve specific milestones.

Series A Stage

The Series A stage marks a significant milestone in a startup’s life cycle. At this point, startups should have a proven business model with some revenue generation. Funding during this round typically ranges from $2 million to $15 million. This capital is often sourced from venture capital firms that specialize in early-stage investments.

In Series A, startups focus on optimizing their product offerings and scaling their operations. This includes refining marketing strategies, expanding their workforce, and improving customer acquisition processes. Investors expect startups to demonstrate strong growth potential and a clear path toward profitability.

This stage is critical as it sets the foundation for future funding rounds. Companies need to show that they can effectively utilize funds to enhance their market position.

Series B Stage

Following successful Series A funding, startups may pursue Series B funding to further expand their reach. At this stage, companies typically have established user bases and steady revenue streams. Funding amounts can vary widely but generally fall between $7 million to $10 million.

The focus during Series B is on scaling operations significantly—this can include entering new markets, enhancing marketing efforts, or developing new products. Investors are looking for companies that have demonstrated solid growth metrics and have plans for continued expansion.

At this point, startups may also begin attracting larger venture capital firms or private equity investors who are interested in more substantial stakes in high-growth companies.

Series C Stage and Beyond

The Series C stage represents an advanced phase of funding where companies are well-established with proven business models looking to accelerate growth further. Funding amounts can vary significantly but often exceed $10 million, depending on the company’s goals.

During Series C funding rounds, startups may aim for global expansion or consider acquiring other businesses within their industry. Investors at this level are generally more risk-averse but expect substantial returns based on the company’s established performance.

If necessary, companies may pursue additional rounds beyond Series C (often referred to as Series D or E) if they need more capital due to missed targets or new opportunities that arise before an IPO.

Initial Public Offering (IPO)

An Initial Public Offering (IPO) is often seen as the ultimate goal for many startups after navigating through various funding stages. An IPO allows a company to offer its shares publicly for the first time, providing access to significant capital while also increasing its visibility in the market.

Preparing for an IPO requires extensive planning and compliance with regulatory requirements. Companies must demonstrate consistent revenue growth, profitability potential, and robust operational frameworks to attract public investors successfully.

An IPO can provide substantial returns for early investors but also comes with increased scrutiny from shareholders and regulatory bodies. Therefore, careful consideration must be given before pursuing this final stage of investment.

FAQs About Investment Stages

- What is the pre-seed stage?

The pre-seed stage involves initial funding from personal resources or family to develop a business idea. - How much funding is typically raised during seed funding?

Seed funding usually ranges from $500,000 to $2 million depending on market potential. - What happens during Series A funding?

Series A funding focuses on optimizing products and scaling operations with investments ranging from $2 million to $15 million. - What is the purpose of Series B funding?

Series B funding aims at expanding market reach and increasing revenue through investments typically between $7 million to $10 million. - What does an IPO signify?

An IPO signifies that a company is offering its shares publicly for the first time to raise significant capital.

Understanding these investment stages helps entrepreneurs navigate their fundraising journey effectively while enabling investors to assess risk levels associated with each phase of investment. By recognizing where a startup stands within these stages, both parties can make informed decisions that align with their goals.