Investment options are diverse and cater to various risk appetites, financial goals, and time horizons. Understanding these options can help individuals make informed decisions about where to allocate their resources. This article will delve into the primary investment types available today, providing insights into their characteristics, benefits, and potential risks.

Investing is crucial for wealth building and financial security. It allows individuals to grow their capital over time, often outpacing inflation and increasing purchasing power. Different investment vehicles offer varying levels of risk and return, making it essential for investors to choose options that align with their financial objectives.

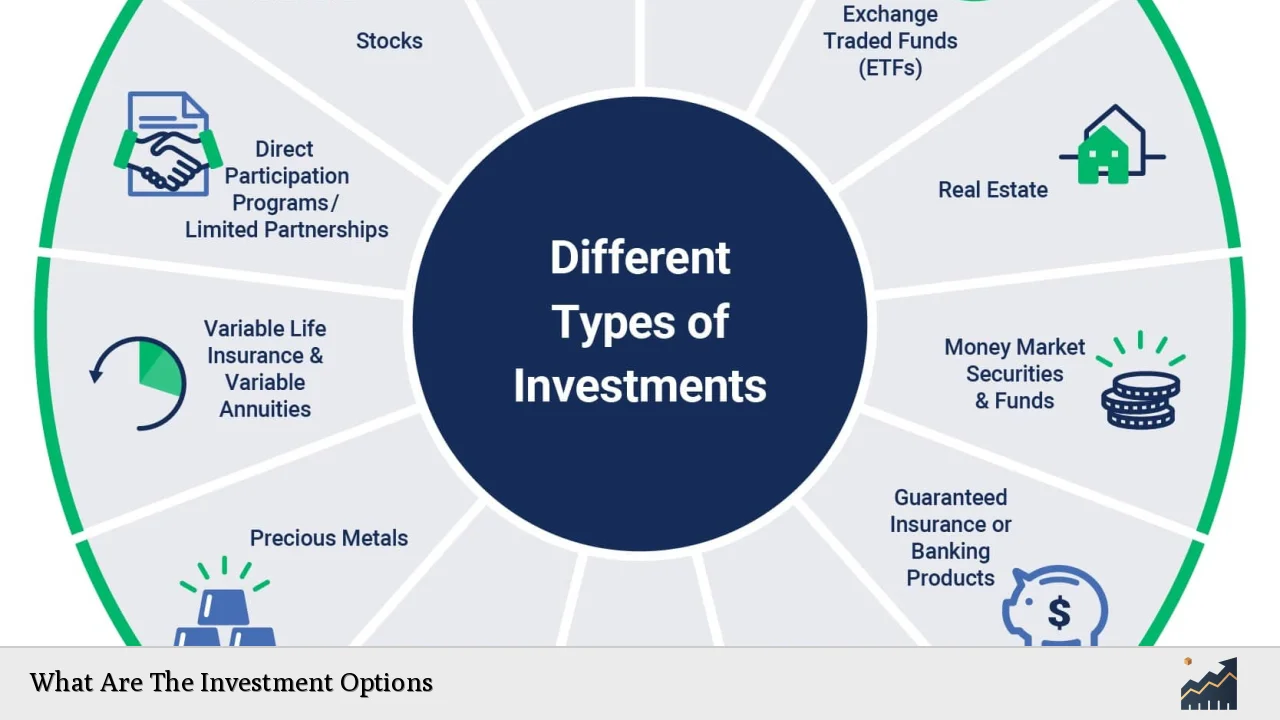

The following table summarizes the main types of investment options:

| Investment Type | Description |

|---|---|

| Stocks | Ownership in a company, offering potential for capital appreciation and dividends. |

| Bonds | Debt securities providing fixed interest payments over time. |

| Mutual Funds | Pooled investments managed by professionals, diversifying across various assets. |

| ETFs | Funds traded on stock exchanges, combining features of stocks and mutual funds. |

| Real Estate | Investments in property for rental income or capital appreciation. |

| Commodities | Physical goods like gold or oil, traded for profit based on market fluctuations. |

| Cryptocurrencies | Digital currencies operating on blockchain technology, known for high volatility. |

Stocks

Stocks represent ownership in a company. When you buy shares, you become a shareholder, entitled to a portion of the company’s profits. Stocks can be categorized into common stocks, which may pay dividends and allow voting rights, and preferred stocks, which typically offer fixed dividends but no voting rights.

Investing in stocks can yield high returns over the long term, especially if the company performs well. However, stocks also come with higher risks due to market volatility. Prices can fluctuate significantly based on economic conditions, company performance, and investor sentiment.

Investors can choose between individual stocks or stock funds, such as mutual funds or ETFs that pool money from multiple investors to buy a diversified portfolio of stocks. This diversification helps mitigate risk as it reduces exposure to any single stock’s performance.

Bonds

Bonds are debt instruments issued by corporations or governments to raise capital. When you purchase a bond, you are essentially lending money in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds are generally considered safer than stocks but offer lower potential returns.

There are various types of bonds:

- Government bonds: Issued by national governments; considered low-risk.

- Corporate bonds: Issued by companies; risk varies based on the issuer’s creditworthiness.

- Municipal bonds: Issued by local governments; often tax-exempt.

Bonds can be an excellent choice for those seeking steady income with lower volatility than stocks. However, they are subject to interest rate risk; when rates rise, bond prices typically fall.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions based on the fund’s objectives.

Investing in mutual funds offers several advantages:

- Diversification: Reduces risk by spreading investments across various assets.

- Professional management: Fund managers conduct research and manage investments actively.

- Accessibility: Many mutual funds have low minimum investment requirements.

However, mutual funds charge management fees that can eat into returns. Additionally, they may not perform as well as individual stock investments in a booming market.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. This allows investors to buy and sell shares throughout the trading day at market prices. ETFs often track specific indices or sectors, providing an easy way to gain exposure to a particular market segment.

Key benefits of ETFs include:

- Liquidity: Can be bought or sold at any time during trading hours.

- Lower fees: Generally have lower expense ratios than mutual funds.

- Tax efficiency: Often more tax-efficient due to their structure.

ETFs offer diversification and flexibility but may involve trading commissions depending on the brokerage platform used.

Real Estate

Investing in real estate involves purchasing properties for rental income or capital appreciation. Real estate can provide a steady cash flow through rent while also appreciating over time as property values increase.

Types of real estate investments include:

- Residential properties: Single-family homes or multi-family units rented out to tenants.

- Commercial properties: Office buildings or retail spaces leased to businesses.

- Real Estate Investment Trusts (REITs): Companies that own or finance income-producing real estate; traded like stocks.

Real estate investments require significant capital upfront and ongoing management but can be rewarding long-term investments if chosen wisely.

Commodities

Commodities are physical goods such as metals (gold, silver), energy (oil), and agricultural products (wheat). Investors trade commodities through futures contracts or invest in commodity-focused ETFs.

Commodities can serve as a hedge against inflation and economic uncertainty. However, they tend to be highly volatile due to fluctuating supply and demand dynamics influenced by geopolitical events and natural disasters.

Investing in commodities requires understanding market trends and may not be suitable for all investors due to their inherent risks.

Cryptocurrencies

Cryptocurrencies are digital currencies that use cryptography for security. Bitcoin is the most well-known cryptocurrency but thousands of alternatives exist. Cryptocurrencies operate on decentralized networks using blockchain technology.

Investing in cryptocurrencies offers:

- High potential returns: Prices can skyrocket quickly.

- Diversification: Adds an alternative asset class to portfolios.

However, cryptocurrencies are extremely volatile and speculative. Investors should exercise caution due to regulatory uncertainties and potential losses from price fluctuations.

Alternative Investments

Alternative investments encompass a wide range of assets outside traditional categories like stocks and bonds. These may include hedge funds, private equity, collectibles (artwork), and more complex financial instruments like derivatives.

Alternative investments often require higher minimum investments and may not be as liquid as traditional assets. They can provide diversification benefits but come with unique risks that investors should understand before committing capital.

FAQs About Investment Options

- What are the main types of investment options?

The main types include stocks, bonds, mutual funds, ETFs, real estate, commodities, and cryptocurrencies. - How do I choose an investment option?

Consider your financial goals, risk tolerance, investment horizon, and whether you prefer active management or passive investing. - Are stocks safer than bonds?

No, stocks generally carry higher risks than bonds but also offer greater potential returns over time. - What is the benefit of investing in mutual funds?

Mutual funds provide diversification and professional management for investors who may lack the time or expertise to manage individual investments. - Can I invest in real estate without buying property?

Yes, you can invest in real estate through REITs or real estate-focused ETFs without directly owning property.

Investment options are vast and varied. Understanding each type’s characteristics helps individuals make informed decisions tailored to their financial goals. Whether seeking growth through stocks or stability through bonds, careful consideration of these options is essential for successful investing.