Decentralized Finance (DeFi) has emerged as a transformative force in the financial sector, enabling users to engage in financial transactions without intermediaries. However, the rapid growth of DeFi has raised significant regulatory concerns. As regulators worldwide grapple with the unique challenges posed by this innovative sector, understanding the implications of regulatory compliance becomes crucial for DeFi projects. This article explores the current market landscape, implementation strategies, risk considerations, and future outlook regarding regulatory compliance in DeFi.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Challenges | DeFi operates on decentralized networks, complicating traditional regulatory frameworks and creating ambiguity in compliance obligations. |

| Consumer Protection | Direct interactions with protocols increase risks for consumers, necessitating clear guidelines and standards to ensure user safety. |

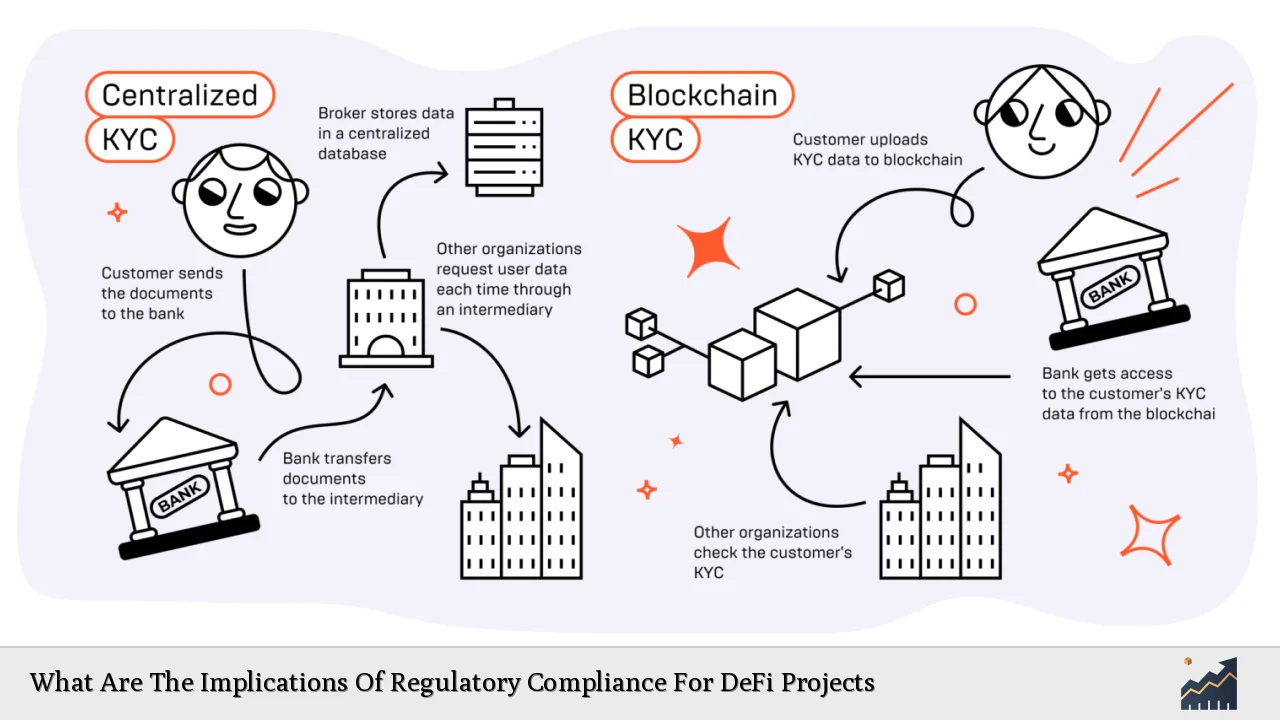

| KYC and AML Compliance | DeFi projects face challenges in implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) measures due to their decentralized nature. |

| Smart Contract Security | The immutability of smart contracts poses compliance challenges; vulnerabilities can lead to significant financial losses. |

| Global Coordination | Cross-border operations of DeFi projects require international regulatory cooperation to prevent regulatory arbitrage. |

| Regulatory Sandboxes | Innovation hubs allow DeFi projects to experiment with compliance frameworks while fostering collaboration with regulators. |

| Future Regulatory Trends | Increased scrutiny from regulators is expected, with potential penalties for non-compliance becoming more common. |

Market Analysis and Trends

The DeFi market is currently experiencing a complex evolution characterized by both growth opportunities and regulatory challenges. According to Statista, the global DeFi market is projected to experience a decline of approximately 9.98% from 2024 to 2025, resulting in a market volume of about $376.9 million by 2025. This downturn reflects growing regulatory scrutiny and the need for compliance measures that could hinder innovation.

Key trends influencing the DeFi landscape include:

- Rise of Decentralized Exchanges (DEXs): DEXs facilitate peer-to-peer trading without intermediaries, but they also attract regulatory attention due to concerns over illicit activities.

- Yield Farming: Users are increasingly participating in yield farming to earn rewards by providing liquidity to DeFi protocols, raising questions about the sustainability and risk management of such practices.

- Integration of NFTs: The incorporation of Non-Fungible Tokens (NFTs) into DeFi platforms is gaining traction, offering new collateralization methods but also complicating regulatory classification.

The growing demand for decentralized financial services highlights the need for clear regulatory frameworks that can accommodate innovation while ensuring consumer protection and financial stability.

Implementation Strategies

To navigate the complex regulatory landscape, DeFi projects must adopt comprehensive implementation strategies that address compliance challenges effectively. These strategies include:

- Developing Robust KYC/AML Procedures: Implementing identity verification mechanisms is essential for preventing illicit activities. Although many DeFi platforms value user privacy, integrating KYC measures can enhance trust among users and regulators alike.

- Smart Contract Auditing: Regular audits of smart contracts are critical for identifying vulnerabilities that could lead to exploitation. Independent third-party audits can provide assurance regarding the security and functionality of these contracts.

- Engaging with Regulatory Bodies: Proactive engagement with regulators can foster understanding and collaboration. Participating in discussions about developing appropriate regulations can help shape a favorable environment for innovation.

- Utilizing Regulatory Sandboxes: Establishing partnerships with regulators through innovation hubs allows DeFi projects to test their models under controlled conditions while ensuring compliance with existing regulations.

Risk Considerations

The decentralized nature of DeFi introduces unique risks that must be managed carefully:

- Regulatory Uncertainty: Ambiguity surrounding which regulations apply to specific DeFi activities can deter institutional investors and hinder project viability. Clear guidelines are essential for fostering confidence within the ecosystem.

- Consumer Risks: Users bear responsibility for managing their assets directly on DeFi platforms, which increases exposure to potential losses from hacks or scams. Regulators must establish standards for transparency and risk disclosure.

- Jurisdictional Challenges: Operating across multiple jurisdictions complicates compliance efforts due to varying regulations. This creates opportunities for regulatory arbitrage, where projects may seek less stringent environments.

- Technological Vulnerabilities: The reliance on smart contracts means that any coding errors or vulnerabilities can have significant repercussions. Continuous monitoring and adaptive compliance measures are necessary to mitigate these risks.

Regulatory Aspects

Regulatory bodies globally are beginning to recognize the need for frameworks that address the unique characteristics of DeFi:

- Global Coordination Efforts: Organizations like the Financial Action Task Force (FATF) advocate for international cooperation to establish consistent standards across jurisdictions, reducing opportunities for regulatory arbitrage.

- Evolving Regulatory Frameworks: The U.S. SEC has utilized the Howey Test to classify certain crypto tokens as securities, indicating a shift toward stricter oversight of DeFi projects.

- Emerging Compliance Technologies: Concepts like “compliance-by-design” and “dynamic compliance” leverage advanced technologies such as AI and blockchain analytics to enhance monitoring capabilities within decentralized markets.

Future Outlook

As we look ahead, several trends will shape the future of regulatory compliance in DeFi:

- Increased Regulatory Scrutiny: With regulators ramping up enforcement actions against non-compliant projects, it is crucial for DeFi participants to adopt proactive compliance measures or risk facing substantial penalties.

- Potential for New Regulations: As regulators gain more insights into the workings of DeFi, we may see tailored regulations that better fit its decentralized nature while ensuring consumer protection and financial stability.

- Collaboration Between Stakeholders: The future success of DeFi will depend on collaboration between industry participants and regulators. Establishing minimum standards and best practices will be essential for fostering a safe and compliant ecosystem.

Frequently Asked Questions About What Are The Implications Of Regulatory Compliance For DeFi Projects

- What are the main regulatory challenges facing DeFi projects?

DeFi projects face challenges related to ambiguity in existing regulations, difficulties in implementing KYC/AML measures, and jurisdictional complexities that complicate compliance efforts. - How do KYC and AML requirements affect user privacy?

KYC and AML requirements necessitate identity verification processes that may conflict with the privacy principles valued by many users in the DeFi community. - What role do smart contracts play in regulatory compliance?

Smart contracts automate transactions but pose unique challenges for compliance due to their immutable nature; any vulnerabilities can lead to significant risks. - How can DeFi projects engage with regulators effectively?

DeFi projects can engage with regulators through proactive communication, participation in discussions about regulation development, and collaboration within regulatory sandboxes. - What is regulatory arbitrage in the context of DeFi?

Regulatory arbitrage occurs when individuals or businesses exploit differences in regulations between jurisdictions, allowing them to bypass stricter regulations by operating from less regulated areas. - What future trends should we expect in DeFi regulation?

We can expect increased scrutiny from regulators, potential new regulations tailored specifically for DeFi, and greater collaboration between industry stakeholders and regulators. - How does global coordination impact DeFi regulation?

Global coordination among regulators helps establish consistent standards across jurisdictions, reducing opportunities for non-compliance and enhancing consumer protection. - What are some best practices for ensuring compliance in DeFi?

Best practices include implementing robust KYC/AML procedures, conducting regular smart contract audits, engaging with regulators proactively, and utilizing emerging compliance technologies.

The implications of regulatory compliance for DeFi projects are profound. As this sector continues to evolve rapidly, it is imperative for all stakeholders—developers, users, investors, and regulators—to work collaboratively towards a balanced approach that fosters innovation while ensuring safety and security within the financial ecosystem.