The emergence of quantum computing stands to revolutionize various sectors, including finance and technology, with significant implications for smart contract platforms. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, rely heavily on cryptographic algorithms for security. As quantum computers advance, they pose a potential threat to these cryptographic foundations, raising concerns about the integrity and security of blockchain systems that utilize smart contracts. This article explores the implications of quantum computing on smart contract platforms, focusing on market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

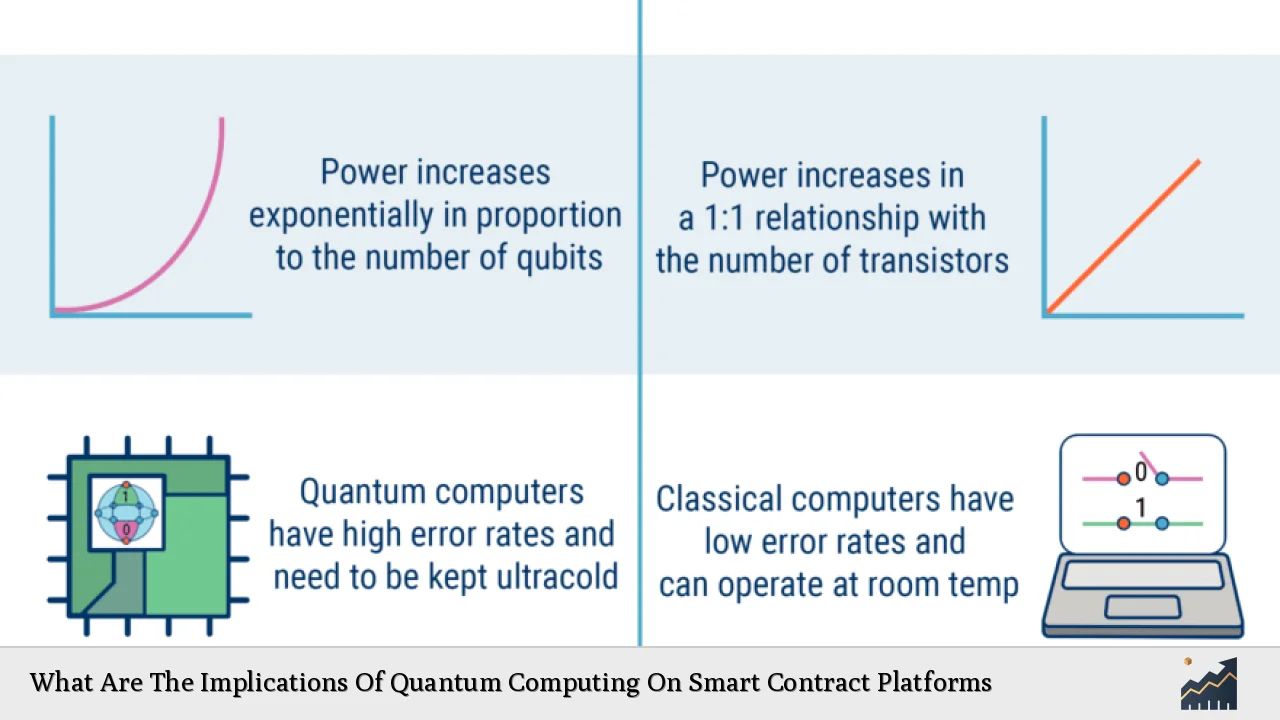

| Quantum Threat to Cryptography | Quantum computers can potentially break widely used cryptographic algorithms like RSA and ECDSA, undermining the security of smart contracts. |

| Quantum-Resistant Algorithms | Development of quantum-resistant cryptographic protocols is essential to protect smart contracts from quantum attacks. |

| Market Growth | The quantum computing market is projected to grow from USD 1.5 billion in 2023 to USD 9.7 billion by 2030, indicating increased investment in quantum technologies. |

| Regulatory Frameworks | Regulatory bodies may need to update frameworks to address the challenges posed by quantum computing in financial technologies. |

| Future Innovations | The integration of quantum computing with AI and machine learning could enhance the functionality and efficiency of smart contracts. |

Market Analysis and Trends

The global quantum computing market is experiencing rapid growth, driven by advancements in technology and increasing investments from both private and public sectors. In 2023, the market was valued at approximately USD 1.5 billion and is expected to reach USD 9.7 billion by 2030, growing at a compound annual growth rate (CAGR) of around 40%. This surge is largely attributed to the potential applications of quantum computing in various fields, including finance, healthcare, and cryptography.

As companies recognize the transformative potential of quantum technologies, there is a notable shift towards developing quantum-resistant systems. Financial institutions are particularly interested in ensuring that their blockchain implementations can withstand future quantum threats. The urgency for such adaptations is underscored by the fact that existing cryptographic methods used in smart contracts may become vulnerable as quantum computing technology matures.

Implementation Strategies

To mitigate the risks associated with quantum computing, smart contract platforms must adopt several implementation strategies:

- Adoption of Quantum-Resistant Cryptography: Transitioning to post-quantum cryptographic algorithms such as lattice-based or code-based cryptography can enhance security against potential quantum attacks. These algorithms are designed to be resistant to the computational capabilities of quantum computers.

- Hybrid Signature Schemes: Implementing hybrid digital signatures that combine classical and quantum-secure signatures can provide a dual layer of protection against both classical and quantum threats.

- Regular System Updates: Continuous updates and audits of smart contract platforms are crucial to ensure they remain secure against evolving threats from quantum computing.

- Cross-Chain Interoperability: Developing multi-chain solutions that allow smart contracts to operate across different blockchain networks can enhance scalability while also distributing risk.

Risk Considerations

The introduction of quantum computing into the realm of smart contracts brings several risk considerations:

- Security Vulnerabilities: Quantum computers have the potential to break existing encryption methods used in smart contracts, leading to unauthorized access or manipulation of contract terms.

- Transaction Integrity: If attackers exploit vulnerabilities before systems transition to quantum-resistant protocols, they could compromise transaction integrity within blockchain networks.

- Market Disruption: The financial sector may face significant disruptions if critical infrastructure is compromised due to inadequate preparation for quantum threats.

- Compliance Risks: As regulatory bodies begin addressing these emerging threats, organizations must ensure compliance with new standards related to quantum security.

Regulatory Aspects

Regulatory frameworks will need to evolve alongside technological advancements in quantum computing. Key considerations include:

- Updating Compliance Standards: Regulatory bodies must establish guidelines for implementing quantum-resistant technologies within financial systems that utilize smart contracts.

- Risk Assessment Protocols: Organizations should develop comprehensive risk assessment protocols that account for potential vulnerabilities introduced by quantum computing.

- Collaboration with Tech Developers: Regulators should work closely with technology developers to ensure that emerging solutions meet safety and compliance standards.

Future Outlook

The future of smart contract platforms in a post-quantum world looks promising but requires proactive measures:

- Increased Investment in Quantum Technologies: As the market for quantum computing grows, continued investment will be crucial for developing robust solutions that address security concerns.

- Integration with AI: The combination of AI and quantum computing could lead to more intelligent smart contracts capable of self-adapting based on real-time data analysis.

- Global Collaboration: Countries must collaborate on research and development initiatives aimed at creating universal standards for post-quantum cryptography in blockchain technologies.

In conclusion, while the implications of quantum computing on smart contract platforms present significant challenges, they also offer opportunities for innovation and advancement. By adopting proactive strategies and embracing new technologies, stakeholders can safeguard their investments and ensure the continued evolution of secure digital agreements.

Frequently Asked Questions About What Are The Implications Of Quantum Computing On Smart Contract Platforms

- What is a smart contract?

A smart contract is a self-executing contract where the terms are directly written into code on a blockchain. - How does quantum computing threaten blockchain technology?

Quantum computing can potentially break traditional cryptographic algorithms used in blockchain systems, jeopardizing their security. - What are post-quantum cryptographic algorithms?

Post-quantum algorithms are cryptographic methods designed to be secure against attacks from quantum computers. - What steps can organizations take to prepare for quantum threats?

Organizations should adopt hybrid signature schemes, update their cryptographic protocols, and regularly audit their systems for vulnerabilities. - Are there any regulatory frameworks addressing quantum risks?

Currently, many regulatory bodies are beginning to explore guidelines for implementing quantum-resistant technologies but comprehensive frameworks are still developing. - What role does AI play in enhancing smart contracts?

AI can improve the functionality of smart contracts by enabling them to process large amounts of data quickly and make intelligent decisions based on analytics. - What is the expected growth trajectory for the quantum computing market?

The global quantum computing market is projected to grow significantly from USD 1.5 billion in 2023 to USD 9.7 billion by 2030. - How can organizations ensure compliance with new regulations?

Organizations should stay informed about regulatory changes and work closely with legal experts to adapt their systems accordingly.

This comprehensive analysis highlights not only the risks posed by quantum computing but also the proactive measures required by stakeholders in financial markets and technology sectors. By understanding these implications thoroughly, investors and professionals can better navigate this evolving landscape.