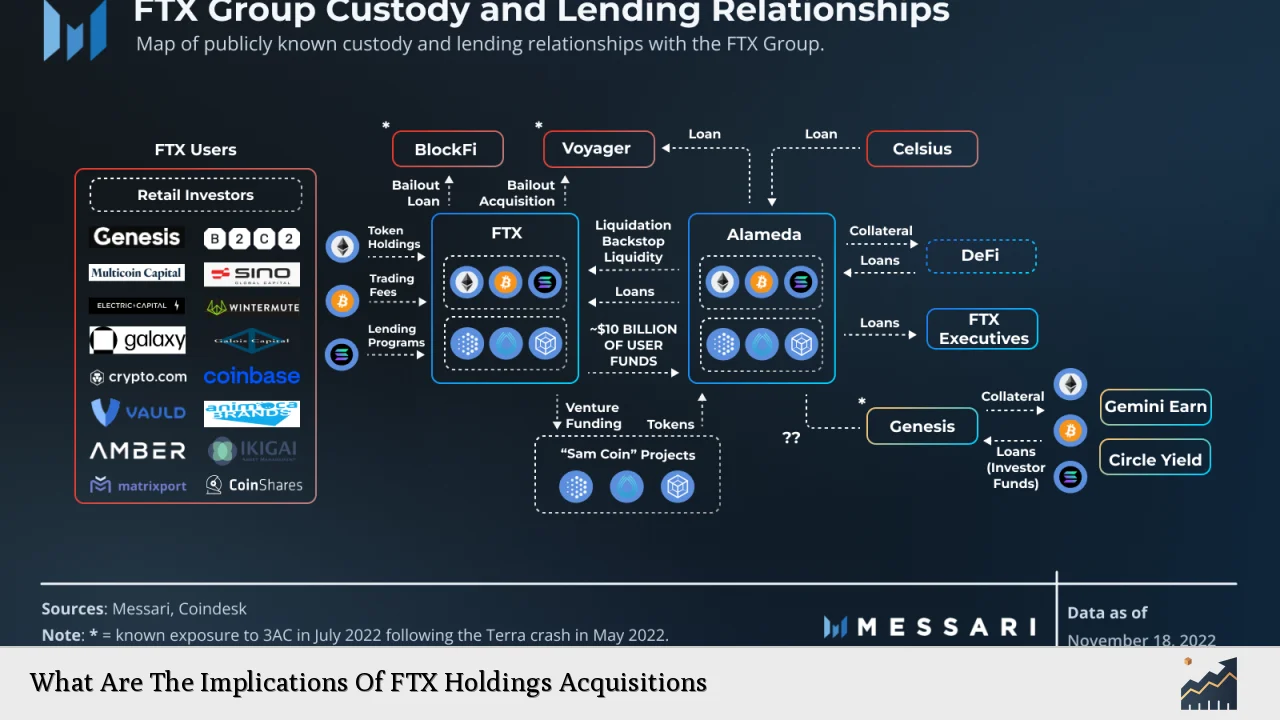

The collapse of FTX, once a leading cryptocurrency exchange, sent shockwaves through the financial and cryptocurrency markets. Its rapid rise and subsequent downfall highlighted significant vulnerabilities within the crypto ecosystem, particularly concerning acquisitions and the management of assets. As FTX engaged in various acquisitions leading up to its bankruptcy, understanding the implications of these actions is crucial for investors, regulators, and industry participants.

| Key Concept | Description/Impact |

|---|---|

| FTX’s Acquisition Strategy | FTX acquired several companies, including BlockFi and LedgerX, to expand its market presence and regulatory compliance. These acquisitions aimed to stabilize its operations but ultimately contributed to its liabilities. |

| Market Confidence | The collapse eroded trust in cryptocurrency exchanges, leading to a significant drop in asset values across the board. This has implications for future investments and market stability. |

| Regulatory Scrutiny | Increased scrutiny from regulatory bodies such as the SEC is expected, potentially leading to stricter regulations on cryptocurrency exchanges and their acquisition strategies. |

| Impact on Acquired Entities | Companies acquired by FTX are facing financial distress due to their ties with the collapsed exchange, impacting their operations and investor confidence. |

| Future of Crypto Acquisitions | The FTX debacle may lead to a more cautious approach towards acquisitions in the crypto space, with potential investors seeking more transparency and stability. |

Market Analysis and Trends

The FTX collapse marked a pivotal moment in the cryptocurrency market. Following its bankruptcy filing in November 2022, the ripple effects were felt across various sectors:

- Market Downturn: Bitcoin and other major cryptocurrencies experienced significant price drops, with Bitcoin falling to its lowest levels in two years. This decline can be attributed to a loss of confidence among investors, leading to increased volatility.

- Investor Behavior: The crisis prompted many retail investors to withdraw funds from exchanges en masse, fearing further collapses. This behavior reflects a broader trend of risk aversion that may persist in the wake of such high-profile failures.

- Shift in Investment Strategies: Investors are now more inclined to seek out projects with robust fundamentals and transparency rather than speculative ventures. This shift could lead to a consolidation phase within the industry as weaker projects fail to attract funding.

Implementation Strategies

In light of the FTX fallout, stakeholders must adopt strategic measures to navigate the evolving landscape:

- Due Diligence: Investors should conduct thorough due diligence before engaging with cryptocurrency exchanges or investing in related projects. Understanding financial health and governance structures is critical.

- Diversification: To mitigate risks associated with individual assets or platforms, investors should diversify their portfolios across various cryptocurrencies and blockchain technologies.

- Focus on Regulation: Companies looking to enter or expand within the crypto space should prioritize compliance with regulatory frameworks. This includes transparent reporting practices and risk management protocols.

Risk Considerations

The implications of FTX’s acquisitions extend beyond immediate financial losses:

- Liquidity Risks: Many companies associated with FTX are now facing liquidity crises themselves. The interconnectedness of these firms means that failures can cascade through the ecosystem.

- Legal Liabilities: Acquired entities may face lawsuits or regulatory actions stemming from their association with FTX. This uncertainty can deter potential investors and partners.

- Reputational Damage: The stigma attached to FTX’s collapse may linger, affecting market perceptions of other exchanges or projects even if they have no direct ties to FTX.

Regulatory Aspects

The fallout from FTX has prompted a reevaluation of regulatory frameworks governing cryptocurrency transactions:

- Increased Oversight: Regulatory bodies like the SEC are likely to impose stricter regulations on cryptocurrency exchanges regarding asset management and customer fund protection.

- Legislative Changes: Lawmakers are considering new legislation aimed at preventing similar incidents in the future, focusing on transparency requirements and operational standards for crypto firms.

- Global Coordination: As cryptocurrencies operate across borders, international cooperation among regulators will be essential in establishing comprehensive guidelines that protect investors while fostering innovation.

Future Outlook

Looking ahead, the implications of FTX’s acquisitions will shape the future landscape of cryptocurrency:

- Market Recovery: While some analysts predict a prolonged “crypto winter,” others believe that recovery is possible as new regulations restore investor confidence over time.

- Innovation Focus: The crisis may lead to a renewed focus on innovative projects that provide tangible utility rather than speculative assets. Investors will likely favor technologies that address real-world problems.

- Evolving Business Models: Companies may pivot towards more sustainable business models that emphasize transparency and risk management, reducing reliance on speculative trading practices.

Frequently Asked Questions About What Are The Implications Of FTX Holdings Acquisitions

- What led to FTX’s collapse?

The collapse was primarily due to mismanagement of customer funds, lack of liquidity, and significant exposure to its native token (FTT), which was used as collateral for loans. - How did FTX’s acquisitions affect other companies?

Many companies acquired by FTX are now facing financial difficulties due to their ties with the exchange, leading to potential insolvencies. - What regulatory changes can we expect after FTX?

We can expect increased regulatory scrutiny on cryptocurrency exchanges regarding transparency, customer fund management, and operational standards. - How should investors approach cryptocurrencies post-FTX?

Investors should prioritize due diligence, diversify their portfolios, and focus on projects with strong fundamentals. - Will there be more acquisitions in the crypto space?

The landscape may see a cautious approach towards acquisitions as companies seek stability and transparency before engaging in mergers or purchases. - What impact did FTX have on market confidence?

The collapse significantly eroded trust among investors in cryptocurrency exchanges, leading to increased volatility and withdrawal behaviors across platforms. - How does this affect future innovations in blockchain technology?

The focus may shift towards projects that offer real utility rather than speculation-driven ventures as investor confidence is restored over time. - What lessons can be learned from the FTX saga?

The importance of transparency, proper risk management practices, and regulatory compliance cannot be overstated; these factors are crucial for sustaining investor trust.

The implications of FTX’s acquisitions are profound and multifaceted. As stakeholders navigate this turbulent landscape, lessons learned will shape future strategies within both investment practices and regulatory frameworks.