Decentralized Finance (DeFi) has rapidly evolved into a multi-trillion-dollar segment of the financial ecosystem, characterized by its innovative protocols and the ability to create new platforms through forking. A fork occurs when developers copy an existing DeFi protocol’s code to create a new project, often with modifications. This practice has significant implications for the DeFi landscape, affecting everything from market dynamics and investor behavior to regulatory considerations and future growth trajectories. Understanding these implications is crucial for investors, developers, and stakeholders in the DeFi space.

| Key Concept | Description/Impact |

|---|---|

| Market Saturation | The proliferation of forks can lead to market saturation, making it difficult for new projects to gain traction and differentiate themselves. |

| Innovation vs. Imitation | While forks can spur innovation by introducing new features, they often result in mere imitations of successful protocols, hindering genuine advancement. |

| Investor Behavior | Forks can attract speculative investment due to potential high returns, but they also increase risks associated with scams and failed projects. |

| Network Effects | Successful forks may struggle to replicate the network effects that established protocols enjoy, limiting their long-term viability. |

| Regulatory Scrutiny | The rise of forks raises questions about intellectual property rights and regulatory compliance, as many projects operate in a legal gray area. |

| Security Risks | Forks can introduce security vulnerabilities if not properly audited, leading to potential exploits and loss of funds. |

| Market Dynamics | The rapid creation of forks can disrupt existing market dynamics, leading to volatility in token prices and liquidity challenges. |

| Community Engagement | Forks often lead to fragmented communities, which can dilute user engagement and loyalty across different platforms. |

Market Analysis and Trends

The DeFi market has seen explosive growth over the past few years. As of January 2024, approximately $55.95 billion is locked in DeFi platforms, up significantly from just $9.1 billion in July 2020. This growth is attributed to various factors including increased adoption of blockchain technology, the rise of decentralized exchanges (DEXs), and innovative financial products such as yield farming and liquidity pools.

Current Trends

- Increased Forking Activity: The number of forks has surged as developers seek to capitalize on successful protocols like Uniswap and Compound. For instance, Uniswap’s code has been forked extensively, with over 35% of all tracked forks derived from it.

- Market Fragmentation: The influx of new projects creates a fragmented market where users may struggle to find reliable platforms amidst numerous options.

- Focus on Security: With the rise of forks comes heightened scrutiny on security practices. Many projects face challenges related to smart contract vulnerabilities and potential exploits.

- Regulatory Developments: As forks proliferate, regulators are increasingly concerned about consumer protection, intellectual property rights, and compliance with existing financial regulations.

Implementation Strategies

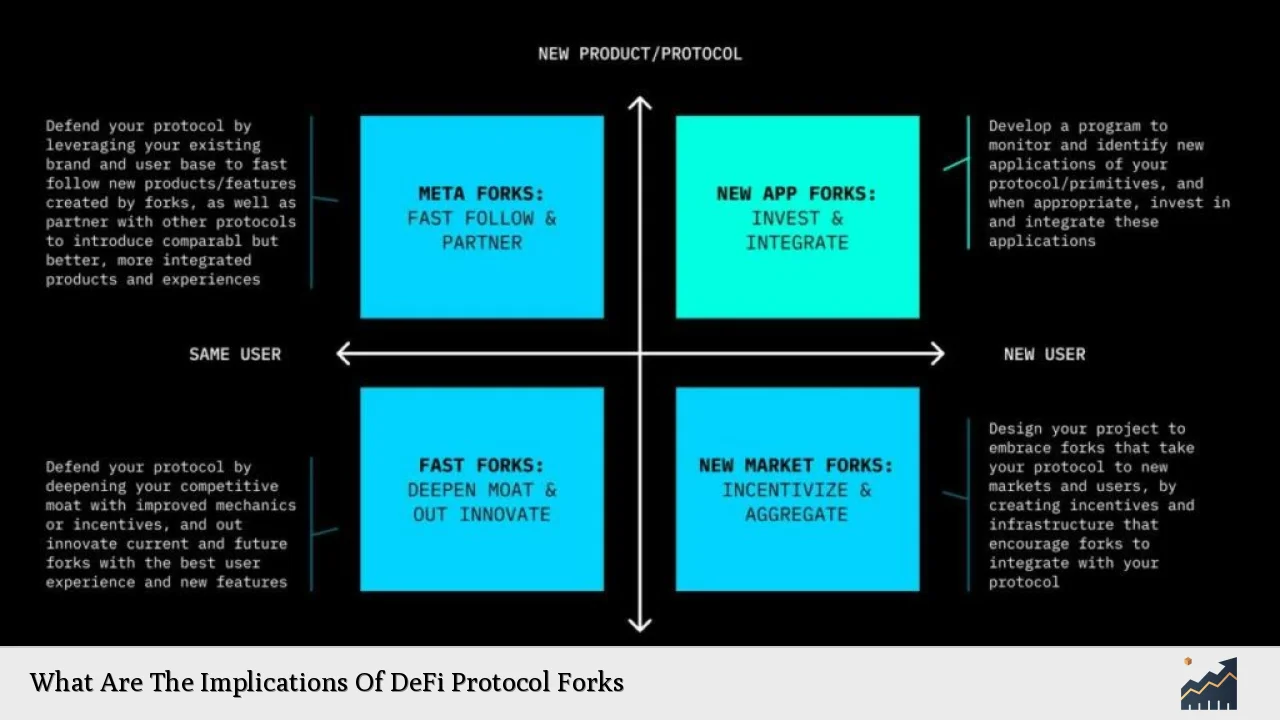

For developers looking to fork existing DeFi protocols successfully, several strategies can enhance their chances of success:

- Unique Value Proposition: Establish a clear differentiation from the original protocol. This could involve innovative features or improved user experiences.

- Community Building: Engage actively with potential users through social media, forums, and community events. Building a loyal user base is crucial for sustaining a forked project.

- Robust Security Audits: Prioritize security by conducting thorough audits of smart contracts before launching the project. This helps mitigate risks associated with exploits.

- Strategic Partnerships: Collaborate with other projects or platforms to enhance visibility and credibility. Partnerships can also provide access to shared resources or user bases.

Risk Considerations

Forking DeFi protocols carries inherent risks that investors and developers must navigate:

- Market Volatility: Forks can lead to significant price swings as speculation drives investment decisions. New tokens may experience rapid rises followed by steep declines.

- Scams and Fraud: The anonymity often associated with DeFi projects increases the risk of scams. Investors should conduct due diligence before participating in any new project.

- Regulatory Risks: The evolving regulatory landscape poses challenges for forked projects that may not comply with local laws or regulations.

- Technical Vulnerabilities: Forked protocols may inherit bugs or vulnerabilities from their predecessors if not adequately addressed during development.

Regulatory Aspects

The regulatory environment surrounding DeFi forks is complex and varies by jurisdiction:

- Intellectual Property Rights: Forking raises questions about copyright infringement and licensing since many protocols are open-source but still protected under intellectual property laws.

- Compliance Requirements: Regulatory bodies are increasingly scrutinizing DeFi activities for compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Consumer Protection: Regulators are focusing on protecting investors from fraud and ensuring that they are adequately informed about the risks associated with investing in forked protocols.

Future Outlook

The future of DeFi forks will likely be shaped by several key trends:

- Consolidation of Protocols: As competition intensifies, weaker projects may be forced out of the market or acquired by stronger players, leading to consolidation within the industry.

- Enhanced Interoperability: Future developments may focus on improving interoperability between different DeFi protocols, allowing for more seamless user experiences across platforms.

- Increased Institutional Interest: As DeFi matures, institutional investors may become more involved, bringing additional capital and legitimacy to the space while also demanding higher standards for security and compliance.

- Technological Advancements: Innovations in blockchain technology could lead to more efficient protocols that better serve user needs while minimizing risks associated with forking.

Frequently Asked Questions About What Are The Implications Of DeFi Protocol Forks

- What is a DeFi fork?

A DeFi fork occurs when developers copy an existing protocol’s codebase to create a new project, often introducing modifications or improvements. - Why do developers fork existing protocols?

Developers may fork protocols to capitalize on successful models while adding unique features or addressing perceived shortcomings. - What are the risks associated with investing in forked DeFi projects?

Investors face risks such as market volatility, scams, regulatory challenges, and technical vulnerabilities. - How can I identify trustworthy forked projects?

Conduct thorough research on the development team’s background, community engagement levels, security audits conducted, and overall project transparency. - Are all forks bad?

No; while many forks may lack innovation or sustainability, some can introduce valuable features or improvements that benefit users. - What role does regulation play in DeFi forks?

Regulation affects how forked projects operate concerning intellectual property rights, consumer protection laws, and compliance requirements. - How do forks impact existing DeFi ecosystems?

Forks can disrupt existing ecosystems by fragmenting user bases but also drive innovation through competition. - What is the future outlook for DeFi forks?

The future may see consolidation among successful projects while increasing institutional interest leads to higher standards for security and compliance.

Understanding the implications of DeFi protocol forks is essential for anyone involved in this dynamic space. By recognizing both the opportunities and challenges presented by forks, investors can make informed decisions that align with their financial goals while contributing positively to the evolving landscape of decentralized finance.