Decentralized Finance (DeFi) represents a transformative shift in the financial landscape, leveraging blockchain technology to create a system of financial services that operates without traditional intermediaries like banks. This innovation offers numerous benefits, including increased accessibility, reduced costs, and enhanced transparency. However, it also raises significant challenges and risks that have implications for global financial systems. As DeFi continues to evolve, understanding its potential impact on traditional finance, regulatory frameworks, and market dynamics is crucial for investors, policymakers, and financial institutions.

| Key Concept | Description/Impact |

|---|---|

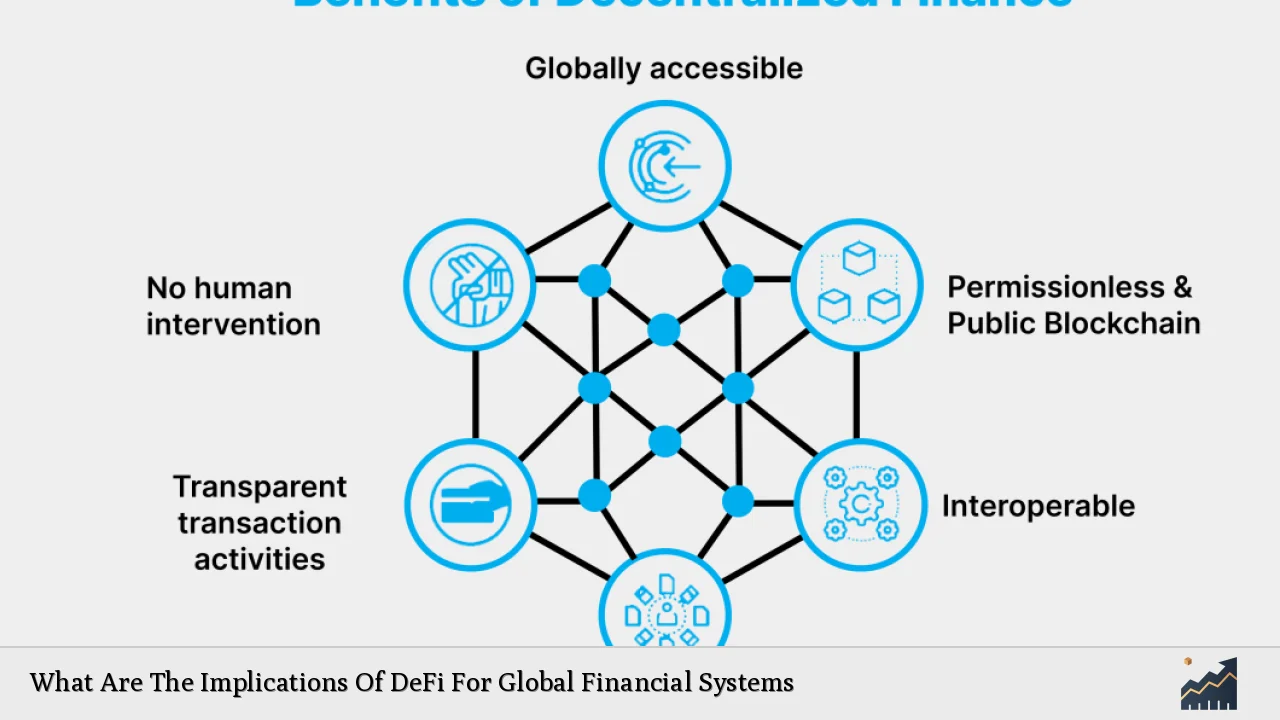

| Accessibility | DeFi platforms provide financial services to the unbanked and underbanked populations globally, fostering financial inclusion. |

| Cost Efficiency | By eliminating intermediaries, DeFi reduces transaction costs and increases the speed of transactions. |

| Transparency | Transactions on DeFi platforms are recorded on public blockchains, enhancing accountability and reducing fraud risks. |

| Innovation in Financial Products | DeFi enables the creation of new financial products such as decentralized exchanges (DEXs), yield farming, and synthetic assets. |

| Market Volatility | The unique pricing mechanisms in DeFi can lead to increased market volatility compared to traditional finance. |

| Regulatory Challenges | The lack of standardized regulations across jurisdictions poses risks for consumer protection and systemic stability. |

| Interconnectedness with Traditional Finance | The growing ties between DeFi and traditional finance could lead to spillover effects during financial crises. |

| Sustainability Initiatives | DeFi is increasingly aligning with ESG standards, promoting sustainable finance practices within its protocols. |

Market Analysis and Trends

The DeFi market has experienced explosive growth in recent years. As of January 2024, approximately $55.95 billion is locked in DeFi platforms, a significant increase from just $9.1 billion in July 2020. This growth reflects a Compound Annual Growth Rate (CAGR) of over 5x during this period. The projected revenue for the DeFi market is expected to reach $46.61 billion by 2024, with further growth anticipated to $78.47 billion by 2029 at a CAGR of 10.98%.

Key Market Drivers

- Technological Advancements: The rise of blockchain technology has facilitated the development of various DeFi applications.

- Institutional Participation: Increased interest from institutional investors is driving liquidity and innovation within the DeFi space.

- User Adoption: A significant uptick in user engagement has been observed, particularly in emerging markets where traditional banking services are limited.

Current Trends

- Layer 2 Solutions: These solutions are enhancing transaction speeds and reducing costs on Ethereum-based platforms.

- Cross-chain Interoperability: As DeFi matures, interoperability between different blockchain networks is becoming a focal point for development.

- Sustainable Finance: Initiatives aimed at integrating environmental considerations into DeFi are gaining traction.

Implementation Strategies

For investors and institutions looking to engage with DeFi, several strategies can be employed:

- Diversification Across Platforms: Engaging with multiple DeFi protocols can mitigate risks associated with individual platforms.

- Utilizing Yield Farming: Investors can earn returns by providing liquidity to various protocols through yield farming strategies.

- Participating in Governance: Many DeFi platforms offer governance tokens that allow holders to influence protocol decisions.

- Risk Management Practices: Implementing robust risk management frameworks is essential due to the inherent volatility and regulatory uncertainties in the DeFi space.

Risk Considerations

While the potential benefits of DeFi are substantial, several risks must be considered:

- Market Volatility: The prices of assets within DeFi can be highly volatile due to low liquidity and speculative trading practices.

- Cybersecurity Threats: The decentralized nature of these platforms makes them susceptible to hacks and exploits.

- Regulatory Risks: The evolving regulatory landscape could impact the viability of certain DeFi projects or lead to increased compliance costs.

- Lack of Consumer Protections: Unlike traditional finance, many DeFi platforms do not offer consumer protections, which can expose users to significant losses.

Regulatory Aspects

The regulatory environment surrounding DeFi is complex and rapidly evolving. Key considerations include:

- Global Regulatory Disparities: Different countries have adopted varied approaches to regulating cryptocurrencies and DeFi, leading to a fragmented landscape that poses challenges for compliance.

- Consumer Protection Frameworks: Regulators are increasingly focused on ensuring that consumers are protected from fraud while encouraging innovation within the sector.

- Tax Implications: Users engaging with DeFi protocols may face complex tax obligations that vary by jurisdiction.

Policymakers must strike a balance between fostering innovation in the DeFi space while ensuring adequate safeguards are in place to protect consumers and maintain systemic stability.

Future Outlook

The future of DeFi appears promising but fraught with challenges. Key trends likely to shape its trajectory include:

- Increased Institutional Adoption: As more institutions explore opportunities within DeFi, we can expect greater liquidity and innovative product offerings.

- Enhanced Regulatory Clarity: Ongoing dialogue between regulators and industry stakeholders will likely result in clearer guidelines that could facilitate broader adoption.

- Integration with Traditional Finance: The convergence of DeFi with traditional financial systems could lead to hybrid models that leverage the strengths of both sectors.

In conclusion, while Decentralized Finance holds transformative potential for global financial systems by enhancing accessibility and efficiency, it also presents unique challenges that require careful navigation by all stakeholders involved.

Frequently Asked Questions About What Are The Implications Of DeFi For Global Financial Systems

- What is Decentralized Finance (DeFi)?

DeFi refers to a financial system built on blockchain technology that enables peer-to-peer transactions without intermediaries like banks. - How does DeFi enhance accessibility?

DeFi provides financial services to individuals who may not have access to traditional banking systems, particularly in underserved regions. - What are the main risks associated with investing in DeFi?

The primary risks include market volatility, cybersecurity threats, regulatory uncertainties, and lack of consumer protections. - How is regulatory oversight evolving for DeFi?

Regulatory bodies worldwide are increasingly focusing on establishing frameworks that ensure consumer protection while promoting innovation in the sector. - What trends are driving growth in the DeFi market?

The growth is driven by technological advancements, institutional participation, user adoption, and increasing interest in sustainable finance. - Can traditional financial institutions benefit from DeFi?

Yes, traditional institutions can leverage innovations from DeFi to enhance their service offerings and improve operational efficiencies. - What role does transparency play in DeFi?

The transparency provided by blockchain technology helps reduce fraud risks and increases trust among users. - What is the future outlook for Decentralized Finance?

The future looks promising as institutional adoption increases and regulatory clarity improves; however, challenges remain that need addressing.

In summary, Decentralized Finance represents a significant evolution in how financial services are delivered globally. While it offers numerous benefits such as increased accessibility and reduced costs, it also poses challenges related to regulation and market stability that must be carefully managed as this sector continues to grow.