The integration of GameFi, a fusion of gaming and decentralized finance (DeFi), is reshaping traditional financial systems in profound ways. GameFi allows players to earn real-world value through in-game activities, which introduces new economic models that challenge conventional finance. This article delves into the multifaceted impacts of GameFi on traditional financial systems, examining market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

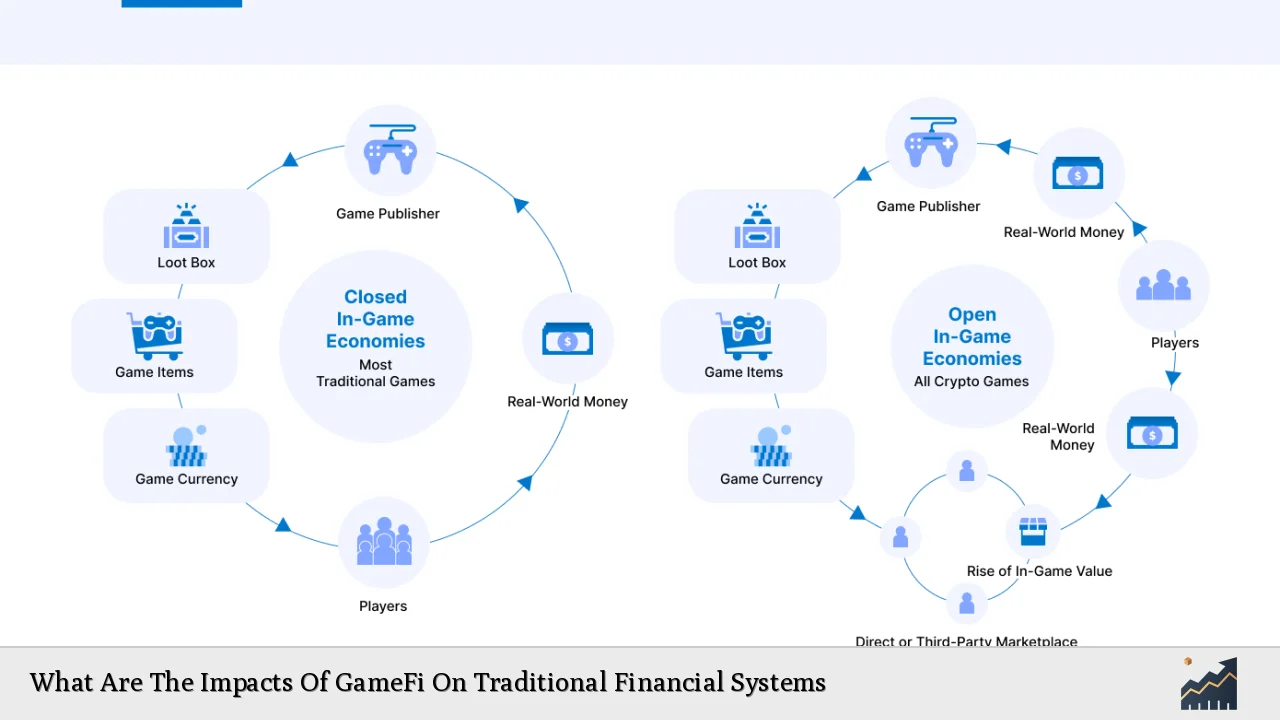

| Decentralized Economies | GameFi promotes decentralized economies where players have control over their in-game assets, disrupting traditional centralized gaming models. |

| Player Ownership | Players can own and trade in-game assets as NFTs, shifting the economic power from developers to users. |

| New Revenue Models | GameFi introduces play-to-earn models, compelling traditional financial systems to adapt to these innovative revenue streams. |

| Financial Inclusion | GameFi provides access to financial systems for unbanked populations through cryptocurrency-based economies. |

| Regulatory Challenges | The rise of GameFi poses significant regulatory challenges as it intersects with traditional finance and requires new frameworks for compliance. |

| Market Dynamics | The growing popularity of GameFi is attracting substantial investment, leading to shifts in market dynamics and competition with traditional financial services. |

| Technological Integration | The incorporation of blockchain technology into gaming is driving innovation in both sectors, enhancing security and transparency. |

| Sustainability Concerns | The sustainability of GameFi projects is questioned due to potential Ponzi-like structures and inflationary tokenomics. |

Market Analysis and Trends

The global GameFi market is experiencing rapid growth, with projections indicating a compound annual growth rate (CAGR) of approximately 29.5%, expanding from an estimated USD 19.58 billion in 2024 to USD 119.62 billion by 2031. This growth is driven by the increasing adoption of cryptocurrencies and the popularity of play-to-earn models that allow gamers to monetize their skills and time spent in games.

Key Market Statistics

- Market Size (2024): USD 19.58 billion

- Projected Market Size (2031): USD 119.62 billion

- CAGR (2024-2031): 29.5%

- North America Market Share: Approximately 40% of global revenue

The increasing interest from venture capitalists and institutional investors further underscores the potential of GameFi as a disruptive force in both gaming and finance.

Implementation Strategies

For traditional financial institutions looking to adapt to the rise of GameFi, several strategies can be employed:

- Partnerships with Game Developers: Collaborating with gaming companies can facilitate the integration of financial services within gaming platforms.

- Adopting Blockchain Technology: Implementing blockchain solutions can enhance transparency and security in transactions, appealing to a tech-savvy consumer base.

- Creating Financial Products for Gamers: Developing tailored financial products such as crypto wallets or investment opportunities linked to gaming assets can attract new customers.

- Education and Awareness Campaigns: Informing consumers about the benefits and risks associated with GameFi will foster trust and encourage participation.

Risk Considerations

While GameFi presents numerous opportunities, it also carries significant risks:

- Market Volatility: The value of in-game currencies and NFTs can fluctuate dramatically, exposing players to financial losses.

- Regulatory Risks: As governments scrutinize cryptocurrencies and decentralized finance, compliance with evolving regulations becomes crucial for sustainability.

- Sustainability Issues: Many GameFi projects rely on continuous player engagement to maintain economic viability; failure to attract new users can lead to collapse.

- Security Vulnerabilities: The decentralized nature of blockchain technology may expose users to hacks and fraud if proper security measures are not implemented.

Regulatory Aspects

The intersection of GameFi and traditional finance raises several regulatory questions:

- Licensing Requirements: Financial authorities may require licenses for platforms that facilitate trading or investment in digital assets.

- Consumer Protection Laws: Regulations must be established to protect players from potential scams or unfair practices within the GameFi ecosystem.

- Tax Implications: Governments may impose taxes on earnings generated through GameFi activities, necessitating clear guidelines for reporting income.

As regulators worldwide begin to address these issues, the landscape for GameFi will likely evolve significantly.

Future Outlook

The future of GameFi appears promising but uncertain. As technology continues to advance, we can expect:

- Increased Integration with Traditional Finance: Traditional banks may begin offering services that cater specifically to gamers, including crypto lending or investment products linked to gaming assets.

- Expansion into Emerging Markets: GameFi has the potential to reach unbanked populations globally, providing access to financial services through gaming platforms.

- Evolution of Economic Models: New economic models will emerge as developers seek sustainable ways to reward players without risking market collapse.

As these trends unfold, the impact of GameFi on traditional financial systems will become increasingly evident.

Frequently Asked Questions About What Are The Impacts Of GameFi On Traditional Financial Systems

- What is GameFi?

GameFi combines gaming with decentralized finance (DeFi), allowing players to earn real-world value through gameplay. - How does GameFi affect traditional banking?

GameFi challenges traditional banking by offering decentralized financial services directly within games, reducing reliance on banks. - What are the risks associated with investing in GameFi?

Risks include market volatility, regulatory uncertainty, sustainability challenges, and potential security vulnerabilities. - How can traditional finance adapt to GameFi?

By forming partnerships with game developers, adopting blockchain technology, creating tailored financial products for gamers, and educating consumers. - What are the regulatory challenges for GameFi?

Regulatory challenges include licensing requirements, consumer protection laws, and tax implications for earnings from gaming activities. - What is the future outlook for GameFi?

The future looks promising with increased integration into traditional finance, expansion into emerging markets, and evolution of sustainable economic models. - How does player ownership impact traditional game developers?

This shift diminishes developers’ control over in-game economies and compels them to rethink monetization strategies. - Can GameFi promote financial inclusion?

Yes, by providing access to cryptocurrency-based economies for unbanked populations worldwide through engaging gaming experiences.

In conclusion, as GameFi continues its ascent within the digital economy landscape, its impacts on traditional financial systems will be substantial. Stakeholders across both sectors must navigate this evolving terrain thoughtfully while embracing the opportunities it presents.